-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

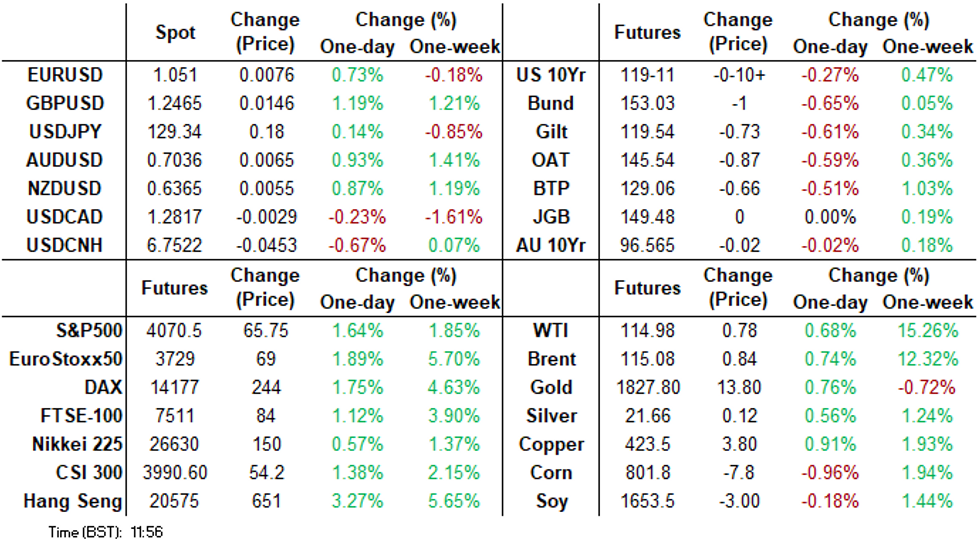

Free AccessMNI US MARKETS ANALYSIS: Markets looking for more hikes

Highlights:

- UK labour market data posts record single month earnings print (driven by bonuses).

- ECB's Knot says hikes of more than 25bp may be possible.

- Expectations of BOE and ECB hikes increase, with core fixed income moving lower.

- USD sells off, initially on the expectations of a Chinese reopening, and then helped by the hawkish CB comments.

US TSYS: Risk-On Led Bear Flattening With Solid Docket Ahead

- Cash Tsys see a decent bear flattening on risk-on sentiment spurred overnight by rescinding Chinese covid concerns and an easing of restrictions in Hong Kong, with the move receiving a further boost as the US comes in.

- 2YY +5.2bps at 2.622%, 5YY +4.3bps at 2.869%, 10YY +2.9bps at 2.911% and 30YY +1.6bps at 3.114%. 2Y yields remain 23bps below cycle highs of 2.85%.

- TYM2 trades 10 ticks lower at 119-11+ after another overnight session of below average volumes. It sits within yesterday’s range and doesn’t trouble technicals with support at 118-03+ (May 11 low) or resistance at 120-01 (Apr 28 high).

- Fedspeak: Bullard (’22 voter) at 0800ET, Harker (’23) at 0915ET, Kashkari (’23) at 1230ET, Powell (chair) at 1400ET, Mester (’22) at 1430ET and Evans (’23) late at 1845ET.

- Data: Retail sales at 0830ET, IP and Cap Util at 0915ET and NAHB housing market index & business inventories at 1000ET.

- Bill issuance: US Tsy $34B 52W bill auction (1130ET)

STIR FUTURES: Fed Hikes Boosted With Risk-On, Powell Later

- Fed Funds implied hikes have increased back to recent highs barring the snap reaction to the CPI beat, amidst broad risk-on helped by rescinding Chinese covid concerns and along with a firming of ECB hike pricing more lately.

- Currently pricing 54bp for June, 104bp for July, 143bp for Sep and 193bp to year-end.

- Powell’s WSJ interview at 1400ET (no text) headlines a heavy schedule of six speakers, three of whom vote this year.

- It follows last week’s Marketplace interview on consideration of larger than 50bp hikes: “I would just say, we have a series of expectations about the economy. If things come in better than we expect, then we’re prepared to do less [compared to 50bp hikes at next two meetings deemed appropriate]. If they come in worse than when we expect, then we’re prepared to do more.”

Source: Bloomberg

Source: Bloomberg

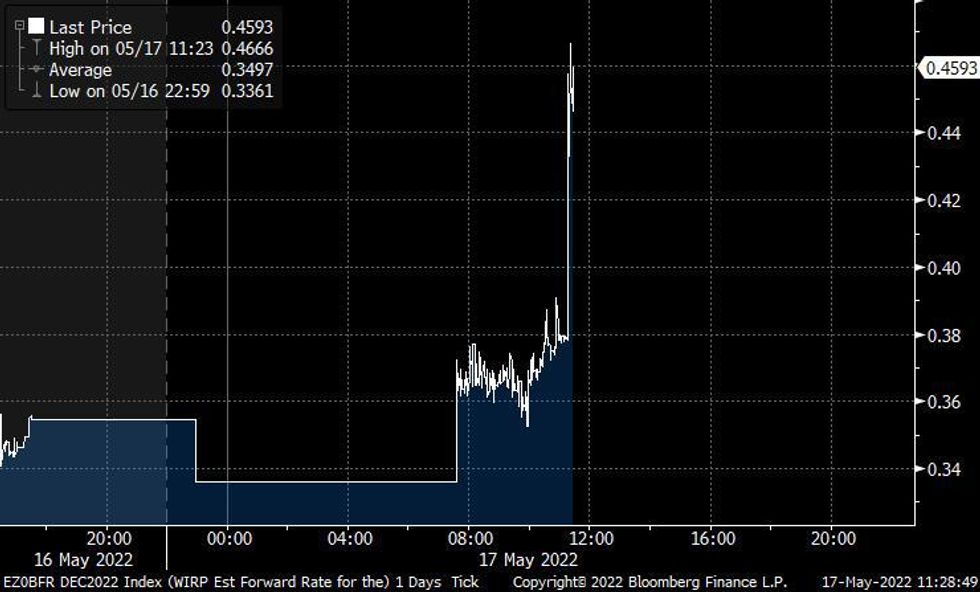

ECB: 2022 Hike Pricing Shoots Higher As Knot Open To 50bp In July

ECB's Knot comments that a 25bp July rate hike "seems realistic" but that "a bigger increase must not be excluded either" if incoming data suggests inflation is "broadening further or accumulating" (as reported by Reuters). He suggests "In that case a logical next step would amount (to) half a percentage point."

- ECB implied Dec meeting rate shot higher by ~8bp, from 0.38% to 0.46% (see chart). Settling down a little now but implies a little over 100bp of 2022 hikes. For July's meeting, pricing moved up 4bp to -0.30%, suggesting more than a quarter-point hike in July.

- EURUSD pushed above 1.05; resistance is at 1.0583, the 20-day EMA.

Source: BBG

Source: BBG

EGB/Gilt: Hawkish CB Speak Fuels Sell-Off

European government bonds have sold off sharply this morning with UK leading the charge following hawkish comments yesterday from BoE Governor Andrew Bailey and very strong labour market data.

- Speaking to the House of Commons Treasury select committee, the BoE's bailey stated “To forecast 10 per cent inflation and to say there isn’t a lot we can do about it is an extremely difficult place to be . . . This is a bad situation to be in", in addition to warning about the risk of an 'apocalyptic' rise in food prices.

- Gilts opened lower and have remained under pressure. Cash yields are now up 4-15bp with the curve bear flattening.

- Adding to the hawkish narrative on monetary policy, the ECB's Klaas Knot this morning stated that normalising monetary policy was 'the only option' and that a larger than 25bp hike could be justified by the data, stating specifically the potential for "half a percentage point".

- Bunds have sold off across the curve with cash yields pushing up 5-9bp.

- The OAT curve has bear flattened with the 2s30s spread narrowing 3bp.

- BTPs trade broadly in line with core EGBs with yields up 7-10bp on the day.

- Supply this morning came from the UK (Gilt, GBP1.75bn), Germany (Schatz, EUR4.115bn allotted), Finland (RFGB, EUR996mn) and the ESM (Bills, EUR1.007bn)

EUROPE ISSUANCE UPDATE

UK sells:

- GBP1.75bln 1.25% Jul-51 gilt, Avg yield 2.040% (prev 1.580%), bid-to-cover 2.91 (prev 2.31x).

Germany sells:

- E6.0bln (E4.115bln allotted) new 0.20% Jun-24 Schatz, avg yield 0.29% (prev 0.16%), bid-to-cover 0.71x (prev 1.26x).

- E996mln 0.50% Apr-43 RFGB, avg yield 1.744% (prev 0.528%), bid-to-cover 1.51x.

EUROPE OPTION FLOW SUMMARY

Eurozone

- RXM2 155c, sold at 15 and 14.5 in 1.7k

- RXN2 150.5/149/148p fly sold vs RXN2 152/151/150.5p fly bought, net trade 2 in 2k

- OEM2 127.50/127.75cs vs 127/126.75ps, sold the cs at 4.5 in 3k

Euribors

- 0RM2 98.37/98.87^^, sold down to 12.5 in 4k0RM2 98.62/98.25/98.12 broken p fly, bought for 8 in 5k

- ERH3 99.12/99.37/99.75 broken c ladder, bought for 3.25 in 2.5k

SONIA

- SFIU2 98.30/98.45/98.60c fly, bought for 2 and 2.25 in 20k.

FOREX: Risk On lead FX

- Story of the European morning session had been the risk-on tone driving the USD lower across the board.

- Although the Dollar still holds small gains vs the Yen.

- The JPY has been under pressure again, led by risk.

- Most notable moves had been in the pound, following the labour market data beat.

- Recent comments from ECB's Knot that a bigger increase than 25bp cannot be excluded has seen EURUSD rise 90 pips at writing to 1.0525.

- Cable has gained over 1.2% and heading towards 1.2500, with next resistance seen at 1.2512 High May 9.

- GBPJPY is up 1.35%, and next upside target is seen at 162.01, the 50% short term retrace of the April/May fall.

- EURGBP broken through the 0.8415 50-day EMA, but has retraced higher following Knot's comments.

- Best performer against the USD, is the SEK.

- Looking ahead, US Retail Sales and IP are the notable Data.

- Speakers include, ECB Lagarde, Centeno, BoE Cunliffe, Fed Powell, Bullard, Harker, Kashkari, Mester and Evans.

FX OPTIONS: Expiries for May17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1980-95(E817mln), $1.2120-25(E689mln-EUR puts),

$1.2150(E1.94bln-EUR puts) - AUD/USD: $0.7750-60(A$1.6bln)

- USD/CNY: Cny6.35($500mln), Cny6.45($906mln-USD puts)

Price Signal Summary - Oil Heads North And Clears Resistance

- In the equity space, S&P E-Minis short-term gains are considered corrective and the primary trend direction remains down. Last week’s continuation lower and fresh cycle lows, reinforce the downtrend and signal scope for a continuation lower. The next objective is 3843.25, the Mar 25 2021 low (cont). In terms of resistance, the key short-term level is 4303.50, the Apr 26/28 high. Initial firm resistance is at 4099.00, the May 9 high. The primary trend direction in the EUROSTOXX 50 futures remains down. However, the contract is currently in a corrective cycle following the recovery from 3466.00, May 10 low. Price is trading at its recent highs ahead of the next resistance at 3740.30, the 50-day EMA. A clear break of this EMA would improve a short-term bullish theme. On the downside, key support and the bear trigger is 34666.00.

- In FX, EURUSD remains in a downtrend and short-term gains are considered corrective. The pair traded lower last Thursday and cleared support at 1.0472, Apr 28 low - confirming a bear flag breakout and a resumption of the primary downtrend. The focus is on 1.0341, the Jan 3 2017 low and a key support. Resistance is at 1.0583, the 20-day EMA. GBPUSD is firmer today and the pair has traded cleared 1.2406, the May 9 high. This improves short-term conditions for bulls. Attention is on the next resistance at 1.2512, the 20-day EMA, where a break would open 1.2638, the May 4 high and a key resistance. On the downside, key support has been defined at 1.2156, May 13 low. This is also the bear trigger. The USDJPY primary uptrend remains intact and last week’s move lower is likely a correction. Initial support has been defined at 127.52, May 12 low. A resumption of gains would refocus attention on the bull trigger at 131.35, May 9 high. A break would open 131.96, the 1.00 projection of the Feb 24 - Mar 28 - 31 price swing.

- On the commodity front, Gold remains vulnerable following last week’s resumption of the downtrend and short-term gains are considered corrective. The yellow metal traded through the $1800.0 handle Monday. The focus is on $1780.4, the Jan 28 low. In the Oil space, WTI futures started the week on a firmer note, trading higher Monday. The contract has breached resistance at $111.37. May 5 high and this has improved the outlook for bulls. Note that $113.51, the Mar 24 high has also been cleared. A continuation higher would open $120.00 and the key resistance and trend high of $121.17, Mar 7 high.

- In the FI, Bund futures remain in a downtrend and recent gains are considered corrective. A fresh cycle low on May 9 reinforced the bearish condition. A resumption of weakness would refocus attention on 150.49, the bear trigger. Firm trend resistance is 156.00, the Apr 28 high. The broader trend condition in Gilts remains down. However, last week’s gains resulted in a break of resistance at 119.79, the Apr 25 high. This signals potential for a stronger short-term corrective bounce and opens 121.84 next, 50.0% of the Mar 1 - May 9 bear leg. Key support has been defined at 116.87, May 9 low.

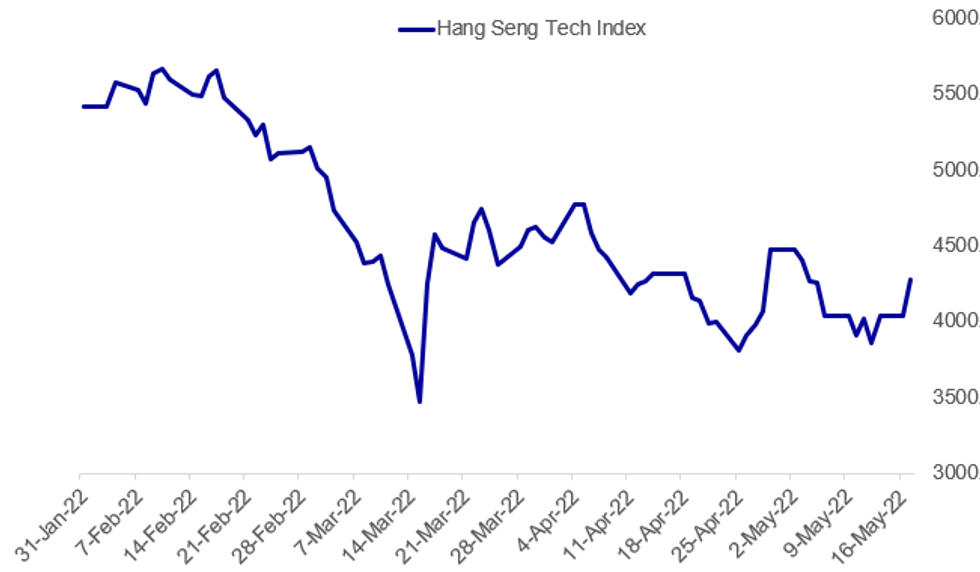

EQUITIES: Tech Stock Rally (Led By Hang Seng)

- Asian markets closed higher: Japan's NIKKEI closed up 112.7 pts or +0.42% at 26659.75 and the TOPIX ended 3.45 pts higher or +0.19% at 1866.71. China's SHANGHAI closed up 19.948 pts or +0.65% at 3093.697 and the HANG SENG ended 652.31 pts higher or +3.27% at 20602.52 - led by the Tech Index (up 6%).

- European equities are also gaining, with the German Dax up 180.62 pts or +1.29% at 14154.95, FTSE 100 up 55.93 pts or +0.75% at 7518.07, CAC 40 up 95.77 pts or +1.51% at 6443.76 and Euro Stoxx 50 up 52.5 pts or +1.42% at 3741.6.

- U.S. futures are higher, led by tech stocks: Dow Jones mini up 330 pts or +1.03% at 32489, S&P 500 mini up 58 pts or +1.45% at 4062.75, NASDAQ mini up 254.25 pts or +2.08% at 12499.

COMMODITIES: Copper Leads Gains On China Reopening Hopes

- WTI Crude up $0.94 or +0.82% at $115.14

- Natural Gas (NYM) up $0.16 or +2.05% at $8.119

- Natural Gas (ICE Dutch TTF) up $2.65 or +2.85% at $95.505

- Gold spot up $4.7 or +0.26% at $1828.8

- Copper up $7.75 or +1.85% at $426.9

- Silver up $0.16 or +0.74% at $21.7807

- Platinum up $4.21 or +0.44% at $953.4

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/05/2022 | 1200/0800 |  | US | St. Louis Fed's James Bullard | |

| 17/05/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 17/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 17/05/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 17/05/2022 | 1315/0915 |  | US | Philadelphia Fed's Patrick Harker | |

| 17/05/2022 | 1400/1000 | * |  | US | Business Inventories |

| 17/05/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 17/05/2022 | 1505/1605 |  | UK | BOE Cunliffe Fireside Chat | |

| 17/05/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 17/05/2022 | 1630/1230 |  | US | Minneapolis Fed's Neel Kashkari | |

| 17/05/2022 | 1700/1900 |  | EU | ECB Lagarde Speech at Soroptimist International Club | |

| 17/05/2022 | 1800/1400 |  | US | Fed Chair Jerome Powell | |

| 17/05/2022 | 1830/1430 |  | US | Cleveland Fed's Loretta Mester | |

| 17/05/2022 | 2245/1845 |  | US | Chicago Fed's Charles Evans | |

| 18/05/2022 | 0130/1130 | *** |  | AU | Quarterly wage price index |

| 18/05/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 18/05/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 18/05/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 18/05/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 18/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 18/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 18/05/2022 | 1230/0830 | *** |  | CA | CPI |

| 18/05/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 18/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 18/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 18/05/2022 | 2000/1600 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.