-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Earnings Add Extra Catalyst For Fresh Highs

HIGHLIGHTS:

- Earnings add extra catalyst for fresh highs in equities

- JPY on backfoot as equities charge higher globally

- New home sales, consumer confidence data takes focus

US TSYS SUMMARY: Long-End Stronger, Short-End Steady Ahead Of 2Y Supply

Long end Treasury yields continued to retrace lower overnight Tuesday, with 10Y and 30Y yields at their lowest in a week in a bull flattening move. The front-end/belly are steady ahead of 2Y supply.

- The 2-Yr yield is up 0.8bps at 0.4437%, 5-Yr is up 0.2bps at 1.1729%, 10-Yr is down 1bps at 1.6203%, and 30-Yr is down 1.3bps at 2.0683%.

- Dec 10-Yr futures (TY) up 1.5/32 at 130-19.5 (L: 130-14.45 / H: 130-22.5). Light volumes (~250k), and less exciting overnight than equities (S&P eminis at fresh all-time highs).

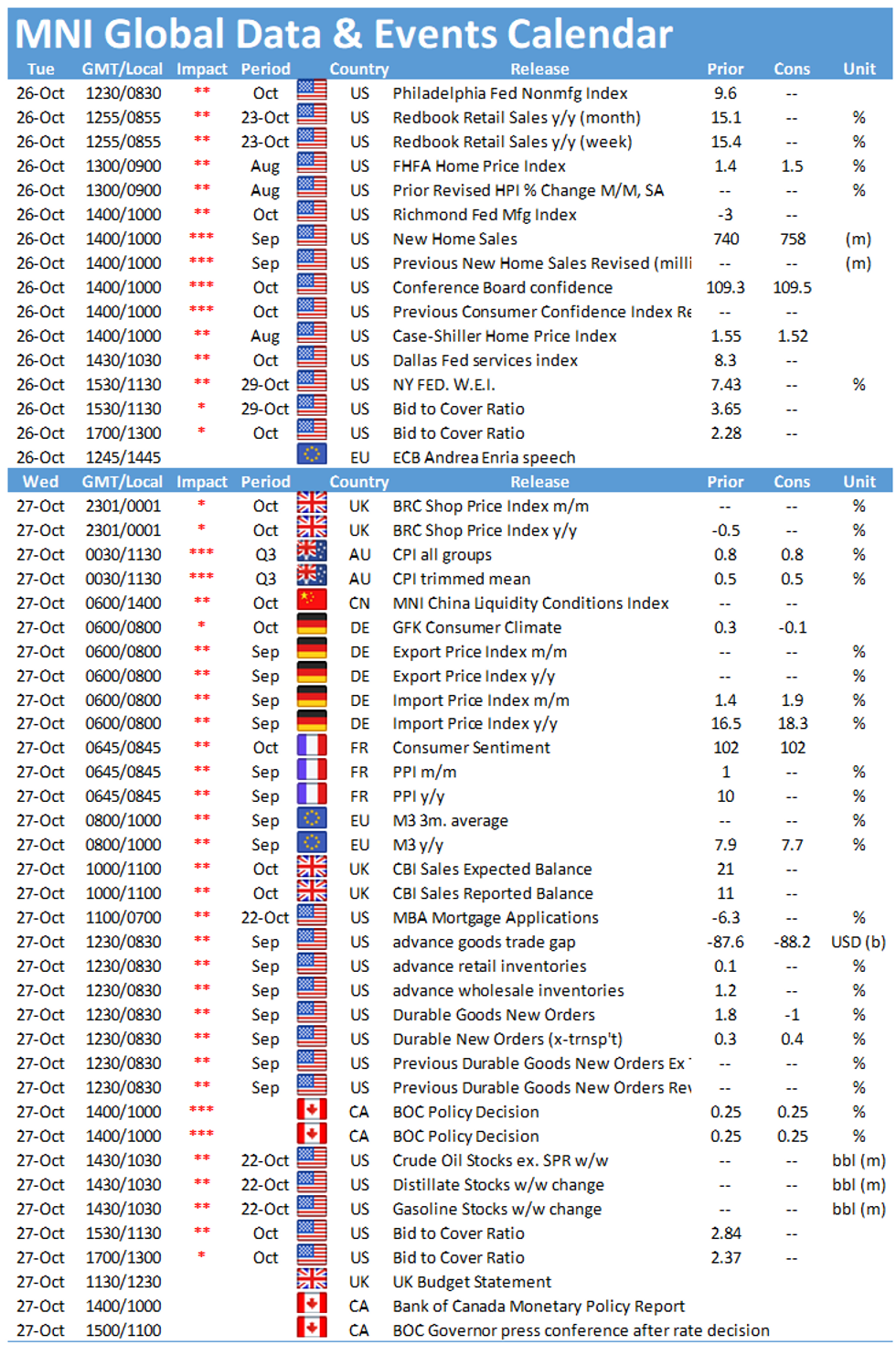

- On the data schedule today is housing data (FHFA and S&P CoreLogic prices at 0900ET, and New Home Sales at 1000ET), along with 1000ET's releases of Conference Board Consumer Confidence and Richmond Fed Manufacturing.

- Supply consists of $40B 48-day bill auction at 1130ET, and $60B in 2Y Note auction at 1300ET.

- Plenty of attention on Capitol Hill with reconciliation / infrastructure legislation in the balance: the House Democratic Caucus meets and Senate Democrats and Republicans hold party lunches.

- NY Fed buys ~$1.225B of 7.5-30Y TIPS.

EGB/GILT SUMMARY - Holding onto gains

- A fairly subdued start for Govies, with most of the early European morning action in Equities.

- Despite the risk on tone, EGBs and Bund have been better bid, as desk unwind some of the price action, pushing yield back lower, as we tested resistances last Friday.

- Peripherals are still wider against the German 10yr, as the US starts to come in. Greece and Italy are the widest by 1.4bps.

- Gilts have mostly traded inline for Bunds, which is reflected n the spread.

- Gilt/Bund spread is 0.2bp tighter (basically flat), at 125bps.

- Looking ahead, speakers include ECB de Cos and Villeroy, but unlikely to learn anything new, with the ECB meeting this week.

- Gilt futures are up 0.12 today at 124.33 with 10y yields down -1.5bp at 1.124% and 2y yields down -0.5bp at 0.636%

- Bund futures are up 0.14 today at 168.79 with 10y Bund yields down -1.3bp at -0.129% and Schatz yields down -0.1bp at -0.672%.

- BTP futures are up 0.01 today at 151.30 with 10y yields down -0.1bp at 0.963% and 2y yields up 0.3bp at -0.225%.

- OAT futures are up 0.14 today at 165.19 with 10y yields down -1.4bp at 0.206% and 2y yields down -0.1bp at -0.671%.

EUROPE ISSUANCE UPDATE

Germany allots E2.361bln 0% Nov-28 Bund, Avg yield -0.31% (Prev. -0.50%), Bid-to-cover 1.00x (Prev. 1.28x), Buba cover 1.26x (Prev. 1.56x)

UK DMO sells GBP2.75bln of 0.375% Oct-26 Gilt, Avg yield 0.789% (0.429%), bid-to-cover 2.16x (vs 2.67x prior), Tail: 1.0bps

Italy sells:

E2.25bln 0% Jan-24 BTP Short Term, Avg yield -0.23% (Prev. -0.32%), Bid-to-cover 1.65x (Prev. 1.58x)

E750mln 0.15% May-51 BTPei, Avg yield -0.16% (Prev. 0.47%), Bid-to-cover 1.34x (Prev. 1.30x)

Netherlands sells:

E2.49bln 0.00% Jul-31 DSL, Avg yield 0.014% (Prev. -0.053%), Price 99.86 (Prev. 100.54)

EUROPE OPTION FLOW SUMMARY

Eurozone:

OEZ1 135c, bought from 12 up to 13 in 8k

US:

TYZ1 129.50p sold at 18 in 10k

FOREX: EUR/GBP Prints a Fresh 2021 Low

- Further strength in US equity futures is fueling a risk-on backdrop, helping USD/JPY trade well ahead of the NY crossover. The pair trades either side of the Y114 handle at pixel time, with resistance at last Friday's high of Y114.21 the first upside resistance. As a result, the JPY and CHF are the poorest performers on the day, while growth proxies and commodity-tied FX including AUD and NZD trade at the top-end of the G10 pile.

- GBP trades well, with EUR/GBP trading a fresh 2021 low this morning. Markets eye near-term support at the 1.0% 10-dma envelope initially at 0.8369 and 0.8356, the Low from Feb 26, 2020. Firmer support is expected headed into the 2019/2020 lows of 0.8282/77.

- US new home sales data crosses alongside October consumer confidence, with a speech from ECB's Villeroy also on the docket.

FX OPTIONS: Expiries for Oct26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600-10(E1.4bln), $1.1720-30(E849mln)

- USD/JPY: Y114.00($590mln), Y114.50($1.1bln)

- AUD/USD: $0.7400(A$561mln)

- USD/CAD: C$1.2400($670mln)

Price Signal Summary - Equities Head North

- In the equity space, S&P E-minis trend needle still points north and the contract continues to climb. Price is approaching the next objective of 4591.25, the 1.00 projection of the Jul 19 - Aug 16 - Aug 19 price swing. EUROSTOXX 50 futures have also rallied and are fast approaching key resistance at 4223.00, the Sep 6 high. This also represents the bull trigger and a break would confirm a resumption of the broader uptrend and open 4290.50, 1.00 projection of the Jul 19 - Sep 6 - Oct 6 price swing.

- In FX, EURUSD continues to consolidate and in pattern terms, the recent pause appears to be a bull flag. A bullish focus remains in place and sights are set on the 50-day EMA at 1.1691. Key short-term support is unchanged at 1.1572, Oct 18 low. GBPUSD is off its recent high however short-term bullish conditions remain intact and corrections are shallow. The focus is on 1.3913, Sep 14 high and a key resistance. USDJPY maintains a bullish tone. Scope is seen for a climb towards 114.99, 1.50 projection of the Apr 23 - Jul 2 - Aug 4 price swing. Initial support is at 112.89, the 20-day EMA. A break is required to signal scope for a deeper corrective pullback.

- On the commodity front, Gold spiked higher Friday and cleared $1800.6, Oct 14 high. Yesterday's gains highlight a short-term positive tone and attention is on $1834.0, the Sep 3 high. WTI trend conditions are unchanged and remain bullish. $85.01, 1.00 projection of the Sep 21 - Oct 6 - 7 price swing has been probed. The focus is on $86.00 next.

- In the FI space, trend conditions remain bearish and short-term gains are considered corrective. Bund futures sights are set on 167.79, 2.50 projection of the Sep 9 - 17 - 21 price swing. Key resistance is at 169.92, Oct 14 high. Initial resistance is at 169.34, the 20-day EMA. Gilt futures path of least resistance remains down and recent weakness has opened 123.16, Feb 27, 2019 low (cont). Key resistance is unchanged at 125.27, the Oct 14 high. 124.77, the 20-day EMA marks initial resistance.

EQUITIES: Earnings Continue to Boost Index Futures to Record Levels

- Equity futures trade uniformly positively, with the e-mini S&P plumbing a fresh record high ahead of the bell, with the contract touching 4580.75 in early European hours. Earnings remain a driver with a tech tilt helping the NASDAQ future outperform core S&P and DJIA contracts.

- The sentiment is reflected in European indices, with the Stoxx600 narrowing the gap with alltime highs printed in mid-August at 476.16. The consumer discretionary and industrials sectors are contributing most notably, with energy the sole sector in the red.

- Focus remains on the earnings cycle following the stronger-than-expected release from Facebook after-market yesterday (shares trade higher by 3% pre-market), with reports from General Electric, UPS, 3M and Lockheed Martin to digest pre-market ahead of Microsoft, Twitter, Visa and Alphabet after the bell. Full schedule with expectations and timings found here: https://marketnews.com/mni-us-earnings-schedule-bu...

COMMODITIES: Metals Stumble

- WTI Crude down $0.5 or -0.6% at $83.29

- Natural Gas up $0.01 or +0.24% at $5.912

- Gold spot down $5.95 or -0.33% at $1801.61

- Copper down $3.5 or -0.77% at $449.3

- Silver down $0.3 or -1.23% at $24.2613

- Platinum down $12.24 or -1.15% at $1050.15

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.