-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Pricing Consolidates Around 50bps Pre-CPI

Highlights:

- CPI provides last look ahead of Wednesday Fed

- 50bps still most likely move by FOMC, per market pricing

- NOK, AUD stronger on underpinned commodity market

TSYS: Modest Bull Flattening With CPI Firmly In Focus

- Cash Tsys trade modestly richer this morning, in a relatively narrow range well within yesterday’s levels on a modestly risk-on atmosphere. Little in the way of headlines overnight, with China & HK Covid-related headline flow having little impact coming ahead of US CPI at 0830ET, the last major input before tomorrow’s FOMC decision.

- 2YY -0.2bps at 4.373%, 5YY -1.4bps at 3.775%, 10YY -2.0bps at 3.591%, 30YY -3.1bps at 3.541%.

- TYH3 trades 4+ ticks higher at 113-31 on slightly below average volumes. The pullback in prior days is seen as corrective with resistance eyed at the bull trigger of 115-06+ (Dec 7 high) but further downside could test 113-21+ (Dec 2 low).

- Data: CPI Nov (0830ET), Real av hourly earnings Nov (0830ET)

- Bond issuance: US Tsy $18B 30Y Bond re-open (912810TL2) – 1300ET

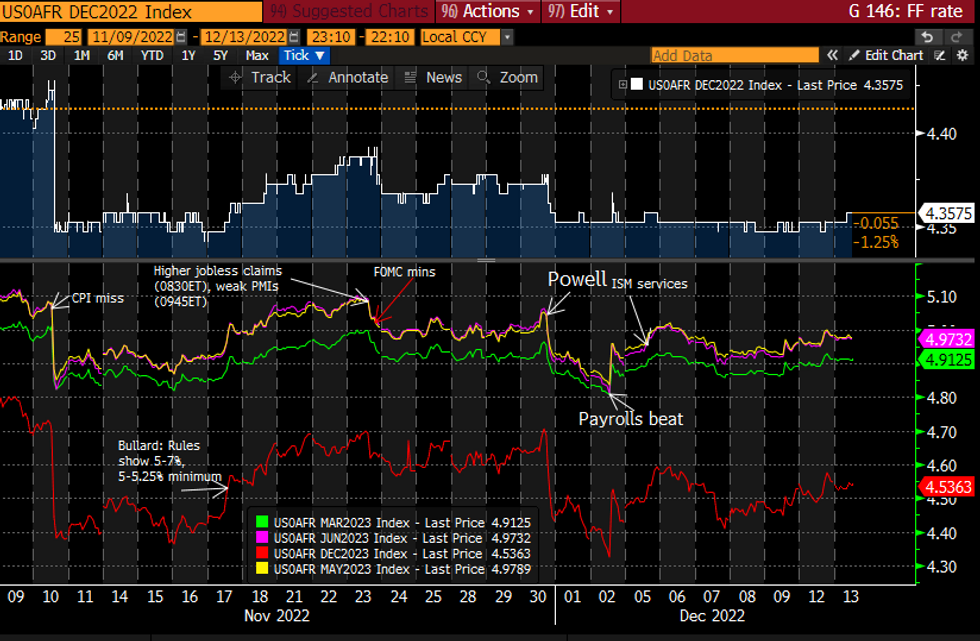

STIR FUTURES: Fed Rate Path Consolidates Increase Ahead Of CPI

- Fed Funds implied hikes overnight held yesterday’s gain, with 53bp for Dec, a cumulative 91bp to 4.74% for Feb’23, terminal 4.98% for May’23 and 4.54% Dec’23.

- The 44bps of cuts priced from the May peak to end-23 is near the lower end of the range since Powell’s Brookings Nov 30 comments but higher end of the post Nov 2 FOMC range.

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

MNI Previews for this week's risk events:

- US CPI Preview: https://roar-assets-auto.rbl.ms/files/48906/USCPIP...

- Fed Preview: https://roar-assets-auto.rbl.ms/files/48886/FedPre...

- Fed Sell-side Analyst views: https://roar-assets-auto.rbl.ms/files/48908/FedPre...

- ECB Preview: https://roar-assets-auto.rbl.ms/files/48893/ECB%20...

- Norges Bank Preview: https://roar-assets-auto.rbl.ms/files/48914/MNINBP...

SLOVAKIA: No Confidence Vote Suspended Until 15 Dec

A no confidence vote in the gov't of PM Eduard Heger, scheduled to have taken place at 1100CET, has been postponed until Thursday 15 December according to wires.

- The minority Heger gov't holds 70 seats in the National Council, and is supported from the outside by five other deputies. The opposition has a combined 75 seats, meaning the swing of even a single deputy in the confidence vote could have a significant impact.

- Local media reports that independent lawmaker Slavena Vorobelova, formerly of the far-right 'People's Party Our Slovakia', has indicated she will back the no confidence motion, leaving Heger with a difficult challenge in winning majority support.

- Should the Heger gov't fall it could have a notable impact at the CEE, EU and wider European level. Slovakian gov't under Heger has been a strong supporter of Ukraine and backed EU efforts to back Kyiv. However, leftist and populist parties doing well in polls have advocated for policies that reduce economic burden on Slovakian households, even if this comes at the expense of backing Ukraine.

FX SUMMARY: CPI Provides the Last Look Ahead of Weds Fed

- Currency markets generally trade inside their recent ranges early Tuesday, with the EUR/USD rate oscillating either side of 1.0550. Similarly, GBP/USD sits inside the week's range so far, with markets awaiting cues from the BoE, ECB and Fed later this week.

- On an intraday basis, there remains minor strength in commodity-tied currencies, putting the likes of AUD, NZD and NOK toward the top-end of the G10 pile as equities extend their recovery off the Monday low. The e-mini S&P remains around 80 points higher on the week, with a late rally into the Monday close largely responsible for the jump.

- Similarly, crude prices have worked their way higher, as concerns around an extended delay to flow through the Keystone Pipeline continue to circulate. This has kept NOK underpinned, with the EUR/NOK rate back below 10.50 ahead of Thursday's Norges Bank decision.

- Focus turns to the November CPI release due later today, with markets expecting a significant step lower to 7.3% and 6.1% for the headline and core Y/Y measures (down from 7.7% and 6.3% respectively).

- The release will be the final look for the FOMC ahead of Wednesday's FOMC rate decision, at which markets continue to expect the board to opt for a slower pace of tightening at 50bps.

BOND SUMMARY: Tsys Steady, Gilts Underperforming Pre-US CPI

Core global FI is mostly softer ahead of the first of the week's major risk events - US CPI (our preview is here).

- Treasury yields have largely traded sideways ahead of the release (0830ET/1330GMT) - core eyed most closely, 0.3% M/M survey, with a modest skew to the upside.

- A modestly risk-on atmosphere prevails, with S&P futures touching 4,000.

- Bunds are cheaper but yields have retraced from session highs, while Gilts are underperforming. EGB periphery spreads are mixed.

- Some attention on BoE pricing, with terminal rates pushing above 4.70% (Aug-Sep 2023) for the first time in a few weeks. Labour market data out earlier was largely in line, with higher nominal wages still negative in real terms on high inflation.

- German ZEW reading was mixed, with expectations slightly stronger than expected, but "current situation" was weaker.

- In the US, aside from CPI, the 30Y Bond re-open at 1300ET also features.

Latest levels:

- Mar US 10-Yr futures (TY) up 2.5/32 at 113-29 (L: 113-25 / H: 114-01)

- Mar Bund futures (RX) down 25 ticks at 140.23 (L: 139.77 / H: 140.4)

- Mar Gilt futures (G) down 42 ticks at 104.6 (L: 104.59 / H: 105.23)

- Italy / German 10-Yr spread 0.4bps wider at 189.3bps

FX OPTIONS: Expiries for Dec13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0450(E752mln), $1.0500(E717mln), $1.0550-55(E1.3bln), $1.0600-15(E1.3bln)

- AUD/USD: $0.6750(A$613mln), $0.6800(A$708mln)

- USD/CAD: C$1.3700($674mln)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/12/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/12/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 13/12/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 13/12/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 13/12/2022 | 1330/0830 | *** |  | US | CPI |

| 13/12/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 13/12/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 13/12/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 14/12/2022 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 14/12/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 14/12/2022 | 0700/0800 | *** |  | SE | Inflation report |

| 14/12/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/12/2022 | 0930/0930 | * |  | UK | Halifax House Price Index |

| 14/12/2022 | 1000/1100 | ** |  | EU | Industrial Production |

| 14/12/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 14/12/2022 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 14/12/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 14/12/2022 | 1900/1400 | *** |  | US | FOMC Statement |

| 15/12/2022 | 2145/1045 | *** |  | NZ | GDP |

| 14/12/2022 | 2230/2330 |  | EU | ECB Elderson Pre-recorded Speech at COP15 |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.