-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI US MARKETS ANALYSIS - Markets Position For Data Deluge

HIGHLIGHTS:

- Italian BTP futures hit new alltime high

- US equity futures slightly softer after testing early November highs in Asia

- Data deluge in focus, with numerous tier 1 US releases pre-Thanksgiving

US TSYS SUMMARY: Heavy Pre-Holiday Data Schedule

Treasuries are on session highs having sharply rebounded from overnight lows ahead of a heavy pre-Thanksgiving holiday data dump and Fed minutes.

- The Tsy move has been a mirror image of equities which topped in Asia-Pac hours. No real macro/headline drivers, more like a breather after Tuesday's surge.

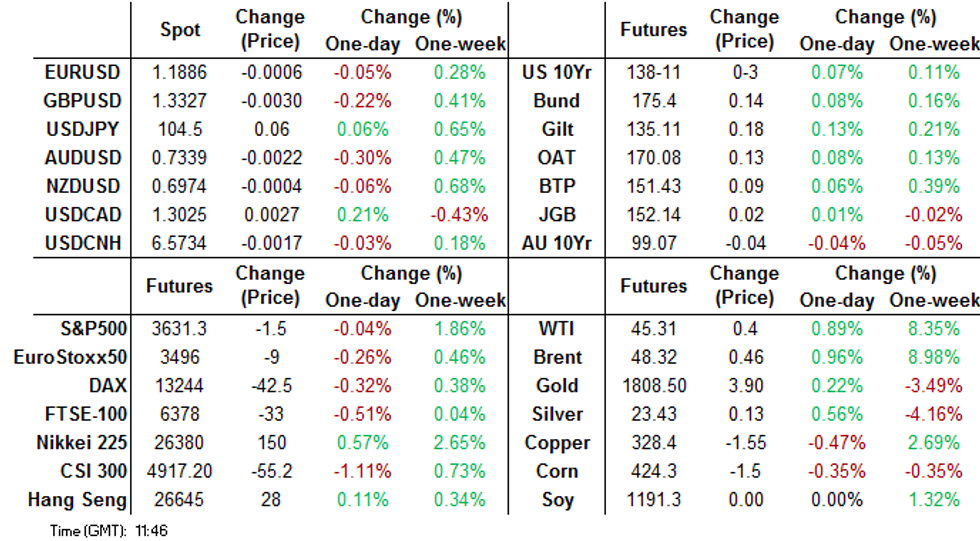

- Bull flattening in the curve: the 2-Yr yield is unchanged at 0.1602%, 5-Yr is down 0.9bps at 0.3861%, 10-Yr is down 1.3bps at 0.8668%, and 30-Yr is down 1.7bps at 1.5882%.

- Dec 10-Yr futures (TY) up 3.5/32 at 138-11.5 (L: 138-04 / H: 138-12). Dec/Mar fut rolls in focus (we're about three-quarters of the way through).

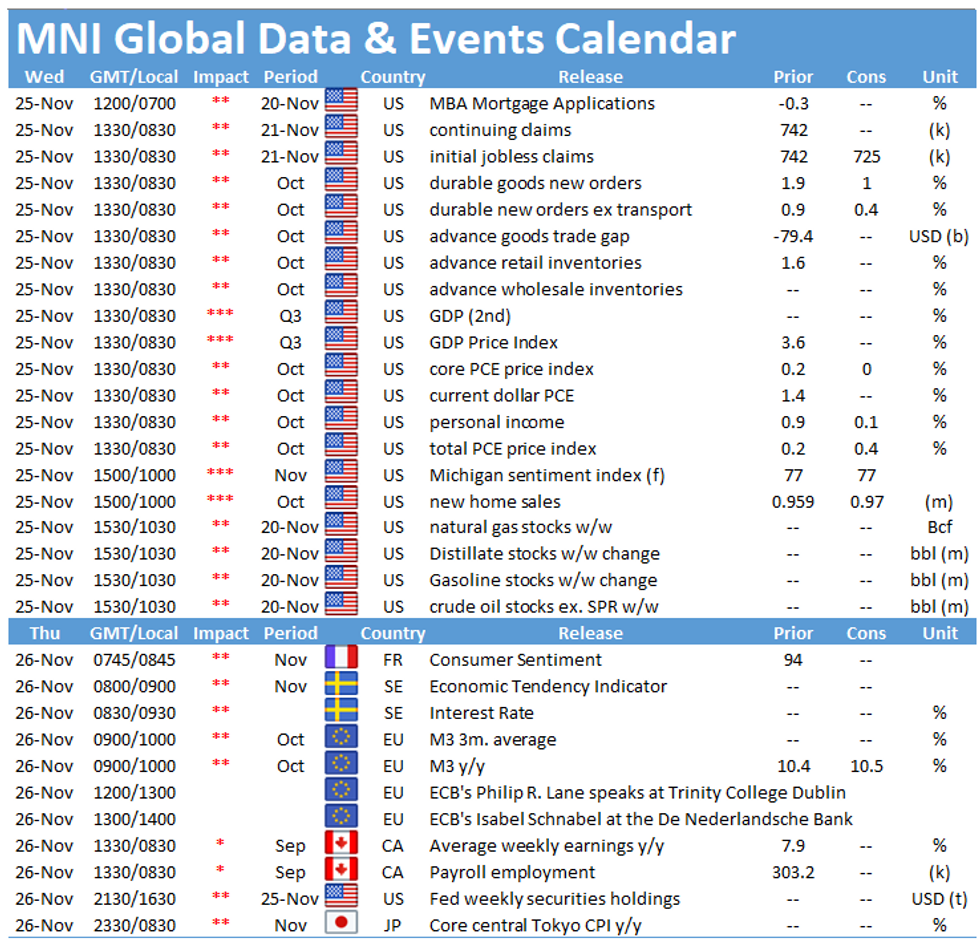

- No shortage of data ahead. 0830ET brings weekly jobless claims, 2nd reading of Q3 GDP, Oct durable goods orders and wholesale inventories. At 1000ET we get Oct personal income/spending alongside Oct new home sales and final Nov UMich sentiment.

- FOMC Nov Meeting minutes out at 1400ET, with asset purchase discussion in focus.

- We also get the last supply of the week, in the form of $65B of 4-/8-week bills (1000ET), followed by $55B of 105-/154-day bills (1130ET). No NY Fed operational purchases today.

EGB/GILT SUMMARY: EGBs Firmer, curves bull flatter

European govies have traded firmer this morning and curves have bull flattened against a broader cautious tone in markets following the recent positive developments on the Covid vaccine front.

- Gilts yields are broadly 2bp lower across the curve, which trades close to flat overall.

- The bund curve is 1bp narrower, with the longer end marginally outperforming.

- OATs trade in line with bunds. Last yields: 2-year -0.6881%, 5-year -0.6675%, 10-year -0.3455%, 30-year 0.3459%.

- It is a similar story for BTPs with cash yields up to 1bp lower. The 10-year benchmark yield hit a fresh record low this morning.

- Supply this morning came from Italy (BTPEi/CTZ, EUR3.25bn).

- The European data calendar has been light today. The second estimate of US Q3 GDP will be published later today, as well as PCE data for October and the final University of Michigan print for November

- UK Chancellor of the Exchequer Rishi Sunak is expected to provide details on a GBP4.3bn spending package to support jobs.

UK: Chancellor's Spending Review Statement Approaching

A reminder, as if one were needed, that Chancellor of the Exchequer Rishi Sunak is set to deliver his statement on the Spending Review this afternoon.

- Sunak should be on his feet at just after 1230GMT (0730ET, 1330CET), just after the conclusion of Prime Minister's Questions.

- The event is not as wide-ranging as a full Budget statement (and will cover Apr 2021-Apr 2022), but there will be several areas of significant focus:

- Forecasts from the OBR on the outlook for GDP, gov't debt and deficit, and unemployment all being closely watched to show just how bad the impact of COVID-19 could be on the economy.

- A potential public sector pay freeze. Not confirmed by the Treasury, but there has been notable speculation that public sector workers, excluding medical professionals in the healthcare sector, could be subject to a pay freeze to try to reduce expenditure. Would likely cause some difficult headlines for the gov't in the short term.

- A new job creation scheme and additional welfare support. GBP2.9bn for a 'restart' scheme for 1mn jobless individuals, while GBP1.4bn is set to go into revamping the Job Centre network.

- Another political grenade for the gov't is the trailed cut to the international aid budget. It was a manifesto pledge in Dec 2019 to keep the law maintaining aid spending at 0.7% of GNI, but to reduce expenditure wherever possible it has been mooted this could be cut to 0.5%. This has provoked outrage among some, stating that any cut would break a manifesto pledge, be morally unacceptable, and reduce the UK's soft-power capabilities. However, a cut to international aid is very popular with the public according to polls, and there is a get-out clause to the law in the event of a substantial drop in national income, as experienced this year.

BTP futures hit another all-time high

BTP futures have been on the front foot again this morning and have moved through yesterday's all time high of 151.46.

- Our technical analyst points to the next resistance at 152.00.

- 10-year spreads to Bunds have also continued to tighten and are 0.6bp tighter on the day at 116.7bp.

- We are not far at all now from the August 2016 and April 2018 double bottom of around 112.8bp.

- The next major reference point is the March 2016 level around 102bp.

- Our technical analyst notes that all trend conditions are still pointing to a continued move lower.

OPTIONS FLOW SUMMARY

UK:

0LM1 99.62/99.75/100.00/100.12c condor, bought for 8.75 in 2k

LZ1 100^, bought for 19.25 in 1k

2LM1 99.62/99.37ps, bought for 2.5 in 5k

US:

USF1 172/170ps vs 177c, bought the ps for flat in 5k

TYF1 140c, bought for 2 in 10k

Eurozone:

SX7E Dec21 100c sold at 60 in 20k

FOREX: Position-Squaring Ahead of US Data Deluge

EUR/USD started the session strongly, bidding up to 1.1930 to mark a new multi-month high. Profit-taking and position squaring then dragged the pair lower, with markets keeping an eye on option interest in the pair layered between 1.1835-70.

Macro/news drivers have been few and far between, with markets looking ahead to a deluge of US data brought forward by the mid-week Thanksgiving market closures. Later today we get weekly jobless claims, trade balance, secondary Q3 GDP, October durable goods, personal income/spending, Uni of Michigan confidence, new home sales and, finally, the FOMC minutes. Markets will be on watch for any mention of QE or asset purchase arrangements, as the market bakes in expectations of action as soon as December's meeting.

GBP is marginally softer, but Brexit news has been thin on the ground as negotiations continue. The still-firm oil price continues to prop up commodity-tied FX, with NOK outperforming.

FX OPTIONS: Highlights

- EUR/USD has nothing particularly standout for today's NY cut(1500GMT) although noticeable that the $1.2000 level has attracted EUR call interest through next week. Today sees E832mln of EUR calls rolling off at $1.2000. (current level $1.1905)

- USD/JPY calendar shows a propensity toward USD puts at and below Y103.00 from today and through next week, though the main stand out is the Y104.00 expiry on Dec3 for $3.35bln USD puts. (current level Y104.48)

- Hopes remain for a Brexit trade agreement which is keeping sterling buoyed. With this in mind EUR/GBP continues to attract EUR put interest at and below Gbp0.8900. For today the calendar shows a total of E1.1bln rolling off between Gbp0.8900-0.8875. (current level Gbp0.8915)

TECHS: Key Price Signal Summary

- Gold remains heavy and appears set to weaken towards $1763.5 , 50.0% retracement of the Mar - Aug rally. $1800.0 provides support for now. Brent (F1) has cleared the Aug highs and is eyeing the psychological $50.00. WTI targets $48.07 next, 0.764 proj of Apr - Aug rally from Nov 2 low.

- In the FX space:

- EURUSD has probed key resistance at 1.1920, Nov 9 high. Continued gains would open this year's high print of 1.2011, Sep 1 high.

- USDJPY key support lies at 103.18, Nov 11 low. Initial support to watch is 103.65, Nov 18 low.

- EURGBP trendline resistance at 0.9011, drawn off the Sep 11 high remains intact. The bear trigger is 0.8861, Nov 12 low.

- The major hurdle for bulls in Cable is at 1.3421, a multi-year trendline resistance drawn off the Nov 2007 high.

- Key FI resistance levels to watch: Bund fut: 175.73, Nov 20 high and 176.08, 76.4% of the Nov 4 - 11 sell-off. Gilts: 135.50, its 50-day EMA. BTP fut: fresh high print today of 151.50 highlights scope for 152.00.

- E-Mini S&P futures continue to trade within the 3668.00, Nov 9 high and 3506.50, Oct 11 key parameters.

EQUITIES: Markets Mixed Ahead of Data Drop

European equity markets are largely non-directional ahead of the Wednesday session, with US futures the same. Italian, French stocks are flat, while UK, German and Spanish markets lag very slightly. That's not to say there hasn't been notable price action overnight, with early strength in US futures putting the e-mini S&P within striking distance of the alltime highs posted on Nov 9th at 3668 - but this has faltered ahead of NY hours.

Across the continent, the underperformers this week have been defensive names, which are bouncing slightly with utilities, consumer staples and healthcare modestly higher, while profit-taking weighs on energy, financials and materials.

Focus remains on the deluge of US data brought forward to today due to Thursday's Thanksgiving holidays.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.