-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: NZ Unemployment At 5.1% Over Q4

MNI ASIA OPEN: Yields Decline Ahead ADP Jobs, JOLTS Decline

MNI ASIA MARKETS ANALYSIS: Tariff Focus Eases Slightly

MNI Eurozone Inflation Insight – January 2025

MNI US MARKETS ANALYSIS - Gilts Surge On UK Fiscal Reversal

Highlights:

- Gilts and GBP outperform as new UK Chancellor unveils major changes to fiscal plans

- Commodities and equities stronger as US dollar softens to start the week

- Attention on Empire manufacturing and corporate earnings, with a light US data / Fed speaker docket

US TSYS: Treasuries Follow Gilts/EU FI Richer With Light Docket Ahead

- Cash Tsys again follow EU FI and Gilts in particular this morning, rallying 4-7bps across the curve as new Chancellor Hunt steers policy down a more fiscally responsible path. A light docket likely sees a headline-driven session.

- Major benchmarks rally 4-7bps across the curve, led by the 5-10Y but the front end also rallying as Fed hike expectations pull back off Friday’s new cycle highs following Thursday's CPI beat.

- 2YY -4.4bps at 4.452%, 5YY -7.3bps at 4.195%, 10YY -6.8bps at 3.951%, and 30YY -4.8bps at 3.944%.

- TYZ2 trades 14 ticks higher at 111-01+ on average volumes, firmly within Friday’s and Thursday’s even wider range, with a high of 111-28+ and low of 110-02 just above the psychological support of 110-00. The technical trend direction remains lower.

- Data: Empire Manufacturing for Oct (-1.5 prev, -4.3 expected) – 0830ET

- Bill issuance: US Tsy $57B 13W, $45B 26W bill auctions – 1130ET

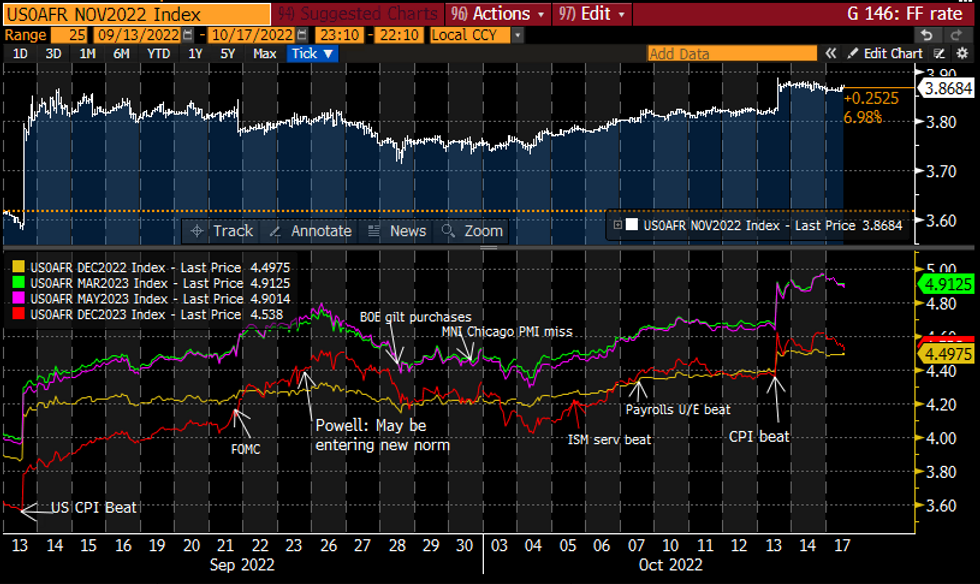

STIR FUTURES: 2023 Fed Rate Expectations Cool Off Friday’s Highs

- Fed Funds implied hikes are little changed from Fri for 2022 (79bp for Nov, cumulative 141bp to 4.49% Dec) but cool further out with terminal 4.9% in Mar/May’23 (-6/-7.5bps) and 4.53% Dec’23 (-8.5bp) off Friday’s highs.

- Bullard (’22) on Sat said premature to judge on Dec'22 hike size and 2023 would be more data dependent albeit seeing a bullish case with inflation risks – summary here.

- A light docket today with no scheduled Fedspeak and the Empire Mfg survey for October headlining, noting that it has been particularly volatile in recent months (going from -1 to +11 to -31 to -1.5 in Sept).

FOMC-dated Fed Funds implied rateSource: Bloomberg

FOMC-dated Fed Funds implied rateSource: Bloomberg

UK: Chancellor Confirms Almost Total U-Turn On Mini-Budget

New Chancellor of the Exchequer Jeremy Hunt confirms that almost all measures from the 23 September mini-budget will be reversed following weeks of market turbulence.

- Hunt: Will make a detailed statement to parliament later today [1030ET, 1530BST, 1630CET].

- Hunt: Stamp duty changes, National Insurance changes will go ahead.

- Hunt: The basic rate of income tax will not be cut, will remain at 20% 'indefinitely' until market conditions allow for a cut.

- Hunt: Measures announced today will raise around GBP32bn

- Hunt: Energy price guarantee will not change until April.

- Hunt: There will be more difficult decisions I'm afraid on tax and spending.

- Treasury on the Energy price guarantee: A Treasury-led review will be launched to consider how to support households and businesses with energy bills after April 2023. The objective of the review is to design a new approach that will cost the taxpayer significantly less than planned whilst ensuring enough support for those in need.

The U-turn comes as a major political humiliation for the Truss gov't. Rumours already circulating this morning on a potential challenge from Conservative backbenchers, and this unprecedented reversal - while having the potential to quell markets - is unlikely to quell MPs angry and scared for holding onto their seats.

UK Market Reaction Reaction to the Chancellor's statement

- Gilts have been trending higher and futures spiked to an intraday high of 98.06 at the details of the Chancellor's plans started to filter through. At the time of writing we are at 97.30, around 20 ticks above the prevailing level prior to the statement (but still 360 ticks higher on the day).

- Gilt yields remain lower by about 34-38bp across the curve with very marginal flattening.

- SONIA futures price in a peak in the Bank Rate around 5.25% (down from a peak of 6.50% a couple of weeks ago). Most of the strip is up around 25 ticks today.

- Markets still fully price in 100bp hike for November but pricing for December has fallen back to a cumulative 179 bp (from around 200bp at Friday's close and a peak above 220bp).

- The pound has held on to its overnight gains, but is back to prevailing levels before the Chancellor spoke.

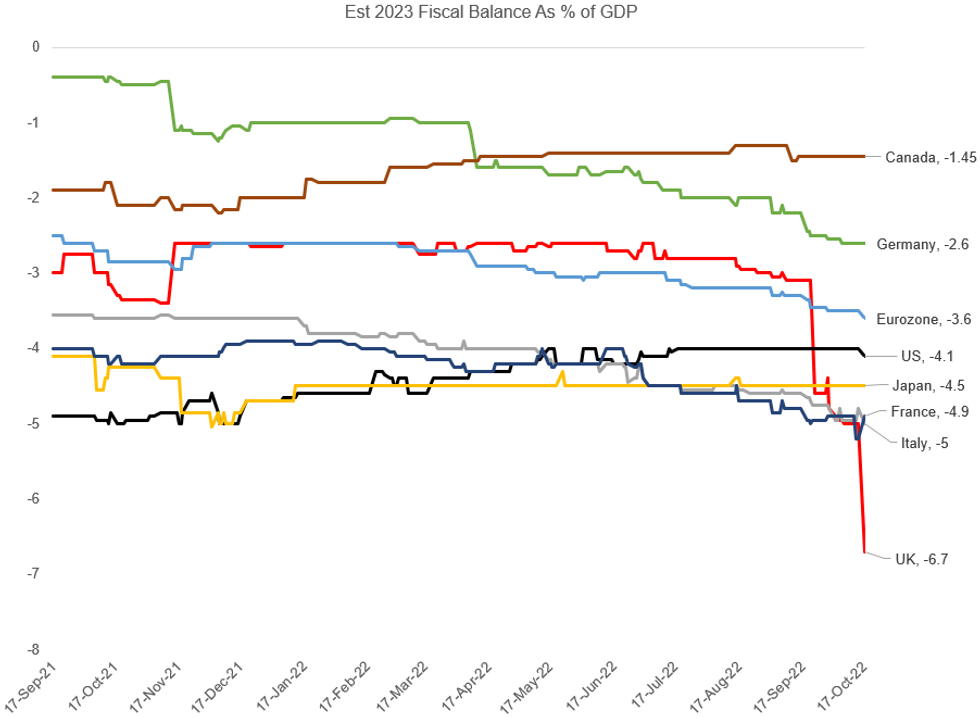

GLOBAL: UK Stands Out On Deficit Outlook (And So Will U-Turn)

As UK Chancellor Hunt unveils on the government's fiscal plans (1100UK), the chart below provides some comparative perspective on the deterioration of the UK's near-term fiscal outlook in the past few weeks.

- Forecasts for 2023 European fiscal balances deteriorated markedly after the Russia-Ukraine war began in February, primarily due to energy subsidies and weaker growth. The UK's fiscal outlook looked less negative than the Eurozone aggregate, with Germany's expected deficit gradually "catching down" with the UK's.

- But since September's mini-budget, the UK's 2023 expected deficit has more than doubled from around 3% of GDP to well above 6%. Italy's is 5% by comparison.

- These forecasts haven't yet caught up with the past week's events. Though the UK's red line is set to "u-turn" over the coming weeks as analysts' surveys adjust, the question is, by how much.

Source: BBG Survey, MNI

Source: BBG Survey, MNI

US EQUITY EARNINGS CALENDAR

- MONDAY: Bank of America.

- TUESDAY: GS, J&J, Netflix.

- WEDNESDAY: Procter & Gamble, IBM, Tesla.

- THURSDAY: AT&T, Blackstone, Philip Morris, Snap.

- FRIDAY: American Express, Verizon.

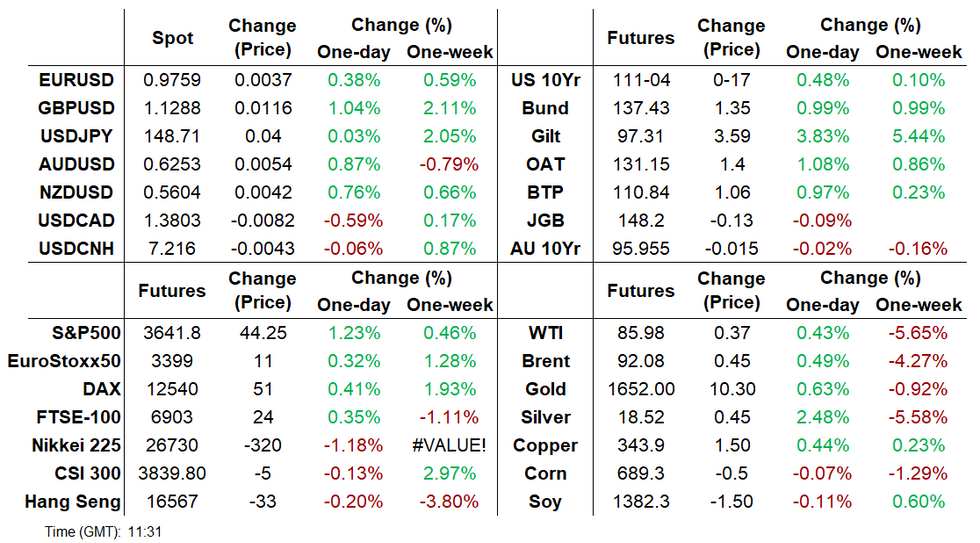

FOREX: ALL EYES on the UK, JPY Under Pressure

- Attention is on the UK today and this week with the UK CPI also release on Wednesday.

- The U-Turn in the mini budget has benefited the Pound - the best performer against the USD in G10.

- ALL EYES are also on the Yen this morning, amid risks of more potential BoJ intervention.

- USDJPY has printed a high of 148.87, a pip above Friday's multi decade high.

- USD is in the red against all G10s, some unwound from the post US Michigan rallies.

- EURUSD trades within ranges this morning, but at the upper end, with Equities underpinned in early trade, in turn USD offered.

- There's 1.07bn option expiry in EURUSD at 0.9750/0.9765 for today.

- Cross assets and FX will be taking their cue from the UK.

- Looking ahead, there's no real notable data releases for the session.

- Speakers include, ECB Lane and Nagel.

FX OPTION EXPIRY

Of note:

EURUSD 1.07bn at 0.9750/0.9765.

EURUSD 1.21bn at 0.9750 (wed).

EURUSD 1.58bn at 0.9800 (thu).

EURSEK ~1bn at 11.00 (thu).

USDJPY 2.94bn at 147.90/148.00 (thu).

EURUSD 1.56bn at 0.9800 (fri).- EURUSD: 0.9700 (392mln), 0.9750 (679mln), 0.9765 (391mln), 0.9800 (349mln).

- USDCAD: 1.3900 (350mln), 1.3905 (535mln).

- AUDUSD: 0.6250 (464mln), 0.6270 (423mln).

- NZDUSD: 0.5730 (363mln).

- USDCNY: 7.20 627mln).

Price Signal Summary - Watch Resistance In Gilts

- In the FI space, the broader bearish theme in {GE} Bund futures remains intact. The focus is on 135.52, the Sep 28 low and key support. This level was probed on Oct 12, a clear break would confirm a resumption of the downtrend and open the 135.00 handle. Resistance is at 138.91, the 20-day EMA.

- Gilt futures remain bearish following the reversal from last week’s high. The focus is on 90.99, Sep 28 low and bear trigger. This level has been pierced, a clear break would open the psychological 90.00 handle. Short-term gains are considered corrective. First resistance to watch is at 98.24, Friday’s high.

- In FX, EURUSD traded to a fresh weekly low last Thursday. Gains are considered corrective and trend remains in a bear mode position. The pair remains inside the bear channel drawn from the Feb 10 high. The focus is on 0.9536, the Sep 28 low.

- GBPUSD is holding on to the bulk of its recent gains. A continuation would signal scope for a test and possible breach of 1.1495, the Oct 5 high and bull trigger. The pair has traded above the 20-day EMA and this has improved short-term conditions for bulls. A resumption of weakness would instead expose 1.0922 and 1.0787, the 50.0% and 61.8% retracement of Sep 26 - Oct 5 bull cycle.

- USDJPY maintains a bullish tone and the path of least resistance is up. Last week's climb resulted in a break of 145.90, Sep 22 high and 147.66, the Aug 1998 high. This has opened 149.22 next, 3.382 projection of the Aug 2 - 8 - 11 price swing.

- In the equity space, a volatile session last Thursday in S&P E-Minis resulted in a strong bounce from the day low as well as the trend low of 3502.00. The recovery suggests the contract has entered a corrective phase and if correct, this will allow an oversold trend condition to unwind. Attention is on 3724.56, the 20-day EMA. A break would reinforce a bullish theme. Key support and the bear trigger lies at 3502.00.

- The EUROSTOXX 50 futures also traded in a volatile manner last Thursday, rebounding sharply from the day low of 3251.00. The focus is on the 50-day EMA at 3473.30 and resistance at 3492.00, the Oct 6 high. Clearance of these two hurdles would highlight a short-term reversal. On the downside, the key support zone to watch is at 3251.00-3236.00, the Oct 13 / 3 lows.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/10/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 17/10/2022 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 17/10/2022 | 1500/1700 |  | EU | ECB Lane at Bocconi Uni & Deutsche Bank Roundtable | |

| 17/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 17/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 17/10/2022 | 2000/1600 |  | CA | BOC Deputy Rogers panel talk at Toronto Centre | |

| 18/10/2022 | 0030/1130 |  | AU | RBA policy meeting minutes | |

| 18/10/2022 | 0800/1000 |  | IT | Trade Balance | |

| 18/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/10/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 18/10/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 18/10/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 18/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/10/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 18/10/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 18/10/2022 | 1600/1800 |  | EU | ECB Schnabel Alumni Event at Uni Mannheim | |

| 18/10/2022 | 1800/1400 |  | US | Atlanta Fed's Raphael Bostic | |

| 18/10/2022 | 2000/1600 | ** |  | US | TICS |

| 18/10/2022 | 2130/1730 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.