-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - EUR higher on Knot's hawkish comments

Highlights:

- Euro rallies as Knot says it's a "bit of a joke" to talk about over-tightening.

- Markets generally in risk-off mode due to concerns surrounding Chinese reopening.

- Busy data week coming up with Eurozone inflation data, US ISM manufacturing and payrolls all due.

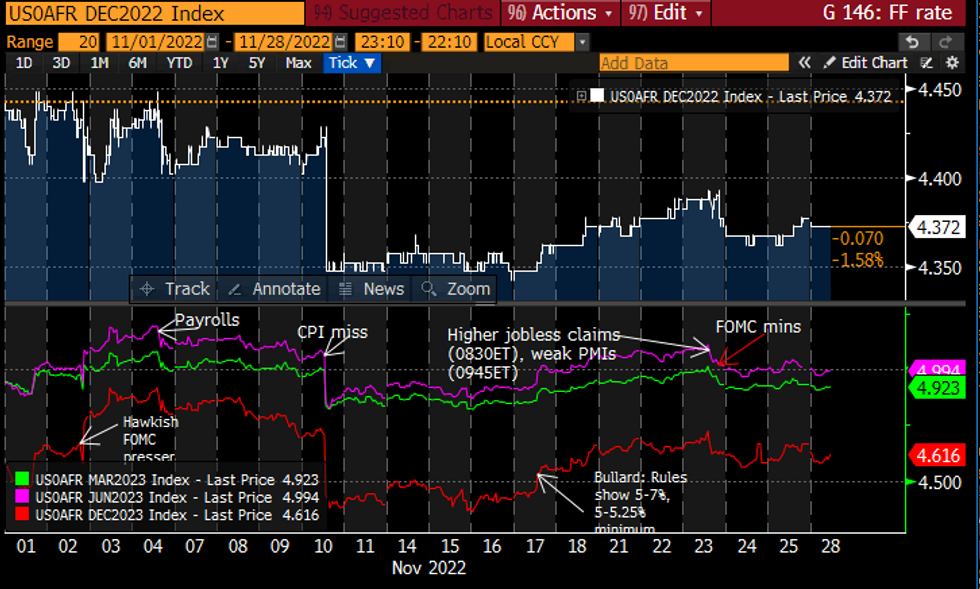

STIR FUTURES: Fed Terminal Just Under 5%

- Fed Funds implied hikes have reversed some of the gyrations of last week’s thin holiday trade to sit little changed/slightly below the post-FOMC minutes close.

- 53.5bp for Dec, 91bp to 4.75% for Feb’23, terminal 4.99% Jun’23 and 4.61% Dec’23.

- Fedspeak bunched at 1200ET: NY Fed’s Williams with text and full Q&A plus a Bullard interview. Williams most recently said financial risks shouldn’t shape Fed rate decisions whilst Bullard saw a terminal at a minimum 5-5.25% whilst citing Taylor Rules showing 5-7%.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

US Treasuries: Reverse Asia Bid To Twist Flatten

- Cash Tsys see a tale of two regional sessions, bid in Asia-Pac dealing with reports of pockets of COVID-related social unrest across some of the major Chinese cities and a continued uptick in new daily COVID cases in China before cheapening in European hours, helped by some hawkish comments from ECB's Knot.

- 2YY +2.1bps at 4.473%, 5YY +2.1bps at 3.879%, 10YY +1.3bps at 3.69%, and 30YY -0.5bps at 3.728%. The twist flattening leaves 2s10s of -78bps close to recent multi-decade lows.

- TYZ2 trades 2 ticks higher at 113-03 on slightly above average volumes, maintaining a bullish outlook with resistance seen at the intraday high of 113-17 and support at the 50-day EMA of 112-14. There has now been more than 80% roll into March for TYA ahead of first notice on Wed.

- Fedspeak: Williams (1200ET), Bullard (1200ET)

- Data: Limited to Dallas Fed mfg index after mixed November readings for other Regional Fed surveys.

- Bill issuance: $54B 13-Week, $45B 26-Week Bills (1130ET)

BONDS: Bunds underperform in risk-off markets

- Early strength in core fixed income has been partially reversed for Treasuries and gilts and fully reversed for Bunds.

- There has been a general risk-off feel to markets this morning following more protests in China but some hawkish comments from ECB's Knot have helped the Euribor strip underperform (and this has translated up the German curve to see Bunds underperform in core FI space too).

- There is little on the calendar today with more focus on the big data ahead this week, headlined by Eurozone inflation prints, the US ISM and payrolls.

- TY1 futures are up 0-7+ today at 113-08+ with 10y UST yields down -1.6bp at 3.666% and 2y yields down -1.1bp at 4.445%.

- Bund futures are up 0.04 today at 140.53 with 10y Bund yields down -0.2bp at 1.969% and Schatz yields down -0.5bp at 2.130%.

- Gilt futures are up 0.36 today at 105.72 with 10y yields down -3.1bp at 3.086% and 2y yields up 1.0bp at 3.261%.

EUROPEAN AUCTION RESULTS

Italy exchange auction result

MEF sells:

- E5.0bln of the new 5-year 3.40% Apr-28 BTP (ISIN: IT0005521981). Avg yield 3.56%, price 99.38, bid-to-cover 1.42x.

MEF buys:

- E659mln of the 0% Jul-23 CCTeu (ISIN: IT0005185456) at 100.360

- E236mln of the 0.65% Oct-23 BTP (ISIN: IT0005215246) at 98.413

- E1.305bln of the 0% Nov-23 BTP Short Term (ISIN: IT0005482309) at 97.525

- E824mln of the 0% Dec-23 CCTeu (ISIN: IT0005399230) at 100.517

- E1.942bln of the 0.95% Apr-25 CCTeu (ISIN: IT0005311508) at 101.700

- E2.265bln of the 2.00% Oct-27 EU NGEU. Avg yield 2.492% (bid-to-cover 1.03x).

- E1bln of the 1.25% Feb-43 Green EU. Avg yield 2.845% (bid-to-cover 1.93x).

FOREX: JPY and EUR outperforms

- The USD benefit from safer haven demand overnight and in early European trade, as Equities gaped lower overnight, on China concerns.

- The standout is the Yen, with the latter up 1.09% so far today, on safer haven interest.

- The USD is now more mixed in G10 at the time of typing, albeit mostly in the red, still holding some gains against the AUD, CAD and NZD.

- The EUR is performing well so far today, in the green against all G10, besides the Yen.

- The currency leads versus the AUD, up 1.37% on the session.

- EURAUD sees 1.56508, the November high, as the initial resistance.

- EURUSD tested immediate resistance 1.0479 High Nov 15, printing a 1.0482 high at the time of typing.

- Looking ahead, there's no tier 1 data today, but some speakers are scheduled, including ECB Knot, Lagarde, Nagel, US Fed Williams, Bullard.

- ALL EYES are on the data releases this week, with EU prelim CPIs and US NFP/AHE to end the week.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/11/2022 | 0900/1000 | ** |  | EU | M3 |

| 28/11/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 28/11/2022 | 1330/0830 | * |  | CA | Current account |

| 28/11/2022 | 1400/1500 |  | EU | ECB Lagarde Intro at ECON Hearing | |

| 28/11/2022 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 28/11/2022 | 1530/1530 |  | UK | DMO Q1 Consultation Meetings | |

| 28/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 28/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 28/11/2022 | 1700/1200 |  | US | New York Fed's John Williams | |

| 29/11/2022 | 2350/0850 | * |  | JP | Retail sales (p) |

| 29/11/2022 | 2350/0850 | * |  | JP | labor forcer survey |

| 29/11/2022 | 0530/0630 | *** |  | DE | North Rhine Westphalia CPI |

| 29/11/2022 | 0700/0800 | *** |  | SE | GDP |

| 29/11/2022 | 0700/0800 | ** |  | SE | Retail Sales |

| 29/11/2022 | 0800/0900 | *** |  | CH | GDP |

| 29/11/2022 | 0800/0900 | *** |  | ES | HICP (p) |

| 29/11/2022 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 29/11/2022 | 0810/0910 |  | EU | ECB de Guindos Opens Encuentro Financiero Event | |

| 29/11/2022 | 0900/1000 | *** |  | DE | Hesse CPI |

| 29/11/2022 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 29/11/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/11/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 29/11/2022 | 1000/1100 | *** |  | DE | Saxony CPI |

| 29/11/2022 | 1000/1100 | ** |  | EU | Economic Sentiment Indicator |

| 29/11/2022 | 1000/1100 | ** |  | IT | PPI |

| 29/11/2022 | 1235/1235 |  | UK | BOE Mann Panels The Conference Board Conference | |

| 29/11/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 29/11/2022 | 1330/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 29/11/2022 | 1330/1430 |  | EU | ECB Schnabel Speech at Frankfurter Konjunkturgespraech | |

| 29/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 29/11/2022 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 29/11/2022 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 29/11/2022 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 29/11/2022 | 1500/1500 |  | UK | BOE Bailey at Lords Economic Affairs Committee | |

| 29/11/2022 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 29/11/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 30/11/2022 | 2350/0850 | ** |  | JP | Industrial production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.