-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - BoE to Clash With Partial Pricing for 50bps

Highlights:

- BoE up next, to clash with partial pricing for 50bps hike

- Norges Bank hikes 50bps, SNB goes 25bps

- NOK surges on hawkish hike, path projections

US TSYS: Leaning Bear Steeper Ahead Of BoE And Hawkish Fed Speakers

Treasuries have retraced Wednesday afternoon's post-20Y auction rebound in overnight trade Thursday, eyeing varied data and Fed speakers ahead.

- TY futures have dipped in sympathy with trans-Atlantic counterparts on a packed European central bank decision day (SNB hiked 25bp in line with survey, Norges Bank 50bp vs 25bp expected, BoE decision at 0700ET).

- That said, trade has been thinned overnight by Asian holidays (TYU3 volumes <150k). The curve leans bear steeper, with 2Y yields +2.2bp, 10Y+3.3bp.

- Atlanta Fed Pres Bostic told MNI yesterday he's prepared to hold rates through end-2024, but would be willing to tighten further if inflation proves more stubborn than he expects.

- Hawks Bowman/Mester at 1000ET are arguably the FedSpeak highlight today, even as Powell simultaneously makes his 2nd day Congressional appearance (which is usually a non-event). Barkin appears after the close.

- Weekly jobless claims highlight 0830ET data releases (also current account and Chicago Fed National Activity readings), with existing home sales and the leading economic index at 1000ET and KC Fed manufacturing at 1130ET.

- In supply: $19B 5Y TIPS re-open and large bill auctions ($70B 4W, $60B 8W), preceded by announcements on 6W/13W/26W bills and the final coupon sales of the month (2Y/5Y/7Y/2Y FRN).

Latest levels:

- The 2-Yr yield is up 2.2bps at 4.7372%, 5-Yr is up 2.5bps at 3.9816%, 10-Yr is up 3.3bps at 3.7519%, and 30-Yr is up 2.5bps at 3.8322%.

- Sep 10-Yr futures (TY) down 7.5/32 at 113-2.5 (L: 113-1 / H: 113-10)

UK: PM To Deliver Economic Update As Public Pressure For Mortgage Relief Mounts

Prime Minister Rishi Sunak is set to deliver a speech later today on the state of the British economy and his gov'ts efforts to curtail inflation and boost growth. While the gov't has so far proved reluctant to engage with the prospect of providing direct relief to mortgage holders as interest rates continue to rise, public pressure is mounting.

- Current polling from YouGov shows 62% of respondents believe the gov't has been handling the issue of rising mortgage costs 'fairly badly' or 'very badly'. Sunak's centre-right Conservative party has often used a perception of economic competence in the party as an electoral asset. However, polling is increasingly indicating that the party has lost this perception with many voters.

- The gov't faces a stark choice between stepping into the mortgage market to offer relief, potentially fuelling further inflation and hitting gov't finances, or run an election campaign in 2024 with many of the party's core home-owning voters feeling a significant economic impact from higher rates.

- Ahead of the speech, Sunak tweets: "[...] Like many countries, the UK faces profound economic challenges. [...] As well as providing immediate relief for people, I’ve been focused on tackling longer term problems [...]. That's why my top three priorities are to halve inflation, grow the economy and reduce debt. [...] I know things are difficult, but if we can hold our nerve I’m confident this plan will deliver."

MNI BOE Sellside Views Update

- There remains a unanimous expectation among sell-side economists that Bank Rate will be raised by 25bp in both June and August.

- Some analysts now look for 1-2 hawkish dissents following the CPI print. No one explicitly is calling for 3+ votes for 50bp. Most believe it doesn’t really matter if we have 1 or 2 dovish dissenters in terms of market reaction.

- Most expect the guidance to be left unchanged, but some look for more hawkish language or a commitment to examine the reasons for the upside inflation prints in the August MPR.

- Goldman Sachs has joined Barclays and BNP with a 5.50% terminal rate forecast. Berenberg and Morgan Stanley increased from 5.00% to 5.25%.

- 47% of analysts expect a 5.00% terminal rate, 38% look for 5.25% while 14% look for 5.50%.

- A fair number of analysts also point to upside risks to their forecasts. No one sees any 50bp hikes in their base case – but most see August as more likely for a 50bp hike than June.

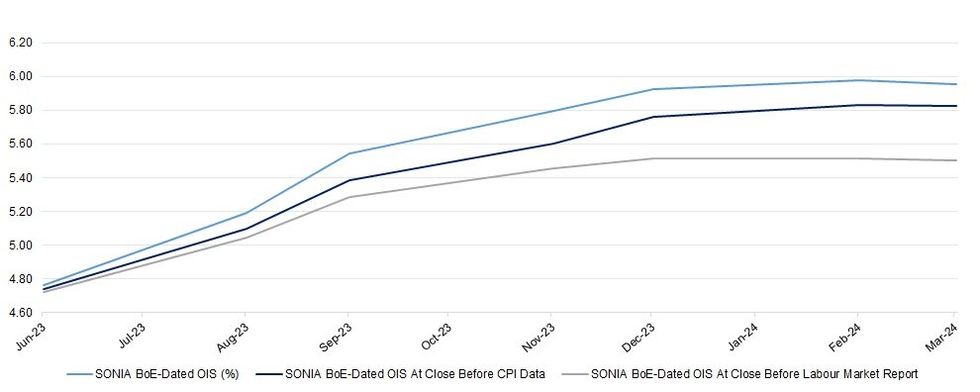

STIRS: Market Remains More Hawkish Than Sell-Side Ahead Of BoE Decision

BoE-dated OIS continues to hold in line with previously flagged levels, showing ~34bp of tightening for today’s meeting, as the recent run of data leaves markets positioned a little more hawkishly than the unanimous (albeit heavily caveated) baseline view of the sell-side, which looks for a 25bp hike. Meanwhile, terminal rate pricing sits a little above 6.00% in policy rate terms.

| BoE Meeting | SONIA BoE-Dated OIS (%) | Difference Vs. Current Effective SONIA Rate (bp) |

| Jun-23 | 4.766 | +33.7 |

| Aug-23 | 5.195 | +76.6 |

| Sep-23 | 5.547 | +111.8 |

| Nov-23 | 5.795 | +136.6 |

| Dec-23 | 5.928 | +149.9 |

| Feb-24 | 5.978 | +154.9 |

| Mar-24 | 5.956 | +152.7 |

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

Norges Bank Boosts Policy Rate by 50bps, Inline with MNI Expectations

- Norges Bank hikes rates by 50bps to 3.75%, alongside MNI expectations, and flags that the key rate will likely be raised further in August.

- Full Norges Bank statement here: https://www.norges-bank.no/en/topics/Monetary-poli...

- New rate path shows higher peak rate, up to 4.21% in Q4'23 and Q1'24, with end-horizon rate boosted to 2.88% from 2.54% in March. That's a 61bps upgrade for the peak rate from the March report.

- Immediate strength noted in the NOK, driving EUR/NOK to new daily lows and putting the cross at 11.5538. FRAs also correcting higher to incorporate the tighter rate path profile - the bank adding ~50bps of further tightening across the forecast horizon. Timing of the rate peak itself is broadly unchanged, but suggests rates will be kept higher for longer. Full rate path inc. Basis point changes here:

SNB Policy Rate Raised by 25bps to 1.75%, Reiterates Readiness to Intervene in FX

- The SNB raises rates by 25bps to 1.75%, and reiterates their readiness to intervene in currency markets. The bank adds that they cannot exclude the possibility of further rate hikes ahead, highlighting the increased inflationary pressure over the medium-term.

Full SNB statement here: https://www.snb.ch/en/mmr/reference/pre_20230622/s...

- Conditional inflation forecast ticks lower into year-end 2023 (2.0% for Q4 from 2.3% prev) but is revised higher across 2024 by 0.2/0.3ppts.

- Whipsaw price action in CHF - USD/CHF initially spikes to 0.8947 (factoring out partial pricing of a 50bps move), and is holding the bulk of the ~20pip bounce at typing.

FOREX: NOK on Top as Norges Re-Accelerate Tightening

- NOK is comfortably outperforming across G10, tipping EUR/NOK back toward the 100-dma support undercutting at 11.4405. The level was last crossed in November last year and a break below would mark a key medium-term momentum shift in the cross.

- Moves across the Norwegian currency follow an acceleration in the tightening pace for the Norges Bank, who raised the policy rate by 50bps to 3.75% and flagged further tightening to come across the Summer months. The Bank's new rate path boosted the peak to near 4.25%, and sees the bank holding policy at a tighter level for longer across the forecast horizon.

- Meanwhile, the SNB raised policy rates by 25bps - disappointing a notable minority that looked for 50bps of tightening today. The Bank warned that further policy tightening cannot be ruled out, although they downgraded their inflation view for 2023 in the process. CHF trades weaker in response, putting USD/CHF higher by ~0.1% on the day.

- The Bank of England rate decision takes focus going forward. At the beginning of the week, consensus firmly looked for 25bps of tightening, but there remain outside risks of a larger move today in response to the accelerating core inflation release posted earlier this week. GBP/USD holds just below 1.2800 at typing, with options markets pricing an approximate 85pip swing in the pair today.

- Weekly jobless claims and the Chicago Fed National Activity Index are the data highlights Thursday, with US existing home sales to follow. Fed's Powell is set to appear for a second session, this time in front of the Senate Banking Panel. Fed's Bowman, Barkin and Mester also make appearances.

FX OPTIONS: Expiries for Jun22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0790-00(E1.8bln), $1.0845-55(E829mln), $1.0875(E674mln), $1.0900(E2.1bln), $1.1000-05(E748mln), $1.1045-50(E709mln)

- USD/JPY: Y138.48-50($1.4bln), Y141.00-20($1.3bln), Y142.00($903mln), Y142.50($760mln)

- AUD/NZD: N$1.1100(A$1.4bln)

- USD/CAD: C$1.3100-15($795mln), C$1.3200-10($755mln)

EQUITIES: E-Mini S&Ps Extend Recent Losses

- The Eurostoxx 50 futures uptrend remains intact, however, a bearish corrective cycle this week has resulted in a move lower and the contract is approaching support at 4301.00, the Jun 8 low. This is a key short-term support and a break would signal scope for a deeper retracement, exposing 4241.00, the May 31 low and a key support. Key resistance and the bull trigger has been defined at 4438.00, the Jun 16 high.

- A bull theme in S&P E-minis remains intact and this week’s pullback appears to be a correction. This is allowing a recent overbought condition to unwind. Initial key support lies at the 20-day EMA which intersects at 4348.95. A break of this average would strengthen a short-term bearish theme and signal scope for a deeper pullback. On the upside, the bull trigger is 4493.75, the Jun 16 high. A break would open 4500.21, the top of a bull channel.

COMMODITIES: WTI Futures Trade Close to This Week's Highs

- WTI futures continue to appreciate and the contract is trading at this week’s highs. Despite recent gains, the outlook remains bearish and the contract is trading below resistance at $75.70, the Jun 5 high. Support at $67.21, May 31 low, has recently been pierced, a clear break would open $64.41, the May 4 low. Moving average studies are in a bear mode position highlighting a downtrend. A break of $75.70 would signal a reversal.

- The bear cycle in Gold remains intact and the yellow metal is trading closer to recent lows. Trendline support was breached last week - the line is drawn from the Nov 3 2022 low and intersects at $1975.7. The break reinforces a bearish condition and marks a resumption of the downtrend. The focus is on $1903.5, 61.8% of the Feb 28 - May 4 bull cycle. Initial firm resistance is $1985.3, the May 24 high and a reversal trigger.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/06/2023 | 0915/1115 |  | EU | ECB Panetta Speech at Buba/ECB/Chicago Fed Conference | |

| 22/06/2023 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 22/06/2023 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 22/06/2023 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 22/06/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 22/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 22/06/2023 | 1230/0830 | * |  | US | Current Account Balance |

| 22/06/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 22/06/2023 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/06/2023 | 1400/1000 |  | US | Fed's Michelle Bowman, Loretta Mester | |

| 22/06/2023 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 22/06/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 22/06/2023 | 1430/1630 |  | EU | ECB de Guindos at Financial Journalists' Roundtable | |

| 22/06/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 22/06/2023 | 1500/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 22/06/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 22/06/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 22/06/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 22/06/2023 | 1900/1500 |  | US | Atlanta Fed's Raphael Bostic | |

| 22/06/2023 | 2030/1630 |  | US | Richmond Fed's Tom Barkin | |

| 23/06/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 23/06/2023 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 23/06/2023 | 2330/0830 | *** |  | JP | CPI |

| 23/06/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 23/06/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 23/06/2023 | 0700/0900 | *** |  | ES | GDP (f) |

| 23/06/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 23/06/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 23/06/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 23/06/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 23/06/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 23/06/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 23/06/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 23/06/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 23/06/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 23/06/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 23/06/2023 | 0915/0515 |  | US | St. Louis Fed's James Bullard | |

| 23/06/2023 | 1200/0800 |  | US | Atlanta Fed's Raphael Bostic | |

| 23/06/2023 | 1245/1445 |  | EU | ECB Panetta in BIS Conference Discussion | |

| 23/06/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 23/06/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/06/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 23/06/2023 | 1530/1630 |  | UK | BOE Announces Q3-23 Active Gilt Sales Schedule | |

| 23/06/2023 | 1740/1340 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.