-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - EuroStoxx 50 Narrows in on 2021 Highs

Highlights:

- European equities remain solid, with EuroStoxx 50 narrowing gap with 2021 high

- GBP/USD fades for second session, but move remains corrective in nature

- Speakers and earnings mark the highlight of the upcoming week

US TSYS: Bear Flattening Ahead of April Surveys, McCarthy Debt Limit Deliberations

- After little trend through Asia hours, cash Tsys continued Friday’s cheapening in the European session as they pushed through Friday’s lows across 2-10Y tenors although are since off fresh lows.

- Amidst a light docket, added attention is likely on House Speaker McCarthy’s remarks expected to focus on the approaching debt limit (seen at 1000ET) plus earnings season with Charles Schwab today’s highlight ahead of a busy week for earnings (calendar here).

- 2YY +3.8bp at 4.137%, 5YY +3.0bp at 3.635%, 10YY +2.1bp at 3.534% and 30YY +1.0bp at 3.745%.

- TYM3 trades 4 ticks lower at 114-23+, clearing yesterday’s low and touching a session low of 114-20+ off somewhat subdued volumes of 200k. It extends last week’s bear cycle and opens support at the 50-day EMA of 114-14 after which lies the key 114-07 (Mar 29/30 lows) whilst to the upside sits resistance at 116-08 (Apr 12 high).

- Data: Empire mfg index Apr (0830ET), NAHB housing Apr (1000ET), TIC flows Feb (1600ET)

- Bill issuance: US Tsy $57B 13W, $48B 26W bill auction (1130ET)

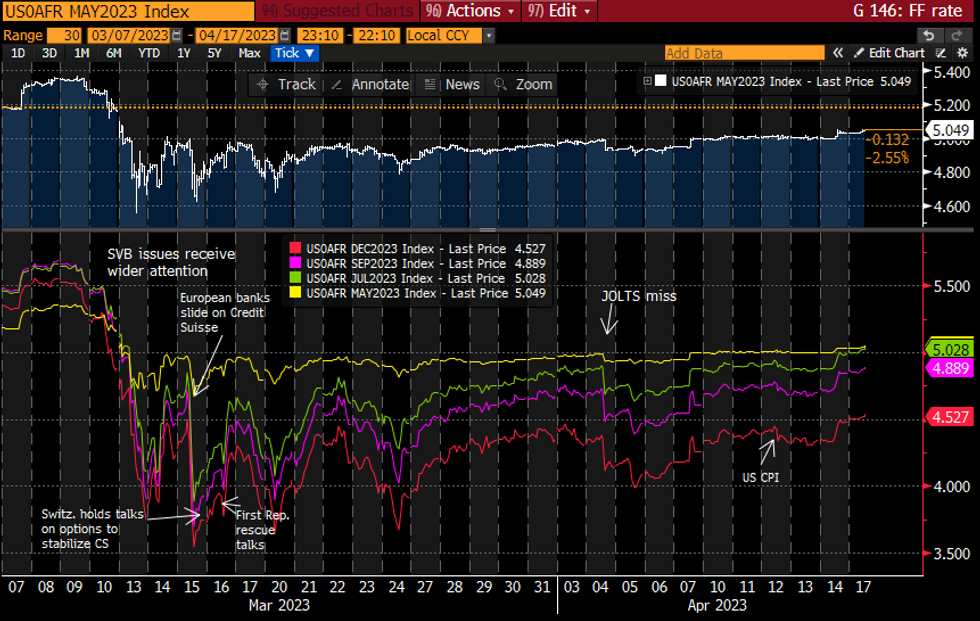

STIR FUTURES: Fed Dec’23 Rate Above 4.5% First Time Since Mar 13

- Fed Funds implied rates have pushed higher overnight with the Dec’23 rate above 4.5% for the first time since Mar 13 as fallout from regional banking woes was more fully being understood.

- 22bp hike for May 3 FOMC (+1.5bp) before a cumulative 29bp for Jun (+4bp). Most of that hike is reversed by Sept (5bps above current levels, +4bp) before half a cut to 4.71% for Nov (+4bp) and just 30bp of cuts to year-end (+4.5bp).

- No Fedspeak scheduled today with Gov Bowman next tomorrow on digital currencies in the last week before the FOMC blackout.

Source: Bloomberg

Source: Bloomberg

EUROPE ISSUANCE UPDATE:

EFSF syndication update- New long 5-year Dec-28. Books in excess of E8.8bln (ex JLM interest), spread set at MS-7bps.

Slovakia auction results:

- E83mln of the 0.25% May-25 SlovGB. Avg yield 3.4455% (bid-to-cover 1.62x).

- E375mln of the 4.00% Oct-32 SlovGB. Avg yield 3.6724% (bid-to-cover 1.29x).

- E144mln of the 3.75% Feb-35 SlovGB. Avg yield 4.0123% (bid-to-cover 2.43x).

- E58mln of the 1.00% Oct-51 SlovGB. Avg yield 3.9539% (bid-to-cover 1.14x).

- The 1.625% Dec-29 EU-bond saw a relatively low bid-to-cover of 1.29x. The lowest accepted price of 91.68 was higher than the prevailing market price in the 10 minutes ahead of the auction cutoff time. Post-auction we have moved lower in line with the wider selloff in EGBs.

- The 2.75% Feb-33 Green EU-bond saw a stronger auction with a bid-to-cover of 1.62x. Again the lowest accepted price of 97.10 was in excess of the pre-auction mid-price and had not been seen in the market for 25 minutes ahead of the auction cutoff time. Despite remaining below this level now, the 2.75% Feb-33 Green EU-bond held up a bit better than other EGBs post-auction.

- E1.771bln of the 1.625% Dec-29 EU-bond. Avg yield 3.018% (bid-to-cover 1.29x).

- E1.732bln of the 2.75% Feb-33 Green EU-bond. Avg yield 3.087% (bid-to-cover 1.62x).

FOREX: GBP/USD Fades Through Overnight Lows to Extend Corrective Pullback

- Currency markets are off to a relatively sedate start to the week, with most pairs and crosses respecting the recent ranges amid light newsflow and market signal.

- GBP/USD faded through overnight lows ahead of the NY crossover, to touch 1.2374 and extend the corrective pullback posted Friday. 1.2345 marks the next major support which, if broken, opens the 1.0% lower 10-dma envelope at 1.2318 - a level crossing ~1.8% below recent highs. The technical indicator has held prices since mid-March - so a show below could mark a more protracted correction in the short-term.

- The greenback is very modestly higher, with the USD Index now north of 101.75 and narrowing in on 101.9904, the 23.6% retracement of the mid-March - April downleg.

- CAD is following the greenback higher, putting GBP/CAD lower for a third consecutive session. The cross is nearing support at 1.6519, the 50-dma last broken in early February.

- Attention turns to upcoming US empire manufacturing for April, with speeches from ECB's Lagarde and BoE's Cunliffe also on the docket. The US earnings schedule remains a focus, with big banks and a number of large tech firms set for release this week.

FX OPTIONS: Expiries for Apr17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0920(E528mln), $1.0935(E931mln), $1.0950-55(E637mln), $1.1050(E2.0bln)

- USD/JPY: Y132.50($1.0bln), Y133.00-11($1.1bln)

- AUD/USD: $0.6700(A$2.3bln)

EQUITIES: Eurostoxx Futures Trading at Recent Highs, Targeting 4381.50 - Jan 5 2022 High

- Eurostoxx 50 futures remain in an uptrend and price is trading at its recent highs. The continued appreciation strengthens the bullish significance of the recent break of 4268.00, the Mar 6 high and a former key resistance. Sights are on 4381.50, the Jan 5 2022 high. Moving average studies are in a bull-mode set-up, highlighting a broader uptrend. Initial firm support lies at 4221.13, the 20-day EMA.

- The current trend condition in S&P E-minis remains bullish. Price has recently breached 4119.50, Mar 6 high, reinforcing a positive theme. The move higher also resulted in a break of 4148.48, 76.4% of the Feb 2 - Mar 13 downleg. This signals scope for an extension to 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key medium-term resistance. Firm support lies at 4065.03, the 50-day EMA.

COMMODITIES: WTI Futures Respect Recent Range, but Remain in Bull Cycle

- WTI futures remain in a bull cycle. Last week’s gains resulted in a break of resistance at $81.81, the Apr 4 high. This confirms a resumption of the current uptrend and note that an important resistance at $83.04, the Jan 23 high, has also been breached. The focus is on $85.01, the Nov 14 high. On the downside, key short-term support is seen at $79.00, the Apr 3 low and the gap high on the daily chart.

- Trend conditions in Gold remain bullish. Last Thursday’s break of resistance at $2032.1, Apr 5 high, confirmed a resumption of the current uptrend. The move higher maintains the positive price sequence of higher highs and higher lows and sights are set on the next key resistance at $2070.4, the Mar 8 2022 high. This is just ahead of the all-time high of $2075.5. Key short-term support has been defined at $1981.7, the Apr 10 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/04/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/04/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 17/04/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 17/04/2023 | 1300/1400 |  | UK | BOE Cunliffe Speech at Innovate Finance Global Summit | |

| 17/04/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 17/04/2023 | 1500/1700 |  | EU | ECB Lagarde Speech at Council on Foreign Relations | |

| 17/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 17/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 17/04/2023 | 1645/1245 |  | US | Richmond Fed's Tom Barkin | |

| 17/04/2023 | 2000/1600 | ** |  | US | TICS |

| 18/04/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 18/04/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 18/04/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 18/04/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 18/04/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 18/04/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 18/04/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 18/04/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 18/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/04/2023 | 1230/0830 | *** |  | CA | CPI |

| 18/04/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 18/04/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/04/2023 | 1300/1500 |  | EU | ECB Elderson in Basel Committee on Banking Supervision | |

| 18/04/2023 | 1500/1100 |  | CA | BOC Governor testifies to House of Commons committee | |

| 18/04/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 18/04/2023 | 1700/1300 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.