-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Equities Off the Mat

HIGHLIGHTS:

- USD resumes downtrend, buoying EURUSD toward key resistance

- Treasury yields recovering off auction-inspired lows

- US PPI, Fed speakers on deck

US TSYS SUMMARY: Weaker Ahead Of PPI And Fed's Mester

Treasuries have retraced most of Thursday's gains, and now sit well off the post-30Y auction highs. After fairly quiet Asia-Pac trade, Tsys dropped after the London open alongside a move lower in Bunds / Gilts and higher in equities.

- Curve has bear steepened: the 2-Yr yield is up 0.6bps at 0.2187%, 5-Yr is up 1.6bps at 0.8047%, 10-Yr is up 2.9bps at 1.3258%, and 30-Yr is up 2.8bps at 1.9255%.

- Dec 10-Yr futures (TY) down 6/32 at 133-10 (L: 133-08.5 / H: 133-16)

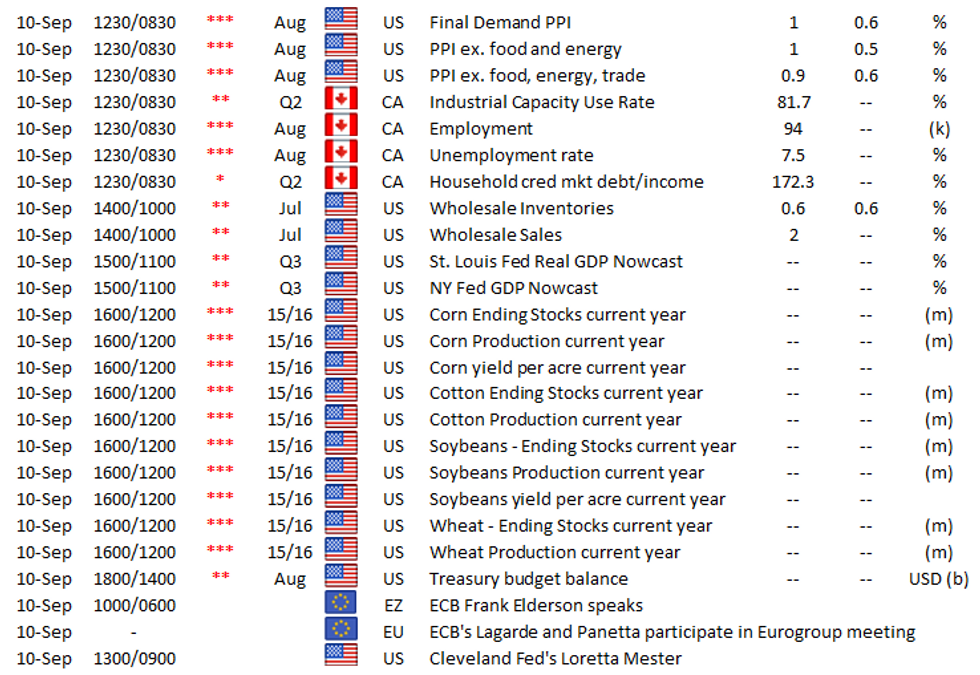

- Aug PPI at 0830ET and Wholesale Jul Inventories at 1000ET form today's data.

- Cleveland Fed's Mester is the lone scheduled FOMC speaker, at 0900ET.

- A couple of Fed headlines overnight: WSJ ran a piece pointing to the FOMC agreeing at the Sep meeting to begin tapering in November. Also Dallas' Kaplan and Boston's Rosengren will sell their individual stock holdings after controversy over their recent trading activity.

- No supply: NY Fed buys ~$8.425B of 2.25-4.5Y Tsys.

EGB/GILT SUMMARY: Bear Steepening

European sovereign bonds have traded weaker this morning while equities are broadly higher across the region. Yesterday's ECB meeting played out largely as expected, confirmation that the ECB is not about to begin tapering anytime soon has provided a modicum of support.

- Gilts opened strongly but soon gave up early gains, to now trade a touch below yesterday's close.

- The bund curve has bear steepened with the 2s30s spread 1bp wider.

- OATs have similarly sold off with cash yields 1-2bp higher on the day.

- BTPs have slightly underperformed core EGBs with yields up 1-3bp.

- Monthly GDP data show UK economic growth slowing to 0.1% MM in July, vs 0.5% expected. Elsewhere, euro area industrial production data for July was mixed: much better than expected in Italy (7.0% Y/Y vs 5.2% survey), weaker than expected in Spain and close to consensus for France.

- European supply came from the UK (UKTBs, GBP3.5bn).

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

Buying: RXX1 170/169 ps for 14 in 3.75k and RXV1 173/174 cs for 14 in 3.75k, Selling: RXX1 173.50/174.50 cs at 6 in 3.75k. Net paid 22 to own the Nov put spread

RXX1 172.00/171.00 put spread sold at 39 in 1.5k

OEX1 135.75/50/135.00 put ladder bought for 2.5 in 3.5k

OEV1 135.50/135.75 1x1.5 call spread sold at 8 in 5k

OEX1 135.75/136.25 1x2 call spread bought for 9 in 2k

UK:

2LV1 99.125/98.875 1 x 1.5 put spread sold at 1.5 in 20k

FOREX: Greenback Following Trend Lower

- In contrast to Thursday's session, early Europe saw JPY selling pressure aided by a strong start for continental equity markets. Trading has possibly be drawn by the sizeable option interest layered between 110.00-25, with $1.7bln notional rolling off at Friday's NY cut.

- Early greenback weakness extended into the NY crossover, with new daily USD lows printed against EUR, GBP, CNH, AUD and others. This put the USD Index through yesterday's lows and within range of support at the 61.8% Fib retracement of the Aug - Sept upmove at 92.2965. Macro newsflow/catalysts for the move lower were few and far between, but the weakness was infitting with the short-term trends in GBP/USD, USD/CNH and AUD/USD.

- This puts JPY, USD at the bottom of the G10 table, while NZD, NOK and AUD outperform.

- US PPI data takes focus going forward, with markets expecting a new series high at 8.2% Y/Y on a final demand basis. The speaker slate is a little busier, with ECB's Lagarde and Elderson due as well as Fed's Mester.

FX OPTIONS: Expiries for Sep10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1750-70(E981mln), $1.1800-10(E723mln), $1.1850(E1.4bln), $1.1875-95(E1.5bln)

- USD/JPY: Y110.00-10($1.2bln)

- EUR/JPY: Y130.00(E535mln)

- AUD/USD: $0.7350(A$663mln), $0.7400(A$704mln)

- USD/CAD: C$1.2510-15($886mln), C$1.2690-00($630mln)

Price Signal Summary - S&P E-Minis Remain Above The 20-Day EMA

- In the space, S&P E-minis are firmer today and have found support ahead of the 20-day EMA that intersects at 4473.93. The underlying trend condition remains bullish with the focus on 4591.25, 1.00 projection of the Jul 19 - Aug 16 - 19 price swing. A break of the 20-day EMA would signal scope for a deeper pullback. EUROSTOXX 50 futures have also found support and defined a key short-term parameter at 4132.50, Sep 9 low . A clear break of this level would expose 4078.00, Aug 19 low. The bull trigger is at 4252.00, Sep 6 high.

- In the FX space, EURUSD remains below the Sep 3 high of 1.1909. Support has been found at 1.1802, Sep 8 low where a break is required to signal scope for a deeper pullback. The trigger for a resumption of gains is 1.1909, the Jul 30 , Sep 3 high. GBPUSD maintains a short-term bullish tone and is firmer today as the recovery from Wednesday's low extends. The trigger for stronger gains is 1.3892, Sep 3 high. Key short-term support has been defined at 1.3727, Sep 8 low.

- On the commodity front, Gold has pulled back from recent highs. The near-term outlook remains bullish with the key trigger for an extension higher at $1834.1, Jul 15 high. Support to watch is $1774.5, Aug 19 low. A break would threaten a bull theme. WTI futures remain in a bull mode. The focus is on $70.74, 76.4.% retracement of the Jul 30 - Aug 23 sell-off.

- In FI, Bund futures remain vulnerable following Tuesday's sharp sell-off and yesterday's gains appear corrective in nature. The focus is on 171.30, 2.382 projection of the Aug 5 - 11 - 17 price swing. Resistance to watch is 172.76, Sep 2 and 3 high. Gilt futures remain in a bear mode following this week's breach of support at 128.03, the Jul 6 low (cont). This opens 127.65, 61.8% of the Jun 3 - Aug rally (cont).

EQUITIES: Oil Rebounds After Thursday Weakness

- Both Brent and WTI crude futures trade in positive territory headed into the NY crossover, effectively erasing the weakness seen into the Thursday close. This keeps markets inline with the overarching bullish condition, with focus on intraday resistance at $69.89/bbl ahead of the September high at $70.61/bbl.

- While production across the Gulf of Mexico remains partially shuttered by the lingering effects of Hurricane Ida, North African output has become a concern, with power struggles across Libya in focus, threatening what had been a marked period of stability.

- Gold and silver both trade in minor positive territory, helped by a resumption of greenback weakness. Nonetheless, key resistance for gold remains intact at $1834.1, Jul 15 high and a bull trigger. A break of this level would strengthen the current bullish theme and pave the way for a climb towards $1863.3, a Fibonacci retracement.

COMMODITIES: Oil Rebounds After Thursday Weakness

- Both Brent and WTI crude futures trade in positive territory headed into the NY crossover, effectively erasing the weakness seen into the Thursday close. This keeps markets inline with the overarching bullish condition, with focus on intraday resistance at $69.89/bbl ahead of the September high at $70.61/bbl.

- While production across the Gulf of Mexico remains partially shuttered by the lingering effects of Hurricane Ida, North African output has become a concern, with power struggles across Libya in focus, threatening what had been a marked period of stability.

- Gold and silver both trade in minor positive territory, helped by a resumption of greenback weakness. Nonetheless, key resistance for gold remains intact at $1834.1, Jul 15 high and a bull trigger. A break of this level would strengthen the current bullish theme and pave the way for a climb towards $1863.3, a Fibonacci retracement.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.