-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Equities Dip as Merck Discontinue Vaccine Trials

HIGHLIGHTS:

- Equities dip pre-NY as Merck discontinue COVID-19 vaccine programme

- Davos schedule eyed, China's Xi Jinping speaks

- Eye on earnings, with some of S&P500's biggest due this week

US TSYS SUMMARY: Pushing Higher On Soft Risk Appetite; 2Y Supply Eyed

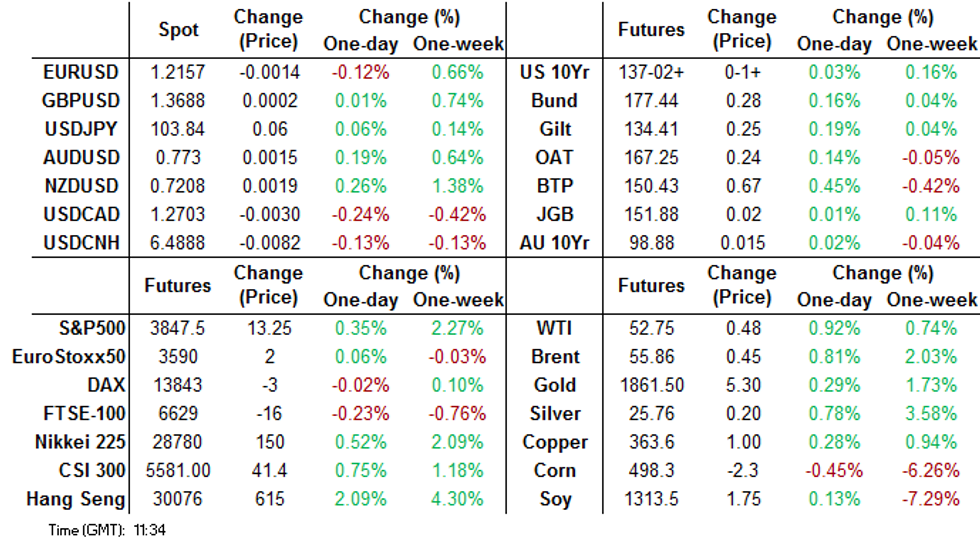

TY futures hit best levels in over two weeks in the European morning, with the curve bull flattening - albeit on modest volumes. 2-Year Note supply eyed.

- Mar 10-Yr futures (TY) up 1/32 at 137-02 (L: 136-30 / H: 137-03.5, not seen since Jan. 7), ~190k traded. Generally risk-off tone, with equities a little weaker (albeit Nasdaq futs hitting an all-time high), with European political risk in the morning.

- The 2-Yr yield is up 0.2bps at 0.123%, 5-Yr is unchanged at 0.4311%, 10-Yr is down 0.5bps at 1.0805%, and 30-Yr is down 1.2bps at 1.8346%.

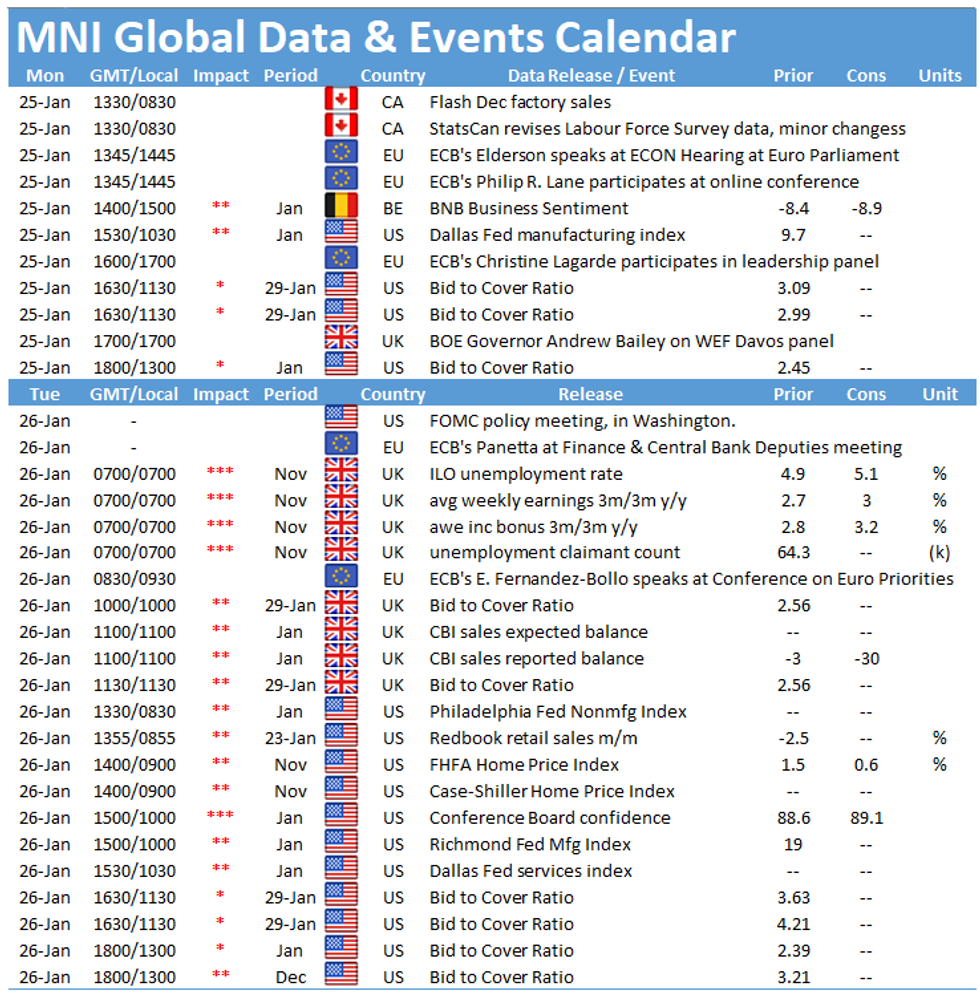

- Little impactful news in the morning. Some attention as ever on fiscal matters, with Biden stimulus package size / approval process (Reconciliation?) under discussion. FOMC decision Wednesday eyed (MNI's preview will be released later today), no change in policy expected.

- In supply, we get $105B of 13-/26-week bills at 1130ET, with a record $60B in 2Y Notes auctioned at 1300ET. NY Fed buys ~$6.025B of 4.5-7Y Tsys.

- Otherwise, thin on scheduled data/events: Chicago Fed Nat'l Activity Index at 0830ET, Dallas Fed Manuf. at 1030ET.

EGB/Gilt Summary: Core EGBs Supported Amid Soft EU Equities

Core EGBs are on the front foot so far Monday with a general risk-off tone sweeping over the market. European equity markets are soft, with US futures also knocked on the news that Merck are to discontinue their COVID-19 vaccine programme. Elsewhere, polling showing French first round elections favour Marine le Pen over incumbent Macron has unsettled sentiment. 10-year Bund and gilt yields are around 2bps lower at writing. A slightly disappointing IFO print has not helped sentiment either.- Against this backdrop, 10-year BTP spreads have narrowed around 4bps after headlines this morning that Conte would not step down (contradicting reports on Friday and in the weekend press).

EUROPE OPTIONS SUMMARY

Eurozone:

RXH1 176/174.5ps, sold at 15 in 1k

RXJ1 173.50/172.50/170.50p fly 2x3x1, bought for 27 in 1k

0EH1 135.00/134.75ps 1x1.5, bought for 3.5 in 2.5k

DUH1 112.30/112.20/112.10p fly, bought for 3 in 2.5k

0RM1 100.37/100.25ps, bought for half in 3k (ref 100.525)

3RM1 100.25/1000.12/100.00/99.87p condor, bough for 1 in 2.5k

SX7E Feb 77.5c, bought for 1.30 in 30k

SX7E Feb 77.50/82.50cs, bought for 0.80 in over 10k

UK:

2LM1 99.62/99.37ps, bought for 1.5 in 1.5k

LH1 100.25c, bought for synth 0.2 in 6k

3LM1 99.50/99.25ps vs 2LM1 99.62p, bought the blue for 1 in 8k

US:

TYH1 136.50/135.00ps vs 137.5c, bought the ps for flat in 5k

FOREX: EUR Softer, Davos Speakers Awaited

Risk is a little lower ahead of the NY open, with equities softer and core bond markets bid. Currency markets aren't quite following suit, with haven currencies CHF and JPY failing to garner any bidtone.

EUR trades poorly on the back of an IFO business climate survey that missed expectations (90.1 vs. Exp. 91.4), which also added to the core bond bid. EUR/USD retreated from just below the 1.22 mark to trade either side of the 1.2150 level ahead of the NY crossover.

The strongest currencies so far Monday include the AUD, NZD and CAD, which are benefiting from a slightly firmer commodities complex.

The Chicago Fed National Activity Index crosses later today, but the central bank speakers slate is busy: today sees speeches from ECB's Lagarde, Panetta, Lane, Weidmann and others. BoE's Bailey and PBoC's Yi Gang are also scheduled. Davos' virtual World Economic Forum begins, with keynote speakers including China's Xi Jinping.

OPTIONS: Expiries for Jan25 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1975(E556mln), $1.2000(E563mln), $1.2050-70(E658mln), $1.2090-1.2100(E519mln), $1.2230-40(E1.2bln-EUR puts), $1.2245-55(E936mln)

USD/JPY: Y103.25-35($601mln-USD puts)

GBP/USD: $1.3370-80(Gbp689mln)

AUD/USD: $0.7550(A$2.8bln), $0.7650(A$1.4bln), $0.7690-0.7700(A$700mln), $0.7750(A$768mln), $0.7800(A$711mln)

USD/CAD: C$1.2700($603mln-USD puts), C$1.2900($536mln-USD puts)

USD/CNY: Cny6.5700($1bln)

USD/MXN: Mxn19.50($550mln), Mxn20.00-01($543mln)

TECHS: Price Signal Summary - Bund Extend Bounce

- E-mini S&P futures are consolidating. The trend outlook remains bullish following last week's breach of resistance at 3824.50, Jan 8 high. The focus is on 3900.00 next.

- In FX, recent gains in EURUSD are considered corrective. Levels to watch are:

- Support at 1.2054, Jan 18 low and trigger for 1.2011, Sep 1 high.

- Resistance is at 1.2230, Jan 11 high.

- USDJPY is still trading below the bear channel top drawn off the Mar 24 high that intersects at 104.02 today. A break is required to signal a reversal.

- Last week's move lower has exposed 103.28 and 103.02, 61.8% and 76.4 % of the Jan 6 - 11 rally.

- The EURGBP outlook remains bearish. Last week's key development was the breach of 0.8867 and 0.8861, the Nov 23 and Nov 11 lows. Resistance to watch is 0.8925, Jan 18 high. Scope is seen for a move to 0.8808,

- On the commodity front, the Gold outlook appears bullish following the Jan 20 rally that signals a possible reversal of the Jan 6 - 18 sell-off. Price has tested the 20- and 50-day EMAs where a clear break would open $1900.3, 76.4% of the Jan 6 - 11 rally. Clearance of support at $1832.6, Jan 20 low would expose recent lows. Oil contracts remain above support. Brent (H1) support to watch is $54.29, the 20-day EMA and WTI (H1) support is at $51.14, also the 20-day EMA.

- In the FI space:

- Bunds (H1) are firm this morning and have extended Friday's recovery from the day low of 176.63. A clear breach of 177.56, Jan 21 high would expose 177.96, Jan 14 high and a key resistance.

- Key resistance to watch in Gilts (H1) remains the 20- and 50-day EMAs. They intersect at 134.47/60.

EQUITIES: US Up, EU Down in Mixed Start

Global equities are off to a mixed start this week, with US futures in modest positive territory while European stocks lag behind. The e-mini S&P is higher by just over 10 points, but is well off the session's best levels printed overnight at 3853.25.

In Europe, cash markets are lower by 0.1-0.7%, with Spain underperforming notably. The outstanding index is Italy, with the FTSE-MIB higher by 0.1% as markets pare back expectations of imminent elections in Italy. The chief of the PD party this morning stated that a government with Conte as PM, with the backing of parliament, is the best solution for Italy.

Across Europe, tech and healthcare names are the best performers, while real estate and energy names are on the back foot.

Focus remains on US earnings - highlights this week include:

TUES: Johnson & Johnson, Lockheed Martin, 3M, Microsoft

WEDS: Apple, Boeing, Facebook, AT&T, Tesla

THURS: Mastercard, McDonalds, Visa

FRI: Caterpillar, Eli Lilly

COMMODITIES: Oil Regains Footing, Gold, Silver Buoyed as USD Eases

Having pulled lower into the close of the week, both WTI and Brent crude futures contracts are positive ahead of the Monday COMEX open, with WTI narrowing the gap with $53/bbl and last week's highs of $53.79.

The dollar traded well in early Europe, benefiting from soft European data and a slip in the EUR. This has eased at the NY crossover, helping buoy both gold and silver - which are also garnering some support from fragile European stock markets this morning.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.