-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Scant Expectations of New Details From Powell

Highlights:

- Eyes on Stockholm as CB symposium on independence underway

- Powell slated to appear, but scant expectations he'll disclose new views

- Frenetic issuance slate, with several syndications and auctions across EGB space

- Markets largely picking up where they left off, with CPI & earnings the focus

US TSYS: Paring Gains Pre-Powell, 3Y Supply Later

- Cash Tsys have pared some of yesterday’s further gains in relatively light trade with Chair Powell eyed at 0900ET, although increased data dependency potentially sees this somewhat in CPI’s shadow on Thursday.

- 2YY +2.9bps at 4.237%, 5YY +2.1bps at 3.694%, 10YY +2.6bps at 3.558% and 30YY +1.2bps at 3.672%, mostly remaining in the lower end of yesterday’s ranges and with 2YY down more than 25bps from just before payrolls on Friday.

- TYH3 trades 9 ticks lower at 114-11 as it pulls back from yesterday’s high of 114-23+ on subdued volumes. The latter sets initial resistance where a renewed push higher as part of the bullish extension could open 115-08+ (2.0% 10-dma envelope). To the downside sits 113-11 (50-day EMA).

- Fedspeak: Powell speaks at a Riksbank panel on central bank independence (0900ET).

- Data: NFIB small business sentiment edged back close to cycle lows along with an encouraging 10pt decline in pricing plans almost back to pre-pandemic averages. Ahead, wholesale trade sales for Nov and final Nov for inventories (1000ET).

- Bond issuance: US Tsy $40B 3Y Note auction (1300ET)

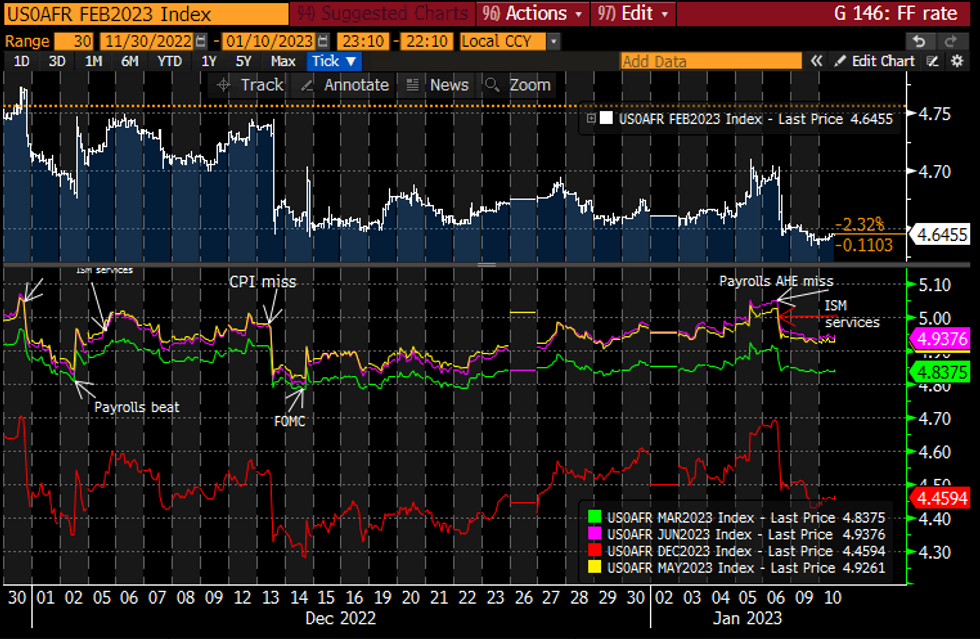

STIR FUTURES: Fed Rate Path Holds Post Payrolls/ISM Decline Before Powell

- Fed Funds implied hikes little changed after yesterday’s mild easing: 31.5bp for Feb (+0.5bp), cumulative 50.5bp to 4.84% Mar (+0.5bp), terminal 4.94% Jun (+0.5bp) and 4.46% Dec (+2bp).

- The terminal holds ~10bps lower just before payrolls/ISM services.

- Powell at 0900ET before of course CPI on Thu. Yesterday, ’24 voters Bostic and Daly warned about declaring victory on inflation prematurely whilst data dependency sees the Feb decision as between a 25bp or 50bp hike on the way to a terminal above 5%.

Source: Bloomberg

Source: Bloomberg

EUROPE ISSUANCE UPDATE

Belgium syndication update:

- New 10-year Jun-33 OLO. Size set at E7bln with book in excess of E51bln. Spread set at MS+10bps.

Italy syndication update:

- New 20-year Sep-43 BTP. Last update showed book in excess of E25bln. Spread set at 1.80% Mar-41 BTP + 12bps

Latvia syndication update:

- New 5-year Jan-28. Size set at E750mln with book in excess of E3.7bln. Spread set at MS+75bps.

Dutch auction result:

- E3.485bln of the 0% Jan-26 DSL. Avg yield 2.578%.

Austria auction results:

- E460mln (E400mln allotted) of the 2.00% Jul-26 RAGB. Avg yield 2.514% (bid-to-cover 3.02x).

- E690mln (E600mln allotted) of the 1.50% Feb-47 RAGB. Avg yield 2.835% (bid-to-cover 2.36x).

German auction result:

- E500mln (E308mln allotted) of the 0.10% Apr-33 ILB. Avg yield 0.16% (bid-to-cover 0.93x).

Gilt auction result:

- GBP3bln of the new 10-year 3.25% Jan-33 Gilt. Avg yield 3.697% (bid-to-cover 2.77x, tail 0.3bp).

FOREX: Currencies Pick Up Where They Left Off

- Currency markets have picked up where they left off on Monday, with EUR/USD holding above the 1.07 handle well ahead of the NY crossover. Overnight developments have been muted, with the main development of the week remaining the USD's step lower on Monday as well as the bullish break for European equities posted ahead of the close.

- A strong recovery extended Monday in EURUSD, confirming the end of the recentcorrective pullback. The bull trigger at the Dec 15 high at 1.0735, has been cleared and this confirms a resumption of the uptrend. The break higher maintains the bullish price sequence of higher highs and higher lows and note that MA studies are in a bull-mode position. The focus is on 1.0787, the May 30, 2022 high.

- CNH sits slightly lower on an intraday basis, but USD/CNH managed a lower low during Asia-Pac hours. This put the pair at new multi-month lows of 6.7589. 6.7359 sits as next support, the Aug 15 2022 low.

- Tier one data releases remain few and far between, keeping focus on central bank speak. The Riksbank hold a day-long conference on the topic of central bank independence, with Fed's Powell, BoE's Bailey, ECB's Schnabel, BoC'S Macklem and others all due to appear.

- The relevance of their comments on near-term policy remains to be seen, with market focus still on Thursday's US CPI release and the incoming raft of US corporate earnings reports.

FX OPTIONS: Expiries for Jan10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0825-50(E512mln), $1.1222-38(E1.6bln)

- USD/JPY: Y131.80-00($520mln)

- GBP/USD: $1.2000(Gbp867mln), $1.2065-85(Gbp510mln)

- AUD/USD: $0.6800(A$501mln)

- USD/CAD: C$1.3500($2.0bln)

BONDS: Yields Higher With Supply, Cenbank Speakers In Focus

Global core FI is slightly weaker in early Tuesday trade, with Bunds underperforming Tsys and Gilts. Focus is on supply and central bank communications.

- German yields have drifted higher most of the morning, with UK and US yields up but off session highs. Periphery EGB spreads are mostly wider.

- Most attention in Tuesday's session is on a Riksbank event that's just gotten underway and is running most of the day, with a heavy set of global central bank speakers due including Fed's Powell.

- While the data docket is relatively quiet, Tuesday's European issuance slate is packed, with supply from the Netherlands, Austria, UK, Belgium, Latvia, and Italy.

- USD corporate sales continue apace meanwhile, and $40B 3Y Note will kick off Tsy coupon issuance for 2023.

EQUITIES: Eurostoxx Futures Clear 4043.0 Bull Trigger, Opens 4100.0 Handle

EUROSTOXX 50 futures traded higher Monday, extending the recent climb. The contract has cleared resistance at 4043.00, the Dec 13 high and a bull trigger. The clear breach of this hurdle represents a key short-term bullish development and paves the way for gains towards the 4100.00 handle. Moving average studies are in a bull-mode condition, reinforcing the current positive trend condition. Initial support lies at 3912.60, the 20-day EMA. S&P E-Minis traded higher Monday but failed to hold on to the session high and closed at the day low. Key resistance at 3917.35, the 50-day EMA, has been breached. A continuation higher and a clear break of this EMA would suggest potential for a stronger recovery and highlight a possible reversal that would open 4000.00 next. On the downside, a break lower would confirm a resumption of the downtrend - the bear trigger is 3788.50, the Dec 22 low.

COMMODITIES: Monday Price Action Extends Current Gold Uptrend

WTI futures failed to hold on to yesterday’s gains. A bearish theme remains intact following the sell-off on Jan 3 and 4. Key support and the bear trigger lies at $70.31, the Dec 9 low. A break of this level would confirm a resumption of the broader downtrend and maintain a bearish price sequence of lower lows and lower highs. This would open $68.19, a Fibonacci projection. On the upside, key resistance is at $81.50, the Jan 3 high. Trend conditions in Gold remain bullish and the yellow metal traded higher Monday, starting the week on a firm note and extending the current uptrend. The move higher maintains the positive price sequence of higher highs and higher lows and note that moving average studies are in a bull mode position - reflecting the current trend condition. The focus is on $1896.5, a Fibonacci retracement. On the downside, support to watch lies at $1825.2, Jan 5 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/01/2023 | 1010/0510 |  | CA | Governor Macklem at Riksbank Conference | |

| 10/01/2023 | 1010/1010 |  | UK | BOE Governor Bailey at Riksbank conference | |

| 10/01/2023 | 1010/1110 |  | EU | ECB's Isabel Schnabel at Riksbank conference | |

| 10/01/2023 | 1010/1910 |  | JP | BOJ Governor Haruhiko Kuroda at Riksbank conference | |

| 10/01/2023 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 10/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 10/01/2023 | 1400/0900 |  | US | Fed Chair Jerome Powell at Riksbank conference | |

| 10/01/2023 | 1400/1500 |  | DE | Buba Vice President Claudia Busch as Riksbank conference | |

| 10/01/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 10/01/2023 | 1500/1000 | ** |  | US | Wholesale Trade |

| 10/01/2023 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 11/01/2023 | 0030/1130 | ** |  | AU | Retail Trade |

| 11/01/2023 | 0900/1000 | * |  | IT | Retail Sales |

| 11/01/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 11/01/2023 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 11/01/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.