-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY68.6 Bln via OMO Thursday

POSCO (POHANG, Baa1/A-/NR) S.Korea to respond to U.S. tariffs

MNI US MARKETS ANALYSIS - Deposit Insurance Plans Underpin Sentiment

Highlights:

- Reports that the US could consider raising deposit insurance helps bolster sentiment

- Early outperformance in US bank names tips stocks toward Friday highs

- Implied market pricing for FOMC decision inching higher through Europe

US TSYS: One-Way Sell-Off To Start Day One Of FOMC Meeting

- Cash Tsys have seen a one-way sell-off after a late open with a Japan national holiday, potentially buoyed by reports which suggested that the US is studying ways to guarantee all bank deposits. In yield space, we have cleared yesterday’s highs across the curve to leave them within Friday ranges prior to the weekend UBS acquisition of Credit Suisse.

- 2YY +10.2bp at 4.078%, 5YY +7.0bp at 3.660%, 10YY +4.5bp at 3.530% and 30YY +2.5bp at 3.691%.

- TYM3 trades 16 ticks lower at 114-19 as it pulls back further from yesterday’s high of 116-24 that had come close to testing key resistance at 116-28+ (Jan 19 high). Instead, it next eyes support at 114-01+ (Mar 17 low). Cumulative volumes are at a more typical 300k after particularly elevated recent sessions.

- Data: Philly Fed non-mfg Mar (0830ET), Existing home sales Feb (1000ET)

- Note/bond issuance: US Tsy $12B 20Y Bond re-open (912810TQ1) (1300ET)

- Bill issuance: US Tsy $34B 52W bill auction (1130ET)

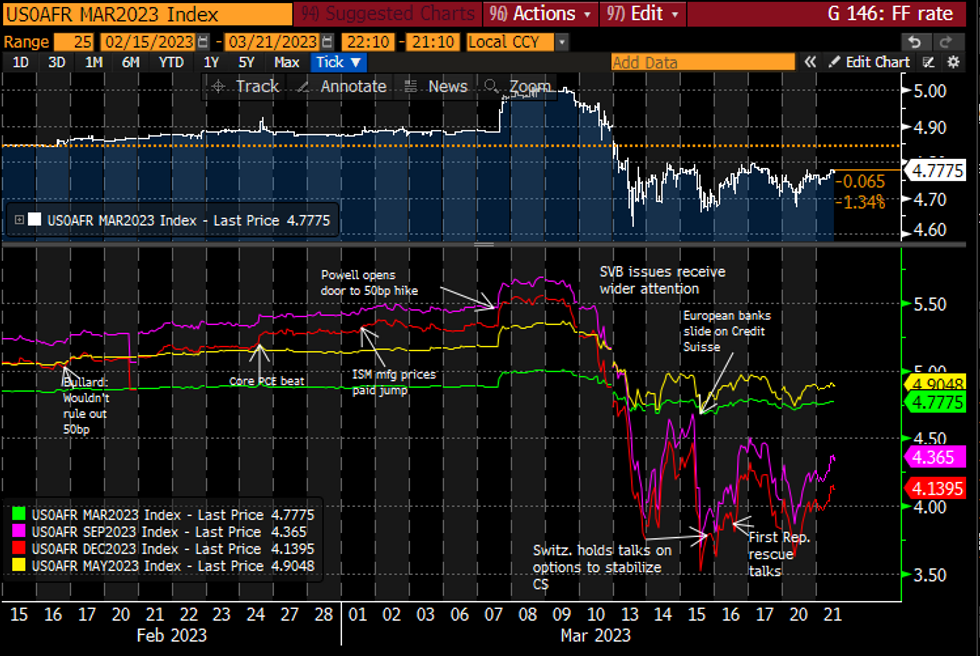

STIR FUTURES: 2H23 Fed Rates Extend Yesterday's Intraday Push Higher

- Fed Funds implied hikes for tomorrow's meeting have nudged higher through European hours with 20bp (+1bp) before a cumulative 33bp for May to a peak 4.91% (+0.5bp) off yesterday’s low of 10bp.

- Larger moves further out with 2H23 meeting implied rates 9-10bps higher on yesterday’s close, pricing 77bps of cuts to 4.14% at year-end. The latter remains in wide ranges of roughly 3.5-4.5% seen since CS slid last week.

Source: Bloomberg

Source: Bloomberg

UK/EU: ERG 'Star Chamber' To Hold Presser Outlining Views On Windsor Framework

A 'star chamber' of legal experts compiled by the hard-line Brexiteer European Research Group (ERG) of backbench Conservative MPs is set to hold a press conference in the coming hour or so outlining its views on the 'Windsor framework' - the deal reached between the UK gov't and the EU on reforming the non-functioning Northern Ireland protocol. Adam Payne at Politics Home reported yesterday the presser could take place around 1130GMT, but this could be brought forwards.

- While the ERG does not hold the political clout that it once did - notably during the tenure of PM Theresa May during the 'meaningful vote' period when she could not pass her Brexit deal due to ERG obstruction - the group's views are likely to gain some prominent political attention. This comes in the run-up to tomorrow's Commons vote on a statutory instrument related to the 'Stormont brake', the provision of the Windsor framework intended to allow Northern Ireland assembly members to veto EU law being implemented in Northern Ireland.

- On 20 March, head of the hard-line unionist Democratic Unionist Party (DUP) Sir Jeffrey Donaldson stated that his party's eight MPs in Westminster would vote against the framework, arguing that “Whilst representing real progress, the brake does not deal with the fundamental issue which is the imposition of EU law by the protocol.”

EUROPEAN ISSUANCE UPDATE:

Gilt auction results- Strong gilt auction with a very tight tail of 0.1bp and the LAP above the pre-auction mid-price (albeit still below the price 6 minutes ahead of the cutoff.

- The 3.75% Oct-53 gilt has rallied following the auction and now trades above 98.00 (the auction average price was 97.967). Wider gilt futures were not really being impacted by the auction too much, but paused their move lower.

- GBP2bln of the 3.75% Oct-53 Gilt. Avg yield 3.864% (bid-to-cover 2.71x, tail 0.1bp).

- The auction of the 1.30% Oct-27 Green Bobl saw a similar volume of bids to the last green auction on 24 January (the 0% Oct-25 Green Bobl). However, despite the price falling ahead of the auction cut-off, today's auction still saw the lowest accepted price of 96.20 below the pre-auction mid-price of 96.213. In our view this made today's auction slightly disappointing, despite the decent bid-to-cover.

- E1.5bln (E1.374bln allotted) of the 1.30% Oct-27 Green Bobl. Avg yield 2.18% (bid-to-cover 1.86x).

FOREX: AUD Slips as RBA Could Ponder Rate Pause

- AUD and NZD make up the poorest performers in G10 following the RBA minutes release overnight, which raised the prospect of a pause to the rate hike cycle. The RBA minutes showed the board took uncertainty surrounding the economic outlook into consideration, and could keep rates unchanged at upcoming meetings in order to judge the impact of the tightening cycle so far.

- AUD/USD has fully reversed the Monday move higher and is partially retracing last week's upside. This keeps the pair off a test of the key resistance layered just above at the 200- and 100-dmas of $0.6763 and $0.6783 respectively.

- JPY is similarly weak, with markets taking profits on the sharp rally in the currency across the unfolding of the banking crisis over the past fortnight. Europe's bank sector is seen higher early Tuesday, helping buoy underlying sentiment to keep haven FX under pressure.

- The USD, EUR trade more favourably headed through to NY hours, with the single currency slightly outperforming. This puts EUR/USD through the Monday high and within range of congestion resistance layered between 1.0749-60.

- The German ZEW survey takes focus going forward, with the current situation component expected to improve only marginally from the February -45.1 read. Canadian CPI and US existing home sales are also on the docket. The central bank speaker slate is typically light for a pre-FOMC decision session, although appearances from ECB's Lagarde & Villeroy at the BIS could draw some attention at 1230GMT.

FX OPTIONS: Expiries for Mar21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E565mln), $1.0665-75(E797mln), $1.0690-10(E2.0bln)

- USD/JPY: Y133.25-50($805mln)

- GBP/USD: $1.2100(Gbp504mln), $1.2150-70(Gbp570mln)

- USD/CAD: C$1.3690-10($945mln)

- USD/CNY: Cny6.9225($918mln), Cny6.9300($501mln), Cny6.9500($574mln)

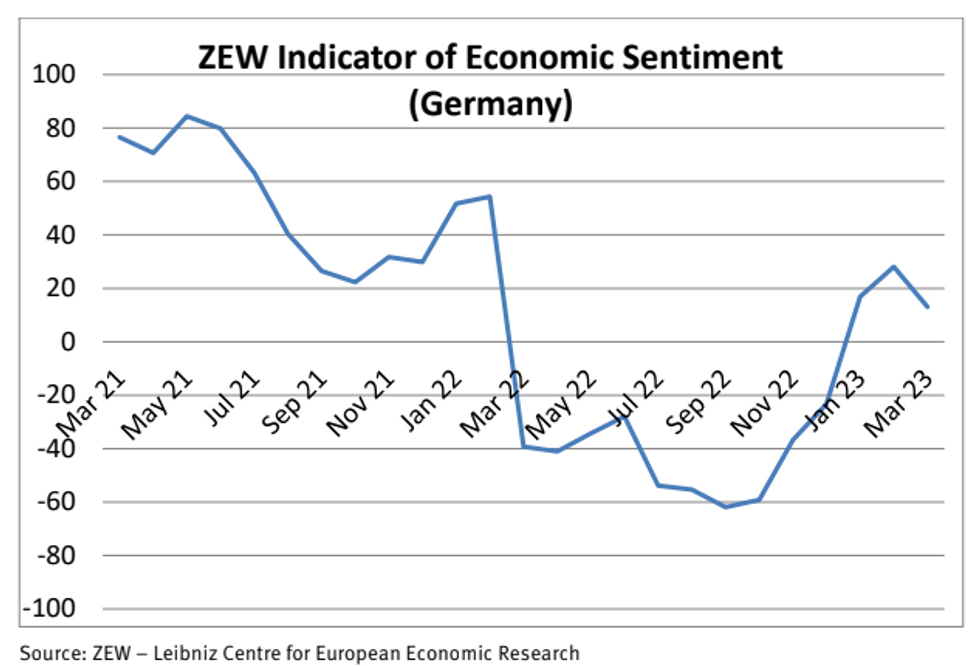

GERMAN DATA: ZEW Expectations Reflect Volatile Market Backdrop

GERMANY MAR ZEW ECONOMIC EXPECTATIONS 13.0 (FSCT 15.0); FEB 28.1

GERMANY MAR ZEW CURRENT SITUATION -46.5 (FCST -44.3); FEB -45.1

- The March ZEW survey of financial market experts declined sharply by 15.1 points to 13.0 on the expectations index, and edged down 1.4 points to -46.5 in the current situation assessment. These readings were slightly weaker than expected.

- The current situation index remains in deeply pessimistic territory, whereby the March fall broke a four-month streak of improving sentiment.

- The survey was conducted March 13-20, encompassing the post-SVB rescue period of the past week. As such, the deterioration in outlooks reflects the currently high level of uncertainty, with respondents downgrading their view on banks' earnings outlooks markedly.

EQUITIES: Stocks Testing Friday High Thanks to Early Bank Outperformance

- Equity futures remain firm, but are stopping short of any break above the Friday high at 4009.25.

- Pre-market trade among US GSIBs continues to dictate price action across the headline index, with strength in JPM (+1.9%), BofA (+2.4%), Citigroup (+2.5%) and Wells Fargo (+3.1%) ahead of the bell.

- Market moves follow the reports overnight that US officials are said to be looking at ways in which to provide a temporary guarantee on all bank deposits - a move that could quell concerns among US regional banks and head off any escalation of the SVB crisis.

- The piece writes that the strategy is being developed as a backstop should the crisis worsen, rather than a proactive tool to be rolled out immediately.

EQUITIES: Eurostoxx Future Outlook Bearish Despite Recovery From Yesterday's Low

- The Eurostoxx 50 futures outlook remains bearish despite yesterday's rebound from the session low - short-term gains are considered corrective. The recent break of the 4000.00 handle signals scope for weakness towards 3865.00, the Jan 4 low and further out towards the 3800.00 handle. Initial resistance is seen at 4123.00, the 20-day EMA. Key resistance has been defined at 4268.00, the Mar 6 high.

- The trend condition in S&P E-Minis remains bearish despite the latest recovery - a correction. Price has recently cleared a key support at 3960.75, the Mar 2 low, to confirm a resumption of the bear cycle that started Feb 2. The move lower signals scope for an extension towards 3822.00 next, the Dec 22 low. Initial firm resistance is seen at 4025.01, the 50-day EMA. A break of this average would alter the picture.

COMMODITIES: Gold Trades Softer Following Reversal From Monday High

- WTI futures remains vulnerable and the contract traded to a fresh low Monday before finding some support. Last week’s sell-off resulted in the break of key support at $71.10, the Dec 9 low. The breach confirms a resumption of the medium-term downtrend. Note too that price has also cleared the psychological $70.00 handle. Attention is on $62.43, the Dec 2 2021 low. Initial resistance is at $69.83, Friday’s high.

- A strong rally in Gold Friday saw the yellow metal trade to fresh YTD high of $1989.4. This confirms a resumption of the uptrend that has been in place since late September 2022. Monday’s gains resulted in a print above the psychological $2000 handle and this further strengthens current bullish conditions. It opens $2034.0 next, a Fibonacci projection. On the downside, Friday’s low of $1918.3 marks firm support.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/03/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 21/03/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 21/03/2023 | 1000/1100 | ** |  | EU | Construction Production |

| 21/03/2023 | 1230/0830 | *** |  | CA | CPI |

| 21/03/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/03/2023 | 1230/1330 |  | EU | ECB Lagarde Panellist at BIS Summit | |

| 21/03/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/03/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 21/03/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 21/03/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 22/03/2023 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 22/03/2023 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 22/03/2023 | 0700/0700 | *** |  | UK | Producer Prices |

| 22/03/2023 | 0845/0945 |  | EU | ECB Lagarde Address at ECB and its Watchers Conference | |

| 22/03/2023 | 0900/1000 | ** |  | EU | EZ Current Account |

| 22/03/2023 | 0930/0930 | * |  | UK | ONS House Price Index |

| 22/03/2023 | 0930/1030 |  | EU | ECB Lane in Debate at ECB and its Watchers Conference | |

| 22/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 22/03/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/03/2023 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/03/2023 | 1345/1445 |  | EU | ECB Panetta in Debate at ECB and its Watchers Conference | |

| 22/03/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 22/03/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting | |

| 22/03/2023 | 1800/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.