-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Conviction Remains Low Pre-Fed

Highlights:

- Greenback reversing Monday gains as conviction remains low pre-Fed

- RBA rate decision points to slower rate hikes ahead

- Markets watch JOLTS, ISM Manufacturing for NFP clues

US TSYS: Strong Bounce for November Rates, FOMC Countdown

November kicks off with strong rally in Tsys back to early Friday levels. Bonds outperforming ahead Wed's FOMC annc, 30YY slips to 4.0783% low, yield curves extend inversion (2s10s -3.478 at -47.557) on decent volumes: TYZ2>370k.

- Fed forward guidance in focus as 75bp widely expected tomorrow, much debate over step-down to a 50bp hike in December as data cools. Little new in WSJ's Fed watcher Timiraos article overnight.

- Tuesday data kicks off at 0945ET: S&P Global US Manufacturing PMI (49.9, 49.9), followed by ISMs, JOLTS and Construction spending at 1000ET:

- ISM Manufacturing (50.9, 50.0)

- ISM Prices Paid (51.7, 53.0)

- ISM New Orders (47.1, --)

- ISM Employment (48.7, --)

- JOLTS Job Openings (10.053M, 9.625M)

- Construction Spending MoM (-0.7%, -0.5%)

- Tsy auction at 1130ET: $34B 52W bills

STIR: Pre-FOMC Rally

US STIR futures have gained ahead of the start of the 2-day FOMC meeting today (our preview here). Longer-dated contracts are outperforming: Eurodollar futures dated beyond 2023 are up 13-15 ticks and gaining.

- Gains picked up steam around 0530ET with the release of another FOMC preview article by the WSJ's Nick Timiraos, which benefited rates by not pushing back on previous dovish-leaning signals.

- 75bp is still firmly priced for this week's hike, though cumulative pricing through December has dipped a couple of basis points: at 135bp, that implies a roughly 40%/60% split between a 75bp/50bp hike at the final meeting of the year.

- Peak Fed funds is now seen at 4.92% in May 2023, down 6bp overnight and 8bp off the 5% session high.

- Attention today is on ISM Manufacturing and JOLTS.

No Row-Back In FOMC Expectations On WSJ Piece

Making the rounds is a pre-FOMC Wall Street Journal piece by Nick Timiraos titled "Fed Meeting to Focus on Interest Rates' Coming Path".

- There is nothing "new" in there - a series of opinions from analysts, and pretty even-handed between dovish and hawkish outlooks at that.

- But US rates are softening a little bit following its publication, with Treasury futures at session highs.

- We would attribute this reaction to a nondescript article to the high anticipation of signals sent by Powell and the FOMC tomorrow. Market participants are taking note that there is no last-minute row-back from Timiraos's prior suggestions that the Fed is eyeing a slowdown in the pace of hikes.

- As MNI notes in our FOMC preview, we would expect such dovishness to be expressed in the press conference rather than the post-meeting Statement, though an amendment to the latter would likely be taken as a very dovish signal.

Curve Twist Steepens, Bonds Firm After RBA’s 25bp Hike

Aussie bonds firmed in the wake of the latest RBA decision, as the Bank deployed the widely expected 25bp rate hike, after stepping down to that increment at last month’s meeting. This came after some overnight/early Sydney cheapening.

- The fact that 32bp of tightening was priced into OIS for today’s decision, coupled with the Bank’s reference to the “material” tightening now deployed in the current cycle and a more overt reference to the lagged impact of monetary policy, allowed Aussie bonds to firm post-decision.

- The major cash ACGB benchmarks were 4bp richer to 4bp cheaper at the close, twist steepening, with a pivot around 7s. YM was +4.0 & XM was -1.0. EFPs were wider again today, with the 3-/10-Year box flattening. Bills were 9bp richer to 5bp cheaper through the reds, as the strip twist steepened, pivoting around the front of the reds. Terminal cash rate pricing eased to ~3.95%.

DENMARK: Former PM Rasmussen Poised For Kingmaker Role As Danes Head To Polls

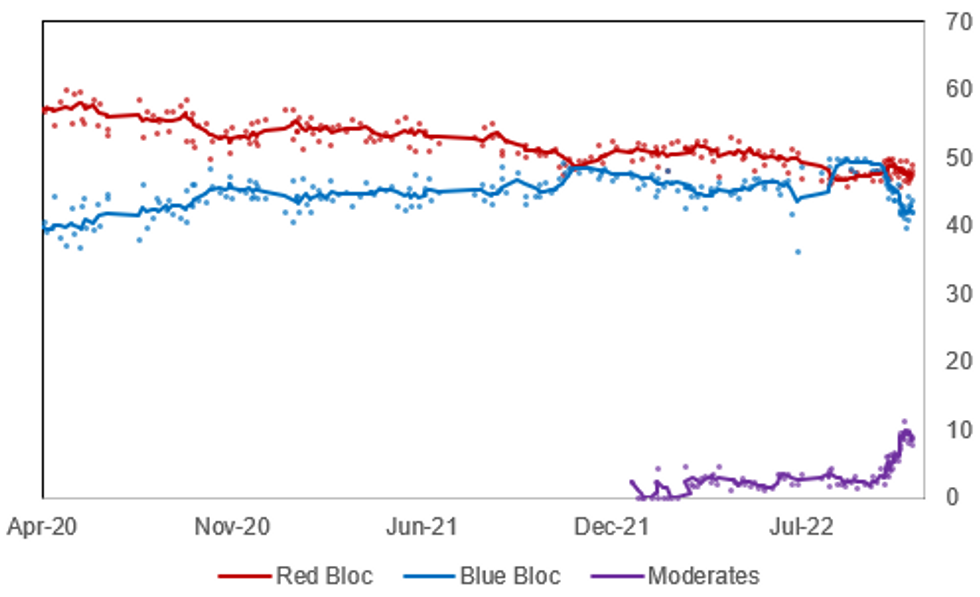

With Denmark's general election taking place today, former PM Lars Lokke Rasmussen's centrist Moderates look set to emerge as the 'kingmakers' in most coalition-building scenarios. Opinion polls show that neither the leftist Red Bloc of parties backing PM Mette Frederiksen's Social Democrats, nor the opposition right-wing Blue Bloc are on course to win an overall majority of seats. This could leave the Moderates - a new party not aligned to either long-standing alliance - with the ability to lend its weight to either side, or indeed seek to create a new gov't.

- The broad state of the electoral outcome will become clear throughout the night, but a lengthy period of coalition negotiations is almost certain to be required in the weeks and even months ahead.

- Should the Moderates emerge as kingmakers, Rasmussen could side with either bloc or - as has been mooted - seek to create a new centrist administration pulling in the least extreme parties from the Red and Blue blocs.

- There is speculation Rasmussen could seek the PM's position, despite leading a party likely to hold fewer seats than the Social Democrats or the liberal conservative Venstre.

Chart 1. Danish General Election Opinion Polling by Bloc, % and 6-Poll Moving Average

Source: Voxmeter, Megafon, YouGov, Gallup, Epinion, MNI

Source: Voxmeter, Megafon, YouGov, Gallup, Epinion, MNI

FOREX: Greenback Erases Monday Bounce as Conviction Low Pre-Fed

- After a strong start to the week, the greenback has reversed course to trade lower against all others to mark the beginning of a new month - just one session ahead of the Fed rate decision on Wednesday. The USD price action concides with a step lower across the UK yield curve, led by the belly to put 10yu yields off 7bps.

- The RBA raised rates by 25bps, alongside expectations, with AUD fading slightly following the decision as the bank failed to commit to a sharp tightening pace going forward, suggesting the bank could be more patient in approaching their peak policy rate. AUD/NZD touched new weekly lows of 1.0951 in response.

- NOK is the firmest performancing currency in G10 so far, benefiting from the bounce in the Brent crude price off Monday's lows, with the price action coming ahead of Thursday's Norges Bank release. Markets remain divided over the viability of a 25bps or 50bps hike this month, with the bank signalling rates could be raised at a slower pace in September.

- Focus turns to JOLTS job openings data later today as well as the October ISM manufacturing. The latter release will be wached for clues ahead of this Friday's NFP release.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/11/2022 | - |  | DK | Danish General Election | |

| 01/11/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/11/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/11/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/11/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/11/2022 | 1400/1000 | * |  | US | Construction Spending |

| 01/11/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 01/11/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 01/11/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 01/11/2022 | 2230/1830 |  | CA | BOC Governor Macklem at Senate bank committee | |

| 02/11/2022 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 02/11/2022 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 02/11/2022 | 0030/1130 | * |  | AU | Building Approvals |

| 02/11/2022 | 0700/0800 | ** |  | DE | Trade Balance |

| 02/11/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 02/11/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 02/11/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 02/11/2022 | 0855/0955 | ** |  | DE | Unemployment |

| 02/11/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 02/11/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 02/11/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 02/11/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 02/11/2022 | 1400/1000 | ** |  | US | housing vacancies |

| 02/11/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 02/11/2022 | 1515/1115 |  | CA | BOC director Ron Morrow speaks on payments supervision | |

| 02/11/2022 | 1800/1400 | *** |  | US | FOMC Statement |

| 03/11/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.