-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - BoC Consensus Looks for First Cut

Highlights:

- BoC consensus looks for cuts, but sizeable minority see risk of delay

- USD/JPY stages impressive intraday bounce, but still short of weekly highs

- ADP, ISM Services eyed for clues on labour market pre-NFP

US TSYS: Tsys Head Higher On Rate Cut Expectations, ADP Private Jobs later

Treasury futures were higher on Tuesday, although finished slightly off session highs amid late position squaring ahead Wednesday's ADP private employment data risk, a precursor to Friday's headline employment report.

- Treasuries maintain a firmer short-term tone following the recovery from last week’s 107-31 low (May 29). Looking at technical levels, initial support is at 109-00+ (20-day EMA), with the 107-31 (May 29 low) the next target, while to the upside initial resistance is at 110-05 (June 5 high), a break here would see a test of 110-09 (May 16 highs/ bull trigger)

- Cash treasury curve bull-flattened again on Tuesday, yields were 3-7bps lower, the 2Y -3.8bps to 4.770%, the 10Y -6.2bps at 4.326% while the 2y10y was -2.285 at -44.455.

- On the Data front: JOLTS Job Openings (8.059M vs. 8.350M est, 8.488M prior) -- lowest since Feb 2021. Meanwhile, Factory Orders little stronger (0.7% vs. 0.6% est, 0.8% prior rev), Ex Transportation (0.7% vs. 0.5% est, 0.4% prior rev); Durable Goods Orders in-line/firmer (0.6% vs. 0.7% est), Ex Transportation (0.4% vs. 0.4% est); Cap Goods Orders Nondef Ex Air softer (0.2% vs. 0.3% est).

- Late year rate cut projections continue to gain vs. late Monday levels (*): June 2024 at -1.3% w/ cumulative rate cut -.3bp at 5.328%, July'24 at -16% w/ cumulative at -4.3bp at 5.288%, Sep'24 cumulative -19.3bp (-17.2bp), Nov'24 cumulative -27.8bp (-25.3bp), Dec'24 -44.3bp (-40.6bp).

- Looking ahead; MBA Mortgage Applications, ADP Employment Change, S&P Global US PMI & ISM Services Index

FED: Key Inter-Meeting Fed Speak – June 2024

We've published our wrap-up of FOMC participants' commentary since the last decision on May 1, ahead of the June 11-12 meeting.

- The message from Chair Powell and other FOMC members since the May meeting has been a fairly emphatic "high for longer", with policy currently seen as restrictive but needing further time to work to bring inflation down.

- See PDF link below:

FedPrevJun2024 - Key Inter-Meeting FedSpeak.pdf

STIR: OI Points To Mix Of Long Setting & Short Cover Dominating In SOFR Following JOLTs

Yesterday’s twist flattening of the SOFR futures strip and preliminary OI data point to the following net positioning swings on Tuesday:

- Whites: A mix of long cover, long setting and short cover.

- Reds: A mix of long setting and short cover, with the former dominating in net pack OI terms.

- Greens: A mix of long setting and short cover, with the latter dominating in net pack OI terms.

- Blues: A mix of long setting and short cover, with the latter dominating in net pack OI terms.

- FOMC-dated OIS saw a dovish move on yesterday’s JOLTS data, leaving ~45bp of cuts priced through year end as the move away from the recent hawkish extremes extended a little.

- The first 25bp cut is discounted through the end of Nov FOMC, with ~75% odds of a cut through the Sep meeting currently discounted.

- Note that BBG’s U.S. economic surprise index has moved to fresh multi-year lows, with stagflation-lite discussions becoming more frequent.

- The impending run of U.S. ISM services, ADP and NFP data will be key for Fed pricing during the remainder of the week.

| 04-Jun-24 | 03-Jun-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRH4 | 912,966 | 920,011 | -7,045 | Whites | -7,370 |

| SFRM4 | 1,221,800 | 1,230,865 | -9,065 | Reds | +6,621 |

| SFRU4 | 1,173,825 | 1,170,127 | +3,698 | Greens | -10,376 |

| SFRZ4 | 1,179,504 | 1,174,462 | +5,042 | Blues | -6,485 |

| SFRH5 | 813,701 | 811,755 | +1,946 | ||

| SFRM5 | 800,264 | 806,021 | -5,757 | ||

| SFRU5 | 732,105 | 732,724 | -619 | ||

| SFRZ5 | 793,779 | 782,728 | +11,051 | ||

| SFRH6 | 563,511 | 561,257 | +2,254 | ||

| SFRM6 | 502,749 | 505,684 | -2,935 | ||

| SFRU6 | 399,164 | 408,286 | -9,122 | ||

| SFRZ6 | 357,951 | 358,524 | -573 | ||

| SFRH7 | 249,504 | 255,561 | -6,057 | ||

| SFRM7 | 194,299 | 193,031 | +1,268 | ||

| SFRU7 | 160,924 | 163,665 | -2,741 | ||

| SFRZ7 | 155,503 | 154,458 | +1,045 |

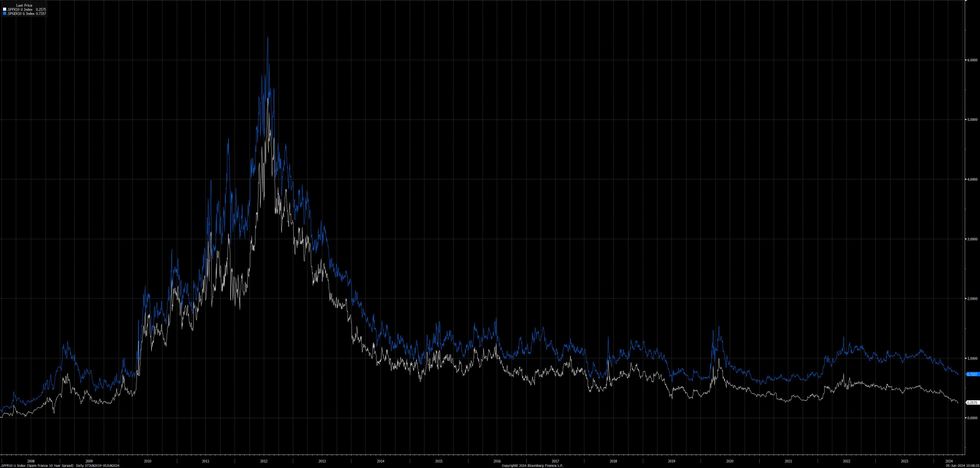

EGBS: BTP/Bunds Continues To Trade At ~130bp, Iberian Tightener Preferences Remain Evident

The recovery from yesterday’s lows in European equities and focus on the widely expected start to the ECB’s easing cycle continues to backstop widening episodes in the 10-Year BTP/Bund spread. The spread has been oscillating around 130bp since the start of May.

- Meanwhile, focus on the same monetary policy dynamics, coupled with fiscal progress in both Spain & Portugal, continues to promote a tightening bias for Iberian paper.

- Friday’s positive Spanish outlook (trend) move from Morningstar DBRS was the latest step on the favourable Spanish ratings trajectory.

- 10-Year SPGB-OAT spreads have recently hit levels not seen since the start of the sovereign debt crisis, with questions over the French fiscal outlook allowing that move to extend further in recent months

- Relative fiscal dynamics mean that Iberian tighteners have been a favoured sell-side play in recent times. Still, Commerzbank “continue to see value in SPGBs vs. OATs/semi-core as well as PGB-convergence trades vs. semi-core which are also hitting new lows.”

Fig. 1: 10-Year SPGB/Bund & SPGB/OAT Spreads (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

USD/JPY's Impressive Intraday Bounce Still Short of Weekly High

- Following the strong JPY rally this week, a moderate reversal for US yields has seen the Japanese Yen retrace substantially overnight. USDJPY stands up 0.87% on the session, having risen back above the 156 handle, where it has been consolidating across the European morning. USD/JPY's intraday bounce has been solid and one-directional, however the pair remains lower on the week, and just over 100 pips off the opening levels printed Monday. JPY is the poorest performer in G10.

- NZD trades well, higher against most others to keep NZD/USD within range of the cycle highs and notable resistance at 0.6198. Clearance here would put the pair at the best levels since mid-March. Moves follow the firmer-than-expected print for China's Caixin Services PMI for May (54.0 vs. 52.5), which proved more market-moving relative to the mixed Italian / Spanish services PMIs released this morning.

- The Bank of Canada rate decision set for later today is expected to see the first cut of the cycle, with consensus looking for a 25bps cut to 4.75%. That said, a sizeable minority see the Bank holding until July (or later), leaving markets ~80% priced for a cut today. Those that see a July, rather than a June, cut cite Fed re-pricing, the dangers of US-CA rate differentials and the still-booming local housing market.

- Outside of the BoC, ADP Employment Change is set to cross ahead of the ISM services index data for May. Both figures will be carefully watched ahead of Friday's Nonfarm Payrolls release, at which markets expect 185,000 jobs added over the month.

CAD Risk Premium Builds into Potential First Cut of the Cycle

- CFTC data shows markets have been building CAD shorts at a swift pace over the past three month, flipping the net position from neutral in February, to outright short (net short equates to 33% of open interest).

- Positioning adjustments gel well with options market activity, which have favoured USD/CAD upside insurance over the past month. Sizeable demand has been building for call strikes layered between 1.3725-1.3750, but topside interest is also evidenced in further OTM calls: over $10bln notional has been wagered against 1.38-1.39 calls over the past month.

- Overnight CAD vols have built a decent risk premium headed into the decision, with overnights clearing 10 points for only the sixth time in 2024, doubling the average YTD background vol to imply a ~60 pip in USD/CAD into tomorrow's NY cut.

- While consensus looks for a 25bps rate cut today, there remain a sizeable minority looking for easing to be delayed until the July decision - leaving markets ~80% priced for a cut today. Those that see a July, rather than a June, cut cite Fed re-pricing, the dangers of US-CA rate differentials and the still-booming local housing market.

- MNI's full BoC preview found here: https://roar-assets-auto.rbl.ms/files/64492/BOCPreviewJun2024.pdf

JPY: Yen Consolidating Back Above 156.00, CADJPY Bounces From Support Ahead of BOC

- Following the strong JPY rally this week, a moderate reversal for US yields has seen the Japanese Yen retrace substantially overnight. USDJPY stands up 0.87% on the session, having risen back above the 156 handle, where it has been consolidating across the last hour.

- On Tuesday, initial support was exposed at 154.66, the 50-day EMA. Despite the level being pierced (154.55 low), the strong subsequent bounce keeps this key support zone intact for now. Adding weight to this area, 153.93, a trendline drawn from the Dec 28 low, remains the key support. For bulls, a move above 157.71, the May 29 high, is required to resume a short-term uptrend.

- With today’s Bank of Canada decision approaching, it is also worth noting that CADJPY has also bounced from support (shown below). Both the 50-day EMA and a trendline drawn from the December 07 low, intersecting around 113.30 will be monitored closely should the BOC deliver their first rate cut and attach any dovish leanings.

- As noted earlier, overnight CAD vols have built a decent risk premium headed into the decision and CFTC data shows markets have been building CAD shorts at a swift pace over the past three month. This may add weight to a potential break lower in CADJPY, signalling scope for a move towards the post intervention lows of 111.42.

Expiries for Jun05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0780-00(E2.2bln), $1.0835-50(E829mln), $1.0855(E1.3bln), $1.0890-00(E1.4bln), $1.0920(E1.4bln)

- USD/JPY: Y153.00-10($1.3bln), Y154.60-75($815mln), Y155.30($885mln), Y156.60-65($739mln)

- AUD/USD: $0.6585-00(A$1.5bln)

- USD/CNY: Cny7.2350($871mln), Cny7.2500($1.0bln)

Technical Uptrend in E-Mini S&P Remains Intact

- Eurostoxx 50 futures traded lower Tuesday, extending the current bear cycle. The recent move down appears to be a correction, but note that support at the 50-day EMA, at 4966.80, has been pierced. A clear break of the average would undermine the short-term bullish theme and signal scope for a deeper retracement, towards 4894.90, a Fibonacci retracement. Initial resistance is seen at 5047.00, the Jun 3 high.

- The uptrend in S&P E-Minis remains intact, however, a corrective cycle has resulted in a pullback from the recent high of 5368.25 (May 23). The latest move down has seen price pierce support at the 50-day EMA, at 5219.79. A clear break of this average would signal scope for a deeper retracement. The recovery from last Friday’s low is a positive development, a continuation would open 5368.25, and a breach of this level resumes the trend.

WTI Futures Trading Above This Week's Lows

- WTI futures have traded sharply lower this week and the contract remains soft. Price has cleared $73.24, the 76.4% retracement of the Dec 13 - Apr 12 bull leg. This reinforces the current bearish theme and signals scope for a continuation. Note that moving average studies are in a bear-mode position too, highlighting a downtrend. Sights are on $71.33 next, the Feb 5 low. Initial resistance is at $76.15, the May 24 low and a recent breakout level.

- A bear cycle in Gold remains in play for now, and the yellow metal is trading closer to its recent lows. The medium-term trend structure is bullish and the recent move down appears to be a correction that is allowing an overbought condition to unwind. Moving average studies are in a bull-mode position, highlighting an uptrend. A resumption of gains would open $2452.5 next, a Fibonacci projection. The 50-day EMA, at $2310.1, represents a key support.

| Date | GMT/Local | Impact | Country | Event |

| 05/06/2024 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 05/06/2024 | 1215/0815 | *** | ADP Employment Report | |

| 05/06/2024 | 1345/0945 | *** | Bank of Canada Policy Decision | |

| 05/06/2024 | 1400/1000 | *** | ISM Non-Manufacturing Index | |

| 05/06/2024 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 05/06/2024 | 1430/1030 | BOC Governor Press Conference | ||

| 06/06/2024 | 0130/1130 | ** | Trade Balance | |

| 06/06/2024 | 0130/1130 | ** | Lending Finance Details | |

| 06/06/2024 | 0545/0745 | ** | Unemployment | |

| 06/06/2024 | 0600/0800 | ** | Manufacturing Orders | |

| 06/06/2024 | 0700/0900 | ** | Industrial Production | |

| 06/06/2024 | 0730/0930 | ** | S&P Global Final Eurozone Construction PMI | |

| 06/06/2024 | 0800/1000 | * | Retail Sales | |

| 06/06/2024 | 0830/0930 | ** | S&P Global/CIPS Construction PMI | |

| 06/06/2024 | 0830/0930 | BOE's Decision Maker Panel Data | ||

| 06/06/2024 | 0900/1100 | ** | Retail Sales | |

| 06/06/2024 | 1215/1415 | *** | ECB Deposit Rate | |

| 06/06/2024 | 1215/1415 | *** | ECB Main Refi Rate | |

| 06/06/2024 | 1215/1415 | *** | ECB Marginal Lending Rate | |

| 06/06/2024 | 1230/0830 | *** | Jobless Claims | |

| 06/06/2024 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 06/06/2024 | 1230/0830 | ** | Trade Balance | |

| 06/06/2024 | 1230/0830 | ** | Non-Farm Productivity (f) | |

| 06/06/2024 | 1230/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 06/06/2024 | 1245/1445 | ECB Monetary Policy Press Conference | ||

| 06/06/2024 | 1400/1000 | * | Ivey PMI | |

| 06/06/2024 | 1415/1615 | ECB's Lagarde presents monpol decision on podcast | ||

| 06/06/2024 | 1430/1030 | ** | Natural Gas Stocks | |

| 06/06/2024 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 06/06/2024 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 07/06/2024 | 0600/0800 | ** | Trade Balance | |

| 07/06/2024 | 0600/0800 | ** | Industrial Production | |

| 07/06/2024 | 0645/0845 | * | Foreign Trade | |

| 07/06/2024 | 0800/1000 | ECB's Schnabel participates in panel discussion at the Federal Ministry of Finance | ||

| 07/06/2024 | 0900/1100 | *** | GDP (final) | |

| 07/06/2024 | 0900/1100 | * | Employment | |

| 07/06/2024 | - | *** | Trade | |

| 07/06/2024 | 1230/0830 | *** | Employment Report | |

| 07/06/2024 | 1230/0830 | *** | Labour Force Survey | |

| 07/06/2024 | 1400/1000 | ** | Wholesale Trade | |

| 07/06/2024 | 1415/1615 | ECB's Lagarde in Atelier Maurice Allais | ||

| 07/06/2024 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 07/06/2024 | 1900/1500 | * | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.