-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Japan Q3 GDP To Be Slightly Revised Down

MNI US MARKETS ANALYSIS - All Eyes on Payrolls

HIGHLIGHTS:

- Analysts eye payrolls gains of ~850k

- Markets in holding pattern pre-release

- EUR weakness pervades, EURUSD could be re-entering downtrend

US TSYS SUMMARY: Bear Steepening Ahead Of Jobs Report

Treasuries have opened nonfarm payrolls Friday a weaker in a continuation of the steady move lower the last couple of sessions.

- Recent flattening has stalled, though, with some bear steepening in the European morning: the 2-Yr yield is up 1bps at 0.2083%, 5-Yr is up 2.3bps at 0.7468%, 10-Yr is up 3bps at 1.2533%, and 30-Yr is up 3.9bps at 1.9004%.

- Sep 10-Yr futures (TY) down 9/32 at 134-07 (L: 134-06 / H: 134-15). Nothing special in volumes (~255k).

- The focus of course is on nonfarm payrolls (BBG survey +858k, MNI dealer median +900k) at 0830ET - we've put out a few preview notes this morning. (As is becoming customary, Pres Biden will speak on the jobs data at 1030ET).

- Rounding out the week's data are wholesale inventories/trade sales (1000ET) and consumer credit (1500ET).

- No supply today; NY Fed buys ~$12.425B of 0-2.25Y Tsys.

July Nonfarms Preview: Eyeing Participation, Education, And Adjustments

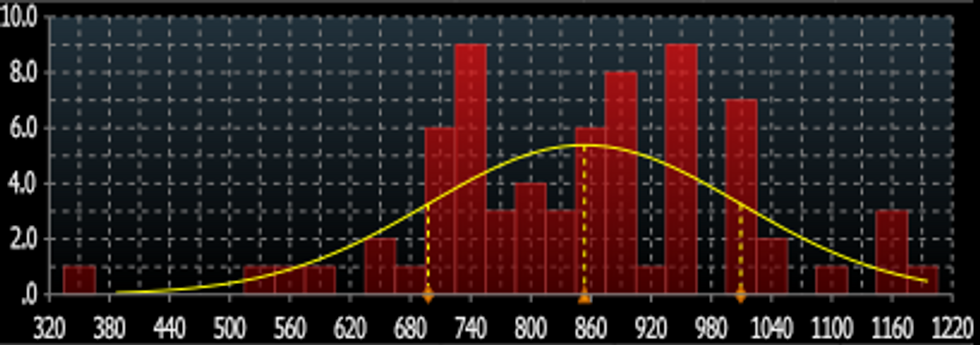

The Bloomberg survey median estimate for the July nonfarm payroll change is +858k (+850k Jun), with an average of +853k.

- The range of estimates is +350k to +1.2mn, with a 155k standard deviation (see chart). The BBG "Whisper" number is +884k (that's down from +915k at the start of the week).

- The unemployment rate is seen dipping to 5.7% (5.9% Jun).

- Private payrolls consensus is +709k (+662k Jun), though some see downside risk in the latter following the weaker-than-expected ADP number on Wednesday.

- Our data team notes: higher wages and more aggressive recruiting could have sped up job growth in the service sector, analysts say, and OpenTable data through the month signaled a recovery in restaurant reservations.

- Analysts who are looking for an above-consensus headline reading point to some common factors: a more favorable seasonal adjustment effect; the unwinding of unemployment benefits in several states helping improve labor supply; and fewer-than-usual education sector layoffs.

- Those who see a below-consensus figure point largely to supply constraints (including retirements, and Covid fears), continuing to keep a lid on participation.

BBG July Nonfarm Payrolls Analyst Survey DistributionSource: BBG

BBG July Nonfarm Payrolls Analyst Survey DistributionSource: BBG

EGB/GILT SUMMARY - Bond trade lower ahead of NFP

A calm start for EGBs and Govies in general, as the street awaits the US NFP.

- Bund has been better offered on positioning and squaring ahead of the data, with similar price action across the board.

- The push lowed in the longer end, has pushed the curves steeper, but volumes and ranges have been somewhat limited.

- Peripheral are mostly tighter versus the German 10yr, Greece is in the lead, by 1.7bp,

- Gilts underperforms EGBs, translating in a 1.2bp wider Gilt/Bund spread.

- Looking ahead, ALL EYES on NFP.

- After market ratings:

- Fitch on Norway (current rating: AAA; Outlook Stable)

- Moody's on the Czech Republic (current rating: Aa3; Outlook Stable) & Malta (current rating: A2; Outlook Stable)

- S&P on the European Stability Mechanism (current rating: AAA; Outlook Stable)

- DBRS Morningstar on Luxembourg (current rating: AAA, Stable Trend)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXU1 177.5/178.5cs, sold at 28 in 2.5k

2RH2 100/100.25cs, sold at 22.5 in 15k (ref 100.395, -16 del)

UK:

SFIZ1 99.85/99.95/100.05c fly, bought for 6 in 2k

SFIM2 99.75/99.85cs 1x2, bought for half in 3k

US:

FVU1 123.75p,. Bough for '10+ in 5k

EUROPE ISSUANCE UPDATE

Belgium sells:

- E400mln 5.50% Mar-28 OLO, Avg yield -0.591%, Bid-to-cover 3.83x

- E100mln 5.00% Mar-35 OLO, Avg yield -0.002% (Prev. -0.029%), Bid-to-cover 3.03x (Prev. 1.48x)

FOREX: EUR/USD Leaning Lower Pre-Payrolls

- EUR trades weaker early Friday, with EUR/USD pressing to new weekly lows of 1.1807. A break below the handle would mark a resumption of the downtrend after the corrective bounce at the tail-end of July. Below 1.18, markets may find some support at 1.1789 ahead of the key level at 1.1752 - the Jul 21 low and bear trigger. Decent option interest could draw focus into the NY cut, with over $1bln notional rolling off at 1.18 today.

- The greenback is mildly stronger, helping the USD Index climb to the best levels since Jul28. This is working against the likes of gold and silver, which both sit lower ahead of NY hours, but a further stabilisation and bounce in oil prices is supporting CAD. EUR/CAD sits on 50-dma support at 1.4769.

- Payrolls for July take focus going forward, with analysts expecting job gains of around 850k, in line with the June report. The whisper number is a touch above consensus at 884k, which may suggest a positive lean headed into the figure.

- The Canadian jobs data also crosses, with markets expecting a further decline in the unemployment rate, seen hitting 7.4% from 7.8% previously. There are no central bank speakers of note.

FX OPTIONS: Expiries for Aug06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E970mln), $1.1825(E625mln), $1.1895-00(E509mln)

- USD/JPY: Y109.50-70($608mln), Y110.00-10($626mln)

- EUR/GBP: Gbp0.8400(E890mln)

- AUD/USD: $0.7400(A$582mln)

- USD/CAD: C$1.2450-60($1.6bln), C$1.2525($1.1bln), C$1.2600($1.0bln)

- USD/CNY: Cny6.45($725mln)

Price Signal Summary - EURUSD Resuming Downtrend?

- S&P E-minis outlook is bullish as evidence of dip buying remains solid on intraday pullbacks. Recent gains have confirmed a resumption of the uptrend and signal scope for a continuation near-term. EUROSTOXX 50 futures continue to trade firmly, edging higher still to touch contract highs. This follows the recent print above a key near-term resistance at 4101.50, Jul 1 high. The breach of this level places on hold the previously bearish outlook and instead signals scope for a stronger recovery.

- In FX, EURUSD traded higher last week, but has faded since, failing to clear the 50-day EMA at 1.1916. This average represents a key short-term resistance and markets look fragile below. GBPUSD traded higher again last week before fading into the weekly close. The pair has cleared the 50-day EMA. The move above this average strengthens the current corrective recovery, signalling scope for gains towards 1.3990 next, a Fibonacci retracement. USDJPY initially extended lower Wednesday, taking out support to trade at 108.72. This follows the recent Jul 19 break of support at 109.48, Jul 29 low. The move lower marks a resumption of the reversal from early July and paves the way for an extension lower.

- On the commodity front, Gold staged a decent intraday rally Wednesday, but the rally faltered ahead of resistance, keeping the near-term outlook neutral. The broader outlook is bullish and the recent pullback was considered corrective. Brent futures remain weak, edging to new weekly lows before stabilising slightly. The move below the 50-day EMA this week looks convincing, with support now exposed at 66.43. To resume any incline, bulls need to again take out $74.47

- Within FI, Bund futures extended the streak of higher highs Thursday, printing up at 177.61 and the highest level since late January. Intraday rallies, however, remain short-lived, with markets keenly watching for any extension of the pullback. BTPs further cemented the uptrend, extending the gains to hit fresh alltime highs. A positive outlook follows the recent resumption of the uptrend that started May 19 - gains on Jul 6 and 7 resulted in a breach of a former key resistance at 152.47, Jun 14 high and established a bullish price sequence of higher highs and higher lows.

EQUITIES: Markets on Pause Pre-Payrolls

- Continental stock markets are mixed early Friday, with most major indices hovering either side of unchanged. The Italian FTSE-MIB is the only notable outperformer, trading with gains of 0.5% a few hours out from the NY crossover. Spain's IBEX-35 underperforms, but only by 0.2% or so.

- In futures space, US markets are broadly flat, mimicking the moves in Asia-Pac markets, with the Hang Seng Index finishing down just 0.1% while the Nikkei 225 notched up gains of 0.3%.

- Europe's financials sector is higher, countering slightly weakness in real estate, industrials and tech names.

COMMODITIES: Brent, WTI Stabilise Further, But Week's Highs Out of Reach

- WTI and Brent crude futures both trade higher early Friday, but the bounce remains shallow and the week's highs printed Monday are well out of reach for now.

- For Brent, this keeps the outlook negative for now, with the move below the 50-day EMA earlier this week looking convincing. This exposes initial support at $66.91 ahead of $65.75.

- Both gold and silver trade in negative territory, with the modest strength in the USD Index (crossing at the week's highs) weighing on precious metals. Today's Nonfarm Payrolls release could see the tight range in gold tested, with gold pinched between support at $1790 and resistance at the $1834.1 bull trigger.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.