-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - AUD Net Short Swells to Largest on Record

Highlights:

- Fedspeak in focus, with Bostic, Goolsbee, Cook all due

- CFTC's AUD tracked net short reaches record levels

- Holiday-shortened week turns focus to month-end flows

US TSYS: Mildly Weaker Start Shortened Holiday Week, Fedspeak

- Cash Tsys looking mildly weaker, extending lows during London morning hours after briefly extending Friday highs in early Asia trade. Curves mildly steeper with Bonds lagging the short end, 2s10s +.383 at -38.936, 10Y yield +.0315 at 4.2296%, modest futures volumes with Jun'24 10Y trading just over 240k.

- Busy Monday session kicks off short week with Friday closed in observance of Easter holiday.

- Economic data includes Chicago Fed Nat Activity Index at 0830ET, New Home Sales at 1000ET, Dallas Fed Manufacturing Activity at 1030ET.

- US Treasury supply resumes with $73B 13W, $70B 26W Bill auctions at 1130ET, $66B 2Y Note auction (91282CKH3) at 1300ET.

- Fedspeak: Atlanta Fed Bostic kicks off with a moderated discussion at Univ of Cincinnati (0825ET), Chicago Fed Goolsbee on Yahoo Finance (0905ET), Fed Gov Cook on dual mandate, Harvard, text, Q&A (1030ET).

- Projected rate cut pricing moderating vs. late Friday highs: May 2024 at -14.5% vs. -16.5% late Friday w/ cumulative -3.6bp at 5.291%; June 2024 -66.7% vs. -69.3% w/ cumulative rate cut -20.3bp at 5.125%. July'24 cumulative at -32.0bp vs. -33.5bp.

TSYS: OI Points To Mix Of Net Long Setting & Short Cover On Friday

The combination of Friday’s rally in Tsy futures and preliminary OI data points to a mix of net long setting (FV, TY & US) and short cover (TU, UXY & WN).

- The former was slightly more prominent in net curve terms, although net positioning adjustments were limited.

| 22-Mar-24 | 21-Mar-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,707,072 | 3,721,746 | -14,674 | -559,695 |

| FV | 5,904,295 | 5,858,223 | +46,072 | +1,963,733 |

| TY | 4,308,590 | 4,302,336 | +6,254 | +410,759 |

| UXY | 2,030,736 | 2,036,656 | -5,920 | -525,599 |

| US | 1,502,212 | 1,498,856 | +3,356 | +444,481 |

| WN | 1,587,223 | 1,590,174 | -2,951 | -611,442 |

| Total | +32,137 | +1,122,237 |

SOFR: OI Points to Mix Of Long Setting & Short Cover In SOFR Futures On Friday

The combination of Friday's rally in SOFR futures and preliminary OI data points to the following net positioning swings ahead of the weekend:

- Whites: Net short cover dominated, driven by SFRH4.

- Reds: Net long setting dominated. although that was driven by a solitary contract (SFRM5). Net short cover was seemingly seen in the remaining contracts in the pack.

- Greens & Blues: Net long setting in all contracts.

- A reminder that a heavy day for the yuan and continued dovish G10 central bank repricing fuelled demand for U.S. fixed income assets ahead of the weekend.

| 22-Mar-24 | 21-Mar-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRH4 | 992,751 | 1,028,569 | -35,818 | Whites | -33,675 |

| SFRM4 | 1,179,701 | 1,184,641 | -4,940 | Reds | +7,474 |

| SFRU4 | 1,012,678 | 1,010,569 | +2,109 | Greens | +14,142 |

| SFRZ4 | 1,147,636 | 1,142,662 | +4,974 | Blues | +8,544 |

| SFRH5 | 718,125 | 718,280 | -155 | ||

| SFRM5 | 781,494 | 764,289 | +17,205 | ||

| SFRU5 | 665,139 | 668,762 | -3,623 | ||

| SFRZ5 | 652,734 | 658,687 | -5,953 | ||

| SFRH6 | 469,606 | 462,808 | +6,798 | ||

| SFRM6 | 505,593 | 504,296 | +1,297 | ||

| SFRU6 | 391,003 | 388,954 | +2,049 | ||

| SFRZ6 | 351,027 | 347,029 | +3,998 | ||

| SFRH7 | 231,992 | 230,925 | +1,067 | ||

| SFRM7 | 197,099 | 194,384 | +2,715 | ||

| SFRU7 | 161,104 | 157,796 | +3,308 | ||

| SFRZ7 | 195,372 | 193,918 | +1,454 |

SWAPS: Long End Swap Spreads Stabilise, Several Widener Recommendations Seen

Long end German swap spreads have started to move away from multi-year tights in recent days.

- Several sell-side names have issued widener recommendations in 10- & 30-Year swap spreads .

- Reasoning for those recommendations includes ‘stretched’ valuations, expectations for a slowing of receiver-side swap flow from the LDI community, a break in long end issuance out of Germany and a potential rebound in mortgage hedging flow.

- Further out, Commerzbank doubt that the Bund swap spread recovery will continue after the Easter break, with an eye on the return of broader EGB super-long issuance. They also have a bias to add to Schatz spread tighteners on further widening.

Fig. 1: German 10-/30-Year Swap Spreads (bp)

Canada Politics Week: Conservatives Push To Halt Apr 1 Carbon Tax Hike

- Opposition Conservatives well ahead in polls keep focus on cost of living, forcing non-confidence vote over carbon tax even though Liberals easily won with support of other parties.

- Earlier this month Newfoundland's Liberal Premier said Apr 1 carbon tax hike should be called off, a rare show of disunity.

- Polling aggregator 338Canada shows Conservatives led by Pierre Poilievre are likely to win a majority government if an election were held now. Election is due in 2025 under a traditional four-year mandate.

- Parliament on break this week, returning Apr 8 and with budget set for Apr 16. Finance Minister Freeland says focus will be on housing costs. She may again struggle to stick to fiscal "anchors" amid rising spending.

- Middle East frays Parliament with Liberals amending then helping pass an NDP motion involving recognition of Palestine, one Liberal MP says he's questioning his political future. Also debate on arms shipments to Israel.

- Canada to limit number of temporary residents, the second move in several weeks to curb record immigration that drew complaints about worsening the housing squeeze.

- Govt introduces changes to Election Act, something Liberals pledged after taking office in 2015. It doesn’t contain a move to proportional representation the Liberals flirted with earlier.

- Sample headline: The carbon levy will haunt Justin Trudeau whether he raises it or not (Toronto Star).

RATINGS: Some Sovereign Outlook Tweaks on Friday

Sovereign rating reviews of note from after hours on Friday include:

- Fitch affirmed Portugal at A-; Outlook Stable

- Fitch affirmed the United Kingdom at AA-; Outlook revised to Stable from Negative

- Moody's affirmed Poland at A2; Outlook Stable

- S&P affirmed Germany at AAA; Outlook Stable

- DBRS Morningstar confirmed Cyprus at BBB (high), Stable Trend

- DBRS Morningstar confirmed Finland at AA (high), Stable Trend

- DBRS Morningstar confirmed France at AA (high), Stable Trend

- DBRS Morningstar confirmed Ireland at AA (low), trend changed to Positive from Stable

- DBRS Morningstar confirmed Norway at AAA, Stable Trend

- Scope Ratings affirmed Japan at A; Outlook revised to Stable from Negative

- Scope Ratings affirmed Spain A-, Outlook revised to Positive from Neutral

FOREX: Currencies Generally Rangebound, CB Speak in Focus

- Markets are generally rangebound and trading on light volumes so far Monday, with CHF marginally the poorest performer and AUD, NZD the strongest.

- Early European trades see the USD recoup the (pretty minor) weakness across the early Asia-Pac session, putting EUR/USD back to flat and retaining the S/T bearish outlook for the pair. Continuation lower here would signal scope for 1.0796 first, the Feb29 low and open the bear trigger further out at 1.0695.

- AUD/USD is firmer off last week's pullback low, and tech traders will be watching for the imminent formation of a death cross in the pair (50-dma < 200-dma) - the first since April last year, which should indicate short-term momentum in the pair is pointed lower. Notably, the AUD net short position continues to swell - putting AUD net positioning at a % of open interest at the largest short on CFTC records stretching back to the early 90s.

- Focus for the session ahead rests on US new home sales data for February and the busier speaker slate. ECB's Holzmann is set to appear after last week's warning that markets should price in the risk of no rate cuts at all this year, while Fed's Bostic, Goolsbee and Cook also make appearances.

- BoE's arch-hawk Mann speaks in Belfast, and markets will be on watch for any mention of her decision to switch from a vote to hike, to a vote to hold rates at last week's BoE rate decision.

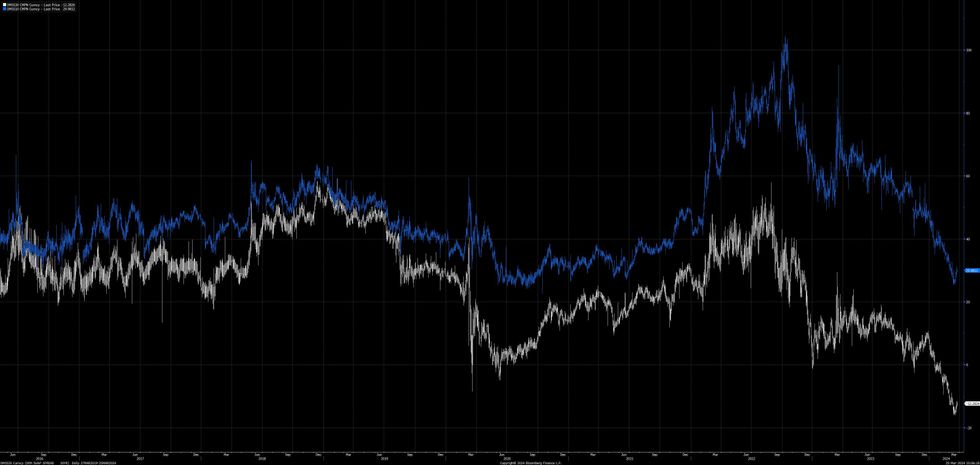

CFTC: AUD Net Short Stretches to New Record Levels

- Friday’s CoT CFTC report showed the AUD net position falling sharply in the latest week – dropping to an alltime low of 48.7% of open interest. The outright position of a net short of 107,538 contracts is also the lowest in recorded history on CFTC data going back to 1993.

- Other comparable periods for when the markets were this net short the AUD: Aug’21 (47% of OI), Sep’18, Dec’13 and Dec’97.

- Positioning shifts coincide with the fade off the March recovery high for AUD and the dropping of the tightening bias at the RBA. Further concerns over the fate of the Chinese economy despite the frequent policy tweaks by the Chinese authorities.

- MXN positioning was the most notable winner of the past week, as markets built the net long position closer to 52w highs. Markets added 24,378 contracts to push the net long to 42.4% of open interest – making the trailing 52-week Z-score the highest among the currencies surveyed at 1.67.

- Other notable positioning swings on the week included a small build for the GBP net long, while markets trimmed the EUR net long, and built the net shorts in NZD, CAD and CHF.

Figure 1: AUD Net Short as % of Open Interest Stretches to New Lows

FX OPTIONS: Expiries for Mar25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0780-85(E1.0bln), $1.0850(E876mln), $1.0900(E705mln)

- USD/JPY: Y149.80-00($2.0bln)

- GBP/USD: $1.2716-25(Gbp645mln)

- AUD/USD: $0.6560-65(A$727mln)

- USD/CAD: C$1.3485-00($2.5bln), C$1.3700($658mln)

EQUITIES: E-Mini S&P Bullish Following Last Week's Extension

- A bullish trend condition in Eurostoxx 50 futures remains intact and last week’s gains reinforce current conditions. The move higher confirms once again a resumption of the uptrend and this has also resulted in a break of the 5000.00 handle. Moving average studies remain in a bull-mode position, highlighting positive market sentiment. Sights are on 5074.7, a Fibonacci projection. Initial firm support is at 4905.50, the 20-day EMA.

- The trend condition in S&P E-Minis remains bullish and last week’s extension reinforces this theme. The break of 5257.25, Mar 8 high, confirmed a resumption of the uptrend and maintains the price sequence of higher highs and higher lows. MA studies remain in a bull-mode position reflecting positive market sentiment. Sights are on 5389.02, the top of a bull channel drawn from the Jan 17 low. Initial firm support is at 5206.16, the 20-day EMA.

COMMODITIES: Latest Pullback in WTI Futures Considered Technically Corrective

- WTI futures traded higher last week and a bull theme remains intact. The latest pullback is considered corrective. Recent gains resulted in a break of $79.87, Mar 1 high. The move higher confirms a resumption of the uptrend that has been in place since mid-December last year. Sights are on $83.87 next, the Oct 20 ‘23 high. A break of this level would open $84.87, the Sep 15 ‘23 high and a key resistance. Support to watch is $79.40, the 20-day EMA.

- The trend condition in Gold remains bullish and last week’s move higher reinforces this condition. The initial rally Thursday delivered another all-time high and confirmed a resumption of the primary uptrend. Moving average studies remain in a bull-mode condition, reflecting positive market sentiment. This signals scope for a climb towards $2230.1, a Fibonacci projection. Key short-term trend support has been defined at $2146.2, the Mar 18 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/03/2024 | 1000/1100 |  | EU | ECB's Lagarde at EIB Climate Council | |

| 25/03/2024 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 25/03/2024 | 1225/0825 |  | US | Atlanta Fed's Raphael Bostic | |

| 25/03/2024 | 1400/1000 | *** |  | US | New Home Sales |

| 25/03/2024 | 1415/1415 |  | UK | BOE Mann At Royal Economic Society Annual Conference | |

| 25/03/2024 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 25/03/2024 | 1430/1030 |  | US | Fed Governor Lisa Cook | |

| 25/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 25/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 25/03/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/03/2024 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 26/03/2024 | 0700/0800 | ** |  | SE | PPI |

| 26/03/2024 | 0800/0900 | *** |  | ES | GDP (f) |

| 26/03/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 26/03/2024 | 1200/0800 |  | CA | BOC Sr Deputy Rogers speaks in Halifax NS | |

| 26/03/2024 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/03/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/03/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/03/2024 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/03/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/03/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/03/2024 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/03/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/03/2024 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 26/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 26/03/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 26/03/2024 | 1900/2000 |  | EU | ECB Lane Lecture At Trinity College Dublin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.