-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Kiwi Craters as NZ Re-Enters Lockdown

HIGHLIGHTS:

- Kiwi craters as RBNZ rate hike called into question over lockdown

- Risk-off pervades, with Wall Street indicated to open lower

- Retail sales, industrial production on the docket, with a Powell appearance later

US TSYS SUMMARY: 10Y Outperforming As Risk-Off Themes Resume

Treasuries have strengthened overnight Tuesday, with 10Y yields touching the lowest levels in 8 sessions (1.215%) as equities retraced.

- The 2-Yr yield is down 1bps at 0.1993%, 5-Yr is down 3.2bps at 0.7296%, 10-Yr is down 3.8bps at 1.2267%, and 30-Yr is down 3.1bps at 1.8965%. Sep 10-Yr futures (TY) up 6.5/32 at 134-17 (L: 134-06.5 / H: 134-19.5).

- Similar risk-off themes to Monday have brought S&P futures off highs and the USD a little stronger: COVID concerns (New Zealand lockdown in focus) and Afghanistan uncertainty.

- Fed Chair Powell hosts a town hall event with educators at 1330ET (with text), and will take questions. Given the nature of the event it's doubtful there will be much market impact, but one never knows. Also, Minn Fed's Kashkari speaks at 1545ET.

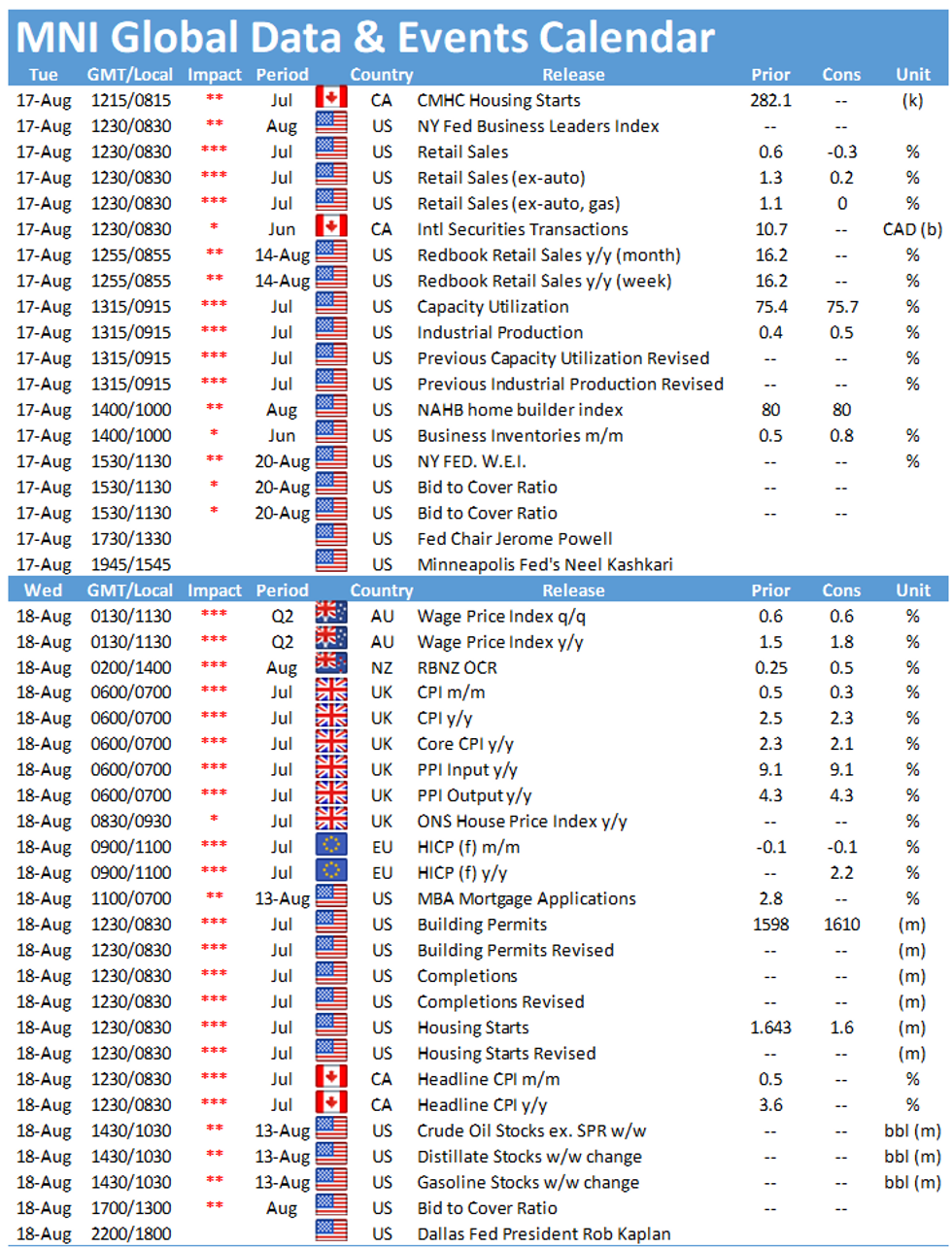

- AdvanceJul retail sales feature at 0830ET (seen contracting on a M/M basis on both headline and ex-auto+gas). July industrial production is out at 0915ET, with business inventories at 1000ET alongside NAHB house prices.

- In supply: $70B of 42-/57-day bill auctions at 1130ET. NY Fed buys ~$1.225B of 7.5-30Y TIPS.

EGB/GILT SUMMARY: Global Factors Driving Higher

Covid cases (particularly the lockdown in New Zealand) and geopolitical events in Afghanistan are weighing on sentiment in Europe today. Bunds and gilts are both above yesterday's highs.

- Peripheral spreads have widened, with BTP and Spanish 10-year spreads around 1.0bp wider on the day.

- We have seen GBP2.0bln of the 25-year 0.875% Jan-46 gilt sold in a strong auction and also the strongest Schatz auction for over three months with the launch of the 0% Sep-23 Schatz for E6bln.

- We have already received UK labour market data which had something for everyone, and was largely in line with expectations while the second print of Eurozone GDP was in line with the first.

- Bund futures are up 0.28 today at 177.08 with 10y Bund yields down -2.1bp at -0.491% and Schatz yields down -0.5bp at -0.748%.

- Gilt futures are up 0.36 today at 130.16 with 10y yields down -4.0bp at 0.533% and 2y yields down -2.1bp at 0.116%.

- BTP futures are up 0.08 today at 155.15 with 10y yields down -1.1bp at 0.553% and 2y yields down -0.3bp at -0.496%.

- OAT futures are up 0.19 today at 162.54 with 10y yields down -2.0bp at -0.144% and 2y yields down -0.5bp at -0.714%.

EUROPE ISSUANCE UPDATE: German, UK Bond Sales

Germany allots E4.809bln 0% Sep-23 Schatz, Avg yield -0.75% (Prev. -0.67%), Bid-to-cover 1.09x (Prev. 0.95x), Buba cover 1.35x (Prev. 1.18x)

UK DMO sells GBP2.0bln of 0.875% Jan-46 Gilt, Avg yield 0.940% (Prev. 1.359%), Bid-to-cover 2.38x (Prev. 2.40x), Tail 0.2bps (Prev. 0.2bps)

EUROPE OPTIONS SUMMARY

Eurozone:

RXV1 171.00 put / 177.00 call strangle sold at 21.5 in 2k

0RU1 100.50 straddle bought for 2.5 in (just under) 5k

NZD: Bearish Onslaught

- The NZD has traded sharply lower today with NZD/USD slipping at the fastest rate since March to put the pair in close proximity to the late July lows of 0.6902 and the Jul 20 low of 0.6881.

- From a technical viewpoint, trend conditions are bearish and today's move lower suggests further weakness is likely near-term.

- A break of 0.6881 would confirm a resumption of a bearish cycle that started late February.

- Key NZDUSD levels to watch are:

- SUP 1: 0.6798 Sep 18, 2020 high

- SUP 2: 0.6703 38.2% of the Mar '20 - Feb bull run

- RES 1: 0.7028 Today's intraday high

- RES 2: 0.7105 High Jul 6 and the short-term key resistance

- GBPNZD has traded sharply higher today too and is approaching the psychological 2.00 handle and the bull trigger at 2.0069, Jul 28 low. If topped, the cross would trade at the highest levels since August 2020, with 2.0272 the next upside level, Aug 20, 2020 high.

- Today's sharp rally in AUDNZD means key support at 1.0418, Dec 1, 2020 low remains intact. The cross is challenging the 20-day EMA at 1.0527, a clear break would open the 50-day EMA at 1.0608.

FOREX: NZD Sold at Fastest Pace Since March as Ardern Cracks Down

- NZD has slipped aggressively against all others, with markets swiftly paring rate hike expectations as New Zealand re-enters lockdown.

- The NZ authorities have detected the first case of community-transmitted COVID-19, prompting a 3-day nationwide lockdown (and a 7-day lockdown in Auckland and surrounding areas), a move that's prompted a number of sell-side analysts to revise their calls for a 25bps rate hike from the RBNZ this week.

- NZD/USD fell at the fastest rate since March to put the pair in close proximity to the late July lows of 0.6902, sitting ahead of the key support and bear trigger at 0.6881.

- GBP/NZD has also narrowed in on some key levels, with the psychological 2.00 handle in view as well as the bull trigger at 2.0069 (late July high). If topped, the cross would trade at the highest levels since August 2020, with 2.0272 the next upside level.

- AUD is lower in sympathy, while haven currencies including JPY, CHF and USD are firmer.

- Advance US retail sales and industrial production are the data highlights, while Fed's Kashkari speak on the economy. Powell is scheduled to appear at an event with educators, but it's unclear whether he'll comment on policy.

FX OPTIONS: Expiries for Aug17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1775(E556mln), $1.1815-25(E1.6bln), $1.1850-55(E900mln)

- USD/JPY: Y109.05-10($586mln), Y110.00($723mln)

- GBP/USD: $1.3810-25(Gbp535mln)

- AUD/USD: $0.7200(A$800mln), $0.7325-30(A$1.1bln), $0.7450(A$546mln)

- NZD/USD: $0.7050(N$597mln), $0.7080(N$593mln)

- USD/CNY: Cny6.4900($1.1bln)

Price Signal Summary - Gold Continues To Climb

- In the FX space, EURUSD remains below the 20-day EMA. Initial short-term resistance is at Friday's high of 1.1805. Recent gains are considered corrective and the outlook remains bearish. USDJPY has found support but remains vulnerable. Attention is on the key support at 108.72, the Aug 4 low. Key resistance is at 110.80, Aug 11 high. EURJPY has probed 128.60, the Jul 20 low. A clear break of this level would confirm a resumption of the current downtrend and signal scope for weakness towards 128.29, Mar 24 low and 127.88, 38.2% retracement of the Oct '20 - Jun rally

- On the commodity front, Gold continues to climb and is approaching its next firm resistance at $1798.7, the 50-day EMA. WTI futures key support lies at $65.01, Jul 20 low. This level represents a key pivot point.

- On the equity front, S&P E-minis outlook remains bullish as evidence of dip buying continues to deliver fresh all-time highs. The focus is on 4481.75, 1.00 projection of the Jun 21 - Jul 14 - 19 price swing. EUROSTOXX 50 futures are lower this morning but remain in a clear uptrend. The focus is on the 4262.07 2.0% 10-dma envelope. First support is at 4409.45, the 20-day EMA

- In FI, support to watch in Bunds is at 176.21, the Aug 11 low. Trend conditions remain bullish. Gilt futures outlook is bullish too and attention is on 130.72, Aug 4 high and the bull trigger. The support to watch is 129.10, Jul 22 low.

EQUITIES: Stocks on Backfoot as New Zealand Lockdown Unsettles Risk Sentiment

- Equity futures across the US are lower, signalling a negative open on Wall Street later today. The imposition of a swift nationwide lockdown in New Zealand has unsettled risk sentiment, with a sharp pullback in both NZD and AUD adding further weight.

- Across Europe, only the FTSE-100 holds in positive territory, with continental indices lower by 0.3-0.9%. Peripheral markets underperform, with Italian and Spanish equities off 0.7-0.9%.

- Europe's financials and real estate sectors are on the decline, with modest strength in materials and tech names not enough to counter.

COMMODITIES: Energy Products Softer, But Above Week's Lows

- Both WTI and Brent crude futures sit in negative territory ahead of the Tuesday open, but both benchmarks continue to hold above the week's lows printed yesterday.

- Yesterday's clarification from OPEC+ that they would not meet US calls for increased output appear to have underpinned a floor in markets, making $65.15 and $65.73 as key supports going forward.

- US advance retail sales data as well as industrial production takes focus going forward, with markets also watching the post-market release of the API inventories data.

- Gold continues to climb and is approaching its next firm resistance at $1798.7, the 50-day EMA. This contrasts with the technical outlook for silver, after the confirmation of a death cross in the DMA space highlighted the current bearish theme. Recent price action since Aug 9, has also taken on the appearance of a bear flag.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.