-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Corporate Supply Pipeline

US Treasury Auction Calendar

MNI US MARKETS ANALYSIS - Data Brought Forward in Last Full Session of the Week

Highlights:

- UK tax cuts likely part of pre-election engineering at today's Autumn Statement

- Last full day of US trade this week, with Thanksgiving to keep markets muted through to end-week

- Weekly jobless claims, UMich sentiment revisions mark data highlights

US TSYS: Firmer On German Fiscal Uncertainty and Oil Weakness

- Cash Tsys trade 0-2.5bp richer, having recently pulled further off session cheaps in moves seen linked to a core FI bid on German fiscal uncertainty along with a sharp step lower in oil with Hezbollah reportedly set to adhere to the short-term Israeli-Hamas ceasefire if the Israeli forces stick to it.

- The bull flattening on the day sees 2s10s at -50bps for back in the middle of yesterday's range.

- TYZ3 at 109-05 is close to the recent high of 109-06. The short-term trend structure remains bullish, with resistance at a nearby 109-08+ (Nov 17 high) and then 109-20 (Sep 19 high). Volumes stand at 335k, buoyed by the pick-up in roll volumes.

- Data highlights today’s docket: weekly MBA data (0700ET), Weekly jobless claims including a payrolls reference week for initial (0830ET), durable goods Oct prelim (0830ET), U.Mich survey Nov final (1000ET)

- Bill issuance: US Tsy $ 4W, $ 8W and $ 17W Bill auctions (1130ET)

STIR: Fed Rates Await Claims And Other Pre-Thanksgiving Data

- Fed Funds implied rates have seen some recent intraday softening to leave them almost unchanged on yesterday’s close and after just before the FOMC minutes.

- The path shows just 1.5bp of tightening for December, with a first cut coming in June (cumulative 32bp), a second in September (61bp but close in July with 46bp) and 92bp of cuts to end-2024.

- Barclays no longer expects the Fed to raise interest rates in January, compared with an earlier forecast of a 25bp hike. Rates will remain unchanged until December next year, it said (Reuters).

- There’s no scheduled Fedspeak, with a pulled forward data calendar leading the docket ahead of Thanksgiving.

STIR: OI Suggests Mixed Positioning Swings On Tuesday, Notable Long Setting In SFRU5

Preliminary open interest data and the twist flattening of the SOFR strip through the blues on Tuesday point to the following positioning swings:

- Whites: An apparent mix of short setting (SFRZ3), long setting (SFRH4) & short cover (SFRM4). It's hard to be definitive re: SFRU3 positioning, as the price level was unchanged on the day.

- Reds: Net long setting was seemingly seen across the pack.

- Greens: Apparent net long setting in SFRU5 dominated in pack terms. A mix of net long setting and short cover was seemingly seen elsewhere in the pack.

- Blues: Net short cover was seemingly seen across the pack.

| 21-Nov-23 | 20-Nov-23 | Daily OI Change | Daily OI Change In Packs | ||

| SFRU3 | 965,887 | 958,497 | +7,390 | Whites | +21,625 |

| SFRZ3 | 1,380,590 | 1,368,873 | +11,717 | Reds | +15,777 |

| SFRH4 | 1,122,165 | 1,113,174 | +8,991 | Greens | +25,667 |

| SFRM4 | 1,009,405 | 1,015,878 | -6,473 | Blues | -10,359 |

| SFRU4 | 917,255 | 913,682 | +3,573 | ||

| SFRZ4 | 892,077 | 889,611 | +2,466 | ||

| SFRH5 | 525,744 | 522,029 | +3,715 | ||

| SFRM5 | 586,356 | 580,333 | +6,023 | ||

| SFRU5 | 583,260 | 549,935 | +33,325 | ||

| SFRZ5 | 537,614 | 546,049 | -8,435 | ||

| SFRH6 | 376,967 | 375,751 | +1,216 | ||

| SFRM6 | 312,351 | 312,790 | -439 | ||

| SFRU6 | 297,817 | 299,025 | -1,208 | ||

| SFRZ6 | 237,428 | 239,882 | -2,454 | ||

| SFRH7 | 135,086 | 140,462 | -5,376 | ||

| SFRM7 | 130,331 | 131,652 | -1,321 |

Autumn Statement @ 1230GMT; Expectations For NIC Cut & Business Tax Breaks

Chancellor of the Exchequer Jeremy Hunt will deliver the Autumn Statement in the House of Commons at around 1230GMT (0730ET, 1330CET) following prime minister's questions (PMQ's pre-fiscal statements is usually strictly kept at 30 mins by the Speaker). Livestream of both PMQs and Autumn Statement can be found here.

- As we noted in our Autumn Statement Deep Dive, greater fiscal headroom than expected and the gov't 'hitting its target' of halving inflation by year-end has given rise to expectations of tax cuts to come later today. With Hunt having stated that any tax cuts cannot prove inflationary, the expectation of any shift to income tax rates or thresholds is low.

- Three areas have come into focus. Firstly, National Insurance contributions, paid by employees at 12% on earnings between GBP12,571 and GBP50,271 - and 2% on anything above that as well as by employers, are seen as likely to be reduced. Secondly, the minimum wage is set to rise.

- Thirdly, Hunt is expected to announce the permanent extension of the GBP9bn/annum "full expensing" tax break for businesses. This sort of measure is unlikely to prove an immediate vote winner, but is seen by the gov't as important for boosting the UK's sluggish growth rate.

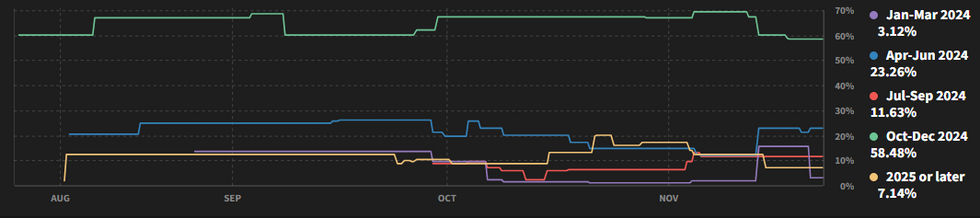

- The Autumn Statement will be looked at for signals of when the next election might take place. Betting markets have Q424 as the most likely period for the vote to take place, with an implied probability of 58.5%. Q224 is the second-favourite, with a 23.3% implied probability.

Source: Smarkets

Source: Smarkets

FOREX: Pullback in USD Index Hits Pause, GBP in Focus Ahead of Autumn Statement

- The USD sits steadier against all others in G10, putting pause to the pullback in the USD Index that persisted into the Monday close. The USD Index has steadied around the 200-dma at 103.621, which may signal a near-term pause ahead of any resumption of the downtrend off the October high.

- JPY is the poorest performer ahead of the Wednesday crossover, helping EUR/JPY snap a four session losing streak. Modest weakness in the JPY comes despite the Bank of Japan cutting the size of their longer-end bond buying Rinban operation, which resulted in a slightly steeper local curve. GBP/JPY trades back above 186.50, with 187.16 the first intraday resistance ahead of 187.39, the 76.4% retracement of the pullback from the cycle high posted on Nov14.

- GBP likely to be a focus going forward, with the UK Chancellor's Autumn Statement set to be delivered from approximately 1230GMT/0730ET. Chancellor Hunt is seen detailing a cut to business taxes and national insurance, with many watching for any clues on the timing of a potential general election in 2024. GBP/USD trades just below the week's highs of 1.2559, with the short-term outlook seen positive on the break of the 1.2504 100-dma.

- Today sees the early release of the weekly jobless claims data due to the Thanksgiving holidays that kick off tomorrow. The release of the final November UMich sentiment survey also crosses - which markets may be wary of considering the considerable upside revision for inflation expectations at the October release. The speaker schedule is busier, with ECB's Centeno, Nagel set to speak as well as BoC's Macklem.

FX OPTIONS: Expiries for Nov22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0730-50(E1.7bln), $1.0840-60(E1.4bln), $1.0905-25(E2.7bln), $1.0930(E591mln), $1.0940-45(E1.9bln), $1.0960-61(E632mln)

- EUR/GBP: Gbp0.8705-15(E867mln), Gbp0.8735-50(E519mln)

- USD/JPY: Y147.75($1.2bln), Y149.10($671mln)

- AUD/USD: $0.6320(A$1.1bln) $0.6435-40(A$1.7bln)

- USD/CNY: Cny7.2400-20($1.2bln), Cny7.2500-10($1.1bln)

EGBS: Mixed Price Action Though Bunds Trade Within Yesterday's Range

EGBs see mixed price action early Wednesday, though Bund futures trade within yesterday's range.

- Global core FI was pressured by a weak BoJ Rinban operation and Israeli cabinet approval of an Israel/Hamas hostage deal overnight, before Bund/OAT futures found support as European desks filtered in (potentially on the back of German fiscal headlines r.e. reinstating the 2024 debt brake late Tuesday and expectations for lower Gilt issuance in the UK Autumn Statement later today).

- An additional bout of weakness came following hawkish comments from RBA Governor Bullock and financial stability concerns from today's ECB review, before price action reversed.

- The short-term tone in Bund futures remains firm, though a break of the Nov 7/13 low of 129.35 would highlight a possible reversal. Today's 15Y supply represents 13.7k Bund equivalent, so is not expected to weigh significantly. Core/semi-core yields are -1bps lower to +2bps higher at typing.

- Periphery spreads to Bunds are marginally tighter this morning. BTPs came under some pressure following headlines from the ECB's Financial Stability Review and ahead of today's exchange auction, but are off intraday lows.

- Today's local docket is light, with ECB's Centeno (presenting Portugal's Financial Stability Report) and Nagel (panel at Osservatorio Permanente Giovani-Editori) not expected to be market movers. Flash Eurozone consumer confidence at 1500GMT provides the data highlight.

GILTS: Holding Cheaper, Autumn Statement Nears

Gilt futures continue to hold shy of settlement levels, with wider core global FI swings (covered elsewhere) and pre-Autumn Statement adjustments moves at the fore thus far.

- That leaves futures -30 or so, just above 97.00. Bulls remain in short-term technical control, with well-defined technical parameters remaining untouched for now.

- Cash gilt yields are 0.5-3.5bp firmer on the day, with a bear flattening impulse seen.

- SONIA futures are flat to 8.5bp lower through the blues, with the late reds and early greens coming under the most pressure. The bulk of that move came late on Tuesday as core global FI markets came under pressure into the gilt close.

- Liquid BoE-dated OIS contracts run little changed to ~4bp firmer on the day.

- We have covered the latest rounds of press leaks/speculation re: the impending Autumn statement elsewhere (largely centred on promoting business investment and a national insurance cut for individuals, with expectations for an income tax cut in a pre-election Spring Budget). Our full preview of the event, including gilt remit expectations, can be found here.

EQUITIES: Eurostoxx 50 Futures Remain Close to its Recent Cycle Highs

- A short-term bull cycle in Eurostoxx 50 futures remains intact and the contract is holding on to its recent gains. Price has recently cleared resistance at both the 20- and 50-day EMAs - a bullish development and activity remains above these averages. Note that resistance at 4256.00, the Oct 12 high, has also been cleared, reinforcing the bullish theme. The focus is on 4388.00, the Aug 30 high. Initial firm support to watch is at 4239.80, the 20-day EMA.

- S&P e-minis traded higher Monday, starting the week on a bullish note and confirming an extension of the recovery that started Oct 27. The trend direction remains up. Recent gains have resulted in the break of a trendline drawn from the Jul 27 high. This reinforces bullish conditions and signals scope for a climb towards 4597.50, the Sep 1 high. On the downside, initial firm support is seen at 4428.70, the 20-day EMA.

COMMODITIES: Gold Targets Key Short-Term Resistance at $2009.4

- A bearish theme in WTI futures remains in play and the latest recovery appears to be a correction. The break lower last week marked an extension of the downtrend that started late September and has maintained a price sequence of lower lows and lower highs. Moving average studies are in a bear-mode position, highlighting bearish sentiment. The focus is on $70.96, a Fibonacci retracement. Key resistance is at $79.65, the Nov 14 high.

- The trend condition in Gold remains bullish and this week’s gains reinforce this condition. The move higher signals scope for a test of key short-term resistance at $2009.4, the Nov 7 high. Clearance of this hurdle would confirm a resumption of the uptrend and pave the way for a climb towards $2022.2, the May 15 high. Key support has been defined at $1931.7, the Nov 13 low. A break would signal a potential reversal.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/11/2023 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/11/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/11/2023 | 1230/1230 |  | UK | UK Autumn Statement | |

| 22/11/2023 | 1330/0830 | ** |  | US | Durable Goods New Orders |

| 22/11/2023 | 1330/0830 | *** |  | US | Jobless Claims |

| 22/11/2023 | 1410/1510 |  | EU | ECB's Elderson keynote speech on stability in the Green Transition | |

| 22/11/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/11/2023 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 22/11/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 22/11/2023 | 1530/1530 |  | UK | DMO publish agenda for quarterly meetings | |

| 22/11/2023 | 1630/1130 |  | CA | BOC Governor Tiff Macklem speech/press conference | |

| 22/11/2023 | 1700/1200 | ** |  | US | Natural Gas Stocks |

| 23/11/2023 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 23/11/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 23/11/2023 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 23/11/2023 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 23/11/2023 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 23/11/2023 | 0830/0930 | *** |  | SE | Riksbank Interest Rate Decison |

| 23/11/2023 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 23/11/2023 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 23/11/2023 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 23/11/2023 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 23/11/2023 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 23/11/2023 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 23/11/2023 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 23/11/2023 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 23/11/2023 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 24/11/2023 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.