-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS: BoJ Sources & Global Core FI Weakness Lead To Fresh USD/JPY '23 High

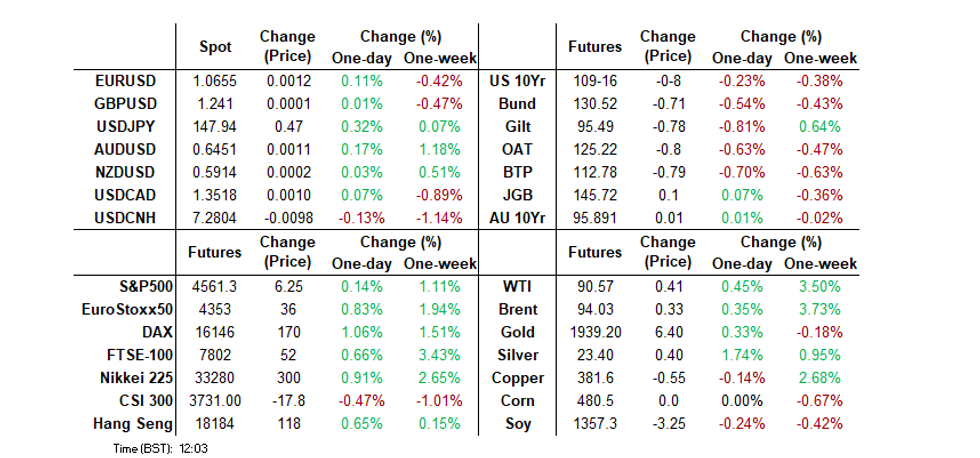

- USDJPY registers a new '23 high, nearly testing Y148.00. JPY weakness comes after BBG sources flagged a gap between the intention in BoJ Governor Ueda's weekend remarks and the hawkish market reaction they generated.

- Subsequent weakness in wider core global FI markets (at least partially linked to a hawkish FT sources piece re: the ECB) has added further headwinds for the JPY, which subsequently finds itself at the foot of the G10 FX pile.

- Preliminary UoM sentiment data headlines the NY data docket.

US TSYS: European & UK Paper Help Tsys Lower Pre-NY, Block Steepener Flow Seen

Tsys run 3-4bp cheaper across the curve as we move towards NY trade, with the lead from Europe (in light of a hawkish ECB sources story from the FT) front and centre.

- TYZ3 last shows -0-08+, at the base of its 0-13+ range, with yesterday’s low comfortably breached. Initial technical support comes in at 109-03, Wednesday’s low.

- Firmer-than-expected Chinese monthly economic activity data and a medium-term liquidity injection from the PBoC did little for the space in Asia-Pac hours.

- Chinese stocks struggled given continued property sector credit worries.

- The weakness in European/UK bonds, along with a more constructive start to the session for e-minis/European equities, then helped bias Tsys lower.

- Oil futures are back from highs after registering another round of ’23 bests during Asia hours.

- Pre-NY flow has been dominated by a ~280K FV/US steepener block.

- Preliminary UoM sentiment data (particularly the inflation exp. component) headlines the NY data docket, with Empire M’fing, terms of trade and industrial production readings also set to cross.

US TSY FUTURES: OI Suggests Short Setting Dominated On Thursday

The combination of yesterday’s data-inspired Tsy cheapening and preliminary open interest data points to a mix of short setting and long cover across the Tsy futures curve on Thursday.

- TY was the only contract to see a (marginal) round of net long cover, with the remaining contracts appearing to see fresh shorts set in net terms.

- That saw a net ~$7mn of DV01 equivalent OI added across the curve, which was lower than the ~$9.5mn round of fresh longs that was seemingly added on Wednesday.

- Roll activity would have provided some minor skew to the DV01 readings.

| 14-Sep-23 | 13-Sep-23 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,688,825 | 3,682,074 | +6,751 | +258,938 |

| FV | 5,497,886 | 5,431,041 | +66,845 | +2,844,967 |

| TY | 4,710,965 | 4,718,743 | -7,778 | -507,642 |

| UXY | 1,808,908 | 1,794,875 | +14,033 | +1,287,933 |

| US | 1,360,270 | 1,345,729 | +14,541 | +1,948,272 |

| WN | 1,537,593 | 1,532,107 | +5,486 | +1,124,181 |

| Total | +99,878 | +6,956,648 |

STIR: Fed End-2024 Implied Rate Closes In On June Dot As Disinversion Continues

- Fed Funds implied rates for near-term meetings continue to be weighed by Wednesday’s CPI report, but beyond that have continued to shake off the decline seen with 2024 rate cut expectations at new recent lows.

- Cumulative hikes from 5.33% effective: +1bp for Wednesday, +9bp for Nov and +12bp for Dec to terminal 5.45%.

- Cuts from terminal: 29bp to Jun’24 (from 31bp at yesterday’s close) and 91bp to Dec’24 (from 94bp).

- It means the implied 4.54% effective rate for Dec’24 is within 5bps of the Fed’s 4.5-4.75% median 2024 dot from the June SEP assuming the current 8bp spread to the lower bound is maintained.

- Looking at SOFR for a cleaner historical comparison, the SFRU3/Z4 spread of -92bps continues to set fresh lows for inversion since shortly after the regional banking woes of March at levels last seen in Oct’22.

STIR: Data-Driven Short Setting Seemed To Dominate SOFR On Thursday

Yesterday’s twist steepening of the SOFR strip, coupled with preliminary OI data, points to the following positioning swings on Thursday:

- An apparent mix of short cover, fresh long setting and fresh short setting in the whites, with the sole round of short setting (SFRH4) in the pack outweighing the other swings.

- The reds through blues also seemed to see net short setting dominate, with only 3 rounds of apparent long cover observed across those packs.

- The most notable round of apparent fresh net short setting on a pack basis seemed to be found in the reds.

| 14-Sep-23 | 13-Sep-23 | Daily OI Change | Daily OI Change In Packs | ||

| SFRM3 | 1,107,426 | 1,107,720 | -294 | Whites | +9,885 |

| SFRU3 | 1,180,044 | 1,178,964 | +1,080 | Reds | +21,673 |

| SFRZ3 | 1,302,709 | 1,304,848 | -2,139 | Greens | +11,920 |

| SFRH4 | 1,002,639 | 991,401 | +11,238 | Blues | +2,602 |

| SFRM4 | 922,001 | 923,373 | -1,372 | ||

| SFRU4 | 837,701 | 833,460 | +4,241 | ||

| SFRZ4 | 898,999 | 887,692 | +11,307 | ||

| SFRH5 | 526,715 | 519,218 | +7,497 | ||

| SFRM5 | 595,254 | 584,670 | +10,584 | ||

| SFRU5 | 482,476 | 489,186 | -6,710 | ||

| SFRZ5 | 434,894 | 429,895 | +4,999 | ||

| SFRH6 | 296,803 | 293,756 | +3,047 | ||

| SFRM6 | 248,722 | 249,881 | -1,159 | ||

| SFRU6 | 172,821 | 171,004 | +1,817 | ||

| SFRZ6 | 171,132 | 169,461 | +1,671 | ||

| SFRH7 | 125,717 | 125,444 | +273 |

EGBS: Cheaper, Bunds Unwind ECB Rally & Peripherals Widen

The early morning hawkish sources report re: the ECB from the FT (‘ECB hawks warn of December rate rise if inflation and wages stay hot’) applied pressure to Bunds, with the contract only really finding a base in recent trade, as the EURIBOR strip ticked away from worst levels.

- The usually hawkish ECB Governing Council member Muller indicated that he doesn’t expect further rate hikes in the coming months, while noting that higher-than-expected inflation levels could generate the need for another hike.

- ECB-dated OIS terminal rate pricing is unchanged on the day, but there has been a modest unwind of some of the pricing of cuts seen in ’24.

- Core/semi-core EGB curves see similar moves to Bunds.

- The sources piece and this morning’s outright cheapening seems to have been enough to trigger some re-widening in peripheral spreads, with BTPs and GGBs seeing the largest moves (+2.5bp vs. Bunds). Yesterday’s dovish hike, which signalled a likely end to the hiking cycle, and lack of movement on the PEPP front promoted peripheral compression post-ECB.

- Various peripheral political figures have expressed unease with the latest ECB rate hike.

- Elsewhere, a late Thursday BBG source piece suggested that the Italian PM and Finance Minister are “increasingly aware of the impact that a wider-than-announced deficit could have on bond yields and the ability to finance new measures,” suggesting they are seeking to reassure investors that Italy’s finances are under control.

GGBS: Eyes On Moody’s Update After Hours, Expectations For IG Index Inclusion In Early ’24

Commerzbank note that “the focus will be on tonight's busy rating schedule.” Moody’s scheduled update on Greece (current rating: Ba3; Outlook Positive) presents the highlight there.

- Commerzbank go on to flag that “Moody's found “upward credit pressures” for Greece in a recent report, citing economic, fiscal and banking reforms that are ongoing.”

- “An upgrade from Moody's is thus on the cards, but the three-notch gap to investment grade seems unlikely to be bridged in one step. The next IG ratings could come from S&P on 20 Oct and Fitch on 1 Dec.”

- The country’s fiscal trajectory & the Greek centre-right’s political victory earlier this year have increased focus on Greek rating dynamics.

- A quick reminder that Greece attained IG status at DBRS Morningstar last week, although that is not meaningful for GGBs re: benchmark bond index inclusion.

- General expectations are for index inclusion in early ’24 owing to the aforementioned rating schedule, index inclusion requirements and current distance from IG status at Moody’s.

- 10-Year GGB/Bund and GGB/BTP spreads sit a little above ’23 tights.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

ECB: No Meaningful Market Moves On Back Of Voluntary TLTRO Repayments

The previously flagged voluntary TLTRO repayments totalled ~EUR34.2bn, which was a little above the estimates that we saw from various sell-side names, although wasn’t too detached from general expectations.

- Euribor futures are incrementally weaker, although that seemed to be a function of some modest outright bond cheapening, as opposed to any TLTRO related spill over.

- 10-Year BTP/Bund spread stable around the release.

FOREX: The Yen Is Again Under Pressure

- USD stays on the back foot in the European session, helped by the Risk On tone.

- AUD was the best early performer in G10s. Next resistance is seen further out, at 0.6522 in AUDUSD.

- USDJPY registers a new '23 high, nearly testing Y148.00. JPY weakness comes after BBG sources flagged a gap between the intention in BoJ Governor Ueda's weekend remarks and the hawkish market reaction they generated.

- Subsequent weakness in wider core global FI markets has added further headwinds for the JPY, which subsequently finds itself at the foot of the G10 FX pile.

- Looking ahead, US IP, and prelim Michigan will be the notable data releases.

FX OPTIONS: Expiries for Sep15 NY cut 1000ET (Source DTCC)

- EURUSD: 1.0600 (1.74bn), 1.0610 (340mln), 1.0615 (510mln), 1.0640 (785mln), 1.0650 (1.75bn), 1.0670 (280mln), 1.0690 (550mln), 1.0700 (2.4bn).

- GBPUSD: 1.2400 (450mln).

- USDJPY: 146.75 (1.56bn) 147.00 (435mln), 148.00 (526mln).

- USDCAD: 1.3490 (290mln), 1.3500 (1.1bn), 1.3510 (219mln), 1.3515 (204mln), 1.3525 (1.12bn).

- AUDUSD: 0.6460 (301mln).

- USDCNY: 7.22 (1.23bn), 7.30 (708mln).

EQUITIES: EUROSTOXX Bounce Extends

- A bear cycle in the E-mini S&P contract remains in play, however, the latest recovery undermines this bearish theme. A continuation higher would open 4597.50, the Sep 1 high, where a break would strengthen a bullish case. This would open 4617.40, 76.4% of the Jul 27 - Aug 18 sell-off. Key short-term support has been defined at 4483.25, the Sep 7 low. A break would be seen as a bearish development.

- EUROSTOXX 50 futures traded sharply higher yesterday and price is firmer today. These strong gains threaten the recent bearish theme and signal a possible short-term reversal with a key support defined at 4210.00, the Sep 8 low. A continuation higher would expose resistance at 4388.00, the Aug 30 high where a break would strengthen a bullish case. For bears, a break of 4210.00, would resume the recent downtrend.

COMMODITIES: Trend Needle In Oil Points North

- On the commodity front, {O4} Gold traded lower again yesterday but has recovered from the session low of $1901.1. A break of this level would strengthen the current bearish theme and highlight the fact that the recovery between Aug 21 - Sep 1 has been a correction. This would expose $1884.9, the Aug 21 low. On the upside, initial firm resistance is seen at $1928.0, the 50-day EMA. Key resistance is at $1953.0, the Sep 4 high. Gains are considered corrective.

- In the oil space, the uptrend in WTI futures remains intact and this week’s gains reinforce this theme. The break higher confirms a resumption of the uptrend and maintains the bullish price sequence of higher highs and higher lows. Note too that moving average studies are in a bull-mode position, highlighting a rising trend. The $90.00 handle has been cleared, this opens $92.17 next, the Nov 8 2022 high (cont). Initial firm support to watch is $84.90, the 20-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/09/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 15/09/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/09/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/09/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/09/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/09/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 15/09/2023 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 15/09/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.