-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Gearing Up For Jackson Hole On Friday

MNI US MARKETS ANALYSIS - Gearing Up For Jackson Hole On Friday

HIGHLIGHTS

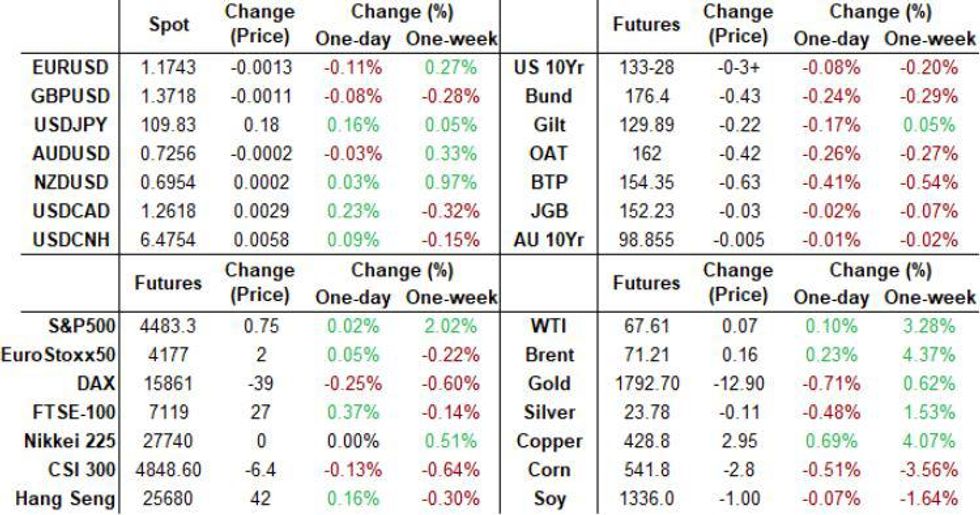

- Sovereign bonds have traded weaker, with curves bear steepening.

- The Expectations component of the latest German IFO report came in weaker than expected.

- Focus this week remains on Jackson Hole.

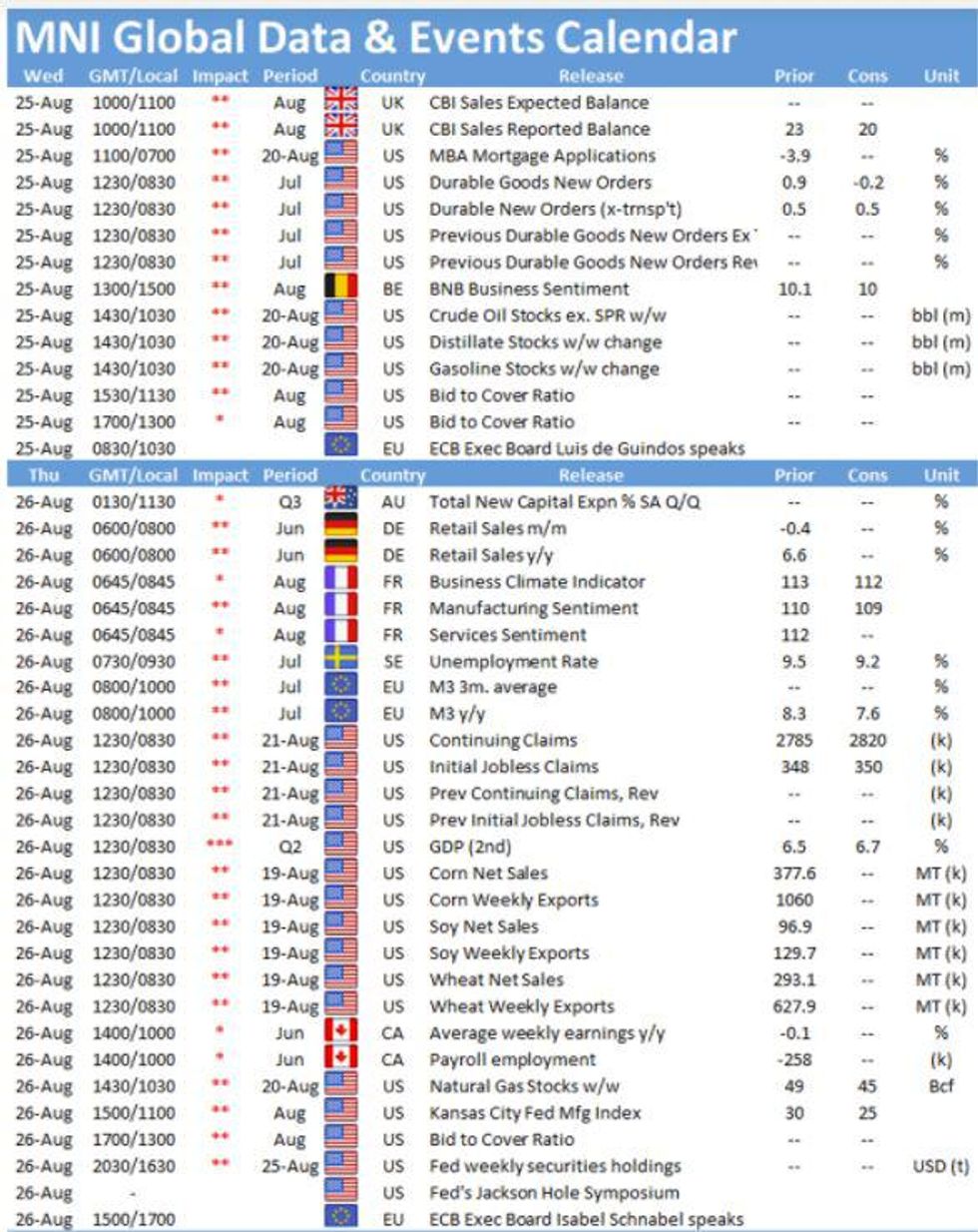

US TSYS SUMMARY: Durable Goods Features With Jackson Hole Nearing

Treasuries have drifted lower from the session highs printed in early European trade, following sideways movement in Asia Pac.

- Sep 10-Yr futures (TY) down 2/32 at 133-29.5 within a 6 tick range (L: 133-28.5 / H: 134-01.5). The curve is largely unchanged: 2-Yr yield is down 0.1bps at 0.2425%, 5-Yr is down 0.2bps at 0.795%, 10-Yr is up 0.5bps at 1.2986%, and 30-Yr is down 0.1bps at 1.9154%.

- Equities and the USD a little stronger, but basically flat.

- The price action suggests something of a holding pattern ahead of Jackson Hole Friday. SF Fed's Daly is the lone FOMC speaker today, at 1300ET (on fintech and racial equity).

- Data today includes MBA mortgage apps at 0700ET, then the main release at 0830ET with durable / capital goods.

- Decent supply today: $26B 2Y FRN auction at 1130ET, with $61B 5Y Note auction at 1300ET. Also a 119-day bill sale for $30B at 1130ET. NY Fed buys ~$1.425B of 10-22.5Y Tsys.

EGB/GILT SUMMARY - Better offered this morning

EGBs are trading heavy during our morning European session, but still within yesterday's ranges for Bund at least.

- Underpinned risk, has kept the lid on Bond's upside.

- BTP led Govies lower, with some report of EU300mln sold in the 30yr part of the curve on.

- BTP/Bund edges 1bp wider, and BTP area of support is still seen at 154.54 (Aug 11 low)/154.52 channel.

- Most other peripherals trade flat against the German 10yr, although Greece has tightened 0.8bp so far.

- Gilts have seen another session dominated by rolling positions into the December contract.

- September and December are trading close to similar volumes today,, 181k vs 141k in Dec.

- Gilt/Bund spread sit a touch tighter, and at lowest level since the 4Th August.

- Looking ahead, US prelim Durable Goods Orders is the notable data release.

- Fed Mary Daly (takes part in a panel discussion on "Fintech, Racial Equity, and an Inclusive Financial System)

EUROPEAN ISSUANCE UPDATE

PORTUGAL AUCTION RESULTS: Exchange Auction Results

IGCP sells:

- E1.025bln of the 2.125% Oct-28 OT at 117.00.

- E336mln of the 4.10% Apr-37 OT at 154.41.

IGCP buys:

- E1.080bln of the 4.95% Oct-23 OT at 112.339.

- E281mln of the 5.65% Feb-24 OT at 115.832.

FOREX: USD Pares Some Gains

The dollar has given back some of its overnight and early European trading gains.

- The dollar was mostly in the green against most G10s, but now down 0.1% against the Kiwi and up 0.14% versus the CAD.

- CAD has been the early worst performer against the USD in G10, but all things considered, it's been a limited move, after the CAD gained 2.86% since Friday, in line with the $6 rally in WTI from Friday to yesterday.

- Initial support at 1.2579 Low Aug 24, has held, printed a 1.2588 low.

- AUDUSD has paused its 2.31% rally since Friday, as Covid spread shows no signs of slowing down, with new daily record for New South Wales.

- AUDUSD is now flat in the early session.

- EUR trades on the back foot against the Scandis this morning, and we pointed out the EURNOK support at 10.3509, as the initial level to watch.

- Market participants faded the move at that level, printing a 10.3498 low, and now at 10.3764 at the time of typing.

- Looking ahead, US prelim Durable Goods Orders is the notable data release.

- Fed Mary Daly (takes part in a panel discussion on "Fintech, Racial Equity, and an Inclusive Financial System)

FX OPTION EXPIRY

FX OPTION EXPIRY (updated, closest ones)

Of note: EURUSD 1.03bn at 1.1700, and noted all week, also at 1.1700, 1.38bn (Thursday), and 1.47bn (Friday).- EURUSD: 1.1700 (1.03bn), 1.1755 (255mln), 1.1775 (593mln).

- USDJPY: 109.50 (459mln), 109.85 (450mln), 109.90 (585mln), 110.20 (705mln)

Price Signal Summary - S&P E-Minis Consolidating At Recent Highs

- On the equity front, S&P E-minis are consolidating at recent highs. This week's climb to a fresh all-time high confirms a resumption of the uptrend and attention turns to the 4500.00 handle. EUROSTOXX 50 key support has been defined at 4078.00, Aug 19 low. The outlook is bullish while this level holds.

- In the FX space, the USD remains in an uptrend and this week's weakness is still considered corrective. EURUSD last week cleared 1.1704, Mar 31 low. This opens 1.1621 next, 1.00 projection of the Jan 6 - Mar 31 - May 25 price swing. Firm resistance to watch is 1.1805, Aug 13 high. GBPUSD remains vulnerable despite Monday's strong bounce. The focus is on the bear trigger at 1.3572, Jul 20 low. Resistance is at 1.3786, Aug 18 high. The Aug 20 price pattern in USDCAD is a bearish shooting star candle and Monday's weak close reinforces the bearish pattern. An extension would expose 1.2512, the 50-day EMA.

- On the commodity front, Gold maintains a bullish tone following this week's breach of its 50-day EMA. The break signals scope for a climb towards $1834.1, Jul 15 high and a bull trigger. WTI futures support has been defined at $61.74, Aug 23 low. Note, Monday's price action is to be a bullish engulfing reversal candle, highlighting a positive short-term theme. Further gains would open $68.13, the 50-day EMA.

- In FI, Bunds support to watch is unchanged at 176.21, Aug 11 low. Trend conditions remain bullish above this level. The bull trigger is 177.61, Aug 05 high. The Gilt futures outlook is bullish too and attention is on 130.72, Aug 4 high and the bull trigger. The support to watch is at 129.23, the 50-day EMA.

EQUITIES: Mixed Morning Moves

- Japan's NIKKEI down 7.3 pts or -0.03% at 27724.8 and the TOPIX up 1.46 pts or +0.08% at 1935.66

- China's SHANGHAI closed up 25.913 pts or +0.74% at 3540.384 and the HANG SENG ended 33.97 pts lower or -0.13% at 25693.95

- The German Dax is currently down 34.32 pts or -0.22% at 15870.87, FTSE 100 up 14.93 pts or +0.21% at 7140.75, CAC 40 up 14.17 pts or +0.21% at 6678.61 and Euro Stoxx 50 up 3.27 pts or +0.08% at 4180.75.

- Dow Jones mini up 11 pts or +0.03% at 35327, S&P 500 mini up 0.75 pts or +0.02% at 4483.5, NASDAQ mini up 5.75 pts or +0.04% at 15362.5.

COMMODITIES: Metal divergence: Platinum down, copper up

- WTI Crude up $0.05 or +0.07% at $67.63

- Natural Gas down $0.02 or -0.49% at $3.876

- Gold spot down $9.08 or -0.5% at $1793.9

- Copper up $3.2 or +0.75% at $429.3

- Silver down $0.11 or -0.46% at $23.7519

- Platinum down $12.92 or -1.27% at $1001.36

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.