-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Markets Pare UK Rate Cut Bets

HIGHLIGHTS:

- Markets pare UK rate cut bets as Bailey highlights "issues" with NIRP

- Oil rallying further, WTI & Brent crude hit new cycle highs

- Fedspeak takes focus, with Brainard, George, Rosengren due

US TSYS SUMMARY: Grinding Lower On Taper Talk, Supply

Treasuries continued to grind lower overnight, as FOMC members continue to signal openness to slowing the pace of Tsy purchases this year, and 10-Yr supply eyed.

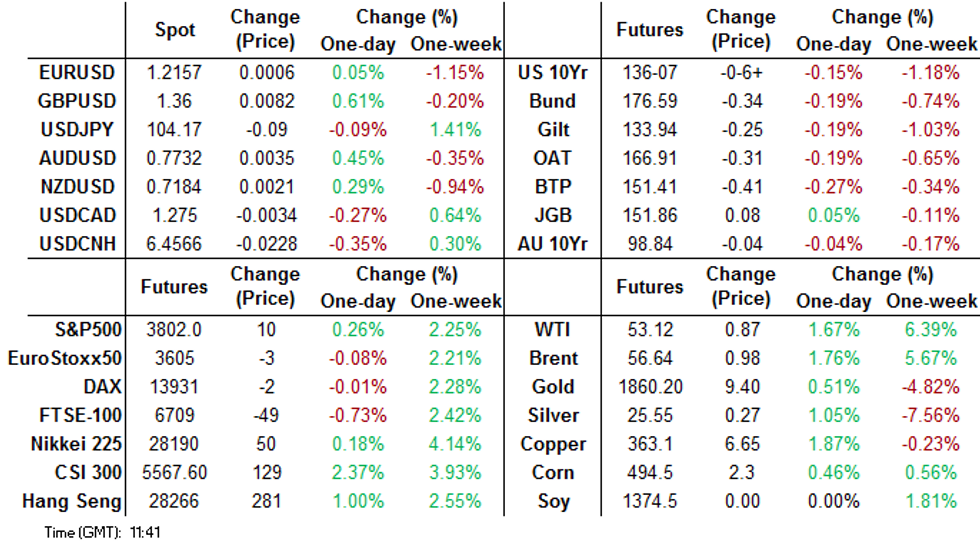

- Mar 10-Yr futures (TY) down 6/32 at 136-7.5 (L: 136-05.5 / H: 136-12.5)

- The 2-Yr yield is unchanged at 0.1449%, 5-Yr is up 1bps at 0.5154%, 10-Yr is up 0.9bps at 1.1547%, and 30-Yr is down 0.1bps at 1.8825%.

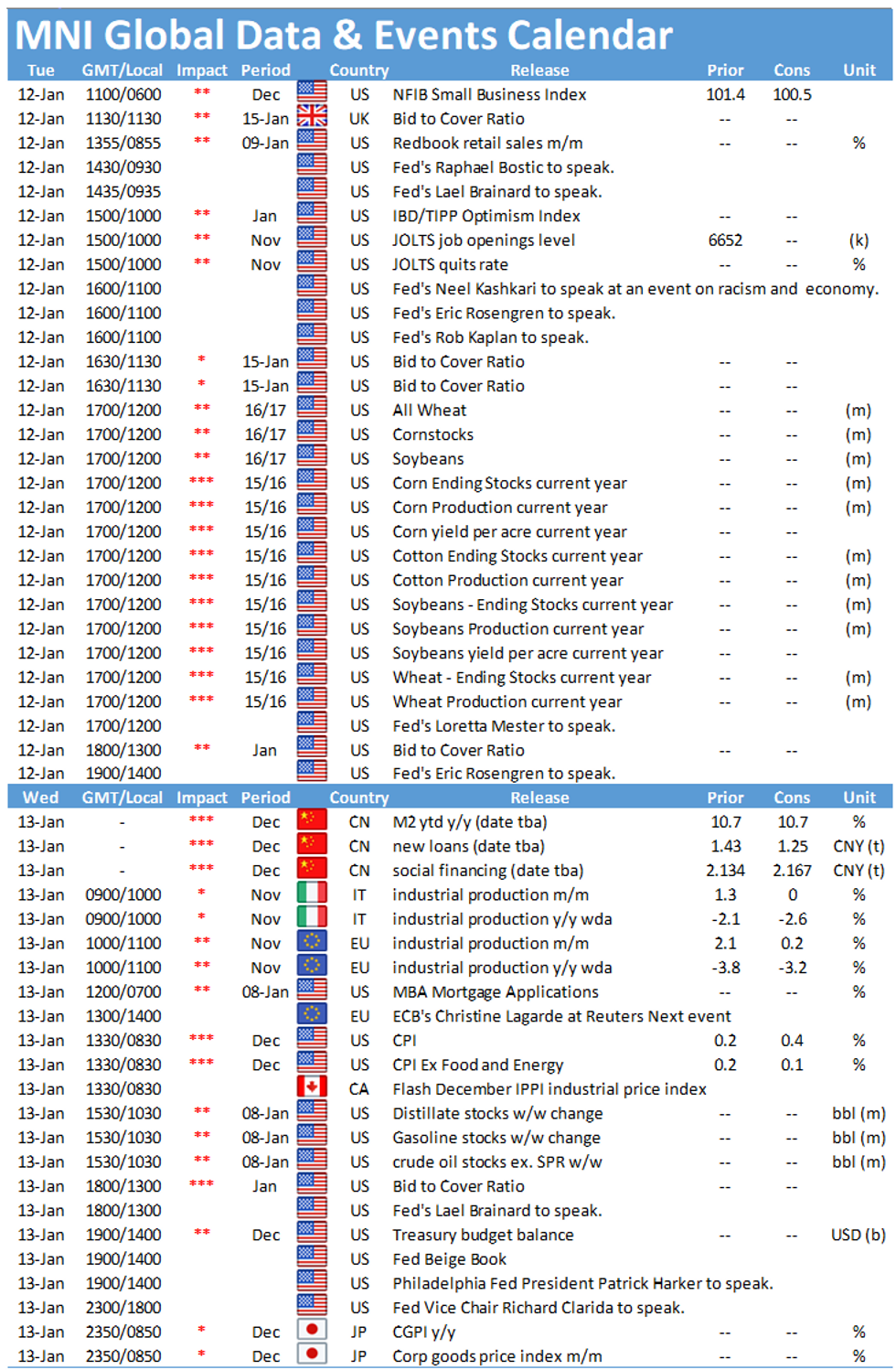

- Several key Fed speakers today in the context of some participants talking in recent days about a 2021 QE taper. Brainard at 0935ET, KC's George at 1300ET, Boston's Rosengren at 1400ET. Rosengren/Kaplan/Kashkari on a panel at 1100ET but unlikely to be much on current mon pol.

- In contrast, light on data: Nov JOLTS at 1000ET. Dec NFIB came in weak.

- House Democrats set to issue resolution for VP Pence to invoke 25th amendment to remove Pres Trump, but this is seen futile (BBG reported Pence and Trump agreed to work together through the inauguration). But is precursor to House impeachment vote, possibly Wednesday.

- We get $60B total in 42-/119-day bill auctions at 1130ET, and $38B 10Y Note auction at 1300ET. NY Fed buys ~$6.025B of 4.5-7Y Tsys.

EGB/GILT SUMMARY - Busy Session, Above Average Volumes

A busy session for EGBs, with above average volumes.

- Lack of risk events, has put all the focus on supplies, and Corp issuances will continue to dominate this afternoon.

- Selling across Govies went through, with the bear steepening bias intact.

- Bund, BTP, GILT, OAT are all down circa 35 ticks in the session, albeit off the lows

- German 5/30s made an attempt at the December peak 63.303 (printed 63.275 high).

- US hope of faster economic recovery, stimulus and a faster vaccination pace has kept Bonds better offered.

- A busy session for Gilts and the shorter end Sterling strip with contracts selling off, following BoE Bailey's comment on negative rates: "There's a lot of issues with negative rates"

- UK Money Market have now discounted/pushed back their 10bps cut to December.

- While OIS moved back to November, for a full cut.

- Looking ahead, we have no data of note, and focus will turn to ECB de Cos as well as Fed Rosengren and George.

- In terms of flow, some attention on Issuance pricing out of Europe and the US.

- Bund futures are down -0.37 today at 176.56

- BTP futures are down -0.45 today at 151.37

- OAT futures are down -0.35 today at 166.87

- Gilt futures are down -0.28 today at 133.91

EUROPE OPTIONS SUMMARY

Eurozone:

RXH1 176p, sold at 59 in 3k

RXH1 175.00p was sold at 27 and 26.5 in 15k (ref 176.76)

RXH1 175.5/179.5^^, bought for 51 in 1.2k

RXH1 176/175ps, bought for 27 in 6k vs RXH1 177p, sold at 99 in 3k

RXH1 177/175.50/175p ladder, sold at 29 in 1k

RXG1/RXH1 177p calendar, bought the March for 37 in 2.75k

RXG1 177/176.5/175p ladder sold at 20 in 2.6k

DUG1 112.20/112.00ps, bought for 1 in 2.5k

DUG1 112.20p, bought for 1.5 in 10k

3RM1 100.25/100ps, bought for 2 in 2k

UK:

0LG1 99.875p, sold at 0.75 in 6.5k

0LM1 100.12/100.12cs 1x2, bought the 1 for 0.25 in 2.5k

LM1 100.00/100.12/100.25/100.37c condor, bought for 3 in 2.5k

L M1 100.00/100.125/100.25c fly, bought for 2 in 5k

0LJ1 100.25c/99.75p RR, bought the call for 0.25 in 5k

LU1 100/100.12/100.25/100.37 call condor, bought for 3.25 in 2k

AUCTION RESULTS

Dutch DSTA sells E1.885bln of the 0% Jan-52 DSL vs E1-2bln target

- Average yield -0.027% (0.028%)

- Average price: 100.85 (99.13)

- Pre-auction mid-price: 100.698

UK DMO sells GBP3.0bln nominal of 0.125% Jan-28 Gilt:

- Avg yld 0.176% (0.116%)

- Bid-to-cover 2.75x (2.67x)

- Tail 0.2bps (0.2bps), price 99.640 (100.063)

- Pre-auction mid-price 99.606

DMO sells GBP1.25bln nominal of 1.625% Oct-54 Gilt

- Avg yld 0.889% (0.972%)

- Bid-to-cover 2.89x (2.52x)

- Tail 0.1bps (0.2bps)

- Price 121.419 (118.839)

- Pre-auction mid-price 121.238

Germany Allots E443mln of Linkers

- E330mln allotted of the 0.50% Apr-30 iBund:

- Average yield -1.55% (-1.35%)

- Bubacover 1.82x (1.69x)

- Bid-to-cover 1.50x (1.29x)

- Price: 120.55 (118.71)

- Pre-auction mid-price: 120.463 - E113mln allotted of the 0.10% Apr-46 BundEi:

- Average yield -1.48% (-1.25%)

- Bubacover 1.90x (2.07x)

- Bid-to-cover 1.08x (0.69x)

- Price: 148.69 (140.85)

- Pre-auction mid-price: 148.682

Austria sells E1.38bln of 10/30-year RAGBs:

- E747.5mln of the 0% Feb-30 RAGB:

- Average yield -0.399% (-0.389%)

- Bid-to-cover 2.16x (3.55x)

- Price: 103.703 (103.724)

- Pre-auction mid-price: 103.375

- E632.5mln of the 0.75% Mar-51 RAGB:

- Average yield 0.159% (0.321%)

- Bid-to-cover 2.14x (2.44x)

- Price: 117.413 (112.521)

- Pre-auction mid-price: 116.974

FOREX: Bailey Dampens Rate Cut Expectations

Implied vols receded early Tuesday, with markets resuming the recent trend of selling USD in favour of growth proxies including AUD and NZD. Equities are mixed, although US futures are pointing to a mildly positive open later today, which has given markets the greenlight to resume their USD-selling bias. A lower close for the USD index today would be the first down-day since Jan 5th.

GBP trades well following a speech from BoE governor Bailey who highlighted the difficulties and uncertainties when it comes to negative interest rates. Bailey stated that while there "nothing to stop" the imposition of negative interest rates, there would be lots of issues including complicating the outlook for the banking sector. Markets read these comments as a firm indication that the MPC are still well away from seriously considering NIRP, resulting in markets pushing out rate cut expectations and boosting GBP in the process. GBP/USD showed above $1.36.

The data schedule is particularly quiet Tuesday, with just US JOLTS job openings data on the docket. Fed's Brainard, George & Rosengren speak as well as ECB's de Cos.

OPTIONS: Expiries for Jan12 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2150(E1.1bln-EUR puts), $1.2200(E1.4bln-EUR puts), $1.2230(E632mln), $1.2250(E1.4bln-EUR puts), $1.2275(E618mln), $1.2300(E2.1bln-mainly EUR puts), $1.2370-75(E826mln-EUR puts), $1.2400(E865mln-EUR puts)

USD/JPY: Y102.90-00($984mln), Y103.10-25($1.4bln), Y103.35-43($616mln), Y103.85-00($1.7bln-USD puts), Y104.10-30($1.1bln)

GBP/USD: $1.3995-1.4000(Gbp986mln-GBP puts)

EUR/GBP: Gbp0.9300(E766mln)

AUD/USD: $0.7500(A$516mln), $0.7650(A$508mln), $0.7750(A$828mln)

USD/CAD: C$1.2750($615mln)

OIL TECHS: WTI And Brent At Fresh Highs

Oil continues to climb with both WTI and Brent at fresh trend highs, confirming a resumption of their uptrends.

- WTI (G1) targets $54.50 next, the Feb 20 high, 2020 and a key resistance (cont).

- Brent is on course for a climb towards $58.59, 76.4% of the Jan - Apr 2020 sell-off (cont).

It is worth noting that trend conditions in both are overbought and have been for some time. The risk of a pullback increases of course as price continues to rise.

EQUITIES: Futures Stabilise, Energy Names Strong

After yesterday's (very) modest pullback in US stocks, futures markets have stabilised well, with the e-mini S&P indicating a muted, but positive, open at the Wall Street opening bell later today. Across Europe, the picture is more mixed. Spain's IBEX-35 outperforms, up around 0.4%, while UK, French markets lag.

Energy names are trading well, with the sector rallying smartly early Tuesday on the continued uptick in WTI and Brent crude prices. Both oil contracts hit new cycle highs Tuesday, marking the best levels for close to a year.

US quarterly earnings season kicks off again this week, with big banks taking focus - JPMorgan, Citigroup and Wells Fargo all cross on Friday.

COMMODITIES: Oil Strikes New Cycle Highs, Nears Best in a Year

Both WTI and Brent crude futures trade well early Tuesday, with both contracts notching up gains of over 1% as they near the best levels in twelve months. A slightly softer USD is only partly responsible, with oil rallying despite technically overbought conditions. Oil markets have resumed their uptrend, but these overbought conditions will be adding to the risk of a near-term pullback.

After suffering late last week, spot gold and silver are inching higher again this morning, with an only tepid recovery in stocks today helping. First tech resistance in gold sits at the 50-day EMA of $1877.30.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.