-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CLOSING FI ANALYSIS: No Love For Targeted Relief

US TSY SUMMARY: Early Risk-On Tone Loses Momentum

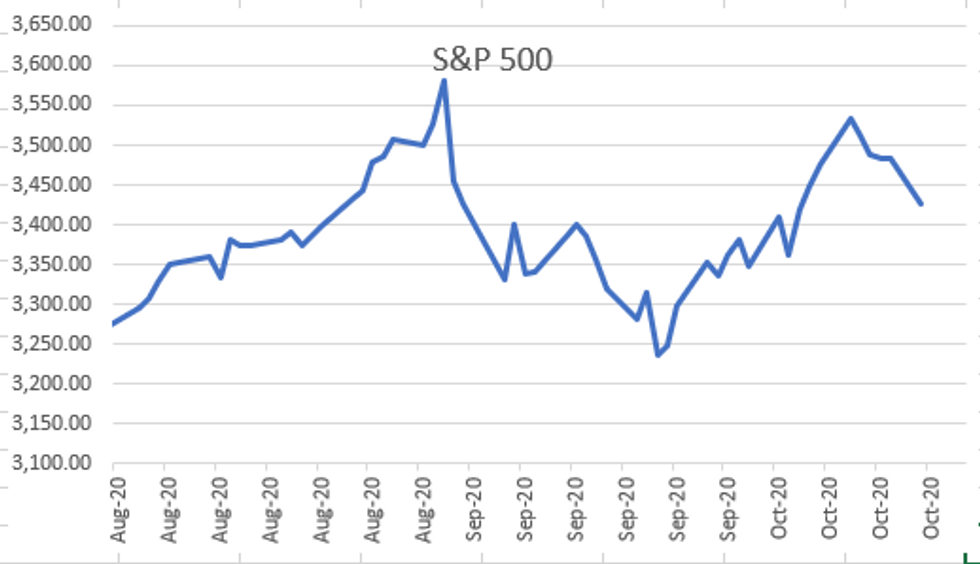

Mkts kicked off new wk w/ concerted risk-on tone, Tsys broadly weaker w/ equities climbing early overnight and holding gains into midmorning. Risk appetite supported by hopes of bipartisan breakthrough on relief stimulus.

- * Grudging reversal started around midmorning. While a "48 hour" deadline for stim-deal given to WH by House Sp Pelosi over weekend, Sen maj/ldr McConnell's insistence on targeted relief soured hopes (w/"PPP loans, creates liability protection, more unemployment benefits, forgiveness of postal service loan, education assistance")

- * Tsys pared losses but remained weaker in second half even as equities continued to extend lows, likely reacting to Bbg headline: "DEMOCRATS SAY DISAGREEMENT ON STIMULUS LANGUAGE REMAINS".

- * Markets showed little react to multiple Fed speakers (Fed chair Powell discussed digital currencies; Bostic, Clarida, Kashkari, Harker all hummed party line), while thorny BREXIT negotiations continued. No noticeable market react, but underscores second half risk-off theme: "US IMPOSES SANCTIONS ON CHINESE FOR TIES TO IRAN," Bbg

- * The 2-Yr yield is up 0.2bps at 0.1451%, 5-Yr is up 0.8bps at 0.3297%, 10-Yr is up 1.3bps at 0.759%, and 30-Yr is up 1.6bps at 1.5442%.

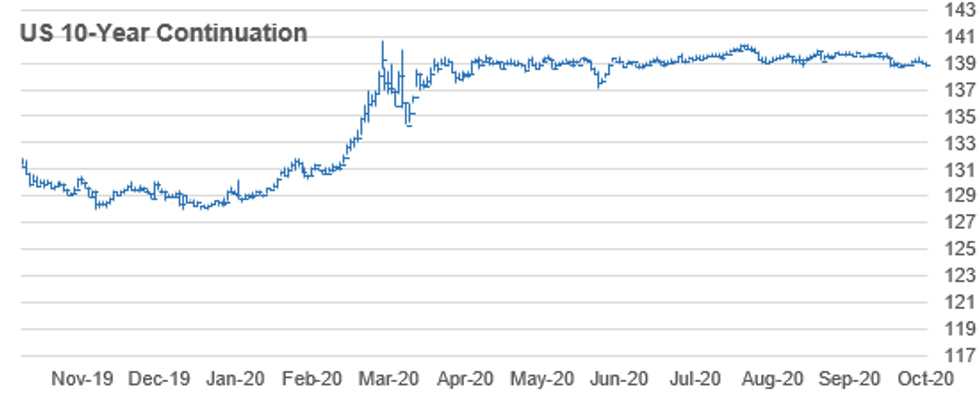

TECHNICALS, US 10YR FUTURE TECHS:

Selling Pressure Dominates

- RES 4: 139-25 High Oct 2

- RES 3: 139-17 76.4% retracement of the Sep 29 - Oct 7 sell-off

- RES 2: 139-14 High Oct 15

- RES 1: 139-01+ Intraday high

- PRICE: 138-28 @16:42 BST Oct 19

- SUP 1: 138-20+ Low Oct 7 and the bull trigger

- SUP 2: 138-18+ Low Aug 28 and bear trigger

- SUP 3: 138-16+ Low Jun 23 (cont)

- SUP 4: 138-12 61.8% retracement of the Jun - Aug rally (cont)

AUSSIE 3-YR TECHS

Looking To Clear Resistance

- RES 3: 100.00 - Psychological round number

- RES 2: 99.886 - 3.0% Upper Bollinger Band

- RES 1: 99.840 - All time High Oct 6, 15 and the bull trigger

- PRICE: 99.835 @ 16:53 BST Oct 19

- SUP 1: 99.760 - Low Oct 1 and 2

- SUP 2: 99.705 - Low Sep 18, 21 and 22

- SUP 3: 99.675 - Low Sep 7 and key support

AUSSIE 10-YR TECHS

Uptrend Remains Intact

- RES 3: 99.480 - High Mar 10 and the all-time high

- RES 2: 99.360 - High Apr 2 (cont)

- RES 1: 99.290 - High Oct 16

- PRICE: 99.250 @ 17:01 BST Oct 19

- SUP 1: 99.075 - Low Oct and the key support

- SUP 2: 99.055 - Low Sep 18 and 21

- SUP 3: 98.970 - Low Sep 8

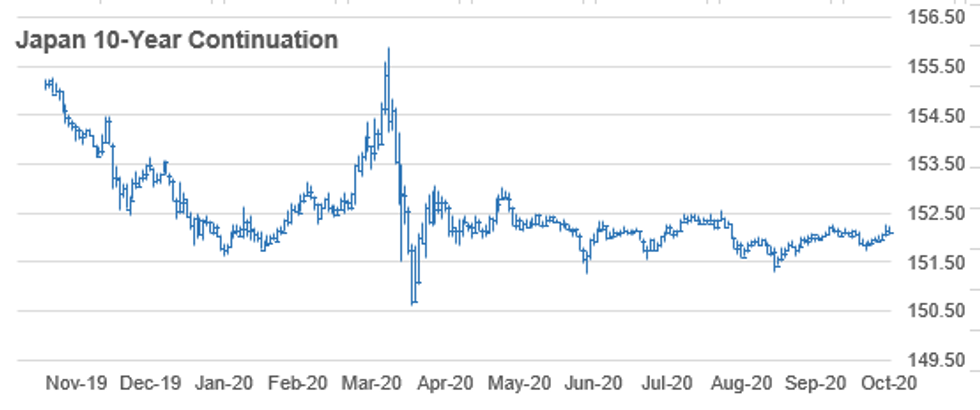

JGB TECHS

Bullish Focus

- RES 3: 152.55 - High Aug 5 (cont)

- RES 2: 152.36- 3.0% Upper Bollinger Band

- RES 1: 152.29 - High Sep 24 and the bull trigger

- PRICE: 152.10 @ 17:02 BST Oct 19

- SUP 1: 151.75 - Low Oct 08 and trend support

- SUP 2: 151.54 - Low Sep 7

- SUP 3: 151.43 - Low Sep 1

TSY FUTURES CLOSE: Weaker by the bell

But well off midmorning lows on moderate volumes (TYZ>940k just after the bell). Rates reluctantly react to stimulus headlines (DEMOCRATS SAY DISAGREEMENT ON STIMULUS LANGUAGE REMAIN" Bbg) reversal in stocks (ESZ0 -45.0). Yld curves steeper but off highs. Update:

- 3M10Y +1.668, 66.596 (L: 64.999 / H: 68.176)

- 2Y10Y +1.464, 61.517 (L: 60.213 / H: 62.782)

- 2Y30Y +2.078, 140.444 (L: 138.902 / H: 141.933)

- 5Y30Y +1.479, 122.027 (L: 121.022 / H: 123.32)Current futures levels:

- Dec 2Y down 0.125/32 at 110-13.625 (L: 110-13.125 / H: 110-13.75)

- Dec 5Y down 2.25/32 at 125-24 (L: 125-22.25 / H: 125-26)

- Dec 10Y down 5.5/32 at 138-28.5 (L: 138-24 / H: 139-01.5)

- Dec 30Y down 16/32 at 174-13 (L: 173-30 / H: 174-27)

- Dec Ultra 30Y down 29/32 at 218-1 (L: 217-02 / H: 218-26)

US TSYS/SUPPLY

Preview of week's auctions:

- DATE TIME AMOUNT SECURITY (CUSIP)/ANNC

- 19-Oct 1130ET $54B 13W-Bill (9127963V9), 0.100%

- 19-Oct 1130ET $51B 26W-Bill (9127962Q1), 0.115%

- 20-Oct 1130ET $30B 42D-Bill CMB (912796TU3)

- 20-Oct 1130ET $30B 119D-Bill CMB (9127964D8)

- 21-Oct 1130ET TBA 105D Bill CMB 20-Oct

- 21-Oct 1130ET TBA 154D Bill CMB 20-Oct

- 21-Oct 1300ET $22B 20Y-bond/R/O (912810SQ2)

- 22-Oct 1130ET TBA 4W-Bill 20-Oct

- 22-Oct 1130ET TBA 8W-Bill 20-Oct

- 22-Oct 1300ET $17B 5Y-TIPS (91282CAQ4)

US EURODLR FUTURES CLOSE: Mostly Weaker, Steady/Mixed In Short End

Lead quarterly gained since 3M LIBOR fell -0.00975 to new record low of 0.20863%** (-0.00575 last wk). Latest lvls:

- Dec 20 +0.005 at 99.765

- Mar 21 -0.005 at 99.790

- Jun 21 steady at 99.805

- Sep 21 steady at 99.805

- Red Pack (Dec 21-Sep 22) -0.01 to steady

- Green Pack (Dec 22-Sep 23) -0.02 to -0.01

- Blue Pack (Dec 23-Sep 24) -0.025

- Gold Pack (Dec 24-Sep 25) -0.03 to -0.025

US DOLLAR LIBOR

Latest settles

- O/N -0.00025 at 0.08088% (-0.00062 last wk)

- 1 Month -0.00800 to 0.14338% (+0.00613 last wk)

- 3 Month -0.00975 to 0.20863%** (-0.00575 last wk)

- 6 Month -0.00325 to 0.25425% (+0.01175 last wk)

- 1 Year +0.00475 to 0.33975% (-0.01263 last wk)

- ** 3M New record Low

US TSYS

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $59B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $159B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.09%, $914B

- Broad General Collateral Rate (BGCR): 0.06%, $348B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $325B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchase

- Tsy 20Y-30Y, $1.734B accepted vs. $3.847B submission

- Next scheduled purchase:

- Tue 10/20 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

OUTLOOK, Look Ahead To Tuesday

OUTLOOK: US Data/Speaker Calendar (prior, estimate)

- 20-Oct 0830 Oct Philadelphia Fed Nonmfg Index (8, --)

- 20-Oct 0830 Sep building permits (1.476M rev, 1.506M)

- 20-Oct 0830 Sep housing starts (1.416M, 1.455M)

- 20-Oct 0855 17-Oct Redbook retail sales m/m

- 20-Oct 0900 NY Fed Williams, remarks culture event

- 20-Oct 1050 Fed VC Quarles, financial stability board

- 20-Oct 1130 US Tsy $30B 42D-Bill CMB auction (912796TU3)

- 20-Oct 1130 US Tsy $30B 119D-Bill CMB auction (9127964D8)

- 20-Oct 1300 Chi Fed Pres Evans, "Pandemic's Impact and Future of U.S. Economy", Detroit Economic Club

- 20-Oct 1330 NY Fed VP Singh on Fed's corp credit facility

- 20-Oct 1700 Atl Fed Bostic, fair housing

PIPELINE: T-Mobile Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/19 $4.75B #T-Mobile $1B 11Y +148, $1.25B tap 3% 20Y +160, $1.5B tap 3.3% 30Y +190, $1B 40Y +210 (adds to $4B on Jun 18: $1B +5Y+120, $1.25B +7Y+155, $1.75B +10Y +187.5)

- 10/19 $1.5B *China Development Bank $1B 5Y +75, $500M 10Y +95

- 10/19 $1B *American Honda $450M 1.25Y FRN L+12, $550M 2Y +27 (issued $1.75B on

- Jan 7: $850M 3Y +40, $400M 3Y FRN +37, $500M 7Y +63)

- 10/19 $1B *Ross Stores $500M +5Y +65, $500M +10Y +115

- 10/19 $1B *KDB $500M 3Y +40, $500M 5.5Y +52.5

- 10/19 $750M *Penske Trucking Leasing +90

- 10/19 $500M #CIBC WNG 5Y Green +63

- On tap for Tuesday

- 10/20 $Benchmark Denmark 2Y +5a

- 10/20 $3B United Airlines 4.1Y EETC deal (enhanced equipment trust certificates, corporate debt securities)

EURODOLLAR/TREASURY OPTIONS

Eurodollar Options:

- 2,000 Green Mar 96 puts, 7.0

- 1,500 Green Nov 96/97 strangles, 3.5

- -1,000 Green Dec 92/93/95/96 put condors, 1.5

- +2,000 Blue Dec 93/95 put spds .25 over Blue Dec 96 calls

- -2,500 Dec 97/98 call spds, 2.75

- Overnight trade:

- 5,000 Nov 95 puts cab

Tsy Options:

- -2,000 TYZ 137.5/138.5 put spds, 18/64 vs. 138-27.5/0.17%

- 1,500 USX 174 puts, 34/64

- -2,500 USX 173/174 put spds, 20-22

- 2,600 wk5 TY 137/137.5/137.75 broken put trees, 0.0

- 2,000 FVZ 126.25 calls, 4.5

- Overnight trade

- 10,000 TYZ 138 puts, 30/64 total volume >17.1k

- 8,000 TYZ 137.5 puts, 20/64 last

- +3,000 TYH 138/138.5/139.5/140 call condors, 9/64

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.