-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI US MARKETS ANALYSIS - Markets Take Profit After Soft China GDP

Highlights:

- Markets take profits on recent equity rally as China growth data disappoints

- Fed media blackout period kicks off, leaving little event risk Monday

- Earnings season kicks off in earnest this week

Holding Richer On China GDP Miss

- Cash Tsys have seen a mostly one directional move richer today after the late open, led by 5-10Y tenors seemingly on the European reaction to softer than expected China GDP growth and perhaps resumed weakness in oil after some Saudi headline confusion.

- There haven’t been any other meaningful, overt triggers for the bounce from session cheaps in core global FI markets, with reports alluding to continued Sino-U.S. tensions (surrounding a potential Taiwanese official stopping off in the U.S. in August) an unlikely driver.

- 2YY -4.4bp at 4.721%, 5YY -5.8bp at 3.989%, 10YY -5.5bp at 3.777%, 30YY -3.8bp at 3.890%. 2s10s consolidates Friday’s flattening at -94bps.

- TYU3 trades 9+ ticks higher at 112-27+ off a high of 112-29+ but remains within Friday’s range, on subdued volumes of 185k owning to the Japan closure. Initial resistance sits at 113-03 (Jul 13 high) with focus on the key resistance at the 50-day EMA of 113-11+, whilst a renewed push lower could see 112-07+ (Jul 13 low).

- Data: Empire mfg Jul (0830ET)

- Bill issuance: US Tsy $65B 13W, $58B 26W Bill auctions (1130ET)

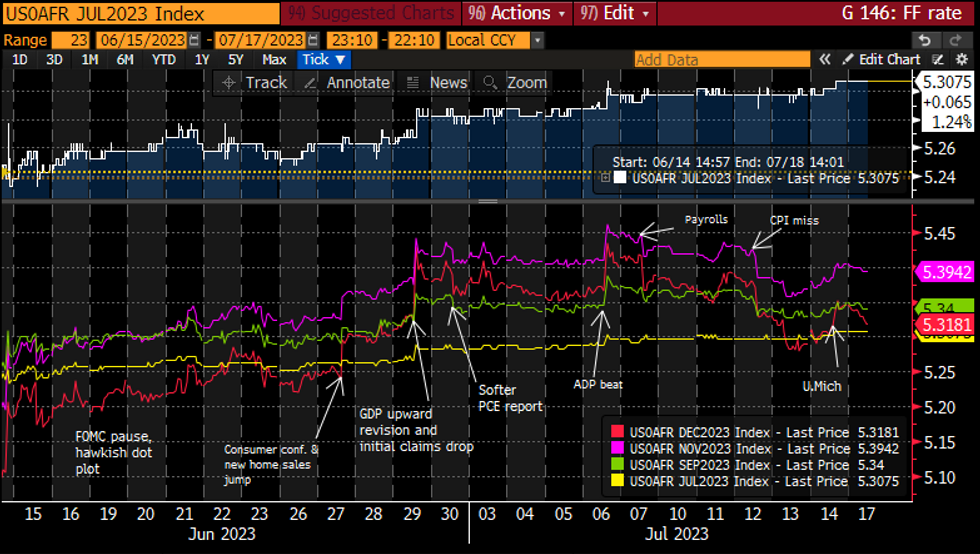

STIR FUTURES: Fed Implied Rates Reverse U.Mich Pop On Softer China GDP

- Fed Funds implied rates are only marginally lower for the next couple meetings but with increasingly large declines further out, mirroring the belly led rally in Treasuries on softer than expected China GDP growth. The move helps reverse most of Friday’s push higher on the strong U.Mich survey.

- Cumulative change from 5.08% effective: +22.5bp Jul 26 (unch), +26bp Sep (-1bp), +31bp Nov (-1bp).

- Cuts from 5.39% Nov terminal: 8bp to Dec (from 6bp), 78bp to Jun’24 (from 73bp) and 153bp to Dec’24 (from 148bp).

- The Fed is now in media blackout. In the flip side to Jefferson’s skip narrative ahead of the June FOMC blackout, the final guiding message this time came from a hawkish Waller.

Source: Bloomberg

Source: Bloomberg

ECB Pricing Little Changed On The Day

ECB-dated OIS is little changed to start the week, with the liquid contracts generally operating within 1bp of Friday’s closing levels at typing. Recent price action in wider core global FI markets has kept any pay-side flow in check.

- ECB speak has seen Governing Council member Vasle warn against the high and resilient nature of core inflation.

- Elsewhere, the Bundesbank flagged a risk of slower than expected German GDP growth vs. previous expectations, while also outlining expectations for core inflation to remain very high over the summer, even with a moderation in general inflation potentially in play over the coming months.

- All in all, ECB-dated OIS prices a 25bp hike at next week’s meeting with virtual certainty, while a little over 42bp of cumulative tightening is showing through September. Beyond there, a terminal deposit rate just above 4.00% is priced, with those measures all operating in familiar territory.

- The latest BBG survey of economists indicated a central expectation for a terminal deposit rate of 4.00% to be reached in September.

- This afternoon will see Executive Board member Elderson & Governing Council Member Vujcic appear on a panel.

| ECB Meeting | €STR ECB-Dated OIS (%) | Difference Vs. Current Effective €STR Rate (bp) |

| Jul-23 | 3.645 | +24.3 |

| Sep-23 | 3.823 | +42.1 |

| Oct-23 | 3.893 | +49.1 |

| Dec-23 | 3.926 | +52.4 |

| Jan-24 | 3.916 | +51.4 |

| Mar-24 | 3.888 | +48.6 |

| Apr-24 | 3.818 | +41.6 |

UK: Inflation data the big event this week

- The big event of the week ahead for UK markets will of course be the June inflation print on Wednesday. Most analysts look for a deceleration in headline CPI from 8.7%Y/Y in May to between 8.1-8.3%Y/Y.

- However, the Bloomberg consensus sees core CPI remaining sticky at 7.1%Y/Y (the same as in May) with most analysts expecting a print in the 7.0-7.2%Y/Y range. There will also be focus on core services inflation, a measure the MPR has recently highlighted, while the breadth of any price increases will also be in focus. We will put out more thoughts on the inflation print ahead of the release.

- Last week saw a significant repricing of the market’s expectations of the peak rate, which fell over 20bp from the previous Friday’s close (we are now looking at a peak around 122bp by March 2023). This is down from a peak of in excess of 160bp on 6 June.

- Labour market data was mixed – and despite the global repricing of rates we think this also contributed to the moves in UK markets. Wage growth was strong – which will keep the pressure on the MPC in the near-term – 43bp remains priced in for the August meeting – but the data showed further signs of a softening in other parts of the labour market, which has helped contribute to the terminal rate falling.

Kremlin: Black Sea Grain Deal Halted, For Now

Comments from the Kremlin hitting wires stating that the Black Sea grain deal is halted "for now," but "Russia will immediately return to deal once the conditions affecting Russia are fulfilled."

- Kremlin states: "Black Sea grain deal have ceased to be valid today... the parts regarding Russia weren't fulfilled, therefore it ceases effect."

- The Kremlin says that there is "no link between the [Kerch] bridge attack and ending the grain deal" adding that Russian President Vladimir Putin "stated [his] position on the grain deal before the attack."

- According to Tass, Putin said on Friday during a last-ditch effort by UN Secretary General Antonio Guterres to find a compromise: “We may suspend our participation in this agreement. And if everyone reiterates that all promises given to us will be fulfilled — let them fulfill these promises. And we will immediately join this agreement. Again."

- White House National Security Advisor Jake Sullivan told CBS yesterday: “We are prepared for any scenario, and we’re working closely with the Ukrainians on that."

- Russian demands include the restoration of an ammonia pipeline through Ukraine and enhanced market access for Russian agricultural exports.

FOREX: AUD, NZD Hampered by Soft China CPI

- AUD, NZD are the poorest performers across G10 on the back of a softer-than-expected Chinese GDP release, with Q2 growth well below forecast at 6.3% Y/Y vs. Exp. 7.1%. While this was an acceleration from Q1's 4.5%, it has prompted a number of sell-side outfits to trim their growth expectation for this calendar year, with most trimming 0.5ppts to forecast 5.0% annual growth this year.

- As such, AUD/USD has faded off the 0.6895 high to trade lower for a second session and challenge the early Thursday lows of 0.6784. The Friday candle has now formed a bearish candle pattern, signalling exhaustion of the recent uptrend and flagging the risk of lower prices.

- JPY is among the strongest in G10, buoyed by a rollover of the previously bullish theme as equity markets backtrack some of the upper-end of the recent rally.

- With the Fed in media blackout mode, there are few central bank speakers or data releases of note, keeping focus on the bigger prints later this week: US retail sales, Canadian CPI and UK inflation data market the highlights.

Expiries for Jul17 NY cut 1000ET (Source DTCC)

Relatively few option strikes of note for the Monday NY cut - with G10 spot (namely EUR/USD and USD/JPY) pinned between larger strikes rolling off later in the week.

Today sees:- EUR/USD: $1.1050(E1.9bln)$1.1500(E539mln)

- USD/JPY: Y137.00($604mln)Y140.00($680mln)

- USD/CNY: Cny7.2000($1.8bln)

EQUITIES: US, European Equity Futures Remain Close to Recent Cycle Highs

- Eurostoxx 50 futures traded higher last week. The rally resulted in a move above the 50-day EMA at 4335.00 and price is through 4371.00, the Jul 6 high. Clearance of this latter level highlights a potentially stronger bull cycle and attention is on key resistance and the bull trigger at 4447.00, the Jul 3 high. Key support and the bear trigger has been defined at 4220.00, the Jul 7 low. Initial support is at the 50-day EMA.

- A bull theme in S&P E-minis remains intact. This week’s rally has resulted in a break of resistance at 4498.00, the Jun 30 high. The break confirms a resumption of the uptrend and maintains a bullish price sequence of higher highs and higher lows. The contract has also traded through 4500.00 and this opens 4556.71, a Fibonacci projection. First support lies at 4439.81, the 20-day EMA. Clearance of this level would highlight a S/T bearish threat.

COMMODITIES: Bull Cycle in WTI Futures Persists Despite Pull Lower Friday

- The current bull cycle in WTI futures persists despite the pull lower in prices across the Friday session. The contract has recently breached $72.72, the Jun 21 high and Wednesday’s move higher resulted in a break of key resistance at $75.70, the Jun 5 high. This strengthens current bullish conditions and paves the way for a climb towards $78.03, a Fibonacci retracement point. Key short-term support has been defined at $66.96, the Jun 12 low. Initial support is at $72.31, the 20-day EMA.

- Gold is holding on to its latest gains. The yellow metal has breached resistance at the 50-day EMA. The average intersects at $1945.0 and the break signals scope for a continuation of the current corrective cycle. This opens $1968.00, the Jun 16 high. Key resistance has been defined at $1985.3, the May 24 high where a break would highlight a stronger reversal. Key support and the bear is at $1893.1, the Jun 29 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/07/2023 | - |  | EU | ECB Panetta at G20 Finance/Central Bank meeting | |

| 17/07/2023 | 1215/1415 |  | EU | ECB Elderson chairs session at ECB CESEE conference | |

| 17/07/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/07/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 17/07/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 17/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 17/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 18/07/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/07/2023 | - |  | EU | ECB Panetta at G20 Finance/Central Bank meeting | |

| 18/07/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 18/07/2023 | 1230/0830 | *** |  | CA | CPI |

| 18/07/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/07/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 18/07/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/07/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 18/07/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 18/07/2023 | 1400/1000 | * |  | US | Business Inventories |

| 18/07/2023 | 1400/1000 |  | US | Fed's Michael Barr | |

| 18/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 18/07/2023 | 2000/1600 | ** |  | US | TICS |

| 19/07/2023 | 2245/1045 | *** |  | NZ | CPI inflation quarterly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.