-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

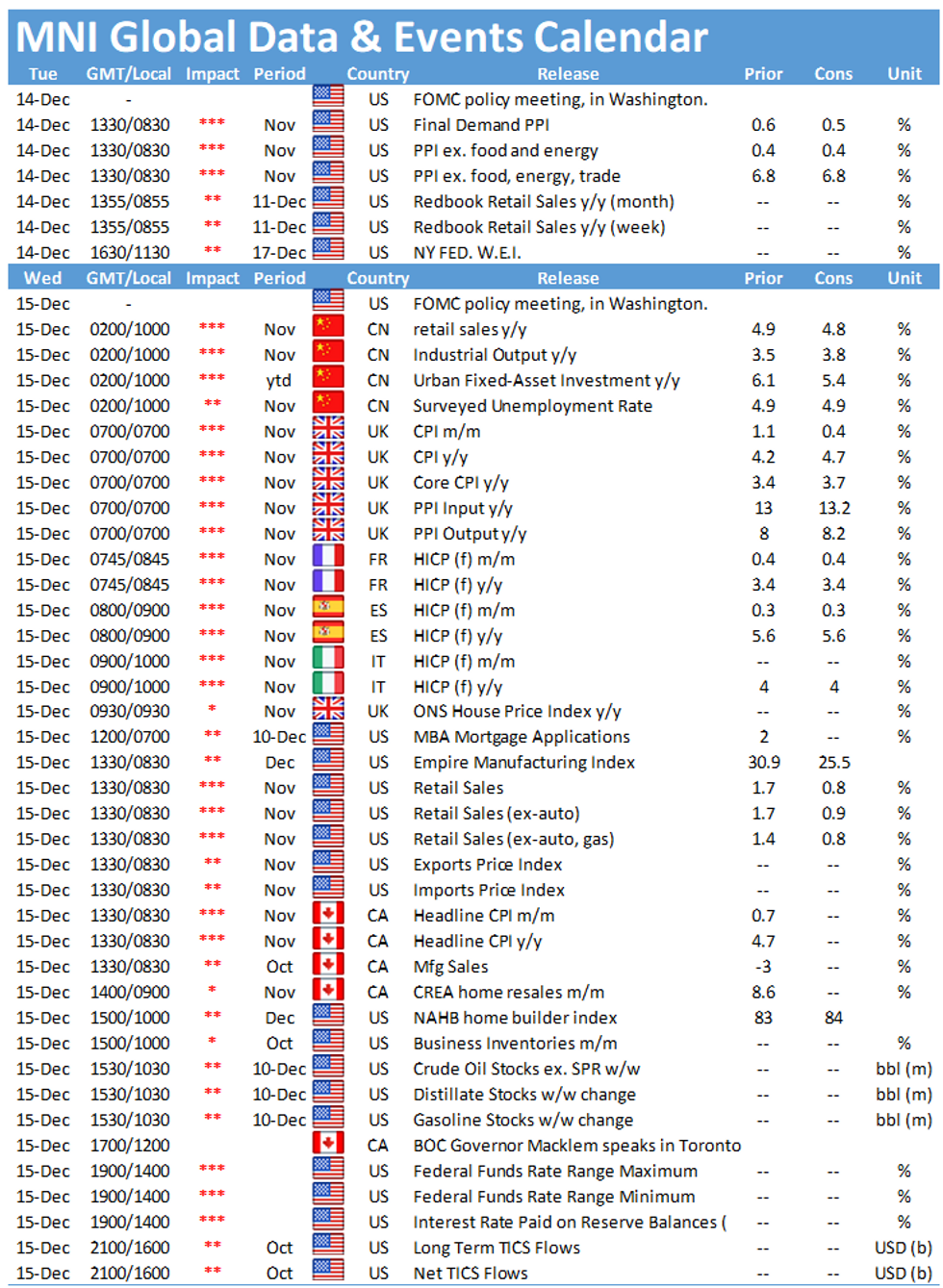

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI FOMC Hawk-Dove Spectrum

MNI US MARKETS ANALYSIS - Risk Off Feel, With Focus Turning to Looming CB Schedule

HIGHLIGHTS:

- Markets have a risk-off tone, with e-mini S&P showing below Monday lows

- South Africa study shows Pfizer efficacy waning vs. omicron

- US PPI seen climbing to new series high

US TSYS SUMMARY: A Pause After Yesterday's Bull Flattening

- Cash Tsys have seen a minor sell-off across the curve as they settle after yesterday afternoon’s sizeable bull flattening ahead of tomorrow’s Fed decision.

- 2Y yields are +1.6bps at 0.649%, 5Y +2.0bps at 1.224%, 10Y +1.7bps at 1.433% and 30Y +1.7bps at 1.817%. The 2s10s spread of 78bps is close to recent lows which in turn are the lowest since Dec 2020.

- TYH2 futures have traded in a tight range today at 130-25+, consolidating yesterday’s rally.

- The Biden-Manchin call was “constructive” but Manchin still won’t yet back the $1.9T Build Back Better. He said “anything’s possible” when asked if a deal was possible before the holiday.

- The Senate votes today to increase the debt ceiling to extend govt funding until at least Nov 2022, with a good chance the House also votes today. Both are expected to pass, allowing Biden to sign it into law.

- US data is overshadowed by the Fed tomorrow, but we have PPI inflation for Nov at 0830ET, with implications for next week’s PCE deflator print.

- NY Fed buy-op: Tsy 0Y-2.25Y, appr $9.325B Vs. $10.875B prior (1030ET).

- No issuance ahead of the debt ceiling vote.

EGB/GILT SUMMARY: Attention turning to CBs later this week

Core fixed income have been grinding lower off of yesterday's highs through most of the morning session with little in the way of headline drivers. Overall, however, moves have been rather limited.

- Attention is turning to the FOMC decision tomorrow and BOE/ECB meetings Thursday.

- Today the UK parliament's vote on Covid Plan B restrictions will be watched, as will the US Senate's vote on the debt ceiling extension.

- On the data front we have already seen some strong UK labour market data while the data highlight later will be US PPI.

- TY1 futures are down -0-2 today at 130-25 with 10y UST yields up 1.3bp at 1.430% and 2y yields up 1.4bp at 0.649%.

- Bund futures are down -0.19 today at 174.49 with 10y Bund yields up 1.1bp at -0.373% and Schatz yields up 1.1bp at -0.703%.

- Gilt futures are down -0.12 today at 127.42 with 10y yields up 1.5bp at 0.710% and 2y yields up 1.8bp at 0.406%.

EUROPE ISSUANCE UPDATE

Italy sells E3.5bln 0% Dec-24 BTP, Avg yield -0.100% (Prev. -0.160%)

Austria sells E805mln 0% Feb-31 RAGB, Allotted E700mln, Avg yield -0.156% (Prev. -0.031%), Bid-to-cover 2.20x (Prev. 2.90x)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXF2 174/173.5/173p fly, bought for 5 in ~2k

2RH2 100/99.75/99.62 broken p fly, bought for 4.5 in 2k

ERU3 99.50p, bought for 17.5 in 2k

FOREX: EUR/USD Back Above 1.13 as Risk Wanes

- Markets trade with a general risk-off tone, as equity indices slip through yesterday's lows and extend the pullback off the week's best levels at 4731 printed on Monday. This has translated into more solid haven currencies - with CHF and JPY among the session's best performers, although the single currency also trades well, with EUR/USD back above the 1.13 handle and eyeing the next resistance level at Monday's 1.1319.

- The broad risk-off follows the release of a further dataset from South Africa's Discovery study into omicron, which showed the effectiveness of the Pfizer jab against omicron waned to 33% from 80% against the prior delta variant.

- Risk and growth proxies including the NOK and AUD are the poorest performers as a result, with USD/NOK rising to touch new weekly highs of 9.0912.

- US PPI data takes focus going forward, with the Y/Y final demand figure seen climbing to a new series high of 9.2%. There are few speakers of note, keeping focus on the key policy decisions due later in the week.

FX OPTIONS: Expiries for Dec14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1295-00(E642mln)

- USD/JPY: Y113.00($825mln), Y113.80-95($1.4bln)

- EUR/GBP: Gbp0.8450(E710mln), Gbp0.8530-50(E879mln)

- AUD/USD: $0.7130(A$596mln)

- USD/CAD: C$1.2670-75($529mln), C$1.2750($515mln)

Price Signal Summary: S&P E-Minis Pullback Considered Corrective

- In the equity space, S&P E-minis failed to hold onto yesterday’s high and the contract is trading lower this morning. The outlook remains bullish though and the focus is on the all-time high print of 4735.00 on Nov 22. The 50-day EMA at 4580.42 marks the key support. EUROSTOXX 50 futures maintain a bullish theme and short-term pullbacks are considered corrective. Sights are on 4311.70 next, the 76.4% retracement of the Nov 18 - 30 downleg. Support lies at 4137.00, the Jul 7 low.

- In FX, EURUSD continues to consolidate and trade below resistance at 1.1383, Nov 30 high. A break of this hurdle is required to signal potential for a stronger short-term recovery. The recent consolidation appears to be a triangle formation. Triangles are continuation patterns and this reinforces the underlying bear trend. Support levels to watch are; 1.1228, the Dec 7 low and 1.1186, Nov 24 low and the bear trigger. GBPUSD trend conditions remain bearish. Scope is seen for weakness towards 1.3135, the Dec 11 2020 low. 1.3321 is resistance, the 20-day EMA. The USDJPY bullish engulfing candle on Dec 6 continues to highlight a potential reversal at 112.53, the Nov 30 low. A break higher would open 114.38, 61.8% of the Nov 24 - 30 downleg and further out, 115.52, the Nov 24 high. Key support is unchanged at 112.53.

- On the commodity front, Gold continues to consolidate ahead of its bull channel that intersects at $1767.20 today. The channel is drawn from the Aug 9 low and represents the key short-term support. A break would open $1721.7, the Sep 29 low. The trend outlook in WTI futures remains bullish. Sights are on $74.40 next, the 50-day EMA. Initial support lies at $69.52, the Dec 7 low.

- In the FI space, Bund futures remain above the 20-day EMA, at 173.62 today. Last week’s high of 175.02 is the bull trigger where a break would confirm a resumption of the uptrend. A move below the 20-day EMA would threaten the trend and signal a short-term reversal. The Gilts trend outlook remains bullish. The focus is on 128.00 next, the Aug 31 high. Initial support lies at 126.67, Dec 10 low.

EQUITIES: A little lower on SA Omicron data

- Japan's NIKKEI down 207.85 pts or -0.73% at 28432.64 and the TOPIX down 4.32 pts or -0.22% at 1973.81

- China's SHANGHAI closed down 19.557 pts or -0.53% at 3661.525 and the HANG SENG ended 318.63 pts lower or -1.33% at 23635.95

- German Dax down 17.7 pts or -0.11% at 15613.42, FTSE 100 up 18.77 pts or +0.26% at 7252.49, CAC 40 down 1.13 pts or -0.02% at 6944.71 and Euro Stoxx 50 down 1.99 pts or -0.05% at 4183.59.

- Dow Jones mini down 37 pts or -0.1% at 35586, S&P 500 mini down 15.5 pts or -0.33% at 4655.75, NASDAQ mini down 106.75 pts or -0.66% at 15988.75.

COMMODITIES: Natgas leading commodities lower

- WTI Crude down $0.19 or -0.27% at $71.06

- Natural Gas down $0.07 or -1.9% at $3.723

- Gold spot down $1.71 or -0.1% at $1784.66

- Copper down $1.05 or -0.25% at $427.4

- Silver down $0.12 or -0.54% at $22.2162

- Platinum down $0.76 or -0.08% at $932.06

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.