-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - GBP Surges as Services Returns to Growth

Highlights:

- Putin maintains belligerent stance in Duma address, withdraws from START

- GBP surges as PMI bounces back to growth

- Treasury curve cheapens ahead of 2y supply

US TSYS: European PMI Strength Helps Post-Holiday Cheapening, 2Y Supply Later

- Cash Tsys sit cheaper across the curve with the US returning from Presidents Day but within Friday's ranges, close to where they opened for the front end but moving lower through European hours in the belly and beyond.

- Ahead of US PMIs, the cheapening pressure is supported by notably stronger than expected European PMIs (Eurozone services, UK both mfg and services). Data and post-holiday flow likely headlines today with no scheduled Fedspeak until tomorrow’s FOMC Minutes.

- In yield space, 2YY +4.8bps at 4.663%, 5YY +6.5bp at 4.094%, 10YY +6.2bp at 3.877% and 30YY +5.0bp at 3.919%.

- TYH3 trades 13 ticks lower at 111-19, off a session low of 111-17+ but still off Friday’s fleeting low of 111-08+ and potentially with some support at 111-10 (Lower 2.0% Bollinger Band) above that.

- Data: Philly Fed non-mfg index Feb (0830ET), S&P Global PMI Feb prelim (0945ET), Existing home sales Jan (1000ET)

- Bond issuance: $42B 2Y notes (1300ET)

- Bill issuance: $60B 13-w and $48B 26-w bills (1130ET), $34B 52-w bills (1300ET)

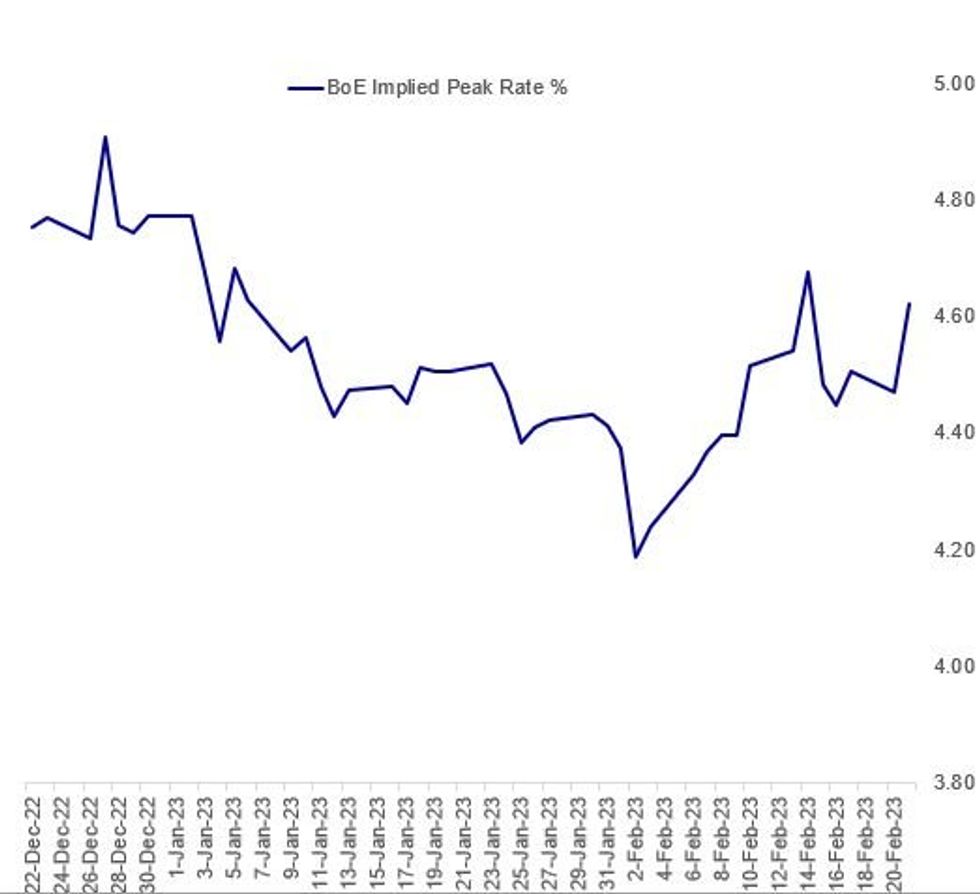

STIR FUTURES: PMI Pushes BoE Terminal Pricing Up 15+bp, Near Recent High

Driven by this morning's PMI beat, BoE terminal rate pricing is up over 15bp on the session, pointing to 63bp of further hikes by September 2023 (Bank rate of 4.63%).- That's still about 5bp off the Feb 14 peak seen after US CPI and UK jobs/wage data (and before reversing the following day on softer-than-expected UK CPI numbers).

- 42bp of cumulative hikes are priced in by the May meeting, up 7bp on the day. This implies 25bp fully priced for March, with about 2/3 prob of a further 25bp in May.

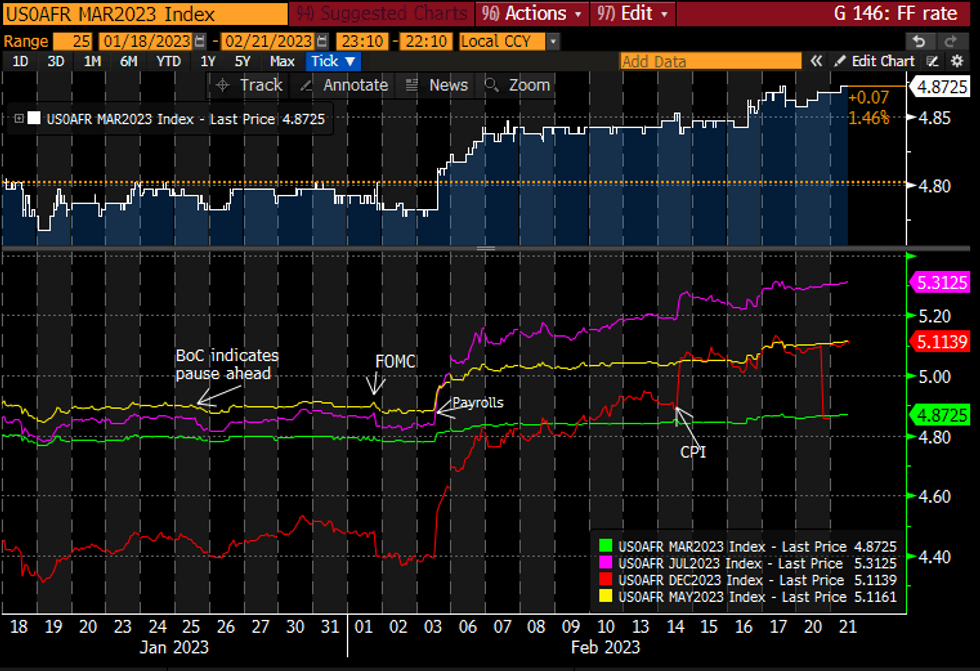

STIR FUTURES: US Returning To Higher Fed Rate Path

- Post Presidents Day, Fed Funds implied hikes show 29bp for Mar (+1.5bp from Fri close), a cumulative 53bp for May (+2bp), 73bp to 5.31% terminal in Jul (+3bp) before cutting to 5.11% in Dec (+5bp).

- That terminal sits fractionally off Friday’s fresh cycle highs whilst the 20bps of cuts from peak to year-end remains within last week’s range having been trimmed heavily prior to that (incl 50bp prior to payrolls).

- Next scheduled Fed commentary not until tomorrow’s FOMC minutes followed by NY Fed’s Williams.

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

NATO: Stoltenberg-We Urge Russia To Reconsider New START Treaty Suspension

Speaking alongside Ukrainian Foreign Minister Dmytro Kuleba and EU High Rep for Foreign Affairs and Security Policy Josep Borrell, NATO Secretary-General Jens Stoltenberg reacts to Russian President Vladimir Putin's address to the Russian Federal Assembly earlier today. Stoltenberg: 'We regret decision of Russia to suspend its participation on New START treaty...we urge Russia to Reconsider this decision.' Russia suspending its participation in New START could significantly obscure the buildup of nuclear warheads by Russia, raising tensions with the US.

- Counters Putin's claim the West started the war, saying 'Nobody is attacking Russia, Russia is the aggressor...Putin keeps escalating the war.'

- Stoltenberg: Putin made clear today he is preparing for more war.'

- Stoltenberg: NATO is 'concerned China is planning to support Russia's war.'

- Stoltenberg: 'We must sustain and step up support for Ukraine...Urgent to deliver on all pledges of weapon supplies for Ukraine...NATO will convene a meeting of procurement experts to ensure Ukraine has the weapons it needs'

EUROPE ISSUANCE UPDATE

Gilt auction results:

- Very weak gilt auction with a tail of 2.2bp (we have only seen two auctions with a tail exceeding 2bp since 2019). In addition the LAP of 83.463 was way below the pre-auction mid-price.

- The 0.50% Jan-29 gilt has moved to closer to the LAP and pulled the rest of the gilt curve lower as a result.

- GBP3.5bln of the 0.50% Jan-29 Gilt. Avg yield 3.597% (bid-to-cover 2.2x, tail 2.2bp).

- That is a relatively strong Bobl auction. The average and low price were both 98.16 (and above the pre-auction mid-price albeit the price did dip from 98.24 5 minutes before the bid deadline). The allotted amount of E4.3535bln was the highest amount seen at a Bobl auction since at least the beginning of 2020 while the amount bid has not been higher since August 2020.

- Following the release of the auction results the Bobl has returned to trading above the auction price. E5bln (E4.354bln allotted) of the 2.20% Apr-28 Bobl. Avg yield 2.59% (bid-to-cover 1.56x)

Spain syndication update:

- Size set at E5bln. Orderbook in excess of E30.7bln Spread set at 0.85% Jul-37 Obli (mid) + 10bps.

Slovenia syndication update:

- Orderbook in excess of E300mln. Spread set at MS+115bp.

Luxembourg syndication announcement:

- 10/20-year dual-tranche to be eld in the near-future.

FOREX: GBP Outperforms on Multi-Month High PMI

- GBP outperforms, rallying against all others as PMI data topped expectations. The services sector was a particular source of strength, with February PMI jumping to 53.3 vs. Exp. 49.2. The release marked an 8-month high for both Composite and Services, and a 7-month high for Manufacturing PMI (albeit still in contractionary territory).

- GBP/USD futures volumes surged on the back of the PMI beat, putting spot at fresh session highs. Over 3,000 contracts traded in the reaction (cash equivalent ~ $250mln) - putting the pair to just below the Feb16 high at 1.2075. 1.2092 (50% retracement for the Feb14 - Feb 17 downleg) sits as next intraday resistance.

- The greenback made modest gains ahead of the NY crossover, while AUD and NOK make up the poorest performers of the session so far.

- Canadian retail sales and inflation data are top of the docket Tuesday, with US February PMIs also due. Existing home sales for January round off the calendar, with ECB's Lagarde also scheduled.

BONDS: Europe Dragging Tsys Lower on PMI Beats

European bonds are lower in early Tuesday trade following stronger-than-expected February flash PMI data.

- Each of the French, German, and Eurozone composite PMIs beat expectations (though services did the heavy lifting, with manufacturing disappointing), followed by a much stronger-than-expected UK print.

- The German and UK curves bear flattened, with ECB and BoE terminal rate expectations rising. Gilts are underperforming, with short-end/belly yields higher by more than 10bp.

- The European core FI move dragged Treasuries lower, with U.S. PMIs and existing home sales the highlights of the data slate.

- ECB's Lagarde is the session's major central bank speaker of note.

- In supply, we get a $42bln 2Y Note auction in the U.S., with Germany selling E5bln of Bobl and Spain selling new 15Y Obli via syndication.

EQUITIES: Equity Futures Recover From Intraday Lows as Putin Addresses Federal Assembly

- EUROSTOXX 50 futures moderated through Friday and Monday trade, finishing flat on the session. This keeps prices just below first resistance at 4303.20, the 2.382 proj of the Sep 29 - Oct 4 rise from Dec 20 low, but still above 4265.00, the Feb 3 high. Note that the trend is overbought. A pullback would represent a healthy correction. Key support lies at 4097.00, the Jan 19 low. Initial support is at 4167.50, the 20-day EMA.

- The S&P E-Minis trend condition is bullish and the latest pullback is considered corrective. The contract has pierced initial support at 4069.52, the 20-day EMA. Firmer support lies at the 50-day EMA, at 4006.63. A clear break of this average would signal scope for a deeper pullback and potentially highlight a reversal. Key resistance and the bull trigger intersect at 4208.50, the Feb 2 high. A breach would resume the uptrend.

COMMODITIES: Gold Consolidates Close to Recent Lows

- WTI futures drifted into the Friday close, returning the outlook to neutral for now. Prices have drifted back below the 50-day EMA, at $78.34, however the medium-term view remains unchanged. Key resistance remains at $82.66, the Jan 18 high. On the downside, initial firm support has been defined at $72.25, the Feb 6 low.

- Trend conditions in Gold are bearish for now, despite the late recovery into the Friday close. This follows the strong sell-off on Feb 2 / 3 as well as the break of support at the 50-day EMA early Wednesday. A clear break here would strengthen a bearish case and suggest scope for a deeper pullback. Vol band support (the 2.0% 10-dma envelope), successfully contained prices Friday, keeping the focus on the level this week.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/02/2023 | 1330/0830 | *** |  | CA | CPI |

| 21/02/2023 | 1330/0830 | ** |  | CA | Retail Trade |

| 21/02/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/02/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 21/02/2023 | 1445/0945 | *** |  | US | S&P Global Services Index (flash) |

| 21/02/2023 | 1500/1000 | *** |  | US | NAR existing home sales |

| 21/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 21/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 21/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 21/02/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 22/02/2023 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 22/02/2023 | 0030/1130 | *** |  | AU | Quarterly construction work done |

| 22/02/2023 | 0030/1130 | *** |  | AU | Quarterly wage price index |

| 22/02/2023 | 0630/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 22/02/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 22/02/2023 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 22/02/2023 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 22/02/2023 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 22/02/2023 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 22/02/2023 | 0900/1000 | *** |  | DE | Hesse CPI |

| 22/02/2023 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 22/02/2023 | 0900/1000 |  | DE | Destatis Press Conference on Updated CPI Weights | |

| 22/02/2023 | 1000/1100 | *** |  | DE | Saxony CPI |

| 22/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/02/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/02/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 22/02/2023 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 22/02/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 22/02/2023 | 2230/1730 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.