-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - GBP Strong as UK & EU Hone in on Deal

HIGHLIGHTS:

- Issuance in focus with a sizeable $ pipeline including Aramco, Italy and World Bank

- E-mini S&P retreats from key resistance as markets take profit on vaccine rally

- GBP buoyed as Brexit negotiators zero in on a deal

US TSYS SUMMARY: Remains steady during the EU session

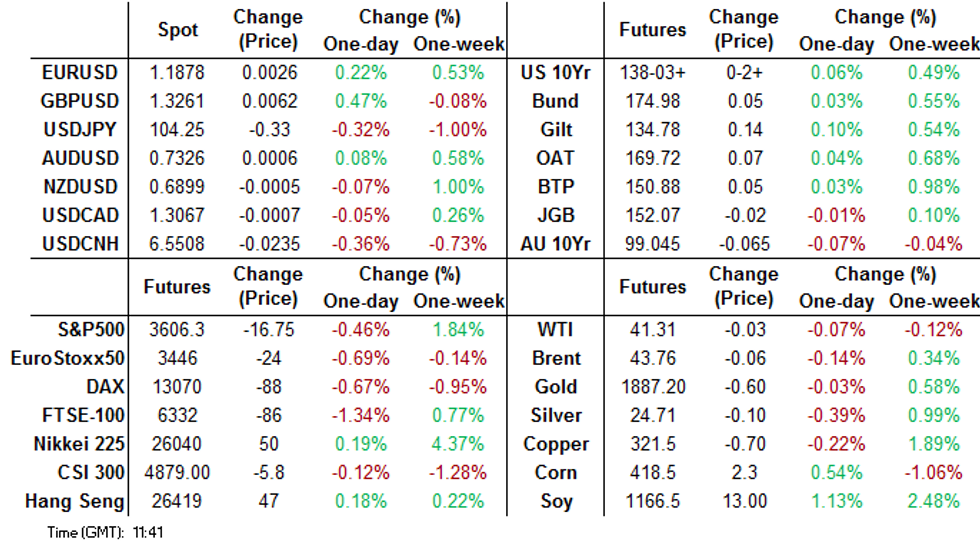

US Treasuries saw a fairly steady session, in a tight range.

- This was inline with European government Bonds, which traded with a lack of direction bias.

- Curve saw initial bull flattening, but this was unwound, and the strip trades flat so far today.

- European equities, FTSE and Ibex were hit the hardest, with Healthcare and Travel leading losses, but this had limited effect into US equities or Treasuries, as investors await on more vaccine news.

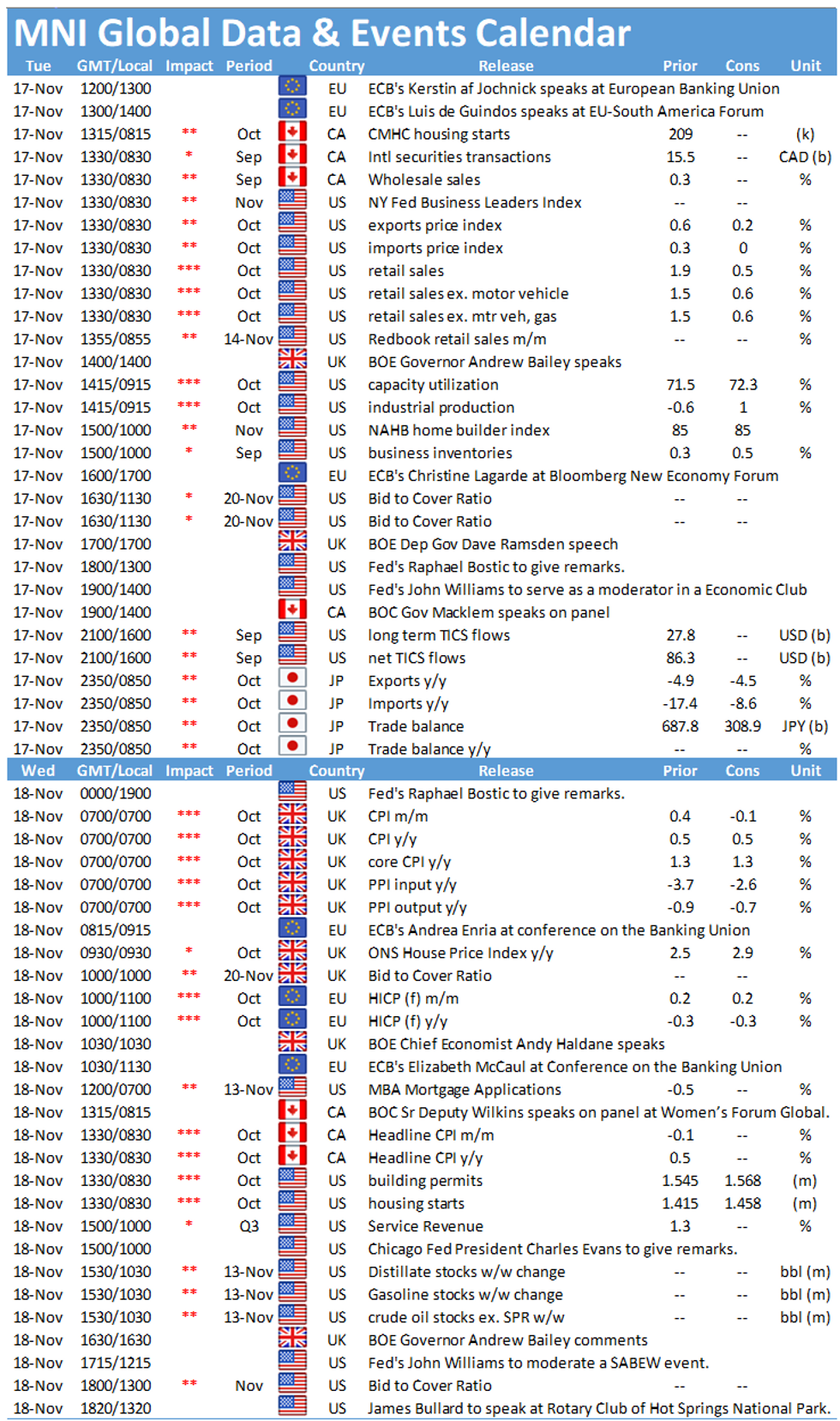

- Looking ahead, US Retail Sales, and industrial Production are the more notable data, but with the street focused on Covid and fiscal stimulus, it is unlikely to move the needle.

- Plenty of Fed speakers are scheduled, including Powell, Bostic, Daly, Kashkari, Rosengren and Barking.

- TY1 futures are up 0-3 today at 138-04

- 2y yields unch today at 0.178%

- 5y yields down -0.6bp today at 0.401%

- 10y yields down -1.6bp today at 0.892%

EGB/GILT SUMMARY: Pause For Thought

The risk-on rebound following the Moderna Covid vaccine announcement yesterday has subsided somewhat this morning with equities inching lower and European govies trading firmer.

- Gilts have made incremental gains with yields up to 2bp lower on the day and the curve marginally bull flattening.

- Bunds trade close to unch on the day. Last yields: 2-year -0.7305%, 5-year -0.7398%, 10-year -0.5500%, 30-year -0.1450%.

- OATs have firmed with cash yields within 1bp of yesterday's close.

- BTPs trade broadly in line with core EGBs.

- Supply this morning came from the UK (Gilts, GBP5.25bn), Germany (Schatz, E4.125bn allotted), Spain (Letras, E1.02bn) and the ESM (Bills, E2bn).

- The European data calendar was light this morning. Norwegian Q3 GDP printed in line with expectations at 5.2% Q/Q.

GERMAN AUCTION RESULTS: Germany Allots E4.125bn of the 0% Dec-22 Schatz

- Average yield -0.74%, Buba cover 1.4x, bid-to-cover 1.12x

UK AUCTION RESULTS:

DMO sells GBP3.25bln nominal of 0.125% Jan-24 gilt

- Avg yld 0.025% (-0.017%), bid-to-cover 2.41x (2.34x), tail 0.2bp (0.2bp), price 100.321 (100.464).

- Pre-auction mid-price 100.307.

- An additional GBP812.5mln will be available through the PAOF to successful bidders until 13:00GMT

DMO sells GBP2.00bln nominal of 0.625% Oct-50 Gilt

- Avg yld 0.92% (0.842%), bid-to-cover 2.27x (2.24x), tail 0.1bps (0.2bps), price 92.307 (94.266).

- Pre-auction mid-price: 92.135

- An additional GBP500mln will be available through the PAOF to successful bidders until 14:30GMT.

PIPELINE: Italy, Aramco, IBRD

Saudi Aramco 5Pt Jumbo Book Over $20B

- Date $MM Issuer (Priced *, Launch #)

- 11/17 $3B World Bank (IBRD) 3Y +2, 7Y +14

- 11/17 $1B BNG Bank 5Y +10

- 11/17 $Benchmark HSBC 6.5NC5.5 +140a

- 11/17 $Benchmark ANZ 15NC10 +200a

- 11/17 $Benchmark Rep of Italy, +5Y +90a (+30Y considered at later date)

- 11/17 $Benchmark Saudi Aramco 3Y +140a, 5Y +155a, 10Y +175a, 30Y +205a, 50Y +230a

- 11/17 $Benchmark Uzbekistan 10Y investor calls

- Chatter:

- 11/?? $Benchmark Rep of Serbia

OPTIONS FLOW SUMMARY

UK:

LG1 100.00c, bought for 2.25 in 5k (ref 99.97)

LH1 100/99.87/99.75p fly, bought for 4.25 in 1k

LM1 99.87/100/100.12c fly 1x3x2, bought for 2.25 in 5k

2LM1 with 2LU1 99.625p strip, sold at 10.75 in 2k (ref 99.845 and 99.82)

Eurozone:

DUZ0 112.40/112.30/112.20 p fly, sold at 5.5 in 2.5k.

US:

TYF1 136.50/135.50ps vs 139.00c, bought the ps for 1 in 20k.

FOREX: USD Weakness Triggers Fourth Session of USD/JPY Declines

JPY is the strongest currency across G10 early Tuesday, putting USD/JPY on track to record its fourth consecutive sessions of declines. USD weakness is very evident elsewhere, with USD/CNH dropping to its lowest level in about two years.

Macro drivers and market direction seems pretty inconsequential at present, with volumes so far a little lower than average for this time of day.

GBP picked up a light bid in early Asia-Pac trade after The Sun reported that UK chief Brexit negotiator Frost told PM Johnson to expect a trade deal with the EU "early next week", possibly as soon as next Tuesday. The report noted that talks can still collapse over fishing rights or red tape, with both sides unwilling to budge on their key demands. Much of the initial GBP strength has since faded, but GBP/USD holds above 1.32 pre-NY.

US retail sales and industrial production data crosses later today, but the central bank speakers schedule will likely garner more interest, with appearances due from BoE's Bailey, ECB's Lagarde, Fed's Powell, BoC's Macklem and RBA's Lowe.

OPTIONS: Expiries for Nov17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-20(E1.4bln), $1.1830(E1.0bln), $1.1850(E2.1bln-EUR calls), $1.1895-1.1905(E1.3bln)

- USD/JPY: Y104.00-09($516mln), Y105.00($636mln)

- EUR/GBP: Gbp0.8900(E923mln), Gbp0.9050(E804mln)

- AUD/JPY: Y76.05(A$552mln), Y76.25(A$604mln)

TECHS: Key Price Signal Summary

- E-Mini S&P futures key resistance at 3668.00. The outlook is bullish however. A break of 3668.00, Nov 9 high would resume the uptrend and open 3699.03, a Fibonacci projection. Price action on Nov 9 is a shooting star candle though and a reversal threat. Watch key support at 3498.25, former bear channel resistance.

- EURUSD key directional triggers identified. 1.1920, Nov 9 high and 1.1746, Nov 11 low mark the key directional triggers. A break of 1.1920 would open this year's high print of 1.2011. On the downside, 1.1603, Nov 4 low is exposed should 1.1746 give way.

- Long legged Doji candle in Bund fut. yesterday. Yesterday's price action is a potential reversal signal and if correct, suggests the recent corrective bounce has run its course. Watch support and the intraday bear trigger at 174.45, Nov 16 low. Key resistance for today is 175.29.

- Elsewhere, watch key support in gold at $1848.8, Sep 28 low and in Brent (F1) at $42.63 and WTI (Z0) at $40.06, the Nov 13 lows.

EQUITIES: Better selling pushes indices lower

Looking at European equities, FTSE and Ibex looked to have been hit the hardest Tuesday, with mainland continental markets down 0.5-1.0%.

- Healthcare and Travel leading losses in a modest . But not seen a clear catalyst.

- Despite the sell off in Equities, USD stays under pressure helping, Cable and EURUSD at the high of the session.

COMMODITIES: Brent steady as OPEC supply curbs come into focus

Focus will be on the OPEC+ meeting today for further supply-side drivers.

Gold and silver are broadly flat, receiving little support from the pullback in equities. Elsewhere, watch key support in gold at $1848.8, Sep 28 low and in Brent (F1) at $42.63 and WTI (Z0) at $40.06, the Nov 13 lows.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.