-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: 25Bp Cut Still Expected From FOMC Wednesday

MNI ASIA MARKETS ANALYSIS: Ylds Climb to 3W Highs Ahead FOMC

MNI US MARKETS ANALYSIS - Hot German CPIs Raise Inflation Concerns in Core Europe

Highlights:

- Hot German regional CPIs raise inflation concerns in core Europe

- MNI US Chicago Business Barometer tops schedule, alongside Fedspeak

- Swiss industry again raises concern over strong domestic currency

US TSYS: Regional German CPIs Weigh, Important Docket Ahead

- Cash Tsy yields sit 3-5bp higher on the day and with only the very long end lagging the move, buoyed by regional German CPI readings posing upside risk to the national core print later today.

- TYM4 at 110-03 (-08) has lifted off the day’s lows of 110-01 with elevated volumes of 385k. The trend needle points south with support at 109-25+ (Feb 23 low).

- There’s a heavy docket today, with data including PCE inflation for January, continuing jobless claims for a payrolls reference period for next week’s report and manufacturing surveys including the MNI Chicago PMI after every main mfg survey for February has surprised higher.

- Data: PCE/Incomes Jan (0830ET), Weekly jobless claims (0830ET), MNI Chicago PMI Feb (0945ET), Pending home sales Jan (1000ET), KC Fed mfg Feb (1100ET)

- Fedspeak: Bostic fireside chat (1050ET), Goolsbee on mon pol (1100ET), Mester on financial stability (1315ET), Mester on Yahoo Finance (1530ET), Williams in moderated discussion (2010ET).

- Bill issuance: US Tsy $95B 4W, $90B 8W bill auctions (1130ET)

STIR: Fed Rate Path Lifts On Hotter German Regional CPI

- Fed Funds implied rates have pushed higher overnight after regional German CPI readings pose upside to the national core print.

- Implied rates unwind most if not all of yesterday’s decline but keep to recent ranges. Cumulative cuts: 0.5bp Mar, 4.5bp May, 17.5bp Jun, 31bp Jul and 78bp Dec – see table.

- Yesterday’s Fedspeak saw Williams (voter) view three cuts in 2024 as a “reasonable starting point” with cuts not needing to tie in with quarterly Fed forecasts, whilst Bostic (’24) reiterated seeing a first cut in the summer and Collins (’25) needs "greater clarity" of sustained 2% inflation.

- Ahead, Bostic (’24) returns after those limited remarks yesterday (this time livestreamed), before Goolsbee (’25), two appearances from Mester (’24 retiring June) and Williams (voter) again late on at 2010ET in a moderated discussion.

- Goolsbee last spoke Feb 14 – inflation can be a bit higher and still on track to 2%, don’t believe last mile of inflation fight the hardest, housing still biggest piece of inflation puzzle.

- Mester last spoke Feb 6 – don’t feel any need to rush rate cuts (or to act only at meetings with forecasts), prudent to wait for more data to confirm trends and open to possibility that neutral rate has risen. She also saw no urgency to slow the pace of QT.

OI Goes Against Talk Of Credit Stress Worry Following SFRZ3 Flows

The combination of yesterday’s move higher in SOFR futures and preliminary OI data points to the following net positioning swings on Wednesday:

- Net long setting in SFRZ3 resulted in a net long setting bias for the white pack, even with the rest of the whites seemingly seeing net short cover.

- Late SFRZ3 flow generated most of the interest Wednesday, with ~240K lots trading across several clips and prices quickly readjusting to pre-flow levels after selling briefly pushed the contract 1bp lower.

- Some pointed to worry re: funding stress surrounding month-end as a driver of the flow, although it was difficult to get any specific colour, outside of speculation re: CRE problems.

- OI pointing to net longs being set in the contract suggests that the initial selling may have reflected cover of an existing long position, as opposed to a fresh sign of potential funding stress.

- Still, the flow was large and represented ~21bp of OI (marked vs. Tuesday's OI).

- It was even more notable given the stage in the expiry cycle.

- In general month-end matters we note that most repo desks seem fairly calm owing to current cash levels, which they believe should comfortably absorb Treasury auction settlement and any month-end related demand.

- The reds and greens saw a bias towards net short cover, while the blues saw net longs set in pack terms.

| 28-Feb-24 | 27-Feb-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRZ3 | 1,216,415 | 1,122,141 | +94,274 | Whites | +66,716 |

| SFRH4 | 1,105,914 | 1,121,403 | -15,489 | Reds | -7,322 |

| SFRM4 | 1,089,412 | 1,096,378 | -6,966 | Greens | -16,921 |

| SFRU4 | 859,676 | 864,779 | -5,103 | Blues | +3,304 |

| SFRZ4 | 1,124,750 | 1,134,562 | -9,812 | ||

| SFRH5 | 679,879 | 673,400 | +6,479 | ||

| SFRM5 | 716,107 | 720,574 | -4,467 | ||

| SFRU5 | 651,413 | 650,935 | +478 | ||

| SFRZ5 | 728,774 | 739,676 | -10,902 | ||

| SFRH6 | 497,787 | 502,660 | -4,873 | ||

| SFRM6 | 485,836 | 487,842 | -2,006 | ||

| SFRU6 | 338,007 | 337,147 | +860 | ||

| SFRZ6 | 307,727 | 304,375 | +3,352 | ||

| SFRH7 | 188,812 | 186,721 | +2,091 | ||

| SFRM7 | 178,507 | 177,812 | +695 | ||

| SFRU7 | 149,629 | 152,463 | -2,834 |

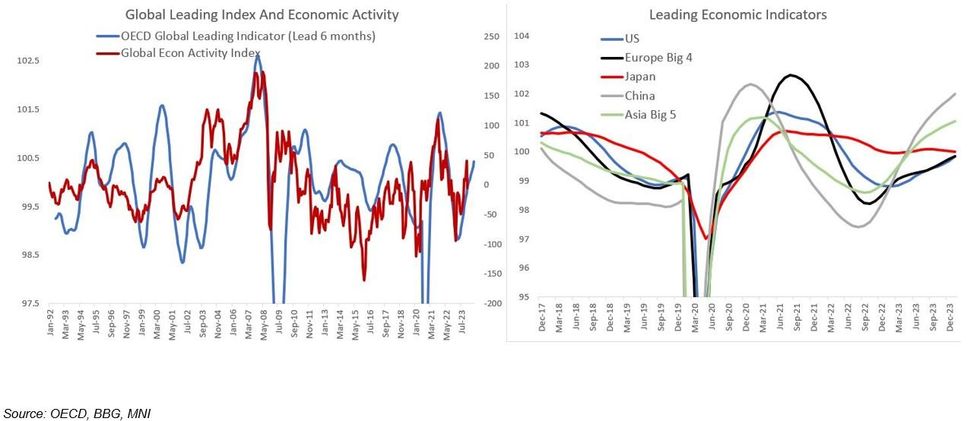

MNI Global Macro Outlook-Feb 2024: Surprisingly Strong Start

MNI's February 2024 Global Macro Outlook meeting surveyed the stronger-than-expected economic start to the year. Our chart pack (emailed to clients, in PDF here) looks at developments from multiple angles.

- The soft/no landing narrative is in full swing as growth prospects have improved despite significant central bank tightening

- The upturn in global growth prospects has come surprisingly early and been surprisingly broad-based.

- The global labour market is not loosening as quickly as expected, with implications for both activity and price pressures

- Services disinflation progress has stalled

- Core goods price deflation appears to be bottoming out (not helped by Red Sea shipping blockage)

- Financial conditions have loosened since the beginning of December and risk is “on”

- Bottom line: expectations that ECB / Fed etc would cut as soon as Q1 have been unfounded and have gotten priced out

- To watch in month ahead: hiking (?) Asia-Pac central banks, Euro inflation, US data and Fed messaging

Industry Calls Against CHF Strength Pressure Case for SNB Cuts

- Earlier Reuters headlines from a Swiss Industry Group stemming from trade association Swissmem, which represent engineering and tech-linked companies. The reference to the Swiss Franc is more specific – the Swissmem President cites a “precarious” situation and sees the CHF overvalued by 5% against the EUR in PPP terms. On the potential for further CHF strength, he warns that could “exacerbate the downward spiral”.

- The risks of a strong currency are known at the SNB, in January, Jordan recognised that “In the last couple of weeks of last year, we saw real appreciation. That makes the situation for some of our firms more difficult.”

- This fresh call against CHF strength keeps pressure on the bank (EUR/CHF is higher by ~1.2% since Jordan’s initial comments) and argues further in favour easier SNB policy this year. The March 21st decision is considered live – with Swiss money markets pricing a decent chance of the first rate cut in Q1. Mar’24 SARON futures price a better-than-even chance of a rate cut next month, but markets have further to go before this outcome is fully priced.

FOREX: JPY on Top as Takata Signals Growing Confidence in Price Targets

- JPY sits on top in currency markets, with USD/JPY touching a pullback low of Y149.61 in early London trade. Tokyo hours saw the JPY rally on the back of some hawkish comments from BoJ's Takata, who pointed to the Bank's inflation target being within sight. Nonetheless, we still see the trend outlook remaining bullish and today's sell-off - for now - appears to be a correction.

- Yields across core EGBs as well as US Treasuries have stepped higher, with the 10y yield cresting above 4.31% on the back of a stubborn set of regional German inflation numbers. The releases suggest upside risks for the national print later today, spelling issues for the ECB's policy plans this year - typified by comments from ECB's Holzmann, who stated that serious ECB rate cut discussions are unlikely before June.

- NOK and NZD are the poorest performers as commodity-tied currencies remain very modestly softer - while EUR and USD are flat-to-higher, but second to JPY in European trade.

- A busy US data session is set to follow, with the MNI Chicago Business Barometer the highlight - seen improving to 48.0 from 46.0 previously. Weekly US jobless claims data is also due, on top of personal income/spending and the latest PCE deflators. Fedspeak picks up, with Bostic, Goolsbee and Mester headlining.

EQUITIES: Bullish Trend Condition in Eurostoxx 50 Futures Remains Firmly Intact

- A bull cycle in Eurostoxx 50 futures remains firmly intact and the contract has traded higher this week. Moving average studies remain in a bull-mode position too, highlighting positive market sentiment. Sights are on 4904.40 next, a Fibonacci projection. Further out, scope is seen for a climb towards a bull channel top at 4981.90. The channel is drawn from the Oct 27 low. Initial firm support lies at 4774.50, the 20-day EMA.

- The trend condition in S&P E-Minis remains bullish and the contract continues to trade closer to its recent highs. The latest move higher again highlights the fact that corrections remain shallow - a bullish signal. Support to watch is 5016.21, the 20-day EMA. A clear break of this average would signal potential for a deeper retracement towards 4936.50, the Feb 13 low. A resumption of gains would open vol-band based resistance at 5153.29.

COMMODITIES: WTI Futures Briefly Pierce Key Resistance at $79.09 Wednesday

- WTI futures traded higher Wednesday and in the process, the contract has delivered a print above key resistance at $79.09, the Jan 29 high. This threatens the recent bearish theme and instead highlights potential for a continuation higher near-term, towards $81.70, a Fibonacci retracement. On the downside, support to watch is at $75.80, the 50-day EMA. A break would instead signal a possible top.

- Gold is unchanged and remains in consolidation mode. Recent activity has defined a key resistance at $2065.5, Feb 1 high, and a key support at $1984.3, Feb 14 low. Both levels represent important short-term directional triggers. A clear break of the Feb 1 high would highlight a short-term reversal and open $2088.5, the Dec 28 high. For bears, clearance of $1984.3 would expose an important support and bear trigger at $1973.2, the Dec 13 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/02/2024 | 1300/1400 | *** |  | DE | HICP (p) |

| 29/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 29/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 29/02/2024 | 1330/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 29/02/2024 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/02/2024 | 1330/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 29/02/2024 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 29/02/2024 | 1445/0945 | *** |  | US | MNI Chicago PMI |

| 29/02/2024 | 1500/1000 | ** |  | US | NAR Pending Home Sales |

| 29/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 29/02/2024 | 1550/1050 |  | US | Atlanta Fed's Raphael Bostic | |

| 29/02/2024 | 1600/1100 |  | US | Chicago Fed's Austan Goolsbee | |

| 29/02/2024 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 29/02/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 29/02/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 29/02/2024 | 1815/1315 |  | US | Cleveland Fed's Loretta Mester | |

| 01/03/2024 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 2330/0830 | * |  | JP | labor forcer survey |

| 01/03/2024 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 29/02/2024 | 0110/2010 |  | US | New York Fed's John Williams | |

| 01/03/2024 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 01/03/2024 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 01/03/2024 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/03/2024 | 0730/0830 | ** |  | CH | Retail Sales |

| 01/03/2024 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/03/2024 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/03/2024 | 1000/1100 | *** |  | EU | HICP (p) |

| 01/03/2024 | 1000/1100 | ** |  | EU | Unemployment |

| 01/03/2024 | 1000/1100 | *** |  | IT | HICP (p) |

| 01/03/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/03/2024 | 1400/1400 |  | UK | BOE's Pill Speech at Cardiff University | |

| 01/03/2024 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/03/2024 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/03/2024 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 01/03/2024 | 1500/1000 | * |  | US | Construction Spending |

| 01/03/2024 | 1515/1015 |  | US | Fed Governor Chris Waller | |

| 01/03/2024 | 1515/1015 |  | US | Dallas Fed's Lorie Logan | |

| 01/03/2024 | 1715/1215 |  | US | Atlanta Fed's Raphael Bostic | |

| 01/03/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 01/03/2024 | 1830/1330 |  | US | San Francisco Fed's Mary Daly | |

| 01/03/2024 | 2030/1530 |  | US | Fed Governor Adriana Kugler |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.