-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - EUR/USD Touches YTD Low, Nears Key Support

HIGHLIGHTS:

- Stocks under pressure as EuroStoxx50 nears 200-dma

- EUR/USD sinks to fresh 2021 low

- ADP eyed for clues on Friday's payrolls

US TSYS SUMMARY: Off Lows, But Global Factors Maintain Pressure

Treasuries have partially recovered from overnight lows Wednesday but remain weaker, with bear steepening in the curve.

- 10Y yields briefly pierced 1.57% for the first time since June. The 2-Yr yield is up 0.6bps at 0.2896%, 5-Yr is up 1.5bps at 0.9878%, 10-Yr is up 1.4bps at 1.5397%, and 30-Yr is up 1.5bps at 2.1104%.

- Rising global energy prices (and concerns over central bank tightening/inflation) continue to take center-stage, with oil rising for the 4th straight session and European natural gas soaring to all-time highs.

- That's helped weigh heavily on FI and equities, with the dollar pushing higher (incl a fresh 2021 high vs the Euro).

- With the debt limit set to be a key focus in coming days, Pres Biden meets w business leaders at 1300ET on the topic, including bank CEOs. Senate Democrats set to try again to vote on the debt limit today.

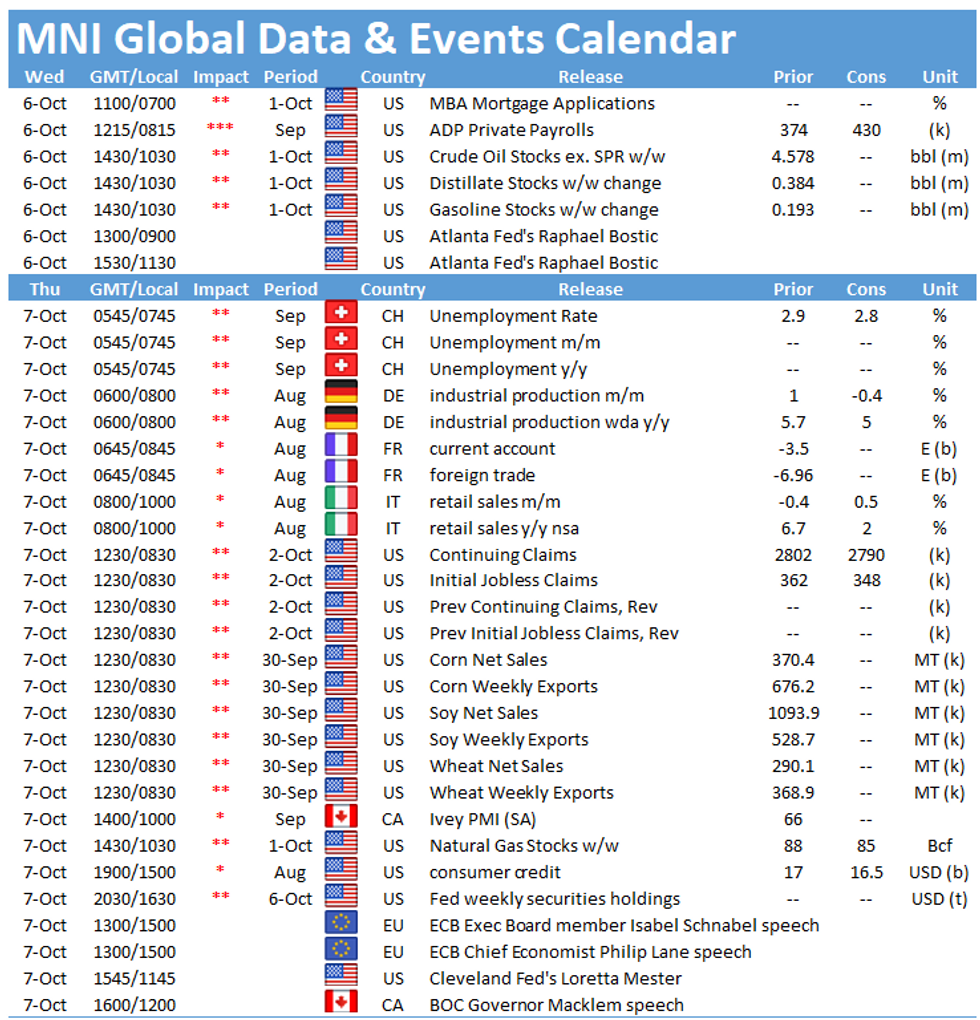

- In data, MBA Mortgage Apps at 0700ET, with ADP employment at 0815ET (as always, eyed ahead of Friday's payrolls numbers).

- Tsy sells $70B combined in 64-/119-day bills at 1130ET. NY Fed buys ~$1.425B of 10-22.5Y Tsys.

EGB/GILT SUMMARY: Bonds & Equities Under Pressure

Government bonds and equities have sold off this morning while the dollar has gained ground across the board.

- Higher energy prices at a time of intensifying logistical challenges coming out of the pandemic has stoked concerns that inflation could prove more persistent at the same time that growth expectations are being reassessed.

- Gilts continue to underperform core EGBs with cash yields 3-4bp higher across the curve.

- Bunds have traded weaker with yields pushing up 1-2bp.

- OATs trade in line with bunds and with the curve a touch steeper.

- BTPs underperform core EGBs with yields 2-4bp higher on the day.

- The UK Construction PMI for September came in at 52.6 vs 54.0 survey, while Eurozone retail sales for August similarly missed, coming in at 0.00% Y/Y vs 0.4% Y/Y expected.

- Supply this morning came from the UK (Gilts, GBP2.50bn), Germany (Bobl, EUR3.235bn), Greece (GTBs, EUR625mn) and the ESM (Bills, EUR4.992bn). Slovakia also sold EUR1bn of a 30-year bond via syndication with books above EUR3.6bn).

EUROPE ISSUANCE UPDATE: German, UK sales, Slovakian Syndication

Germany allots €3.235bln 0% Oct-26 Bobl, Avg yield -0.54% (Prev. -0.69%), Bid-to-cover 1.02x (Prev. 1.31x), Buba cover 1.26x (Prev. 1.59x)

UK DMO sells Gbp2.50bln 0.50% Jan-29 Gilt, Avg yield 0.948% (Prev. 0.575%), Bid-to-cover 2.21x (Prev. 2.30x), Tail 0.3bps (Prev. 0.3bps)

EGB SYNDICATION: Slovakia 30-year - Final terms

- Size set at E1.0bln (in the E1.0-1.5bln range MNI expected)

- Spread set at MS+47bps

- Original guidance was MS+55bp area before revision to MS+50bp (+/- 5bp WPIR).

- Orderbooks in excess of E3.6bln (incl. JLM interest)

- Maturity: 13 October 2051

EUROPE OPTION FLOW SUMMARY

UK:

3LX1 98.75/98.625 ps bought for 3.5 in 10k (ref 98.835, 16 del)

US:

2EV1 99.125/2EZ1 99.25 call strip bought for 2 in 10k on block

FOREX: EUR/USD Sinks to New 2021 Low

- EUR/USD holds close to the day's lows amid a firmer greenback and further signs of a slowdown in the post=pandemic recovery. Eurozone retail sales for August came in well below expectations, with the July figure also being revised lower to a drop of 2.6% on the month. The pair has so far found some support at the 1.1550 level, but further weakness would open losses toward 1.1493, the 50% retracement of the 2020-2021 rally.

- Risk-off is evident across assets this morning, with equities sinking to erase the entirety of Tuesday's late rally. A push through 4267.50 could reignite the risk-off tone, further favouring the USD and haven currencies, which are already outperforming ahead of the NY crossover.

- At the other end of the table, NZD is the underperformer, falling against all others despite the RBNZ hiking rates overnight. While the bank took the first step in their tightening cycle, they declined to provide a commitment to further rate rises, undermining NZD throughout Asia-Pac trade.

- Focus turns to ADP employment change data for another further insight into Friday's payrolls release. There are no notable central bank speakers Wednesday.

FX OPTIONS: Expiries for Oct06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1615-25(E622mln)GBP/USD: $1.3835-55(Gbp663mln)

- AUD/USD: $0.7300(A$671mln)

- NZD/USD: $0.7000(N$2.2bln)

- USD/CAD: C$1.2550-60(C$1.6bln), C$1.2600($868mln), C$1.2720-30($1.2bln)

Price Signal Summary - Risk-Off Mood Dominates

- In the equity space, S&P E-minis are holding above Friday's low of 4260.00. The outlook is unchanged and remains bearish with scope seen for weakness towards 4214.50, Jul 19 low. Short-term gains are considered corrective. EUROSTOXX 50 futures outlook remains bearish too. A resumption of weakness opens 3902.50, Jul 20 low.

- In FX, EURUSD remains bearish and has resumed its downtrend this morning, confirming a recent bear flag formation. The focus is on 1.1493 next, 50.0% of the Mar '20 - Jan '21 bull phase. 3902.50, Jul 20 low. GBPUSD remains vulnerable following last week's sell-off and despite the recent strong corrective bounce. The pair has reversed lower this morning having found resistance at the former triangle support. Attention is on the 1.3412, Sep 29 low where a break would open 1.3354, Dec 23, 2020 low. Initial resistance is at yesterday's high of 1.3648. The recent corrective pullback in USDJPY has found support at 110.82, Oct 4 low and the focus is on the bull trigger at 112.08, Sep 30 high. A break would confirm a resumption of the uptrend and open 112.23/40, the Feb 20 and 24 highs.

- On the commodity front, Gold remains in a downtrend and attention is on $1690.6, the Aug 9 low and the bear trigger. Note though that the Sep 30 price pattern is a bullish engulfing candle. This highlights the potential for a stronger corrective bounce and defines an initial support at $1721.7, the Sep 29 low. A reversal higher would open $1787.4, Sep 22 high. WTI futures continue to climb. The focus is on the psychological $80.00 hurdle next..

- In the FI space, the primary trend remains down. Bund futures weakness has exposed 169.01 next, 1.764 projection of the Sep 9 - 17 - 21 price swing. Resistance is seen at170.55, Oct 4 high. Gilt futures remain heavy too and have gapped lower today. The focus is on 123.79, 1.764 projection of the Aug 31 - Sep 17 - 21 price swing.

EQUITIES: Stocks Resume Decline, EuroStoxx50 Nears 200-dma

- Equity futures across both Europe as well as the US trade weaker, with losses of around 2% pretty uniform across continental cash indices. Equity weakness resumed across Asia-Pac hours, with the e-mini S&P rolling well off the late Tuesday highs of 4359.75. This puts the index in close proximity to the Monday lows at 4260, below which the outlook deteriorates further.

- In Europe, consumer discretionary and industrials names are leading losses, helping pressure the EuroStoxx50 to fresh multi-month lows and within range of key support at the 3950.75 200-dma. A break below here puts the index on track to test mid-July lows and correction territory at 3827.85.

COMMODITIES: Fourth Session of Higher Highs for WTI Crude

- Oil markets remain solid, with both WTI and Brent crude futures holding close to the week's best levels and printing a fourth consecutive session of higher highs and higher lows. This keeps the bull trend intact despite a very modest edge off the overnight highs in recent trade.

- Natural gas markets have extended recent volatility, with European and UK natural gas benchmarks surging further still. The UK day ahead natural gas price is now higher by over 500% year-to-date, while the Dutch benchmark touched a gain of over 700% since January 1st. The supply crunch over winter remains a key focus for markets, with prices expected to remain distressed in the coming months.

- Gold and silver prices sit in negative territory, keeping the outlook for gold bearish for now. This follows last week's move lower and extension of the bear phase that has been in place since Sep 3. A break of $1721.7, Sep 29 low would confirm a resumption of weakness and open key support at $1690.6, Aug 9 low.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.