-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Gilt Week Ahead

MNI US MARKETS ANALYSIS - Dollar Dip Bought Pre-ECB

Highlights:

- Consensus looks for 25bps from the ECB, but small minority look for more

- Norges Bank stick to guidance with 25bps rate hike

- Markets resolve to buy the dollar dip post-Fed

US TSYS: Bank Fears Limit Earlier Cheapening With ECB, Further Labor Data Ahead

- After a late open from a Japan national holiday, cash Tsys have on balance chipped away at yesterday’s post-FOMC rally, although have recently rallied as First Horizon slides pre-market with bank concerns again at the forefront after PacWest came under strong pressure after market yesterday. Yields are still below pre-FOMC levels except for the very long-end with further labor data and importantly the ECB policy decision ahead.

- 2YY +2.9bp at 3.834%, 5YY +2.4bp at 3.322%, 10YY +1.9bp at 3.354% and 30YY +1.5bp at 3.697%.

- TYM3 trades 14+ ticks higher at 116-11+ on decent volumes of 310k, off an intraday high of 116-25+ from the open (initial resistance). A further shift higher could open 116-30 (Apr 5/6 highs) whilst support is seen at 115-17+ (May 3 low).

- Data: Challenger job cuts Apr (0730ET), Weekly jobless claims (0830ET), Trade balance Mar (0830ET), ULCs/productivity Q1 (0830ET)

- Bill issuance: US Tsy $50B 4W, $45B 8W bill auctions (1130ET)

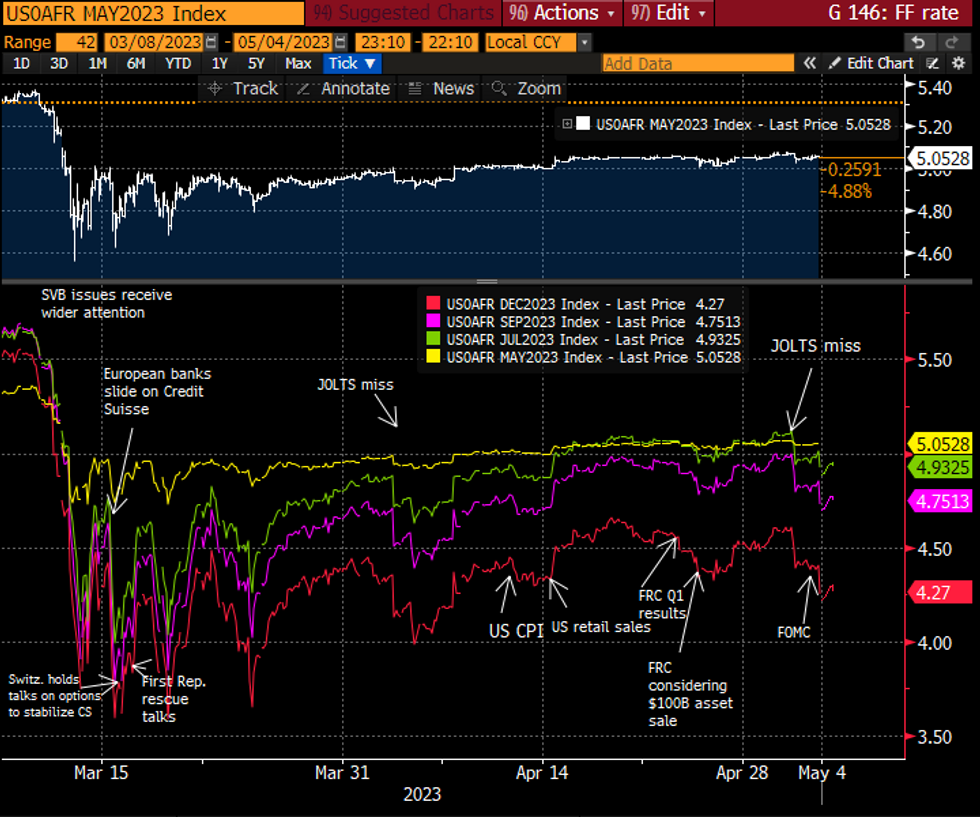

STIR FUTURES: Fed Rate Path Holding Lower Post-FOMC

- Fed Funds implied rates have seen a recent dip lower again as First Horizon slides pre-market, after overnight steadily retracing a fall that started after Chair Powell’s presser concluded yesterday. Rates remain below pre-FOMC levels.

- Yesterday’s 25bp hike to 5-5.25% is still seen as the peak for the cycle with currently just 2.5bp of cuts priced for June and half of it unwound in July.

- Assuming a current effective 5.08%, the first full cut is seen for Sep (-32bps to 4.76%) with three cumulative cuts to year end (-80bps to 4.28%).

- Bullard (non-voter) and Gov Cook (voter) are first on the slate for tomorrow when the blackout is lifted.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

Kremlin-Washington Behind Drone Attack

A series of comments from Kremlin spox Dmitri Peskov hit wires. Peskov: 'Washington is definitely behind this attack, we are well aware of this...Attempts by Kyiv and Washington to disown drone incident are absolutely ridiculous...We know decisions about such terrorist acts are taken in Washington, not Kyiv...Kyiv just implements these decisions...We know Washington often selects the targets; Washington should clearly understand that we know this.'

- This sort of language is likely to raise concerns in the West of Russian retaliation not only against Ukraine but against the US or other NATO member, which risks escalating the conflict into a much more widespread conflagration. However, at present there appears no sign that the retaliation has gone beyond the drone strikes on Ukrainian cities overnight.

- Peskov: Putin always remains calm in these situations....no plan for an address, security council meeting or change in tempo of special military operation [the invasion of Ukraine]. However, Security Council to hold a regular meeting on Friday [5 May] and is likely to dicuss drone incident.

- Peskov: Of course air defences will be strengthened, this was happening anyway in context of May 9 Victory Day parade.

- Peskov does not answer question of whether Ukrainian President Volodymyr Zelenskyy is a legitimate target for Russia.

FOREX: EUR Fading, Magnitude of ECB Hike in Focus

- The single currency is softer ahead of the open, with EUR/USD erasing the entirety of the Asia-Pac session strength to settle back below pre-Fed rate decision levels. The Fed decision provided only brief volatility in the greenback, with normal service resuming headed through to the second half of the week.

- The Norwegian central bank raised rates by 25bps, alongside expectations, with the bank also name-checking June as the next most likely hike. There were few surprises in the bank statement, with the board once again stating their focus on the weaker-than-expected currency and its spillover effects for inflation. NOK reversed initial post-decision weakness to re-align NOK with the modest bounce in the oil price. NOK is among the strongest currencies in G10 ahead of NY.

- CHF is softer, helping USD/CHF bounce off the cycle low printed overnight at 0.8820. For the bouce to persist, markets need to re-take 0.8995 - the Tuesday high - for any progres toward the 50-dma of 0.9126.

- Focus turns to the upcoming ECB rate decision, at which the bank are seen raising rates by 25bps, although a not insignificant minority see the possibility of a 50bps step today. Lagarde's subsequent press conference will also be carefully watched for signals on how close to the peak rate the ECB have now become.

FX OPTIONS: Expiries for May04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0940(E3.0bln), $1.1000(E1.3bln), $1.1075(E1.1bln), $1.1100(E1.2bln)

- USD/CNY: Cny7.00($1.7bln)

EQUITIES: Fresh Regional Banking Worry Applies Light Pressure To E-minis, KRW Lower Pre-Market

E-mini futures tick lower after BBG headlines note that TD Securities and First Horizon have terminated their $13bn merger pact, applying fresh weight to the SPDR S&P Regional Banking ETF (KRE) in pre-market pricing (last indicated 4.2% lower).

- It has been a bit of a topsy turvy round of indicative pricing for regional banks since the NY close. Fresh worries re: the future of PacWest became evident at yesterday’s NY bell, with a BBG report noting that the company was weighing its strategic options. The bank followed this up with confirmation that it is in talks with potential buyers. This was accompanied by assurance attempts from PacWest and regional banking peer Western Alliance re: deposit flows.

EQUITIES: Global Equities Mixed Post-Fed

- A key short-term support in Eurostoxx 50 futures at 4285.10 has been breached this week - the 20-day EMA. The recent move down is considered corrective for now. A continuation lower would signal scope for a deeper corrective pullback towards 4219.00, the 50-day EMA. On the upside, a break of 4363.00, the Apr 21 high and bull trigger, would confirm a resumption of the uptrend.

- S&P E-minis have traded to a low of 4075.50 today. The contract has found support and this leaves price above a key short-term level at 4068.75, the Apr 26 low. A break of this level would signal scope for a deeper short-term pullback. From a trend perspective, the condition remains bullish - moving average studies are in a bull-mode position. Clearance of 4206.25, Tuesday’s high, would confirm a resumption of the trend.

COMMODITIES: WTI Futures Posts Only Modest Rebound from Intraday Lows

- WTI futures remain bearish and have traded in a volatile manner today - the contract has recovered from its intraday low of $63.64. The print below $64.58, the Mar 20 low and a key support, reinforces a bearish theme. A clear break of this level would confirm a resumption of the broader downtrend. The short-term trend condition is oversold and gains would be considered corrective. Initial resistance is at $71.79, yesterday’s high.

- Gold traded higher Wednesday to cancel any short-term bearish threat. Instead, the yellow metal traded through resistance at $2048.7, the Apr 13 high and confirmed a resumption of the broader uptrend. This maintains the bullish price sequence of higher highs and higher lows and moving average studies remain in a bull-mode set-up. The focus is on $2070.4, the Mar 8 ahead of the all-time high at $2075.5. Key support is 1969.3, the Apr 19 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/05/2023 | 0900/1100 | ** |  | EU | PPI |

| 04/05/2023 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 04/05/2023 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 04/05/2023 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 04/05/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 04/05/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 04/05/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 04/05/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 04/05/2023 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 04/05/2023 | 1245/1445 |  | EU | ECB Post-Meeting Press Conference | |

| 04/05/2023 | 1400/1000 | * |  | CA | Ivey PMI |

| 04/05/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 04/05/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 04/05/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 04/05/2023 | 1650/1250 |  | CA | BOC Governor speech/press conference. | |

| 05/05/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 05/05/2023 | 0545/0745 | ** |  | CH | Unemployment |

| 05/05/2023 | 0600/0800 | ** |  | DE | Trade Balance |

| 05/05/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 05/05/2023 | 0630/0830 | *** |  | CH | CPI |

| 05/05/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 05/05/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/05/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 05/05/2023 | 0800/1000 | * |  | IT | Retail Sales |

| 05/05/2023 | 0800/1000 |  | EU | ECB Elderson Speech at European University Institute | |

| 05/05/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 05/05/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 05/05/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 05/05/2023 | 1230/0830 | *** |  | US | Employment Report |

| 05/05/2023 | 1700/1300 |  | US | St. Louis Fed's James Bullard | |

| 05/05/2023 | 1700/1300 |  | US | Fed Governor Lisa Cook | |

| 05/05/2023 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.