-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Equities Stabilise, Volatility Offered

HIGHLIGHTS:

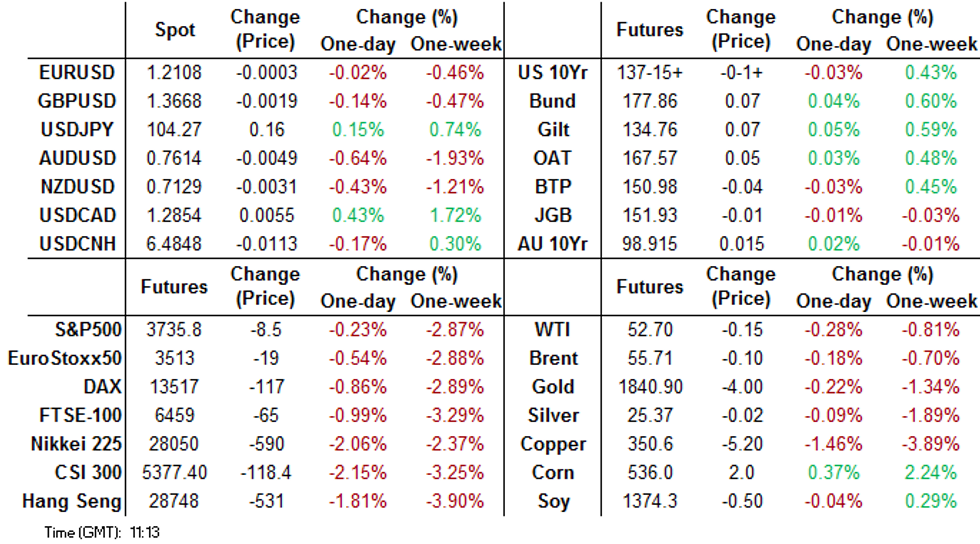

- USD gains for second session, USDJPY nears 2021 high

- Equity futures recover off overnight lows, volatility edges lower

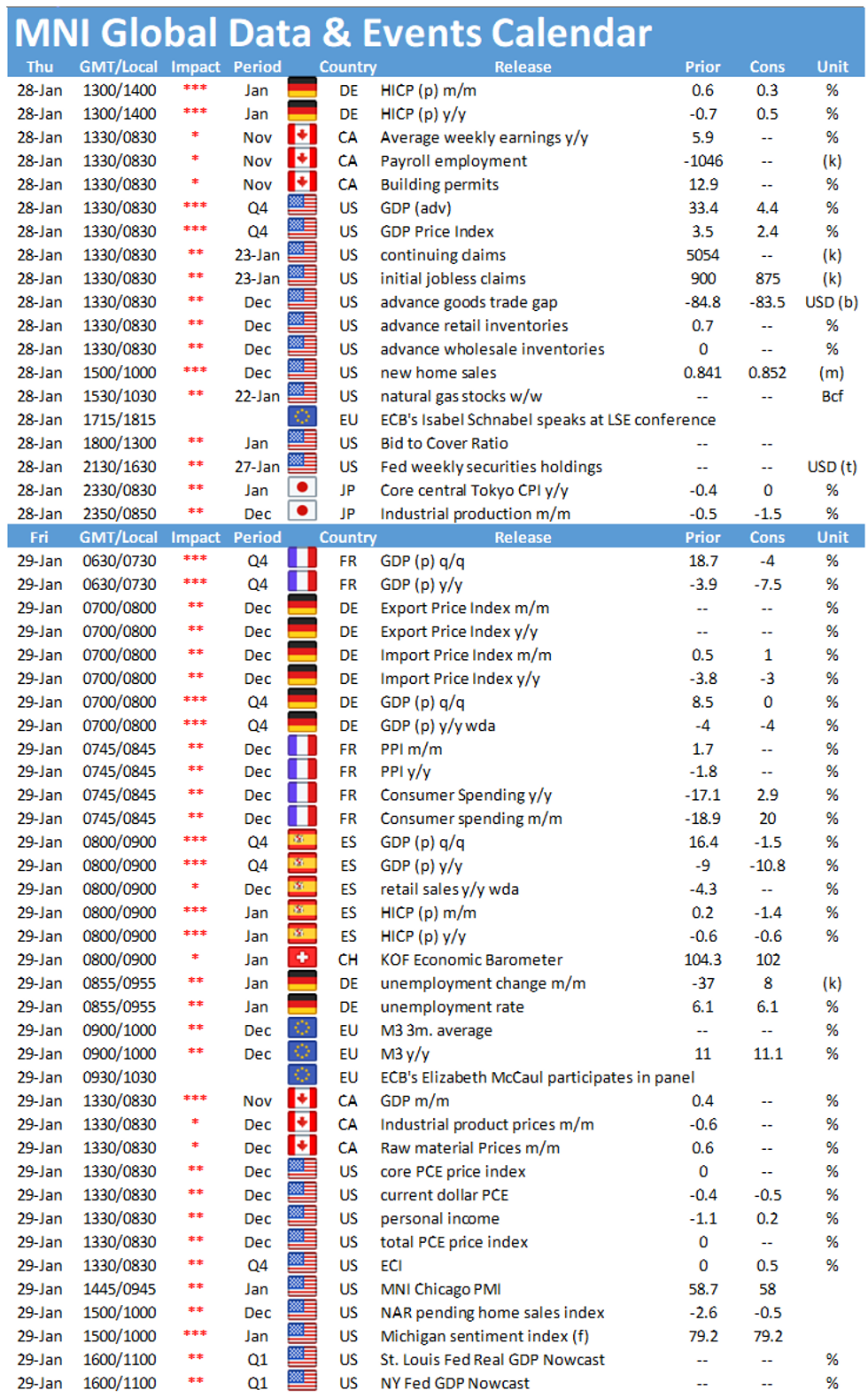

- US GDP in focus, US seen growing 4.2% annualized

US TSYS SUMMARY: Drifting Post-FOMC, Pre-Data

Tsys are drifting within Wednesday's ranges so far on above-average volumes, with dollar strength and equity weakness suggesting a continued querying of the "reflation" trade.

- Mar 10-Yr futures (TY) down 1.5/32 at 137-15.5 (L: 137-13.5 / H: 137-19), elevated volumes (~420k).

- The 2-Yr yield is unchanged at 0.1191%, 5-Yr is unchanged at 0.4114%, 10-Yr is down 0.7bps at 1.0093%, and 30-Yr is down 0.8bps at 1.7657%.

- While the January FOMC meeting was basically a non-event for markets, looking through sell-side reactions overnight there appears to be a split opinion over whether the Fed/Powell leaned more dovish or less dovish than expected. Will have our full review out shortly.

- 0830ET data haul: weekly jobless claims; Q4 advance GDP; inventories; goods trade balance. 1000ET sees Dec new home sales.

- In supply, $65B of 4-/8-week bill auction at 1130ET, with $62B of 7-Yr Note selling at 1300ET. NY Fed buys ~$1.750B of 20-30Y Tsys.

EGB/GILT SUMMARY: EGBs Broadly Firmer

European sovereign bonds have broadly traded firmer this morning alongside equity losses and a retracement of G10 FX against the US dollar.

- Gilts have rallied and the curve has slightly bull flattened. The 2s30s spread is 1bp narrower.

- Bunds have similarly firmed with yields within 1bp of yesterday's close.

- It is a similar story for OATs with the curve marginally flatter on the day.

- The fallout over Covid vaccinations in the EU continues with Belgium sending investigators to the AstraZeneca plant in Seneffe, Hainaut. A call yesterday evening between AstraZeneca chief executive Pascal Soriot and European officials failed to broker a solution that could speed up vaccine deliveries.

- In the UK, cabinet minister Michael Gove rejected claims that vaccines produced at UK plants could be diverted to the EU.

- UK PM Boris Johnson headed to Scotland today to extol the virtues of the United Kingdom amid a resurgence in momentum for Scottish independence.

- Supply this morning came from Italy (BTP/CCTeu, EUR8.75bn)

AUCTION RESULTS

Italy sells E8.75bln BTP/CCTeu vs E7.25-8.75bln target

E3.5bln of the 0.50% Feb-26 BTP:

Average yield 0.06% (0.01%)

Bid-to-cover 1.48x (1.90x)

Price 102.15 (102.51)

Pre-auction mid-price 102.091

E3.75bln of the 0.90% Apr-31 BTP

Average yield 0.65% (0.59%)

Bid-to-cover 1.38x (1.57x)

Price 102.48 (103.12)

Pre-auction mid-price 102.416

E1.5bln of the 0.50% Apr-26 CCTeu

Average yield 0.04% (-0.02%)

Bid-to-cover 1.52x (1.58x)

Price 99.88 (100.19)

Pre-auction mid-price 99.823

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

RXH1 176/175ps 1x2 bought for 19 in 1k

DUH1 112.30/112.20ps 1x2, bought for 1.5 in 6k

DUH1 112.30/112.40/112.50c fly sold at 3 in 2.5k

DUJ1 112.40/60cs 1x2 sold at 0.5 in 3.25k

UK:

LK1 100.25c, was bought for 0.75 in 5k

3LM1 99.50/99.25ps vs 2LM1 99.62p, bought the Blue for 0.75 in 8k

US:

TYH1 137.00/136.50/136.00put ladder, bought for 3 in 1.5k

FOREX: Greenback Strength Extends Post-Fed

Having been the strongest currency in G10 yesterday, the USD has added to these gains, with the USD index gaining further to rival the best levels seen in US hours Wednesday. A break above 90.131 opens January's best at 90.951 and would extend the rally from the 2021 low to near 2%. USD strength has accompanied a further pullback in stock futures, with the e-mini S&P off a further 20 points at pixel time.

EUR also trades well, bouncing further off the Wednesday lows, although EUR/GBP has stopped short of the week's best levels so far. JPY has been a notable mover, with USD/JPY breaking above downtrendline resistance to open the bull trigger at 104.40.

Currency options volumes have been particularly firm post-Fed, with an uptick in implied vols noted across the front-end of most G10 curves. Demand for KRW, JPY and AUD hedges have been the main drivers so far Thursday.

Focus Thursday turns to weekly jobless claims data, prelim German CPI numbers and advanced Q4 GDP from the US. GDP is expected to have grown at 4.2% on an annualized basis.

FX OPTIONS: Expiries for Jan28 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2200-20(E658mln)

USD/JPY: Y103.45-60($595mln-USD puts), Y103.80-95($560mln-USD puts)

EUR/GBP: 0.8900(E705mln-EUR puts)

AUD/NZD: N$1.0665(A$530mln)

NZD/USD: $0.7050(N$645mln)

USD/CNY: Cny6.37($500mln), Cny6.4200($590mln)

TECHS: Price Signal Summary - USDJPY Clears Channel Resistance

- In equities, E-mini S&P futures traded sharply lower yesterday.

- Support to watch is at 3696.02, the 50-day EMA. A break would open 3652.50, Jan 4 low.

- EUROSTOXX50 is weaker too and price has cleared the 50-day EMA. An extension lower would open 3455.94 next, Dec 22 low.

- In the FX space, EURUSD has yet to clear support at 1.2054, Jan 18 low. A break would open 1.2011, Sep 1 high.

- Firm resistance has been defined at 1.2190, Jan 22 high.

- USDJPY has cleared the key bear channel resistance drawn off the Mar 24 high. Attention is on 104.40, Nov 11 high that if breached would reinforce the importance of the channel break out. This would also highlight an important shift in sentiment.

- On the commodity front, Gold is pressuring support. A deeper sell-off would expose the key short-term level at $1804.7, Jan 18 low. Oil contracts remain above support. Brent (H1) support to watch is $54.48, Jan 22 low and WTI (H1) support lies at $51.44, the low from Jan 22.

- In the FI space:

- Bunds (H1) yesterday breached resistance at 177.96, Jan 14 high. Attention is on 178.37, Jan 4 high. Support lies at 177.39, yesterday's low.

- Key resistance in Gilts (H1) at the 20- and 50-day EMAs has been breached this week. A resumption of gains would open 135.04, 61.8% of the Jan 4 - 12 downleg.

EQUITIES: Stocks Remain Offered, Stoxx600 Wipes Out 2021 Gains

Following the negative close on Wall Street after the Fed rate decision (S&P500 closed lower by over 2.5%), European stock markets are similarly offered this morning, resulting in the Stoxx600 erasing all gains posted since the beginning of the year.

UK's FTSE-100 and Germany's DAX are hardest hit this morning, off by around 1% apiece, while France's CAC-40 is lower, but by the smallest margin. Energy and communication services names are the worst performing sectors, while consumer staples are flat.

The e-mini S&P is in the red, but has retraced much of the day's losses to around 10 points. After yesterday's spike higher, VIX futures have calmed, but remain well elevated above recent averages.

COMMODITIES: Oil Holding Up Well Despite USD Strength

In contrast with the broad-based losses across continental and US equity markets this morning, oil prices are holding well, with WTI and Brent crude futures broadly flat on the day. This keeps directional parameters in tact, with WTI's bull trigger just above at $53.94, while $51.44, the Jan 22 low, undercuts as support.

Having traded under pressure yesterday, spot gold is calmer this morning, with spot gold around $10 above yesterday's lows. Gold's positive correlation with equities remains firm, leaving precious metals particularly sensitive to sentiment swings and equity volatility at this juncture. The 20-day EMA to the upside at $1860.80 is the first target.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.