-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI US MARKETS ANALYSIS - Shaky Equities Shows Prices Could Remain Volatile into Holidays

Highlights:

- EUR/USD surge puts USD on backfoot into NY hours

- Shaky equity market shows markets could remain volatile across holiday period

- Tertiary GDP/PCE unlikely to waver underlying market theme

US TSYS: Yesterday’s Late Gains Pared, Jobless Claims And GDP Revisions Ahead

- Cash Tsys trade 3-4bps cheaper as they pare gains seen in spillover from the late equity slide. They still sit well within yesterday’s range having been biased richer by notably softer than expected UK CPI inflation and having ultimately faded beats for existing home sales and Conf. Board consumer confidence.

- TYH4 is close to the day’s low of 112-21, the middle of yesterday’s range on subdued volumes of 215k. Trend conditions remain bullish with resistance at yesterday’s 112-31+ before 113-12+ (Fibo projection of Oct-Nov price swing).

- Today sees data focus on initial jobless claims for a payrolls reference week whilst revisions should be watched for Q3 national accounts, before the last Tsy supply of the week with 5Y TIPS.

- Data: Third revision for Q3 national accounts (0830ET), Weekly jobless claims (0830ET), Philly Fed mfg Dec (0830ET), Conf Board Leading Index Nov (1000ET) and Kansas City Fed mfg Dec (1100ET).

- Note/bond issuance: Tsy $20B 5Y TIPS re-open (91282CJH5) – 1300ET

- Bill issuance: Tsy $80B 4-week bills, $80B 8-week bills – 1130ET

Fed Implied Rates Lift Off Yesterday’s Equity-Driven Lows

- Fed Funds implied rates have lifted back off lows seen late yesterday, triggered by risk-off following the slide in equity indices, which saw a close with a cumulative 25bp of cuts priced for March and 157bp to end-2024.

- As it is, Fed Funds are back to pricing 21.5bp of cuts for March, 47bp for May, 74bp for June and 151bp for Dec.

- There is no Fedspeak scheduled today, with finalized GDP and broader national account data for Q3 and jobless claims headlining the session.

MNI Global Macro Outlook-Dec 2023: What Could Go Wrong?

MNI's December 2023 Global Macro Outlook meeting surveyed the consensus outlook for the year ahead - PDF available here

- Market pricing overwhelmingly expects a “soft landing” in 2024; analysts agree but less so

- Global growth is seen below potential in 2024, with the US and Eurozone at stall speed

- Inflation is set to remain above 2% in most developed countries by well down and closed to target by 2025

- Modest fiscal drag is seen on 2024 growth vs 2023; historically low unemployment rates are seen ticking higher

- Manufacturing appears to be bottoming out, but services will be the key to 2024 growth and inflation outcomes

- Amid large-scale central bank rate cuts in 2024, consensus is for US dollar weakness

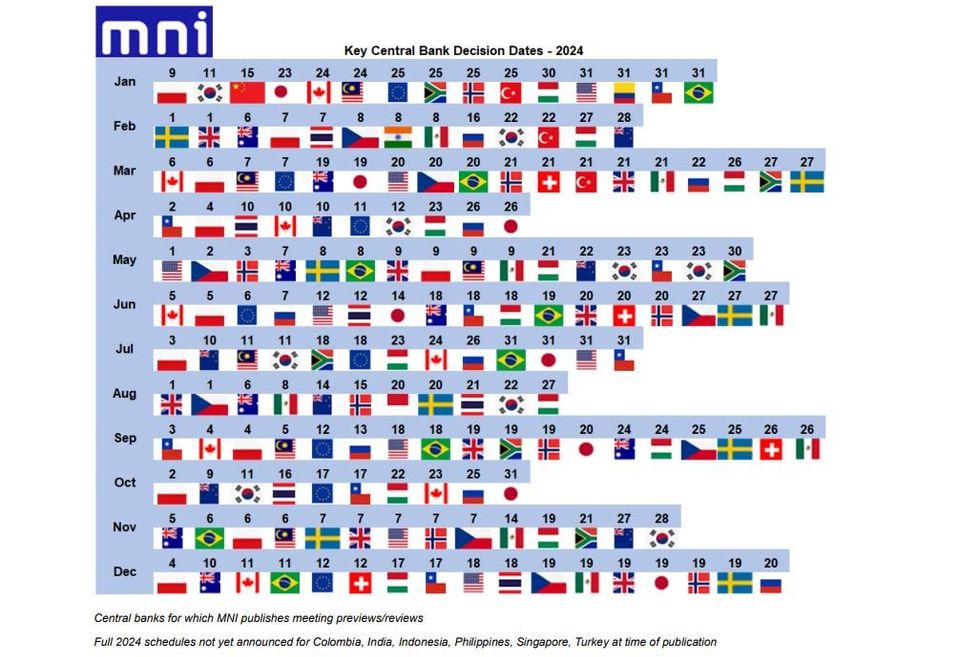

GLOBAL POLITICAL RISK: MNI Publishes Political Event Calendar 2024

MNI's Political Risk team has published its Political Event Calendar for 2024. In our Political Risk calendar for 2024 we include details on the major political events scheduled to take place in developed and major emerging markets over the course of the next 12 months. We only include those events that have a set date or period in which they will take place.

- Moreover, in a year that is already packed with major market-moving elections, summits, bilaterals, and conferences, there are a number of potential event that are seen as likely to take place but have no confirmed date, such as snap elections in Japan or the United Kingdom.

- The plethora of dates outlined in the table below, combined with unconfirmed but expected events; ongoing conflicts in Ukraine, the Middle East and elsewhere; continued political, economic, and resource competition between global powers; and the ever-present prospect of ‘black swan’ events will ensure that political risks continue to have a significant impact on financial and commodity markets through 2024.

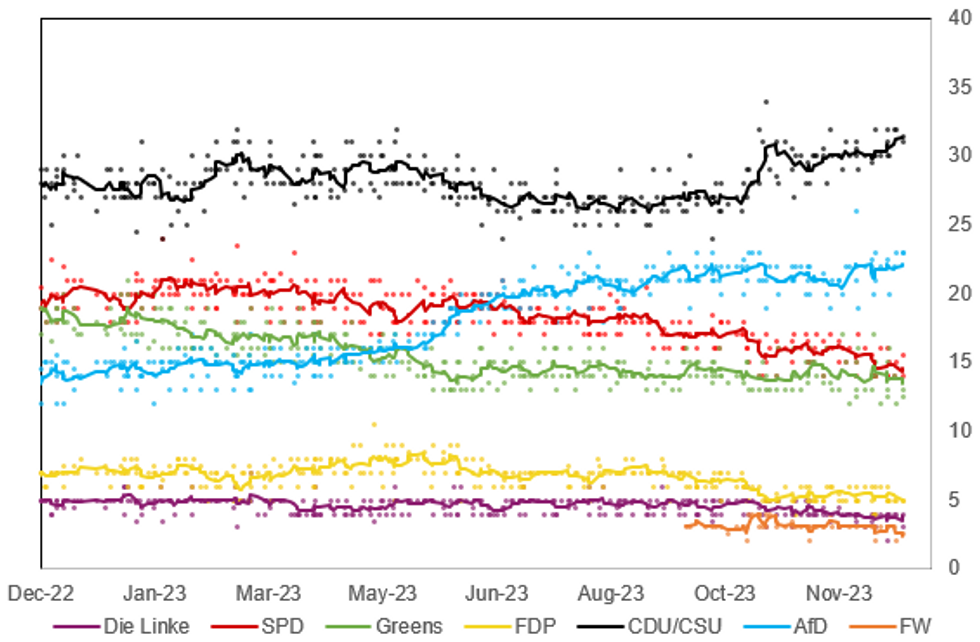

Ballot Underway As Members Vote On Whether FDP Should Remain In Gov't

A survey is underway among the ~76k members of the pro-business liberal Free Democratic Party (FDP) to gain their views on whether the party should remain as part of the federal governing coalition. The vote runs until 1 Jan 2024, and while non-binding in nature could have a significant impact on the stability of the German gov't. A strong vote against remaining in the 'traffic light' coalition, alongside the centre-left Social Democrats and environmentalist Greens, on a high turnout would place significant pressure on party leader and German Finance Minister Christian Lindner.

- Die Welt reports: "The initiative followed an open letter from 26 state and local politicians from the FDP who, after the poor election results in Hesse and Bavaria, had demanded that the FDP reconsider its coalition partners." Letters have been published publicly from senior FDP officials on both sides of the argument, highlighting the significant internal divisions.

- The vote comes in the immediate aftermath of a messy and combativebudget negotiation process that has hit public support levels for the governing parties. The FDP continues to barely exceed the 5% nationwide vote threshold, while the Greens and SPD record support at multi-year lows. The main opposition centre-right Christian Democratic Union (CDU) and the right-wing nationalist Alternative for Germany (AfD) have proved the main beneficiaries, with the latter's support at record-highs.

Source: FGW, INSA, Forsa, Infratest dimap, YouGov, Verian, Wahlkreisprognose, GMS Allensbach, MNI

Source: FGW, INSA, Forsa, Infratest dimap, YouGov, Verian, Wahlkreisprognose, GMS Allensbach, MNI

Surge in Volumes Triggers EUR/USD Rally

- Greenback extending losses further in recent trade, helping aid EUR/USD to a new daily high of 1.0985. We're seeing the best volumes of the day on this move higher: EUR futures have seen close to 3k contracts trade on the move for a cash equivalent of $400mln.

- Rally in spot narrows the gap with decent option interest at the $1.10 handle: E1.06bln set to roll off at that strike for today's NY cut.

- Recall the solid equity rally this month may prompt month-end FX rebalancing flows to be USD negative - an effect that could be brought forward given the staggered nature of market opening/closings across the next week or so.

FOREX: Shaky Equities Could Dictate Dollar Trends into New Year

- The JPY is furtively the firmest performer in G10, rising against all others to put USD/JPY through yesterday's lows and narrow the gap with the levels seen ahead of the BoJ decision earlier in the week. The 142.25 level marks key support ahead, a break below here would be bearish.

- The late sell-off for US equities on Wednesday has reminded markets that price action can remain volatile despite the proximity to the holiday break. US futures are paring losses, indicating a higher open on Wall Street later today, however the e-mini S&P remains a good 50 points off yesterday's highs.

- The USD Index sits modestly lower. Early month-end rebalancing models look to the sharp global stock market rally across December as pointing to greenback sales into month-end, of which flows may be front-loaded due to the staggered nature of market closures across the next week or so.

- GBP trades poorly, with GBP/USD holding the entirety of the post-UK CPI losses. The pair has plumbed a new low at 1.2612, however losses are deemed corrective in nature, as the underlying technical bull trend remains intact. The picture would deteriorate on a move below the 1.2500 handle - the Dec13 low - and the 200-dma of 1.2514.

- US PCE data and the weekly jobless claims numbers take focus during US hours. GDP sees its third revision, meaning markets may pay little attention to the backward-looking release. The Q3 data is expected unrevised at an annualized rate of 5.2%. ECB's Lane is set to speak, however his appearance yesterday may mean fresh policy messaging is unlikely.

Expiries for Dec21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0845-50(E2.6bln), $1.0900-20(E2.7bln), $1.0950-70(E2.9bln), $1.1000(E1bln)

- USD/JPY: Y144.75-80($1.0bln), Y145.00($1.3bln)

- GBP/USD: $1.2600-20(Gbp1.3bln), $1.2650-55(Gbp568mln), $1.2745-50(Gbp1.1bln)

- EUR/GBP: Gbp0.8630-35(E747mln)

- AUD/USD: $0.6800-15(A$1.9bln)

- NZD/USD: $0.6150(N$759mln)

- USD/CAD: C$1.3400-10($1.0bln)

- USD/CNY: Cny7.3300($1.3bln)

EQUITIES: Sharp Sell-Off in E-Mini S&P Deemed Technically Corrective For Now

- A bullish theme in Eurostoxx 50 futures remains intact and the latest pullback appears to be a correction. Recent gains confirmed, once again, a resumption of the uptrend and this has maintained the bullish price sequence of higher highs and higher lows. Moving average studies are in a bull-mode position too, signalling a rising cycle. The focus is on 4636.70, a long-term Fibonacci retracement. Support to watch is at 4503.90, the 20-day EMA.

- A bullish theme in S&P e-minis remains intact and yesterday’s abrupt sell-off appears to be a correction - for now. This week’s fresh trend highs, confirm once again a resumption of the uptrend that started Oct 27. The contract has recently cleared resistance at 4738.50, the Jul 27 high, reinforcing current positive trend conditions. Sights are on 4854.75 next, a Fibonacci projection. On the downside, initial firm support lies at 4681.74, the 20-day EMA.

COMMODITIES: Recent Gains in WTI Futures Appear Corrective with Bearish Conditions Intact

- Bearish conditions in WTI futures remain intact and recent gains still appear to be a correction. Resistance to watch is $76.06, the 50-day EMA. A clear break of this hurdle would strengthen a bullish theme and highlight a stronger reversal. For bears, moving average studies are in a bear-mode position, highlighting a downtrend. The bear trigger lies at $67.98, the Dec 13 low. A break of this level would open $65.24, the May 4 low and a key support.

- Gold is in consolidation mode. The Dec 13 reversal signals the end of the recent Dec 4 - 13 corrective pullback and highlights a bullish theme. MA studies are in a bull-mode position too, highlighting an uptrend. A continuation higher would signal scope for a climb towards key resistance and the Dec 4 all-time high of $2135.4. A break of this level would resume the primary bull trend. Initial firm support lies at $1973.2, the Dec 13 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/12/2023 | 1100/0600 | *** |  | TR | Turkey Benchmark Rate |

| 21/12/2023 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 21/12/2023 | 1330/0830 | *** |  | US | Jobless Claims |

| 21/12/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 21/12/2023 | 1330/0830 | * |  | CA | Payroll employment |

| 21/12/2023 | 1330/0830 | ** |  | CA | Retail Trade |

| 21/12/2023 | 1330/0830 | *** |  | US | GDP |

| 21/12/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 21/12/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 21/12/2023 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 21/12/2023 | 1600/1700 |  | EU | ECB Lane Participates In Workshop Panel | |

| 21/12/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 21/12/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 21/12/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 22/12/2023 | 2330/0830 | *** |  | JP | CPI |

| 22/12/2023 | 0700/0700 | *** |  | UK | Retail Sales |

| 22/12/2023 | 0700/0800 | ** |  | SE | Retail Sales |

| 22/12/2023 | 0700/0800 | ** |  | SE | PPI |

| 22/12/2023 | 0700/0700 | *** |  | UK | GDP Second Estimate |

| 22/12/2023 | 0700/0700 | * |  | UK | Quarterly current account balance |

| 22/12/2023 | 0700/0800 | ** |  | DE | Import/Export Prices |

| 22/12/2023 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 22/12/2023 | 0745/0845 | ** |  | FR | PPI |

| 22/12/2023 | 0800/0900 | *** |  | ES | GDP (f) |

| 22/12/2023 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 22/12/2023 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 22/12/2023 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 22/12/2023 | 1330/0830 | ** |  | US | Durable Goods New Orders |

| 22/12/2023 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 22/12/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 22/12/2023 | 1500/1000 | *** |  | US | New Home Sales |

| 22/12/2023 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 22/12/2023 | 1530/1530 |  | UK | Publication of the Treasury Bill Calendar for January - March 2024 | |

| 22/12/2023 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.