-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - House Takes Initiative After Budget Vote

MNI Eurozone Inflation Preview - February 2025

MNI US MARKETS ANALYSIS - Curve Nears Flattest Levels of 2025

MNI US MARKETS ANALYSIS - China Holiday, Fed Media Blackout Makes For Quiet Start

Highlights:

- China's Lunar New Year, Fed media blackout keeps lid on price action

- Data calendar remains light, with ECB speak the focus for market so far

- Earnings season continues, with just under 25% of the S&P 500's market cap due

US TSYS: Potential ECB Spillover In Focus With Little Else Scheduled

- Cash Tsys see ongoing cheapening pressure in recent hours in a reversal of a bid through Asia hours amidst low volumes with the Lunar New Year. The downward pressure is possibly helped by some spillover from EU FI (Nagel sees inflation return to target without a recession, Kazimir wants to deliver two more 50bp hikes), even if Fed expectations are little changed on the day. ECB’s Lagarde to speak later at 1215ET.

- 2YY +1.0bp at 4.181%, 5YY +1.7bp at 3.579%, 10YY +2.4bp at 3.502%, 30YY +2.9bp at 3.684%.

- TYH3 trades 4 ticks lower at 114-30, close to Friday’s low of 114-27+. Support is seen nearby at 114-16 (Jan 18 low) whilst resistance remains at 116-08 (Jan 19 high).

- A minimal US docket today, with FOMC now in media blackout and data limited to the leading index for Dec at 1000ET.

- Bill issuance: US Tsy $60B 13W, $48B 26W bill auctions – 1130ET

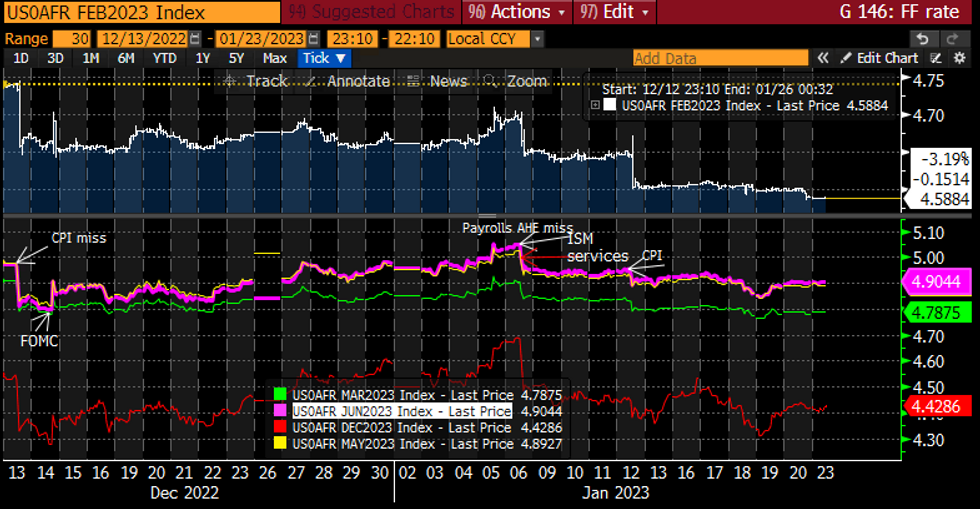

STIR FUTURES: Holding With 25bp Feb Hike Seen Locked In From FOMC

- Fed Funds implied hikes hold Friday’s nudge lower for Feb 1 to 25.5bp after Gov. Waller also leant support to such a move.

- Similar profile beyond: cumulative 46bp to Mar (+0.5bp), 57bp to terminal 4.90% Jun (unch) before 48bps of cuts to 4.43% in Dec (+1bp).

- Latter is despite Waller pushing back on cuts, noting a risk management approach requires holding rates higher than would otherwise be the case, in what was the final Fedspeak before the media blackout began.

Source: Bloomberg

Source: Bloomberg

EUROPE ISSUANCE UPDATE

EU bond mandate:- The EU will tap the 30-year 3.00% Mar-53 EU-bond tomorrow via syndication.

- MNI looks for a E3-5bln transaction size.

MNI US EARNINGS CALENDAR - Quarter of S&P500 Market Cap Due in Coming Week

Executive Summary:

- Pace of earnings picks up in the coming week, with just under a quarter of the S&P 500's market cap set to report

- Microsoft, Chevron, Tesla, Johnson & Johnson make up the highlights

- Earnings season reaches critical mass in the first week of February, during which over half the index's market cap will have reported

FOREX: USD/JPY Falters Ahead of Friday High

- JPY is the poorest performing currency across G10, although price action is largely within recent ranges. USD/JPY continues to oscillate either side of the Y130.00 handle, but intraday strength through the European open faltered ahead of any test on the Friday high at 130.61.

- By a small margin, Scandi currencies are outperforming, putting both SEK and NOK at the top of the pile, but macro drivers are few and far between ahead of the NY crossover.

- EURGBP continues to trade closer to its recent lows and maintains a softer tone following last week’s move lower. The cross has traded below the 50-day EMA, at 0.8755. The average represents a key short-term support and a clear break of it would signal scope for a deeper retracement.

- The Chinese Lunar New Year and the beginning of the Fed's pre-rate decision media blackout period have made for a quiet start to the week, with a light data docket likely to keep a lid on price action going forward. The December US Leading Index and Eurozone consumer confidence make up the risk events for the rest of the session.

FX OPTIONS: Expiries for Jan23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700-25(E1.3bln), $1.0800-25(E1.0bln), $1.0900-25(E1.3bln)

- USD/JPY: Y135.65($526mln)

EQUITIES: Bearish Threat in E-Mini S&P Present Following Pullback From Jan 18 High

- EUROSTOXX 50 futures traded lower last Thursday. The broader trend outlook remains bullish, however, the cycle is overbought and this warns of the potential for a short-term pullback. A move lower would allow the overbought reading to unwind. A resumption of weakness would open 4046.30, the 20-day EMA and a key near-term support. Key short-term resistance and the bull trigger has been defined at 4206.00, the Jan 18 high.

- S&P E-Minis have found support at 3901.75, the Jan 19 low. A short-term bearish threat remains present following the pullback last week from 4035.25, the Jan 18 high. Price has traded through support at the 50-day EMA. The average intersects at 3933.04 and a clear break would highlight a potential bearish reversal and expose 3891.50, Jan 10 low. On the upside, the contract needs to clear 4035.25 to cancel any developing bearish threat.

COMMODITIES: Trend Conditions in Gold Bullish After Printing Fresh Cycle High Friday

- WTI futures traded higher last week but prices pulled back from $82.66, the Jan 18 high. The move lower warns of a potential bearish threat and attention is on support at $78.29, the 20-day EMA. A break of this average would highlight a stronger bear threat and expose support at $72.74, the Jan 5 low. On the upside, clearance of $82.66 would reinstate the recent bullish theme and instead expose $83.14, the Dec 1 high.

- Trend conditions in Gold remain bullish and the yellow metal traded to a fresh cycle high last week. This confirms an extension on the uptrend and maintains the price sequence of higher highs and higher lows. Note that moving average studies are in a bull mode position - reflecting the uptrend. The focus is on $1963.0 next, a Fibonacci retracement. Support to watch lies at $1873.0, the 20-day EMA. Short-term pullbacks are considered corrective.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/01/2023 | 1430/1530 |  | EU | ECB Panetta Into at ECON Hearing | |

| 23/01/2023 | 1500/1000 | ** |  | US | leading indicators |

| 23/01/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 23/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/01/2023 | 1745/1845 |  | EU | ECB Lagarde Speech at Deutsche Boerse | |

| 24/01/2023 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 24/01/2023 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 24/01/2023 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 24/01/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 24/01/2023 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/01/2023 | 0815/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/01/2023 | 0815/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/01/2023 | 0830/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/01/2023 | 0830/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/01/2023 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 24/01/2023 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 24/01/2023 | 0900/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 24/01/2023 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/01/2023 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/01/2023 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/01/2023 | 0945/1045 |  | EU | ECB Lagarde Video Message at Croatia Conference | |

| 24/01/2023 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 24/01/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 24/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 24/01/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/01/2023 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/01/2023 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 24/01/2023 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 24/01/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 25/01/2023 | 2145/1045 | *** |  | NZ | CPI inflation quarterly |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.