-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: PBOC Increases Gold Reserves

MNI BRIEF: Japan Q3 GDP Revised Up On Net Exports, Capex

MNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US MARKETS ANALYSIS - NZD Falters as Inflation Expectations Track Back

Highlights:

- NZD falters as inflation expectations track back in Q2

- US implied rate path sticks to four cuts from September

- UMich inflation expectations seen slowing this month

US TSYS: Bear Steepening With U.Mich May Survey Eyed

- Cash Tsys have seen a modest bear steepening, with the front end little changed on the day but cheapening pressure continuing to grow further out the curve with equities also lifting. Front yields consolidate yesterday’s second half recovery but remain some 15bps off pre-CPI levels ahead of today’s docket headlined by U.Mich preliminary survey for May.

- In debt ceiling talks, the Biden-McCarthy meeting scheduled for today has been pushed into next week after progress at staff-level talks according to people familiar with the talks.

- 2YY +0.2bp at 3.901%, 5YY +1.5bp at 3.370%, 10YY +2.8bp at 3.412% and 30YY +3.5bp at 3.769%.

- TYM3 trades 3 ticks higher at 115-30+, just off session lows of 115-28 but within yesterday’s range. Support remains intact around 115-00, with 115-01+ (May 9 low) and 114-29+ (50-day EMA) whilst to the upside sits 116-16 (May 11 high).

- Data: Import prices Apr (0830ET), U.Mich consumer survey May prelim (1000ET)

- Fedspeak: Daly (1420ET), Bullard & Jefferson moderated panel (1945ET)

STIRS: Fed Rate Path Holding Four Consecutive Cuts From September

- Fed Funds implied rates are little changed since being nudged higher by Gov Bowman earlier noting that the recent economic data have not provided evidence that inflation is on a clear downward path and the Fed may need to tighten monetary policy further.

- It consolidates yesterday’s second half recovery that more than reversed a further dip after initial claims and PPI.

- Cumulative moves from 5.08% effective: 0bp for Jun (+0.5bp on the day), -10bp for Jul (+1.5bp), -27bp for Sep (+2bp), -52bp for Nov (+2.5bp), -76bp for Dec (+2.5bp) and -100bp for Jan (+3bp).

- Ahead: Daly ('24 voter) limited to a commencement speech before Bullard (non-voter) and Gov Jefferson (voter) in a panel late on.

FOMC-dated Fed FundsSource: Bloomberg

FOMC-dated Fed FundsSource: Bloomberg

MNI MARKET ANALYSIS – Last Look Ahead of Turkish Elections

Options markets are pricing considerable volatility in the wake of the Turkish elections, with polling data still too close to call, and the sizeable policy gap between the frontrunners making for extensive uncertainty for the Turkish economy. This document compiles a summary of sell-side views for the election itself, the trajectory of the economy and the scale of the market reaction.

See the full piece here:

One-week implied vol surged to new highs this week and sits above 60%, as the contract captures May 14 elections (Figure 1). Markets are bracing for further weakening in TRY, regardless of the outcome of elections on Sunday, due to concerns regarding the sustainability of government measures to prevent TRY depreciation. However, the limited success of such macroprudential measures is evidenced by the growing spread between the official USD/TRY spot rate and the unofficial 'Grand Bazaar' rate in recent weeks (Figure 2). This further emphasizes the limited ability of the authorities to contain the increasingly fragile market.

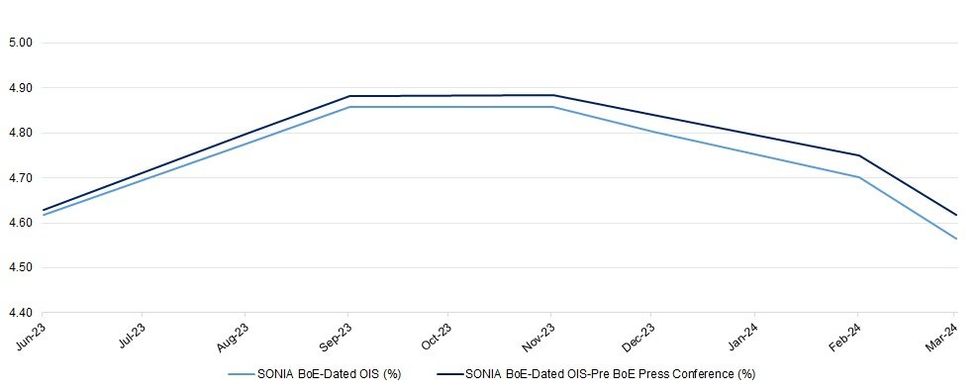

STIRS: BoE Terminal Rate Pricing In Familiar Territory

The latest round of U.S. banking sector worry coupled with BoE Governor Bailey telling BBG that the current hiking cycle could be near an end applied weight to BoE-dated OIS yesterday, after the initial knee-jerk move higher post-decision.

- BoE pricing still hasn’t regained pre-press conference levels, even in the presence of some hawkish Fedspeak and a recovery in e-mini futures.

- BoE Governor Bailey told BBG the following on Thursday:

- “We are approaching a point when we should be able to in a sense rest in terms of the level of rates. But we haven’t seen the evidence yet to give a stronger sense of the read of that, so that’s why I’m very clear that we have to be evidence driven.”

- When questioned on the proximity to a pause, he said: “Well, I’m going to say I hope we are because this is the 12th consecutive increase in rates. But again, I’ll be very clear that we will be guided by the evidence.”

- He also flagged a focus on the persistence in inflation in the BBG interview, while referencing BoE expectations for a notable moderation in inflation during ’23.

- Eyes are on the usually hawkish BoE Chief Economist Pill, who will speak at 12:15 London.

| BoE Meeting | SONIA BoE-Dated OIS (%) | SONIA BoE-Dated OIS-Pre BoE Press Conference (%) |

| Jun-23 | 4.618 | 4.628 |

| Aug-23 | 4.777 | 4.797 |

| Sep-23 | 4.857 | 4.881 |

| Nov-23 | 4.858 | 4.885 |

| Dec-23 | 4.802 | 4.841 |

| Feb-24 | 4.702 | 4.749 |

| Mar-24 | 4.564 | 4.617 |

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FOREX: NZD Falters on Pullback in Inflation Expectations

- NZD is comfortably the poorest performer in G10 after inflation expectation data overnight came in well below forecast at 2.79% for Q2 vs. 3.30% in the first three months of the year.

- NZD was marked lower upon release, putting the pair lower for a second session and well through the 100-dma support at 0.6279. Further losses open the 50-dma initially at 0.6220 ahead of 0.6216, the 61.8% retracement for the April - May upleg.

- CHF is a furtive outperformer in early Friday trade, helping tilt USD/CHF back toward the 0.89 level, although broader ranges remain generally muted. Equity markets are higher across Europe and the US, with some modest strength noted in the benchmark EuroStoxx50 (+1.0% at typing). JPY is at the other end of the table, helping EUR/JPY moderate the early May pullback.

- Prelim University of Michigan data takes focus going forward, with markets looking for inflation expectations to havbe moderated in the May prelim read. The central bank speaker slate will also draw some focus, with BoE's Pill set to speak as well as Fed's Daly - although Daly's appearance is unlikely to result in policy-relevant comments.

FX OPTIONS: Expiries for May12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0985-00(E601mln), $1.1020-40(E1.4bln), $1.1050(E697mln), $1.1090-00(E1.4bln)

- USD/JPY: Y135.00($1.1bln), Y136.00-20($1.1bln)

- EUR/GBP: Gbp0.8725-40(E539mln)

- AUD/USD: $0.6740(A$742mln)

- USD/CAD: C$1.3425-35($536mln), C$1.3500($563mln)

EQUITIES: E-Mini S&Ps Pare the Majority of Thursday's Losses

- Eurostoxx 50 futures remain in consolidation mode. Price is trading above support at 4233.90, the 50-day EMA. The recent move down is considered corrective and the broader uptrend is intact. A continuation higher would signal scope for a test of 4363.00, the Apr 21 high and bull trigger. Clearance of this level would confirm a resumption of the uptrend. A clear break of the 50-day EMA is required to signal a top.

- S&P E-minis are consolidating and continue to trade above the 50-day EMA, which intersects at 4106.37. A continuation higher would refocus attention on key resistance and the bull trigger at 4206.25, the May 1 high. A breach of this level would confirm a resumption of the bull trend that started Mar 13. Key support has been defined at 4062.25, the May 4 low. A move through this support would be a bearish development.

COMMODITIES: WTI Futures Ease Off Recent Highs

- WTI futures have pulled back from recent highs. The latest recovery is considered corrective and the move higher has allowed a recent oversold trend condition to unwind. Initial resistance is at $73.93, the Apr 28 low ahead of $76.92, the Apr 28 high. On the downside, the recent print below $64.58, the Mar 20 low and a key support, reinforces a bearish theme. A clear break of it would confirm a resumption of the broader downtrend.

- Gold trend conditions remain bullish. The yellow metal has recently breached resistance at $2048.7, the Apr 13 high to confirm a resumption of the broader bull cycle. This maintains the bullish price sequence of higher highs and higher lows and moving average studies are in a bull-mode set-up. The focus is on $2070.4, the Mar 8 2022 high ahead of the all-time high at $2075.5. Key support is 1969.3, the Apr 19 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/05/2023 | 0800/1000 |  | EU | ECB de Guindos Lecture at Academia Europea Leadership | |

| 12/05/2023 | 1115/1215 |  | UK | BOE Pill & Shortall Monetary Policy Report National Agency Briefing | |

| 12/05/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 12/05/2023 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 12/05/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/05/2023 | 1820/1420 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.