-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Greenback Bounce Puts USD Index Back Above 50-dma

Highlights:

- USD bounce puts Index back above 50-dma

- Italian, French inflation poses problems for ECB day after rate decision

- Fed rate path unwinds ECB-inspired drop

US TSYS: Treasuries Cheapen With European Data; ECI & PCE Swing Into Focus

- Cash Tsys have seen a sizeable belly-led retracement of yesterday’s post-ECB rally, starting slowly in Asia hours and then spurred on by a string of European data beats including German GDP and Italian CPI. Focus will shortly turn to a data-heavy docket with an eye on Wednesday’s FOMC decision.

- 2YY +8.7bps at 4.361%, 5YY +9.9bps at 4.16%, 10YY +7.9bps at 3.998%, and 30YY +3.5bps at 4.118%.

- TYZ2 trades 16 ticks lower at 111-06 towards the middle of yesterday’s range on above average volumes. The primary trend remains down, with resistance at yesterday’s high of 111-31 and support seen at 110-16 (Oct 26 low).

- Data: Focus on ECI for Q3 (0830ET), PCE for Sep (0830ET) and final U.Mich for Oct (1000ET), even if yesterday’s Q3 data imply core PCE of 0.42% M/M barring revisions, whilst also see pending home sales for Sep (1000ET).

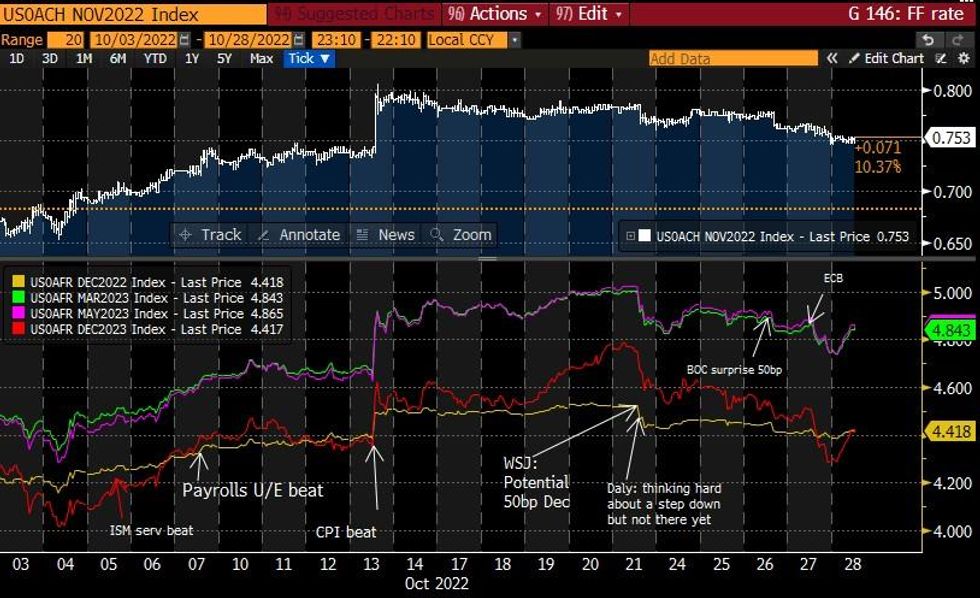

STIR FUTURES: Fed Rate Path Nearly Unwinds ECB Drop

- Fed Funds implied hikes keep to 75bps fully priced for Nov having drifted lower in recent days.

- 133.5bp to 4.42% for Dec’22 and a terminal 4.86% in May’23 sees an unwind of most of yesterday’s post-ECB cooling, potentially in spillover from European data beating.

- Smaller retracement in 2H23 with 4.42% for Dec’23, with the Dec23-Dec22 spread zero from a peak 25bps last week when the Dec’23 peaked at almost 4.8%.

FOMC-dated Fed Funds implied hike (top panel) and rates (bottom panel)Source: Bloomberg

FOMC-dated Fed Funds implied hike (top panel) and rates (bottom panel)Source: Bloomberg

UK-Macron, Sunak To Attempt Bilateral Summit In 2023

Elysee Palace publishing readout of the first call between President Emmanuel Macron and new UK PM Rishi Sunak. States that the two discussed the situation in Ukraine as well as energy supplies/security. Elysee states that Macron 'told Sunak of his willingness to deepen bilateral ties between France and the UK, especially in areas such as defence and energy.'

- The two agreed to try to hold a bilateral summit in 2023. The last bilateral summit took place in Sandhurst, England in 2018, with Macron meeting then-PM Theresa May.

- States that Macron and Sunak discussed climate change and the upcoming COP27 summit in Egypt (which PM Sunak has announced he will not be attending).

- Downing St. spox states that in the call, PM Sunak 'stressed the importance he places on the UK's relationship with France, a neighbour and ally'.

- Politically important for Sunak to seek good relations w/Macron. Major issue domestically are small boat crossings on the English Channel. If the large numbers crossing can be stemmed it would provide notable boost to Sunak gov't, French cooperation essential on the matter.

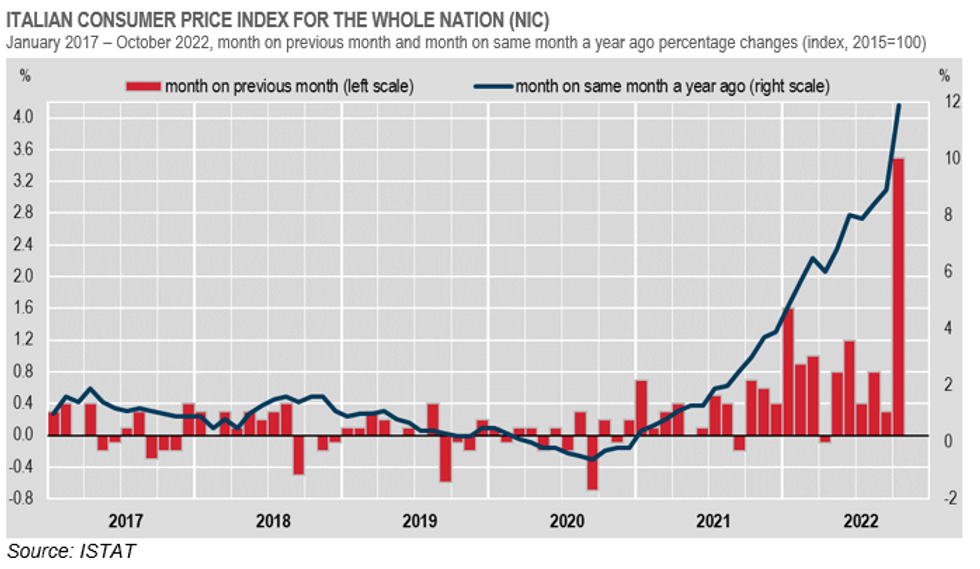

ITALY: October CPI Surges; Eurozone CPI Likely Steady Around 10%

ITALY OCT FLASH HICP +4.0% M/M, +12.8% Y/Y; SEP +1.6%r M/M, SEP +9.4% Y/Y

- Italian headline inflation surged by 4.0% m/m to a fresh euro-era record of +12.8% y/y, massively outpacing expectations of a more modest +1.4% m/m uptick and 0.5pp acceleration to +9.9% y/y.

- A monster jump in energy prices to +73.2% y/y ( from 44.5% in Sep) alongside an acceleration in food prices to to +13.1% (from +11.4% in Sep) drove the jump in the October print.

- The only slowing was seen on the recreational services front, which will largely reflect slowing tourism demand as the cost of living reduces spending.

- Core inflation remains a fraction of headline CPI, up 0.3pp at +5.3% y/y in October. Of concern here is the jump in good to +17.9% y/y (from +12.5% in Sep), implying that persistently high energy costs are feeding into broad-based inflation.

- This data alongside upside surprise in French CPI and the German state CPIs are more in line with the aggregate print holding steady around the +10% mark (versus earlier expectations of +9.5%).

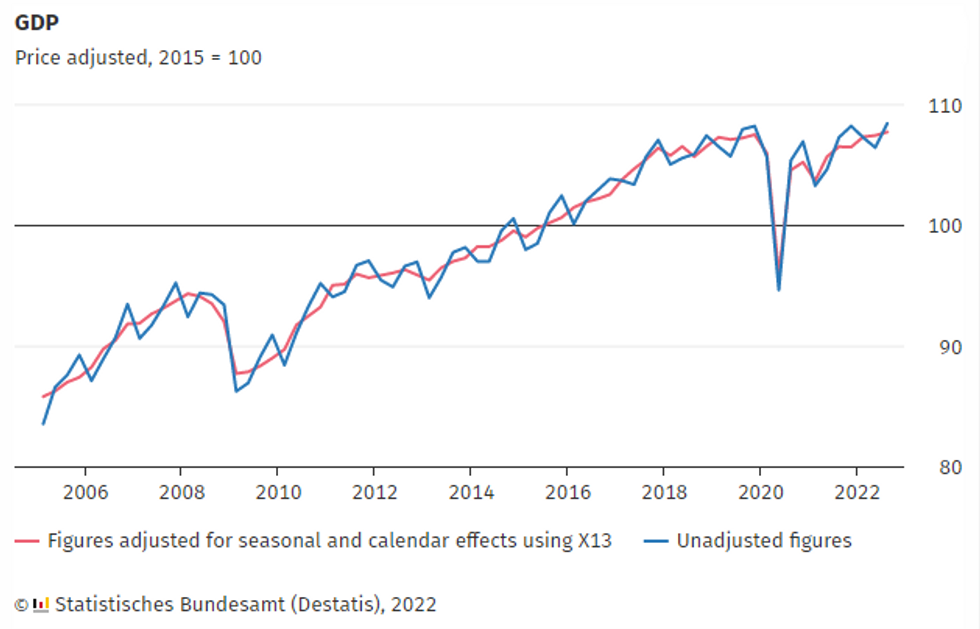

GERMANY: Upside GDP Surprise Wards Off Recession - For Now

GERMANY Q3 FLASH GDP +0.3% Q/Q (FCST -0.2%); Q2 +0.1% Q/Q

GERMANY Q3 FLASH GDP WDA +1.2% Y/Y (FCST +0.7%); Q2 +1.7% Y/Y

- German GDP surprised to the upside in the Q3 flash estimate, advancing by +0.3% q/q, a 0.2pp uptick on Q2 growth and beating expectations of a -0.2% q/q contraction. Annualised GDP was also stronger than anticipated at +1.2 % y/y.

- Private consumption was the driver of Q3 growth.

- In comparison to pre-pandemic Q4 2019, price and calendar-adjusted GDP exceeded pre-pandemic levels (by +0.2%).

- This data signals that the German economy is more robust than anticipated, following consumer demand surveys, IFO and ZEW surveys signalling the onset of a recession.

- The marked upside surprise to German GDP will outpace the marginal downside surprise in the Spanish data this morning. This could see EZ GDP stabilise at a flat reading (currently consensus is looking for -0.1% q/q).

- German CPI is due at 1300 BST following this monring's slew of state data, with another uptick likely to weigh on growth headed into Q4.

FOREX: EUR Holds Up Well as Kazimir Sees 'Runaway Train' on Rates

- ECB speak has picked up following yesterday's decision, with hawks among the governing council still clearly in control as inflation marches higher. ECB's Kazimir stated that the bank would cross the neutral rate like a "runaway train". This has helped EUR hold toward the upper end of the G10 table so far Friday, second to only the USD.

- The USD Index is testing the 50-dma resistance, extending the bounce off yesterday's lows to over 1.25%. 111.135 marks the next upside level for the USD Index ahead of Fib resistance of 111.5378.

- The Bank of Japan rate decision came and went with little surprise, with governor Kuroda doubling down on policy by stating that markets should not expect rate hikes or an exit from easy policy anytime soon. The JPY is falling against most others, helping put USD/JPY back above Y147.50.

- The latest leg higher in the pair followed an operational update from the BoJ - who made the first mid-quarter tweak to their bond purchase plan for the first time and boosted the frequency of super-long JGB purchases next month.

- Focus turns to the prelim German CPI read for October, with markets expecting prices to have risen 0.6% on the month and 10.1% on the year. In the US, personal income/spending data takes focus - both of which seen rising 0.4%. Final UMich data also crosses.

FX OPTIONS: Expiries for Oct28 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9800(E892mln), $0.9900(E551mln), $0.9975(E632mln), $1.0000(E1.6bln), $1.0100(E758mln), $1.0200(E912mln)

- USD/JPY: Y147.00($505mln)

- EUR/JPY: Y146.50(E1.0bln)

- GBP/USD: $1.1000(Gbp1.3bln), $1.1210(Gbp758mln)

- USD/CAD: C$1.3690-05($550mln)

- USD/CNY: Cny7.00($4.0bln)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/10/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/10/2022 | - | *** |  | JP | BOJ policy announcement |

| 28/10/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 28/10/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 28/10/2022 | 1230/0830 | ** |  | US | Employment Cost Index |

| 28/10/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 28/10/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 28/10/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.