-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

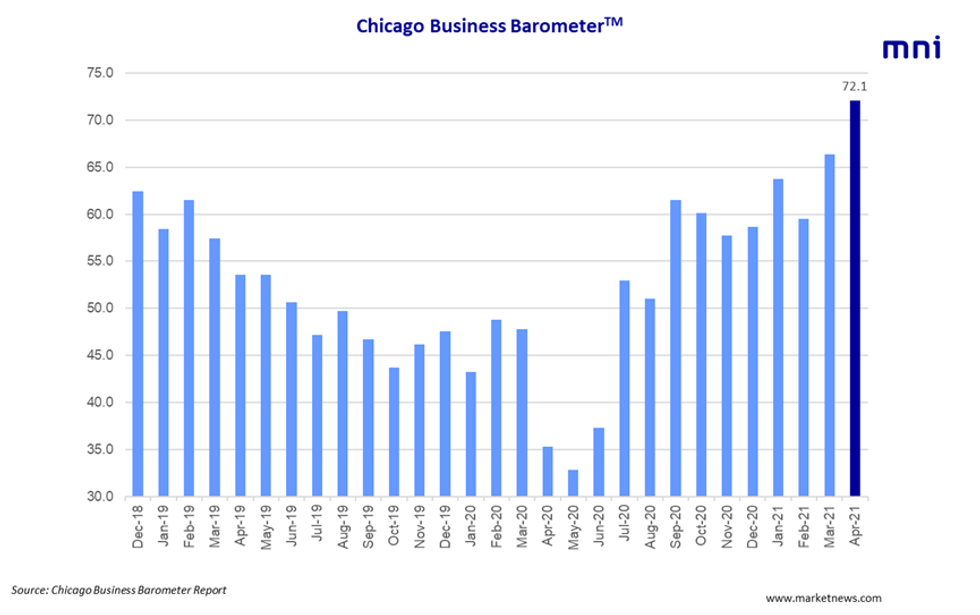

Free AccessMNI: Chicago Business Barometer At Near 38-Year High In April

Chicago Business Barometer 72.1 April Vs 66.3 March

The Chicago Business Barometer rose sharply in April, with the headline index accelerating 5.7 points to 72.1*, driven by a sharp increase in order backlogs and an influx of new business. April's reading marks the highest level since December 1983 and the index increased in contrast to financial markets expecting a downtick.

Among the main five indicators, Order Backlogs posted the largest increase, while Supplier Deliveries saw the biggest decline.

Demand improved markedly in April with New Orders rising to a near-7-year high. The index gained 9.9 points and now stands at 72.2. Production gained 0.9 points to 72.9, the highest level since January 2018. Anecdotal evidence suggested an anticipated increase in business activity, partly because firms are overbuying due to raw material shortages.

Order Backlogs soared, up 16.2 points to 73.2 in April, hitting the highest level since December 1973. Firms are experiencing difficulties in getting certain components and raw materials. Meanwhile, Inventories fell to 46.8 in April, dipping below the 50mark for the first time since December 2020.

EMPLOYMENT

Employment edged higher in April to 56.4, its highest level since August 2018 and the second successive reading in expansionary territory.

Supplier Deliveries eased to 76.4 in April, down from 79.9 recorded in March. Nevertheless, the index remains elevated and firms continued to experience slow delivery times due to logistical constraints. Prices paid at the factory gate skyrocketed by a further 11.1 points to 91.5 in April, hitting a 41-year high. Raw material shortages and transportation problems continue to weigh on companies cost burden.

This month's special question asked, "Do you plan to expand your workforce over the next three months?" The majority, at 54.8%, plans to expand their work force, either with permanent (16.7%) or temporary (14.3%) workers, or both (23.8%). Against that, 45.2% have no plans to expand their staff levels.

This month's survey ran from April 1 to 19.

*rounding shows marginal difference in gain to headline number

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.