-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI US MARKETS ANALYSIS - Softer Short-End Yields Lead USD to Oct Lows

HIGHLIGHTS:

- Short-end leads recovery in Treasuries, prompting bull steepening

- Softer yields lead Greenback to fresh October lows

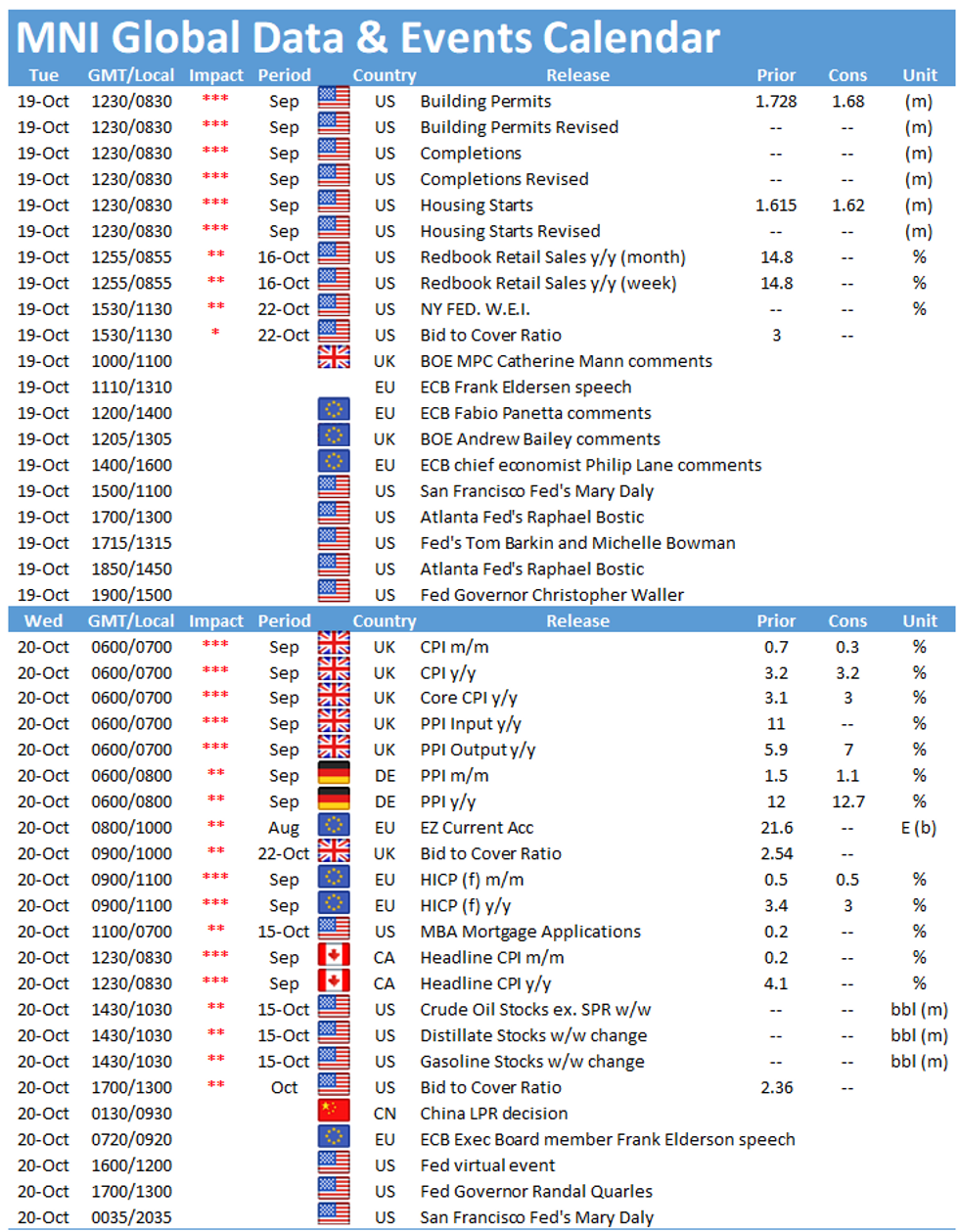

- Deluge of central bank speak, with plethora of ECB, BoE and Fed speakers due

US TSYS SUMMARY: Short End Leads Gains

Treasury yields have largely recovered from overnight lows, with the exception of the short end. The curve is therefore bull steepening, reversing some of Monday's bear flattening.

- The 2-Yr yield is down 3bps at 0.3953%, 5-Yr is down 2.3bps at 1.1471%, 10-Yr is down 1.1bps at 1.5897%, and 30-Yr is up 0.4bps at 2.0378%.

- Dec 10-Yr futures (TY) up 0.5/32 at 130-25 (L: 130-20.5 / H: 130-31).

- Front EDs have bounced, EDZ2 now up about 10 ticks from Monday's lows.

- Overall, the short-end gains haven't really been on any particular headline/macro driver, more of a retracement of yesterday's frantic price action.

- A solid Fed speaker slate: SF's Daly (1100ET), Richmond's Barkin (1215ET), Atlanta's Bostic (1450ET), Gov Waller (1500ET).

- In data, Sept housing starts at 0830ET.

- Supply consists of a $60B 40-Day bill auction at 1130ET. NY Fed buys ~$8.425B of 2.25-4.5Y Tsys and ~$2.025B of 1-7.5Y TIPS.

EGB/GILT SUMMARY: Gilts Stabilise Following Hawkish BoE Repricing

Following yesterday's hawkish repricing of BoE rate expectations, gilts have stabilised somewhat this morning with the longer end of the curve close to flat on the day. Equities have inched higher, while the US dollar has been on the back foot against G10 FX.

- EGB curves have broadly steepened

- The bund curve is 4bp steeper on the day, while the 2s30s OATs spread is similarly 4bp wider.

- BTPs have traded weaker with cash yields 1-3bp higher across the curve.

- Supply this morning came from Spain (Letras, EUR1.926bn), Austria (ATBs, EUR1.677bn), Finland (RFGB, EUR941mn) and the ESM (Bills, EUR1.5bn).

- There were no tier one European data releases this morning.

EUROPE ISSUANCE UPDATE

Finland sells E941mln 0.125% Sep-31 RFGB, Avg yield 0.070% (Prev. -0.015%), Bid-to-cover 1.49x (Prev. 1.77x)

FOREX: Greenback Ebbs to Monthly Low

- The USD pullback this morning has drawn some market focus at these levels, with the USD Index edging to new October lows of 93.592 to narrow the gap with the 50-dma support of 93.2378. This puts the USD as the weakest performing currency so far Tuesday.

- The greenback move coincides with a softer US yield curve, with 10y yields off as much as 3bps while the front-end also sees a decent correction lower.

- EUR, GBP both printing new October highs vs. USD, but the move is perhaps most notable in CNH, with USD/CNH falling through 6.40 for the first time since mid-June, exposing the YTD lows of 6.3525.

- GBP/USD is testing resistance at 1.3795 at typing, the level marks the 76.4% retracement of the Sep 14 -29 downleg. Break through here opens the mid-September highs of 1.3854, which sit just above the 100-dma of 1.3811.

- US housing starts and building permits data crosses later today, but the central bank speaker will likely draw more focus. Speeches from ECB's Elderson, Rehn, Lane and Panetta, Fed's Daly, Barkin, Bostic and BoE's Bailey are all due.

FX OPTIONS: Expiries for Oct19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1550-65(E1.0bln), $1.1600-15(E1.0bln)

- USD/JPY: Y113.50-70($718mln), Y113.80-00($520mln)

- GBP/USD: $1.3685-00(Gbp871mln), $1.3740-55(Gbp646mln)

- AUD/USD: $0.7350(A$661mln)

- USD/CAD: C$1.2550-70($701mln)

Price Signal Summary - S&P E-Minis Extend Gains And Clear Resistance

- In the equity space, S&P E-minis remain firm and have breached resistance at 4472.00, Sep 27 high. This signals potential for stronger gains near-term and opens 4500.00 and 4539.50, Sep 3 high and the bull trigger. EUROSTOXX 50 futures are trading close to recent highs and holding onto the bulk of last week's gains. The focus is on 4200.50, Sep 24 high.

- In FX, EURUSD is trading higher and has breached its 20-day EMA at 1.1625. The break signals scope for a stronger short-term corrective bounce and potentially opens the 50-day EMA that intersects at 1.1704. GBPUSD is firmer too and testing resistance at 1.3795, 76.4% of the Sep 14 -29 downleg. A clear break of this level would open 1.3913, Sep 14 high. USDJPY maintains a bullish tone and short-term dips would be considered corrective. Initial resistance is at 114.50, 1.382 projection of Apr 23 - Jul 2 - Aug 4 price swing. Initial support lies at 113.65, Oct 15 low.

- On the commodity front, Gold failed to hold onto recent highs and Friday's sharp reversal lower highlights a developing bearish threat, despite today's recovery. Short-term resistance has been defined at $1800.6, the Oct 14 high. A move lower would expose support at $1746.0, Oct 6 low. WTI trend conditions remain bullish. The focus is on $84.00 next.

- In the FI space, the path of least resistance remains down. Recent Bund weakness has exposed 167.98, 2.382 projection of the Sep 9 - 17 - 21 price swing. Resistance is at 169.92, Oct 14 high. Gilt futures remain in a downtrend. A resumption of weakness would refocus attention on 123.27, 2.00 projection of the Aug 31 - Sep 17 - 21 price swing. Resistance is at 125.29, the 20-day EMA. Treasuries yesterday resumed their downtrend. Sights are on 130-07 next, 1.764 projection of the Aug 4 - 11 - 17 price swing.

EQUITIES: Stocks Improve Off Mixed Start

- European cash markets started off mixed, with French and German indices opening lower but swiftly recovering to trade inline with yesterday's close after an hour or two. Europe's energy and utilities sectors are leading the way higher, while consumer staples and healthcare add a headwind.

- US futures are trading higher, with the e-mini S&P higher by 15 points or so. S&P E-minis recovered last week and price action on Oct 14 resulted in a move above the 50-day EMA - at 4393.95 today. A clear breach of the average has strengthened the case for bulls and this week's positive price action reinforces current short-term conditions. 4472.00, Oct 7 high has been breached opening 4539.50, the Sep 3 high and bull trigger.

- VIX futures trade under pressure, with the contract now in close proximity to the mid-June lows of 16.05 points and post-pandemic lows.

COMMODITIES: WTI Keeps October Highs Under Pressure

- Crude futures trade solidly ahead of the US open, with front-month futures keeping yesterday's cycle highs under pressure $83.87. This would extends the bull trend to initially target round number resistance at $84/bbl to turn the focus to $84.97 next, a Fibonacci projection.

- Russian lawmakers have made it clear that they won't go out of their way to provide extra gas supplies to mainland Europe unless regulatory approvals are forthcoming to start shipments through the Nord Stream 2 pipeline.

- Gold failed to hold onto recent highs and Friday's sharp reversal lower highlights a potential bearish threat. Key short-term resistance has been defined at $1800.6, the Oct 14 high. A resumption of weakness would expose support at $1746.0, Oct 6 low and clearance of this level would reinforce a bearish threat and attention would turn to $1721.7, Sep 29 low.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.