-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - EUR Dragged Off Highs as Knot Strikes Soft Tone

Highlights:

- ECB's Knot strikes uncharacteristically soft tone on inflation

- Treasuries undergo a belly-led rally, triggered by EGBs

- US retail sales, industrial production and Canadian inflation headline the schedule

US TSYS: Belly Led Rally Following EU FI Ahead Of Stacked Docket, Earnings

- Cash Tsys are holding a belly-led rally, with a move that started through Asia trade and continued as Tsys followed core EU FI richer after dovish ECB commentary. The move sees the 2Y having now unwound most of Friday’s U.Mich beat-related sell-off whilst 10Y yields touched fresh lows since June before edging higher.

- Ahead, earnings season could shape sentiment in the very near term. BNY Mellon beat adjusted EPS expectations and BofA beat FICC trading revenue estimates, whilst Morgan Stanley, Charles Schwab and Lockheed Martin all report pre-market before a stacked docket headlined by US retail sales.

- 2YY -5.1bp at 4.692%, 5YY -6.0bp at 3.959%, 10YY -4.7bp at 3.760%, 30YY -3.3bp at 3.895%.

- TYU3 trades 8+ ticks higher at 112-31+ just off a high of 113-02+ having easily breached yesterday’s range to test resistance at 113-03 (Jul 13 high) after which lies a key level at 113-11+ (50-day EMA). Volumes are subdued at 235k.

- Data: Retail sales Jun (0830ET), NY Fed services Jul (0830ET), IP & Cap util Jun (0915ET), NAHB housing index Jul (1000ET), Business inventories May (1000ET), TIC flows May (1600ET)

- Bill issuance: US Tsy $50B 42D CMB auction – 1130ET

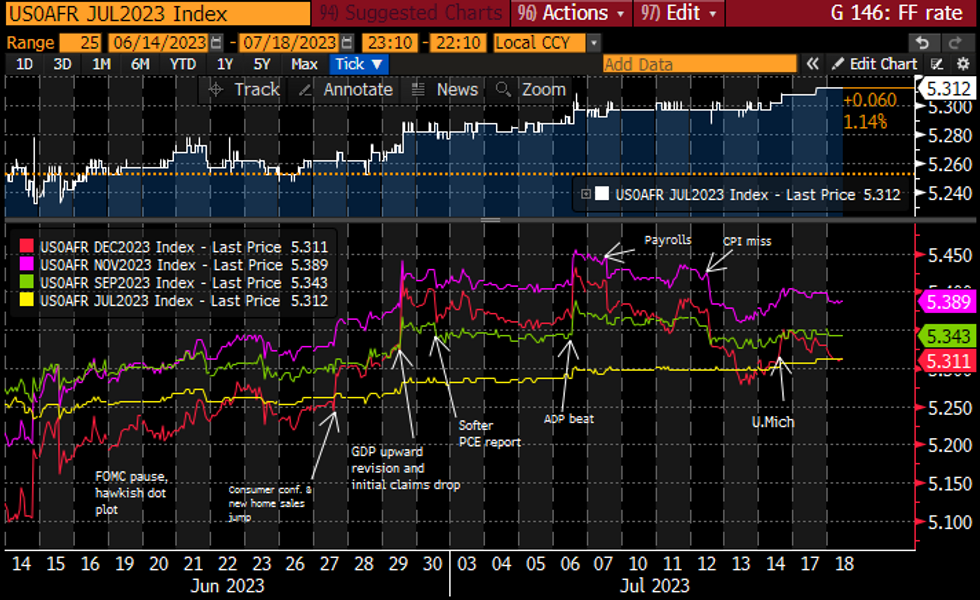

STIR FUTURES: Fed Rate Cuts Build With Retail Sales Next On The Docket

- Fed Funds implied rates have softened overnight, coming through Asia hours on clear drivers but then being further supported by dovish ECB speak from Knot. Near-term meetings see only modest change with larger declines into 2024 with later 2024 inversion building more notably.

- Cumulative hikes from 5.08% effective: +23.5bp Jul (unch), +26.5bp Sep (unch), 30.5bp to a terminal 5.39% Nov (-1bp).

- Cuts from terminal: 8bp to Dec’23 (from 7bp), 80bp to Jun’24 (from 76bp) and 157bp to Dec’24 (from 148bp).

- Amidst the FOMC blackout on all things mon pol-related, two supervision-related appearances from Fed officials today at 1000ET touching on fair lending and climate change.

Source: Bloomberg

Source: Bloomberg

BONDS: EGB-Led Global Rally as ECB Hikes Priced Out

EGB yields have fallen sharply in early trade Tuesday, pulling down Treasury and Gilt yields with them.

- The catalyst for the EGB move was uncharacteristically dovish commentary by ECB hawk Knot who sounded unconvinced about the need for hikes past next week's near-certain 25bp raise (tightening beyond this month "would at most be a possibility but by no means a certainty").

- The comments knocked 5bp off the market- implied ECB terminal policy rate and saw the German curve bull steepen with Schatz yields down double-digits.

- Periphery EGB spreads tightened on prospects of a less hawkish ECB, with 10Y BTP/Germany hitting tights not seen since Jun 28 (163bp).

- The EGB moves triggered a rally in Treasuries, led by the curve belly, with 10Y yields hitting the lowest levels since June (a touch below 3.75%).

- Gilt gains were briefly pared by a weak long-dated auction, but subsequently recovered.

- US data is the focus for the rest of the session, with retail sales, industrial production, inventories, and homebuilder sentiment featuring.

EUROPE ISSUANCE UPDATE

Gilt auction result- Very weak gilt auction with a wide 2.2bp tail and a LAP at a lower price than the prevailing market had traded for 50 minutes. The price of the 3.75% Oct-53 Gilt fell from about 87.782 to around 87.58 at the time of results publication.

- Gilt futures also touch their lowest level in 75minutes - although retraced most of their losses within 10 minutes. For reference, we haven't had a tail that wide on a long-dated gilt auction since October 2022 in the midst of Truss' premiership (although we have on two short-dated gilt auctions in that period: 0.50% Jan-29 in Feb23 and 3.50% Oct-25 in Mar23).

- GBP2.5bln of the 3.75% Oct-53 Gilt. Avg yield 4.484% (bid-to-cover 2.33x, tail 2.2bp).

- E6bln (E4.963bln allotted) of the new 3.10% Sep-25 Schatz. Avg yield 3.07% (bid-to-cover 1.22x).

FOREX: EUR Off Cycle Highs as Knot Strikes Softer Tone

- EUR/USD printed a new multi-month high at 1.1272 early Tuesday, with markets resuming the soft USD backdrop in early European hours. The price action soon reversed, however, on comments from ECB's Knot. Knot struck an uncharacteristically dovish tone, flagging that beyond a July rate hike, the path for policy is more uncertain, expressing confidence that the peak in core inflation has passed. The subsequent Bund rally aided EUR/USD's climb lower, to trade broadly flat headed into the NY crossover.

- JPY is firmer against most others in G10, however there's been little impetus from equities, which look somewhat directionless after a quiet morning. The e-mini S&P remains firmer on the week, however is off the best levels of the Monday session.

- NZD is the poorest performer across G10, helping keep NZD/SEK under pressure and extending the recent losing streak. The cross has fallen in 8 of the past 9 sessions, now sitting at the lowest levels since mid-May.

- US retail sales take focus going forward, with markets expecting sales to have risen 0.5% on the month. Industrial production updates are set to follow, with Canadian inflation also on the docket.

FX OPTIONS: Fade Off Highs Brings EUR/USD Within Range of Day's More Sizeable Strikes

Reversal off highs for EUR/USD puts spot within range of a larger $1.1225 option strike, although further weakness will bring the most sizeable strikes of the day (and the week) into play at $1.1100-10 (E4.5bln):- EUR/USD: $1.1100-10(E4.5bln)$1.1225(E521mln)

- USD/JPY: Y139.50-70($543mln)

- GBP/USD: $1.3010(Gbp853mln)

- AUD/USD: $0.6800-15(A$1.1bln)$0.6850(A$957mln)$0.6875-95(A$1.2bln)

- USD/CAD: C$1.3240($526mln)

- USD/CNY: Cny7.1500($1.4bln)

EQUITIES: Eurostoxx Futures Continue to Ease Off Last Week's Highs

- Eurostoxx 50 futures traded higher last week. The rally resulted in a move above the 50-day EMA at 4335.00 and price is through 4371.00, the Jul 6 high. Clearance of this latter level highlights a potentially stronger bull cycle and attention is on key resistance and the bull trigger at 4447.00, the Jul 3 high. Key support and the bear trigger has been defined at 4220.00, the Jul 7 low. Initial support is at the 50-day EMA.

- A bull theme in S&P E-minis remains intact. This week’s rally has resulted in a break of resistance at 4498.00, the Jun 30 high. The break confirms a resumption of the uptrend and maintains a bullish price sequence of higher highs and higher lows. The contract has also traded through 4500.00 and this opens 4576.62, a Fibonacci projection. First support lies at 4439.81, the 20-day EMA. Clearance of this level would highlight a S/T bearish threat.

COMMODITIES: Gold Prints Fresh Multi-Week High, Approaching Next Resistance

- The current bull cycle in WTI futures persists despite the pull lower in prices across the Friday session. The contract has recently breached $72.72, the Jun21 high and Wednesday's move higher resulted in a break of key resistance at $75.70, the Jun 5 high. This strengthens current bullish conditions and paves the way for a climb towards $78.03, a Fibonacci retracement point. Key short-term support has been defined at $66.96, the Jun 12 low. Initial support is at $72.31, the 20-day EMA.

- Gold is holding on to its latest gains. The yellow metal has breached resistance at the 50-day EMA. The average intersects at $1945.0 and the break signals scope for a continuation of the current corrective cycle. This opens $1968.00, the Jun 16 high. Key resistance has been defined at $1985.3, the May 24 high where a break would highlight a stronger reversal. Key support and the bear is at $1893.1, the Jun 29 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/07/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/07/2023 | - |  | EU | ECB Panetta at G20 Finance/Central Bank meeting | |

| 18/07/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 18/07/2023 | 1230/0830 | *** |  | CA | CPI |

| 18/07/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/07/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 18/07/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/07/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 18/07/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 18/07/2023 | 1400/1000 | * |  | US | Business Inventories |

| 18/07/2023 | 1400/1000 |  | US | Fed's Michael Barr | |

| 18/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 18/07/2023 | 2000/1600 | ** |  | US | TICS |

| 19/07/2023 | 2245/1045 | *** |  | NZ | CPI inflation quarterly |

| 19/07/2023 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 19/07/2023 | 0600/0700 | *** |  | UK | Producer Prices |

| 19/07/2023 | 0830/0930 | * |  | UK | ONS House Price Index |

| 19/07/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 19/07/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 19/07/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/07/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 19/07/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 19/07/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 19/07/2023 | 1600/1700 |  | UK | BoE Ramsden speech on QT - Money Macro and Finance Society | |

| 19/07/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.