-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Pivot Pricing Back in Focus

Highlights:

- Pivot pricing returns with bonds bid, dollar dented

- Spot gold at strongest level since mid-August, nearing key upside level

- Fedspeak in focus, with FOMC's Harker & Cook on the docket

US TSYS: TYZ2 Sets New Post-CPI Highs

- Cash Tsys largely looked through weaker than expected China economic data and G20-related communique suggesting continued differences re the Russia-Ukraine war, only for an increasingly large bid through European hours despite a larger than expected bounce in German ZEW sentiment.

- A terminal rate drifting back to Friday close levels keeps downward pressure on front end yields but with broad pressure also across the curve: 2YY -3.8bps at 4.351%, 5YY -5.6bps at 3.934%, 10YY -4.3bps at 3.811%, and 30YY -2.5bps at 4.011%.

- TYZ2 trades 12+ ticks higher at 112-16+, close to session highs of 112-21+ that form initial resistance having pushed through post CPI highs of 112-19 on above average volumes. It opens key resistance at 113-30 (Oct 4 high) having cleared the 50-day EMA of 112-12+.

- Data: PPI inflation for Oct with usual implications for core PCE and Empire manufacturing, both at 0830ET.

- Fedspeak: Harker (’23 voter, text) 0900ET, Gov Cook 0900ET and VC Supervision Barr (text) 1000ET.

- No issuance.

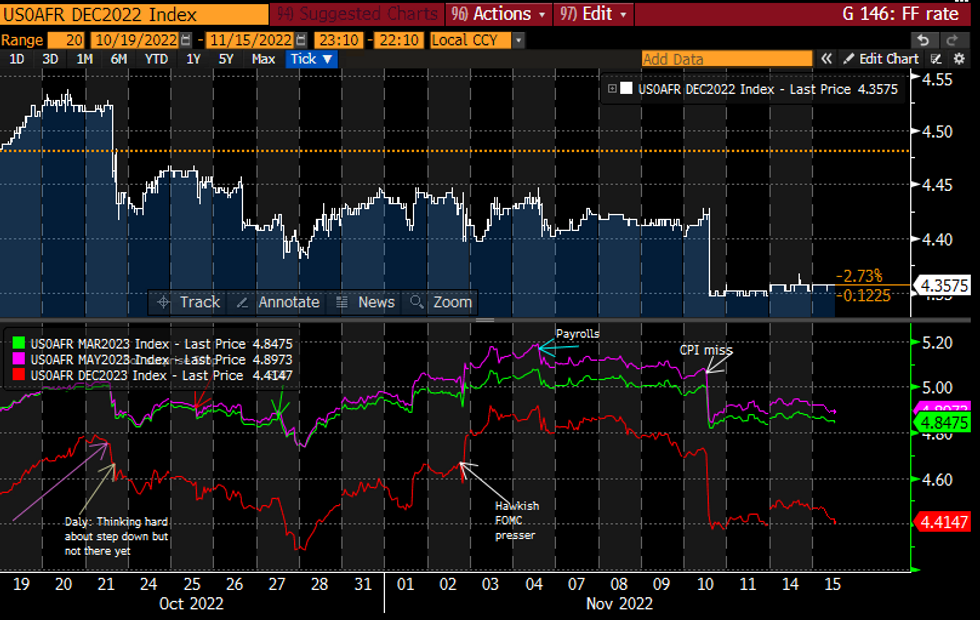

STIR FUTURES: Fed Rate Path Unwinds Waller Boost

- Fed Funds implied hikes continue to cool into 2023, nearly back at Friday’s close after previously being boosted by Waller weekend comments that better CPI was just one print.

- 51bp for Dec (+0.5bp), cumulative 85bp to 4.70% for Feb (-0.5bp), terminal 4.89% May (-2.5bp) and 4.41% for Dec’23 (-5bp). The almost 50bps of cuts priced to end-2023 is contrary to closer to 35bps prior to CPI.

- Front-loaded Fedspeak: Harker (’23 voter, text) at 0900ET, Gov Cook at 0900ET and VC Supervision Barr (text) at 1000ET.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

BOND SUMMARY: Tsy Futures Eye Post-CPI Highs

Global core FI is stronger across geographies and curves early Tuesday, with the USD under a little pressure, and terminal Fed funds expectations pulling back a little.

- Against that backdrop, US Tsy futures are nearing the post-CPI, pre-Veterans Day highs (112-19 the level to watch for TYZ2).

- Bunds and Gilts are strnger, but periphery EGBs are outperforming in Europe (10Y BTP spreads to Bunds are testing 200bp again).

- While data hasn't hugely moved markets, there has been plenty: UK wage data impressed; CPIs in the Eurozone were finals, EU GDP was in-line, and German ZEW improved strongly.

- Main focus for the rest of the session is on US PPI, which while unlikely to have much impact, will be eyed for further pipeline inflation pressures. Empire State Manufacturing also worth watching.

- ECB speakers later include Holzmann and Elderson; Fed speakers: Harker, Cook, and Barr.

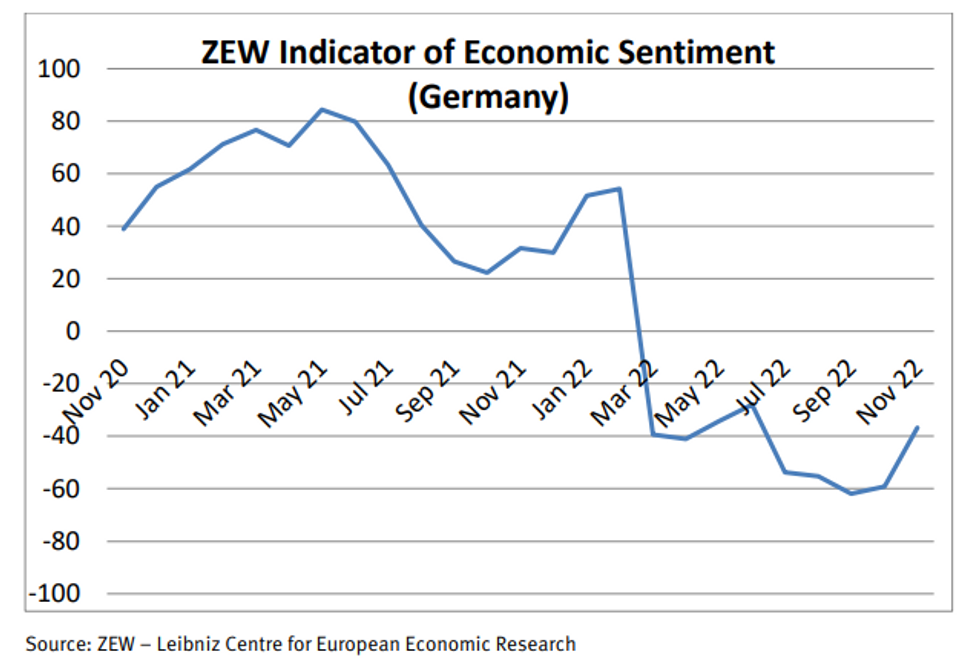

GERMANY: ZEW Boost From 'Improved' Inflation Outlook

GERMANY NOV ZEW SURVEY EXPECTATIONS -36.7 (FCST -51.0); OCT -59.2

GERMANY NOV ZEW CURRENT SITUATION -64.5 (FCST -69.3); OCT -72.2

- The German ZEW survey recorded a substantial 22.5 rebound in expectations, lifting the index to -36.7, the highest since June. Outlooks still remain in negative territory.

- The perception of the current situation also saw recovery, albeit less markedly (+7.7 to -64.5).

- According to the report, improvements were largely on the back of hopes that inflation will fall in the near future and monetary tightening will not be as severe as initially anticipated. Whether this merits the jump in outlooks is uncertain.

- October recorded a surge in inflation to +11.6% y/y (HICP). With prices yet to see any cooling, German industry will see weak demand and profit margins into year-end.

- Pessimistic outlooks regarding global demand persist, yet improvements in China's growth outlooks could provide a much-needed boost to the German export industry.

EUROPE ISSUANCE UPDATE:

EU Syndication Update- E6bln of the new Feb-33 Green EU. Books over E33bln. Spread set at MS+1bps

- E2.5bln of the new Mar-53 EU MFA. Books over E23bln. Spread set at MS+74bp

- GBP3.25bln of the 1.00% Jan-32 Gilt. Avg yield 3.426% (bid-to-cover 2.11x, tail 0.7bp)

- GBP2.25bln of the 0.875% Jan-46 Gilt. Avg yield 3.592% (bid-to-cover 2.11x, tail 0.5bp)

German auction result

- E4bln (E3.105bln allotted) of the 2.10% Nov-29 Bund. Avg yield 2.1% (bid-to-cover 1.38x)

- E695mln of the 1.375% Apr-27 RFGB. Avg yield 2.423% (bid-to-cover 1.93x)

- E750mln of the 1.375% Apr-47 RFGB. Avg yield 2.661% (bid-to-cover 1.48x).

FOREX: EUR/USD Nearing 200-dma Last Crossed in 2021

- The greenback is fading early Tuesday, prompting EUR/USD to print a fourth session of higher highs and narrow the gap with the next key upside level at 1.0429 - the 200-dma. The pair hasn't traded above this level consistently since May 2021.

- Markets continue to take recent Fed communications into balance, with WSJ's Nick Timiraos citing Brainard in writing this morning that the Fed are likely to slow their tightening pace in December - the so-called 'policy pivot' that markets have been on the lookout for over the past few months.

- As a result, growth proxies are outperforming early Tuesday, with AUD and NZD among the session's best performers. CHF and JPY are trading more moderately given the upside in US equity futures, with the e-mini S&P higher by 0.7% at typing.

- US Empire Manufacturing and PPI for October are the data highlights Tuesday, with Canadian manufacturing sales also due. The Fed speaker slate picks up, with commentary from Fed's Harker and Cook on the docket.

COMMODITIES: Gold Prints Seventh Consecutive Higher High

The pullback in WTI futures early last week continues to highlight a bearish threat. A bearish shooting star candle on Nov 7 was followed by a bearish engulfing candle the following day - a strong bear signal. Yesterday’s move lower reinforces this theme. A continuation lower would open $81.30, Oct 18 low. On the upside, key short-term resistance is at $93.74, Nov 7 high.

Gold rallied sharply higher last week and remains bullish this week. Last week’s gains resulted in the break of a number of important resistance points. The yellow metal has cleared $1729.5, the Oct 4 high. This strengthens the current bullish theme and paves the way for an extension towards the $1800.0 handle and resistance at $1807.9, the Aug 10 high. On the downside, initial firm support is seen at $1702.3, the Nov 9 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 15/11/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 15/11/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 15/11/2022 | 1000/1100 | * |  | EU | Trade Balance |

| 15/11/2022 | 1000/1100 | * |  | EU | Employment |

| 15/11/2022 | 1000/1100 | *** |  | EU | GDP First Estimates |

| 15/11/2022 | 1130/1130 | ** |  | UK | Gilt Outright Auction Result |

| 15/11/2022 | - |  | ID | G20 Summit in Indonesia | |

| 15/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 15/11/2022 | 1330/0830 | *** |  | US | PPI |

| 15/11/2022 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 15/11/2022 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 15/11/2022 | 1400/0900 |  | US | Philadelphia Fed's Patrick Harker | |

| 15/11/2022 | 1400/0900 |  | CA | BOC Deputy Kozicki moderates panel on diversity | |

| 15/11/2022 | 1400/0900 |  | US | Fed Governor Lisa Cook | |

| 15/11/2022 | 1500/1000 |  | US | Fed Vice Chair for Supervision Michael Barr | |

| 15/11/2022 | 1630/1630 |  | UK | BOE Discusses Selling of "temporary" Holdings of Long-dated/IL Gilts w. GEMMS | |

| 15/11/2022 | 1730/1830 |  | EU | ECB Elderson Speech at Euro Finance Week | |

| 16/11/2022 | 0030/1130 | *** |  | AU | Quarterly wage price index |

| 16/11/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 16/11/2022 | 0700/0700 | *** |  | UK | Producer Prices |

| 16/11/2022 | 0900/1000 | *** |  | IT | HICP (f) |

| 16/11/2022 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 16/11/2022 | 0930/0930 | * |  | UK | ONS House Price Index |

| 16/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 16/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 16/11/2022 | - |  | ID | G20 Summit in Indonesia | |

| 16/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 16/11/2022 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 16/11/2022 | 1330/0830 | *** |  | CA | CPI |

| 16/11/2022 | 1330/0830 | *** |  | US | Retail Sales |

| 16/11/2022 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 16/11/2022 | 1415/0915 | *** |  | US | Industrial Production |

| 16/11/2022 | 1415/1415 |  | UK | BOE Treasury Select Committee hearing on Nov Monetary Policy Report | |

| 16/11/2022 | 1450/0950 |  | US | New York Fed's John Williams | |

| 16/11/2022 | 1500/1000 | * |  | US | Business Inventories |

| 16/11/2022 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 16/11/2022 | 1500/1600 |  | EU | ECB Lagarde Speech at European School Frankfurt Anniversary | |

| 16/11/2022 | 1500/1600 |  | EU | ECB Panetta at ABI's Executive Committee Meeting | |

| 16/11/2022 | 1500/1000 |  | US | Fed Vice chair for Supervision Michael Barr | |

| 16/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 16/11/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 16/11/2022 | 1935/1435 |  | US | Fed Governor Christopher Waller | |

| 16/11/2022 | 2100/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.