-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - EUR/USD Looks to Erase Friday Losses

Highlights:

- Haven currencies on the backfoot, as EUR/USD looks to erase Friday losses

- Fed rate cut pricing trimmed further, but September still live

- US consumer confidence, appearance from Fed's Barr takes focus

US TSYS: Cheaper On Net Ahead Of 5Y Supply, Deluge Of Second Tier Data

- Cash Tsys have seen mixed overnight trade, rallying with and after the open before cheapening in the European session as they lag larger sell-offs in EGBs and Gilts. The cheapening impetus remains although Treasuries are off lows along with a fading in equities.

- 2YY trades +6.2bps at 4.006% for yesterday’s newly issued 2Y (although just +1.5bps on a generic basis), 5YY +4.0bps at 3.631%, 10YY +1.3bp at 3.543% and 30YY -0.5bp at 3.755%.

- TYM3 trades 6+ ticks lower at 114-25+ off intraday lows of 114-18 that form support above the 20-day EMA of 114-03.

- Data: Wholesale & retail inventories (0830ET), advance goods trade balance (0830ET), FHFA House prices (0900ET), S&P CoreLogic house prices (0900ET), Conf Board consumer survey (1000ET), Richmond Fed mfg index (1000ET) and Dallas Fed services activity (1000ET).

- Fedspeak: VC Supervision Barr speaks at Senate Banking Panel testimony (1000ET).

- Note/bond issuance: US Tsy $43B 5Y Note auction (91282CGT2) – 1300ET

- Bill issuance: US Tsy $30B 7-day CMB auction (1130ET), $45B 17-day CMB auction (1300ET).

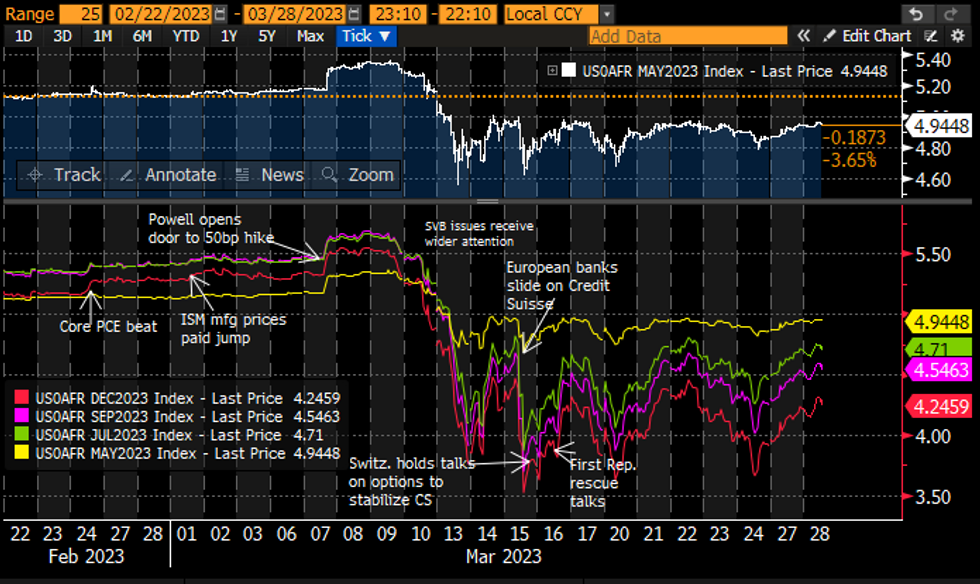

STIR FUTURES: Fed Rate Path Pushes Higher, First Cut With Sept FOMC

- Fed Funds implied rates have continued yesterday’s push higher although are a little off session highs, with 12bp of hikes for Mar to a peak 4.95% (unch).

- There is now just one cut priced from the current effective 4.83% with the Sept FOMC (4.55%, +3.5bp) compared to Friday’s low of three cuts, with 58bp of cuts to year-end with 4.25% in Dec (+4.5bp).

- Sole scheduled Fedspeak from VC Supervision Barr at the Senate with prepared remarks released yesterday (MNI Brief here).

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

GREECE: PM Calls Election For 21 May, Faces Tough Race

Greek Prime Minister Kyriakos Mitsotakis has confirmed that the first round of the country's general election will take place on Sunday 21 May. The new electoral system (put in place by the previous leftist gov't of PM Alexis Tsipras) is a proportional system, doing away with the 'majority bonus' of seats given to the largest party which often ensured one-party gov't rather than coalitions.

Full article PDF attached below:

MNI POLITICAL RISK-Greek PM Calls Election For 21 May, Faces Tough Race.pdf

EUROPE ISSUANCE UPDATE

EU-bond syndication update:

- Size set at: E6bln WNG, spread set at MS+68bp, books in excess of E73bln (inc E3.55bln JLM interest)

- E1.985bln of the 0% Jan-52 DSL. Avg yield 2.501%.

- A decent Italian auction with the average price above the pre-auction mid-price and the bid-to-cover broadly in line with last month's results. The 3.40% Mar-25 BTP-ST reversed the losses seen in the 10 minutes ahead of the bidding deadline and following the auction traded in line with the average price of the auction.

- E1.25bln of the 2.50% Dec-24 BTP. Avg yield 3.1% (bid-to-cover 1.9x).

- E2.75bln of the 3.40% Mar-25 BTP Short Term. Avg yield 3.29% (bid-to-cover 1.48x).

- E1.5bln of the 0.10% May-33 BTPei. Avg yield 2.02% (bid-to-cover 1.37x).

- There was a tight tail on the Schatz auction with the LAP in line with the average price at 99.760, and both exceeding the pre-auction mid-price of 99.759. This is in line with the prevailing price 5-10 minutes before the auction cutoff time but above the low of 99.736 seen around a minute before the auction close.

- On the results, the 2.50% Mar-25 Schatz moved higher and shortly after moved above the auction price.

- E5.5bln (E4.444bln allotted) of the 2.50% Mar-25 Schatz. Avg yield 2.62% (bid-to-cover 1.41x).

FOREX: Early JPY Gains Reverse While Equities Back to Flat Pre-NY

- Most major pairs are fading off the session high, with GBP/USD's pullback outpacing that of the EUR. Overnight lows at 1.2283 should provide weak support, but seen stronger headed into 1.2179 - marking both the Mar 23 and 21 low. The modest recovery for the USD index mimicks the move in equity markets, with the e-mini S&P fading off the overnight highs to trades broadly flat headed through the NY crossover.

- CHF is the poorest performer in G10, helping EUR/CHF continue the recent oscillation either side of the 0.9924 50-dma. CAD also trades poorly, with USD/CAD inching higher to partially reverse the oil price-based outperformance noted on Monday.

- US March consumer confidence data takes focus, which is expected to ebb to 101.00 from 102.9 previously, while Fed's Barr appears before the Senate Banking Panel. A number of ECB speakers are due, with Makhlouf and de Cos on the docket - although their topic of conversation is cryptocurrencies.

FX OPTIONS: Expiries for Mar28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0875-80(E1.1bln), $1.0945-55(E1.8bln)

- USD/JPY: Y128.50-70($875mln)

- AUD/USD: $0.6500(A$575mln), $0.6750(A$652mln)

EQUITIES: Eurostoxx Futures Advance at Open, 4164.00 Marks Key Short-Term Resistance

- Eurostoxx 50 futures remain below last week’s 4164.00 high (Mar 22). The recent pullback threatens the recent bull theme and signals the end of what appears to have been a corrective bounce. A resumption of weakness would open 4009.50, 61.8% of the Mar 20 22 rally. A move below the 4000.00 handle would expose 3914.00, the Mar 21 low and bear trigger. Key short-term resistance is 4164.00, the Mar 22 high.

- A break would be bullish. S&P E-Minis remains below last Wednesday's high of 4073.75. The recent pullback means that price has - so far - failed to remain above pivot resistance at the 50-day EMA - the EMA intersects at 4020.18. A clear upside break of it is required to strengthen bullish conditions. Support lies at 3937.00, the Mar 24 low. A breach would open 3897.25 next, the Mar 20 low. Key short-term resistance is at 4073.75, the Mar 22 high.

COMMODITIES: WTI Futures Target 50-Day EMA After Trading Sharply Higher Monday

- WTI futures traded sharply higher Monday. Price has breached resistance at the 20-day EMA which intersects at $72.54. The break is a short-term bullish development and a continuation higher would expose the 50-day EMA, at $75.12. This average represents the next key resistance point. On the downside, initial firm support lies at $66.82, the Mar 24 low. A break of this level would be bearish.

- Trend conditions in Gold remain bullish and the recent short-term pullback is considered corrective. The breach on Mar 17 of former resistance at $1959.7, Feb 2 high, confirmed a resumption of the bull trend that started late September 2022. The test above $2000.0 opens $2034.0 next, a Fibonacci projection. $1918.3 is seen as a firm support. It is the Mar 17 low and a break is required to signal scope for a deeper pullback.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/03/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/03/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 28/03/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 28/03/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 28/03/2023 | 1315/1515 |  | EU | ECB Lagarde Speech at BIS Innovation Hub Opening | |

| 28/03/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 28/03/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 28/03/2023 | 1400/1000 |  | US | Senate Banking Committee Hearing | |

| 28/03/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 28/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 28/03/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 28/03/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 28/03/2023 | 2000/1600 |  | CA | Federal budget (Release around 4pm, as finance minister delivers it to Parliament) | |

| 29/03/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/03/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 29/03/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 29/03/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 29/03/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 29/03/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/03/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/03/2023 | 0930/1030 |  | UK | Bank of England FPC Report/minutes | |

| 29/03/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 29/03/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 29/03/2023 | 1400/1000 |  | US | US House Financial Services Hearing | |

| 29/03/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 29/03/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 29/03/2023 | 1630/1230 |  | CA | BOC Deputy Gravelle speech "The market liquidity measures we took during COVID" | |

| 29/03/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 29/03/2023 | 1850/1950 |  | UK | BOE Mann Panellist at NABE | |

| 29/03/2023 | 2045/2245 |  | EU | ECB Schnabel Panels NABE Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.