-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - NZD Falters as CPI Slips Below Forecast

Highlights:

- NZD slips as CPI misses forecast, hindering RBNZ tightening plans

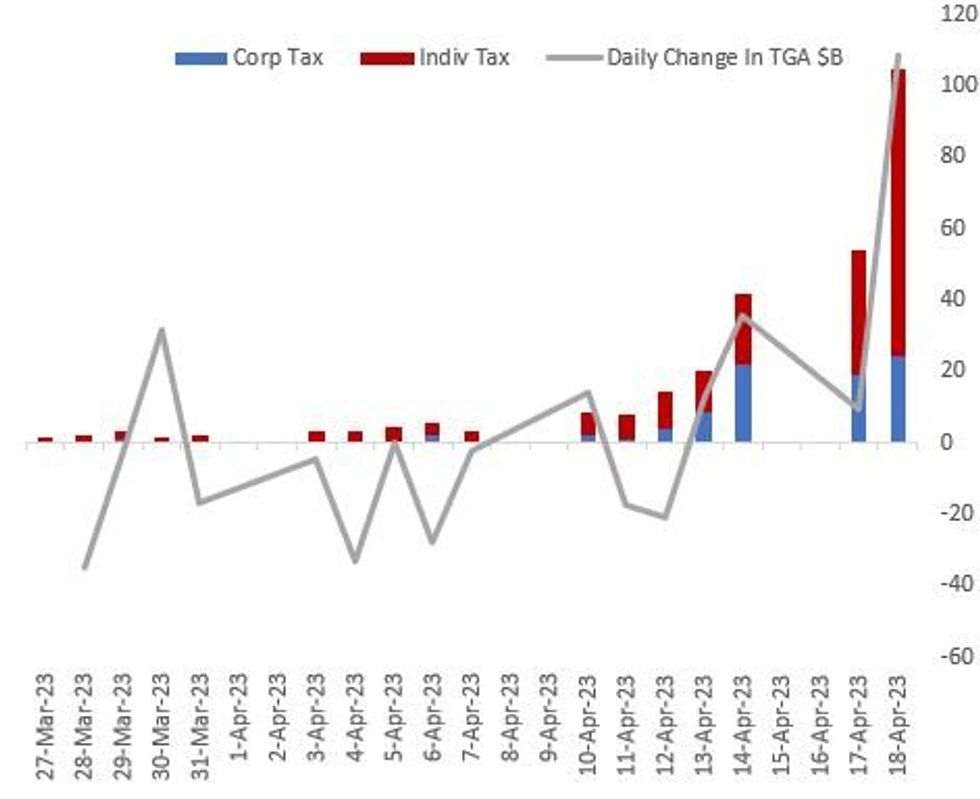

- T-bill yields stirred as markets eye tax collection implications for the debt ceiling

- Markets wade through deluge of Fed, ECB speak Thursday

US TSYS: Reversal Of Yesterday's Cheapening Ahead Of Earnings, Fedspeak and Data

- In the opposite of yesterday’s European led cheapening, cash Tsys have rallied through European hours to move than offset the move higher in yields, although headline drivers have been less clear today. However, after some paring of earlier gains in EU FI, front end Treasuries currently outperform. Ahead, sizeable company earnings still due before market before data and then a heavy schedule for Fedspeak later on.

- Updated late yesterday, April tax collection data so far are basically in the middle-to-low end of expectations, which maintains ambiguity over whether an "x-date" for Treasury will arrive in early June or later.

- 2YY -4.8bp at 4.195%, 5YY -4.4bp at 3.658%, 10YY -3.6bp at 3.555% and 30YY -2.8bp at 3.759%

- TYM3 trades 12 ticks higher at 114-18 off a high of 114-20+ although the bear threat is seen remaining with support at 113-30+ (Apr 19 low). Volumes are in line with the recent average albeit relatively subdued at 250k.

- Data: Weekly jobless claims (0830ET), Philly Fed business outlook Apr (0830ET), Existing home sales Mar (1000ET) and Leading index Mar (1000ET)

- Fedspeak: Waller (1200ET), Mester (1220ET), Bowman (1500ET), Logan (1500ET), Bostic (1700ET), Harker (1945ET).

- Note/bond issuance: US Tsy $21B 5Y TIPS auction (91282CGW5) – 1300ET

- Bill issuance: US Tsy $50B 4W, $45B 8W bill auctions - 1130ET

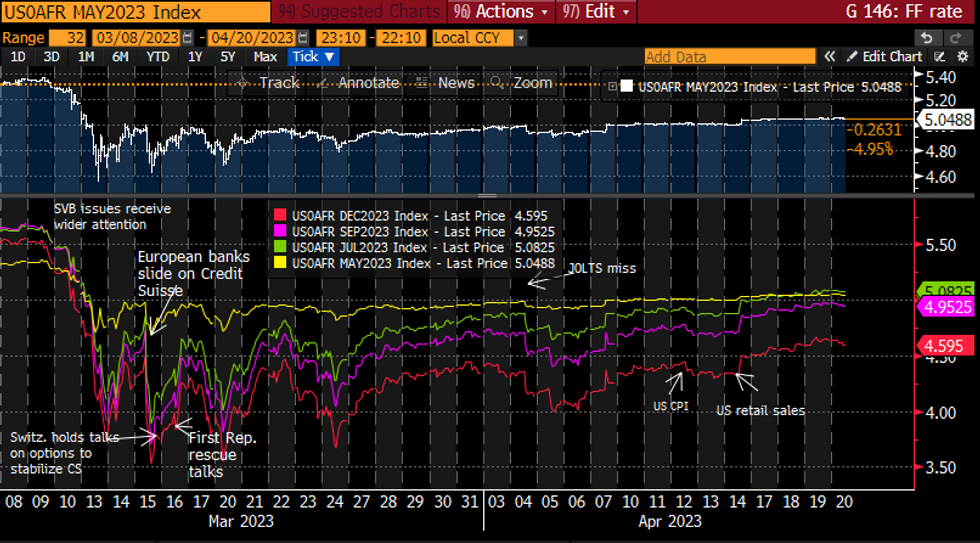

STIR FUTURES: Fed 2H23 Rates Ease, Fedspeak Deluge Ahead Of Blackout

- Fed Funds implied rates are little changed for upcoming meetings but have unwound about half of yesterday’s climb for 2H23 overnight. 22bp hike for May (unch) and cumulative 29.5bp for Jun (+0.5bp), -5.5bps for Nov from current levels (-3bp) and 23bp of cuts from current to 4.60% for Dec (-4bp).

- In case missed yesterday, Williams suggested the U.S. economy remains overheated and policymakers have more tightening to do, even as tougher credit conditions may dampen spending.

- Six lots of Fedspeak today, four of which are current voters and only Bostic without text, with two full days left before the blackout. Gov Waller (voter) on financial innovation, Mester (’24) on policy outlook, Gov Bowman (voter) welcoming remarks, Logan (’23), Bostic (’24) on economic conditions and Harker (’23) on economic outlook.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

Tax Day Doesn't Resolve X-Date Ambiguity

US April tax collection data so far are basically in the middle-to-low end of expectations, which maintains ambiguity over whether an "x-date" for Treasury will arrive in early June or later.

- Yesterday's daily Treasury statement showed a $108.5B increase in the TGA cash pile on April 18 (the tax deadline), with the relevant lines for individual and corporate tax collection reaching a combined $104.6B.

- The 2-day total is $158.6B, with the TGA up $117B - now up $166B since bottoming on April 12.

- Collection so far is seen on the light side of expectations. The TGA size of $242.5B is the highest in a month, but it's still unclear whether the April tax haul will be enough toward off an x-date in early June.

- There's still more data to come, including today's release (for April 20th's collections, which is seen as crucial by some analysts but not others), though the prior two days had been seen as the major driver of collections.

- There are timing issues at play (including potential weekend payments, use of checks vs faster electronic payments, etc) but we'll have a clearer view in a week, by which time the vast majority of April tax collections will be in.

- The general consensus among analysts is that the incoming data points to risks of an x-date earlier than the widely expected late Jul/early Aug timeline, but doesn't alter the base case.

Tax Numbers Don't Alter Analyst Core Scenarios, But Risks Evident

- Goldman Sachs sees month-to-date receipts down 31% from last year when adjusted for calendar and other issues - and they believe 35% is the threshold for Treasury to announce an early June x-data. A drop of less than 30% would keep late July as the base case. "Non-withheld tax receipts so far still lean slightly in favor of a late July deadline, but it would take only a few days of slightly weaker tax collections to tip the deadline to early June."

- Wrightson ICAP says the April 18 revenues came in below their expectations, but due to other factors, their overall cash flow projections for the month have only fallen by $10B since the beginning of the week. They now see around a 20% probability of an x-date being hit in June, though late July/early August is still the most likely outcome. "The debt ceiling timeline remains ambiguous ... we still think the Treasury will probably have enough fiscal resources to get past its seasonal low point in the second week of June, but the risk of a June x-date edged up a little yesterday. "

- NatWest writes that comparing 2023's tax season to 2019's rather than to 2022's is more apt given unusually large collections in the latter; in this regard, collections are 12% higher this year than in 2019. "We don’t think these numbers are underwhelming and doesn’t lead us to change our forecast for an x-date to early June yet (still think late July is when Treasury would run out of cash).

- JPMorgan analysts write that while the key electronically-filed individual income taxes are totalling well below 2022 levels, it's "prudent to wait a couple more days in order to get a cleaner read on individual income taxes". But "regardless, at this point, it appears that risks around our x-date estimate skew earlier."

EUROPE ISSUANCE UPDATE:

Spain auction results:- Another relatively strong Spanish auction with E6.425bln nominal issued (towards the upper end of the E5.5-6.5bln target range) and the stop price coming in above the pre-auction mid-price for all three Oblis on offer.

- Despite the auction results, all three Oblis sold drifted below the pre-auction mid-price in the few minutes post-auction.

- E2.276bln of the 0.80% Jul-29 Obli. Avg yield 3.257% (bid-to-cover 1.51x).

- E2.757bln of the 3.15% Apr-33 Obli. Avg yield 3.509% (bid-to-cover 1.38x).

- E1.393bln of the 2.70% Oct-48 Obli. Avg yield 3.926% (bid-to-cover 1.29x).

- A decent MT OAT auction with a higher-bid-to-cover for the 2.50% Sep-26 OAT than in March (despite a higher volume) and bids totaling over E30bln in nominal terms across all three lines - up from E26.6bln in the March auction.

- E11.5bln was sold, in line with the top end of the guidance, but this was a little lower than the E12.0bln sold in March.

- E4.656bln of the 2.50% Sep-26 OAT. Avg yield 2.93% (bid-to-cover 2.77x).

- E4.787bln of the 2.75% Feb-29 OAT. Avg yield 2.88% (bid-to-cover 2.34x).

- E2.055bln of the 0% Nov-29 OAT. Avg yield 2.83% (bid-to-cover 2.97x).

- E802mln of the 0.10% Mar-28 OATi. Avg yield 0.03% (bid-to-cover 2.22x).

- E702mln of the 0.10% Jul-38 Green OATei. Avg yield 0.63% (bid-to-cover 2.9x).

- E244mln of the 0.10% Jul-53 OATei. Avg yield 0.59% (bid-to-cover 3.59x).

FOREX: NZD Slips as Markets Speculate May Hike Could Be Last of Cycle

- NZD sits at the bottom end of the G10 pile, as the soft CPI release overnight drove market-implied expectations for monetary policy notably lower. Q1 CPI slowed to 1.2% against expectations of a 1.5% print, helping prompt a number of sell-side outfits to redraw expectations around the May interest rate hike possibly being the last in the cycle.

- NZD/USD traded through the 200-dma support in response, pulling back to a fresh April low of 0.6149. Support undercuts at 0.6140 ahead of the March low at 0.6085.

- EUR/NOK continues to grind higher, hitting a new cycle best at 11.6341 today and the highest since Apr'20. The moves today will be adding pressure to the already weaker-than-expected imported-weighted I44 rate used by the Norges Bank in policy-setting. Yesterday's I44 close of 121.15 was decidedly above the Bank's March projection of 119.50 for Q2 (Dec MPR forecast was 110.73), meaning a convincing NOK rally will have to follow in order to prevent the Bank revising their FX forecasts further still at June's forecast round and will add further pressure to the bank to raise rates again at the May 4th meeting.

- Key upside level in EUR/NOK crosses at 11.7486 - the 61.8% retracement for the 2020-2022 downleg and could come into play should the Apr'20 high of 11.6966 give way.

- CHF and the EUR trade better on an intraday basis, but both currencies are generally respecting the recent ranges.

- Weekly jobless claims data are the highlights of the data calendar, although the Philly Fed Business Survey could draw focus. Existing home sales data are expected to show near-term fragility in the housing market, although Eurozone consumer confidence is seen improving on the margin.

- Central bank speak is thick and fast Thursday, with no fewer than 6 ECB speakers, 5 Fed speakers, 2 from the Bank of Canada and a BoE MPC member on the docket. Of the lot, most focus will likely be paid to Fed's Logan, a voter and neutral member of the FOMC, and ECB's Holzmann, who will likely retain the recent hawkish tilt.

FX OPTIONS: Expiries for Apr20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0870-85(E1.6bln), $1.0895-00(E1.1bln), $1.0920-25(E1.9bln), $1.0975-80(E948mln), $1.1000-10(E1.3bln), $1.1100(E1.1bln)

- GBP/USD: $1.2350(Gbp865mln)

- USD/JPY: Y132.00-15($1.4bln), Y134.30($738mln)

- EUR/JPY: Y142.65-75(E1.1bln)

- AUD/USD: $0.6695-00(A$1.2bln)

- AUD/NZD: N$1.0800(A$602mln)

- USD/CAD: C$1.3290($550mln), C$1.3510($668mln)

EQUITIES: Eurostoxx Futures Trade Close to Recent Highs

- Earnings highlights due Thursday: American Express, AT&T, Union Pacific, Philip Morris International

- See full earnings calendar here: https://roar-assets-auto.rbl.ms/files/52491/MNIUSE...

- Eurostoxx 50 futures are consolidating at recent highs and the uptrend remains intact. Recent gains have reinforced the bullish significance of the break of 4268.00, the Mar 6 high and a former key resistance. The breach confirmed a resumption of the trend and maintains the bullish price sequence of higher highs and higher lows. Sights are on 4381.50, the Jan 5 2022 high. Initial firm support lies at 4250.00, the 20-day EMA.

- The trend outlook in S&P E-minis remains bullish and the contract continues to trade closer to its recent highs. Attention is on the 4200.00 handle where a break would open 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key medium-term resistance. Firm support lies at 4077,86 the 50-day EMA. Initial support to watch lies at 4119.30, the 20-day EMA. Pullbacks would be considered corrective.

COMMODITIES: WTI Futures Record Fresh April Low; 50-Day EMA at $77.42 Marks Immediate Support

- WTI futures are trading lower this week. This has resulted in a breach of support at $79.00, the Apr 3 low and the gap high on the daily chart. A continuation lower would signal scope for a deeper retracement, towards the 50-day EMA at $77.42. On the upside, key short-term resistance has been defined at $83.53, the Apr 12 high. A break of this level is required to resume the recent uptrend.

- Trend conditions in Gold remain bullish, however, the yellow metal has entered a short-term corrective cycle and traded lower Wednesday. Price has breached initial firm support at $1985.5, the 20-day EMA, highlighting potential for a deeper retracement. This has opened $1949.7, Apr 3 low. Key short-term resistance has been defined at $2048.7, the Apr 5 high. A break of this level would confirm a resumption of the uptrend.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 20/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/04/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/04/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/04/2023 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/04/2023 | 1415/1015 |  | US | Secretary Yellen on U.S.-China economic relationship | |

| 20/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 20/04/2023 | 1530/1130 |  | CA | BOC Governor testifies at Senate committee | |

| 20/04/2023 | 1530/1630 |  | UK | BOE Tenreyro Panels National Bureau of Economics Research Conf | |

| 20/04/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 20/04/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 20/04/2023 | 1600/1200 |  | US | Fed Governor Christopher Waller | |

| 20/04/2023 | 1620/1220 |  | US | Cleveland Fed's Loretta Mester | |

| 20/04/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 20/04/2023 | 1900/1500 |  | US | Dallas Fed's Lorie Logan | |

| 20/04/2023 | 1900/1500 |  | US | Fed Governor Michelle Bowman | |

| 20/04/2023 | 2015/2215 |  | EU | ECB Schnabel Lecture at Stanford Graduate School of Business | |

| 20/04/2023 | 2100/1700 |  | US | Atlanta Fed's Raphael Bostic | |

| 21/04/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 21/04/2023 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 21/04/2023 | 2330/0830 | *** |  | JP | CPI |

| 20/04/2023 | 2345/1945 |  | US | Philadelphia Fed's Pat Harker | |

| 21/04/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 21/04/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 21/04/2023 | 0700/0900 |  | EU | ECB de Guindos Remarks at Fundacion La Caixa | |

| 21/04/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 21/04/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 21/04/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 21/04/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 21/04/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 21/04/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 21/04/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 21/04/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 21/04/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 21/04/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 21/04/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 21/04/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 21/04/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 21/04/2023 | 1430/1630 |  | EU | ECB Elderson at Peterson Institute Climate Event | |

| 21/04/2023 | 1745/1945 |  | EU | ECB de Guindos at Colegio de Economistas de Madrid Event | |

| 21/04/2023 | 2035/1635 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.