-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

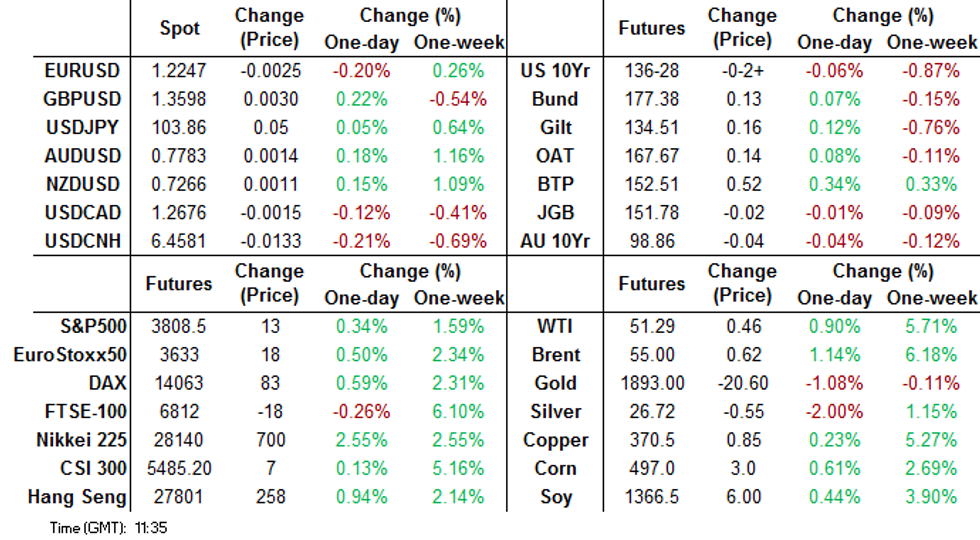

Free AccessMNI US MARKETS ANALYSIS - Equities, Oil Rallying Pre-Payrolls

HIGHLIGHTS:

- Stocks hit new alltime highs pre-payrolls

- USD bounce stutters as Tsy yields fail to top 1.10%

- US expected to have added 50,000 jobs over the month of December

US TSYS SUMMARY: A Little Weaker Ahead Of Payrolls

Treasuries have come off lows with early steepening reversing, though we remain well below Thursday's opening levels (let alone Tuesday's pre-Georgia election). The main event Friday is of course the Dec employment report though we also get a speech by Fed VC Clarida later in the session.

- Positive headlines on COVID vaccine effectiveness against new variants, and Pres Trump pledging smooth transition, helped buoy risk appetite and weigh on Tsys overnight.

- Curve mixed: the 2-Yr yield is unchanged at 0.1369%, 5-Yr is down 0.1bps at 0.4578%, 10-Yr is up 0.4bps at 1.083%, and 30-Yr is up 0.2bps at 1.8548%.

- Mar 10-Yr futures (TY) down 3/32 at 136-27.5 (L: 136-23.5 / H: 136-29.5), unremarkable volumes.

- Nonfarm payrolls at 0830ET. BBG Survey and Whisper = +50k, MNI Median = 0. We also get Nov wholesale trade at 1000ET and consumer credit at 1500ET.

- Clarida's the only scheduled Fed speaker today; at 1100ET he'll discuss the economy and monetary policy (text and moderated Q&A).

- No supply today. NY Fed buys ~$12.825B of Tsy 0Y-2.25Y Tsys.

PIPELINE: Near $75B High-Grade Debt Issuance First Wk 2021

Expected issuance slowdown Friday after heavy start to 2021

- Date $MM Issuer (Priced *, Launch #)

- $7.25B Priced Thursday; $74.05B/wk

- 01/07 $3.5B *World Bank (IRBD) $2.35B 2Y FRN SOFR+13, $1.15B 2027 Tap SOFR+34

- 01/07 $3B *Standard Chartered $1.5B 4NC3 +89, $1.5B 6NC5 +100

- 01/07 $750M *Northwestern Mutual Global Funding 5Y +38

- $12.9B Priced Wednesday; $66.8B/wk

- 01/06 $4B *ADB 10Y +15

- 01/06 $3B *Toyota Motor Cr $1B 3Y +25, $750M 3Y FRN SOFR+33, $700M 5Y +40, $550M 10Y +62.5

- 01/06 $2.25B *BNP Paribas 6NC5 +90

- 01/06 $2B *Kommunalbanken 5Y +9

- 01/06 $1B *AerCap Ireland 5Y +155

- 01/06 $650M *Ares Capital +5Y +180

EGB/GILT SUMMARY: Periphery Rallying Alongside Equities

Core EGBs trade mixed and close to unch on the day while the periphery has rallied alongside gains for equities.

- The gilt curve has marginally flattened with the 2s10s spread 1bp narrower on the back of the short end trading weaker.

- Bunds tare little changed on the day. Last yields: 2-year -0.7118%, 5-year -0.7361%, 10-year -0.5235%, 30-year -0.1324%.

- BTPs have rallied with cash yields 2-4bp lower and the curve bull flattening.

- Supply this morning came from the UK (Bills, GBP4.0bn).

- The German trade balance deteriorated in November on the back of stronger growth in imports (4.7% M/M vs 0.4% survey) relative to exports.

- Elsewhere, French industrial production for November came in slightly above expectations (-4.6% Y/Y vs -5.0% survey).

- US NFP comes into focus this afternoon.

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXH1 175.5p/179.5c, sold at 42 in 10k

DUG1 112.30/40/50c fly bought for 1.5 in 2k

DUG1 112.20/112.00ps, bought for 0.75 in 15k

3RM1 100.37/100.25ps vs 100.50/100.62cs, bought the ps for 0.25 and 0.5 in 5k

UK:

2LM1 99.50p, bought for 1 in 4k (ref 99.88 LH3)

LM1 100.12/100.25/100.37c fly, bought for 1.5 in 2k

LM1 100.00/100.12cs 1x2, sold the 1 at 0.25 in 2.5k

0LH1 100.12/100.25cs, bought for 1.5 in 2k

US:

TYG1 138.5c, bought for 2 in 20k (Block)

FOREX: Jobs Data in Focus, USD Bounce Stutters

In typical pre-NFP trade, markets have been rangebound and largely muted early Friday. The USD made early gains in Asia-Pac hours, but these have been swiftly reversed thanks to a modest uptick in GBP, AUD and NZD. The single currency trades also trades soft, although EUR/USD has recovered off overnight lows of 1.2213.

Scandi FX trades poorly, with NOK and SEK the poorest performers so far, albeit on light newsflow, although industrial production data from both Sweden and Norway continues to look weak.

The US jobs report crosses later today, with the US expected to have added 50,000 jobs over the month of December - the lowest since the outbreak of the COVID crisis early last year. The whisper number is inline with consensus, with the unemployment rate expected to tick higher to 6.8%. The equivalent Canadian data is also on the docket. The speaker slate is quiet, with just Fed's Clarida due.

Tech Focus: Price Signal Summary - USD bounce extends

- In the equity space, the trend in the E-Mini S&P contract remains bullish with the focus on 3819.10, 1.764 projection of Sep 24 - Oct 12 rally from Oct 30 low. A break would open 3900.00 further out.

- A bearish risk still prevails in the FI space despite a recovery off recent low.

- Treasuries (H1) breached support at 136-26+, Nov 11 low to resume the downtrend that started August 2020. The break exposes 136.21+, 61.8% of the Mar - Aug rally (cont).

- Bunds (H1) focus is on support at 177.01, Dec 23 low. A break would trigger deeper losses.

- Gilts (H1) traded through 134.47 yesterday. This has opened 134.01, Dec 24 low and a key support.

- On the commodity front, Gold continues to pull away from highs earlier this week and has pressured the 50-day EMA at 1879.9. A deeper pullback would open $1855.4, the Dec 21 low. The move lower is still considered a correction. Oil contracts remain bullish. Brent (H1) has potential for $55.14 next, the 1.382 projection of the Nov 13 - 26 rally from Dec 2 low. WTI (G1) targets $52.11, 1.00 projection of Apr - Aug rally from the Nov 2 low.

- In FX , the USD remains weak from a trend perspective although it has found some support again this morning. The EURUSD upside objective remains 1.2380, 2.00 projection of the Nov 4 - 9 rally from the Nov 11 low. Support lies at 1.2210/09, the 20-day EMA and Dec 31 low and the recent pullback is considered a correction. USDJPY targets 102.02, Mar 10 low following this week's fresh low prints. For now though, and with the pair correcting, attention is on a key resistance at 104.45, the bear channel top drawn off the Mar 24 high.

FX OPTIONS: Expiries for Jan08 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2000(E793mln), $1.2175-80(E897mln-EUR puts), $1.2240-60(E870mln-EUR puts), $1.2300(E922mln)

USD/JPY: Y103.90($790mln-USD puts)

EUR/GBP: Gbp0.8850-55(E610mln)

USD/MXN: Mxn19.70($500mln-USD calls), Mxn19.90($515mln)USD/ZAR: Zar15.65($606mln-USD puts)

EQUITIES: Stocks Strong Pre-Payrolls

Cash equity markets across Europe are firmer at the midpoint of the Friday session, with US futures following suit. The e-mini S&P touched a new alltime high overnight at 3,817.75, with Dow and NASDAQ futures mimicking the price action. Further signs of risk-on seen in Tesla shares, which sit higher by another 4% pre-market, indicating another extension of the recent rally at the cash open.

In Europe, German stocks outperform with the DAX higher by 0.7%, while UK, Spanish names lag. Tech and utilities are strongest sectors, with financials and energy lagging in likely profit-taking after Thursday's rally.

Strength in Germany's DAX has been driven by a 33% rally in TUI AG shares on signs that their rights issue had been fully underwritten to raise well over EUR500mln.

COMMODITIES: Gold, Silver Slip as Equity Outlook Improves Further

A firmer outlook for equities and a break of the 100-dma at $1893.71 pressured spot gold prices early Friday, pressing the metal to its lowest level since Dec30. The 50-dma now undercuts as support at $1870.28, which would mark a near 5% pullback from the Jan6 highs.

WTI and Brent crude futures both trade well after a muted session Thursday. Both contracts hit new post-COVID crisis highs, extending the 2021 rally in oil. For WTI, this narrows the gap with the first upside target at the late February highs of $54.50.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.