-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Split Congress Aides USD Bounce

Highlights:

- Midterms point to split Congress, favouring USD bounce

- Fed rate path holds near lower end of recent range

- Equity recovery stalls, but well above recent lows

US TSYS: Treasuries Consolidate Prior Rally As Assess Prospects Of Split Congress

- Cash Tsys consolidate yesterday’s rally, with currently relatively little change from close whilst assessing a less dominant performance from the Republicans than expected with indications of a split Congress. Treasuries briefly touched highest levels since last week's FOMC meeting before reversing, whilst China’s Guangzhou locking down a third district on Covid fears has little lingering impact.

- In yield space, 2YY +2.3bps at 4.674%, 5YY +1.8bps at 4.312%, 10YY +1.3bps at 4.136% and 30YY -0.5bps at 4.269%.

- TYZ2 trades just 1+ ticks lower at 110-07+ with average volumes, off a session high of 110-15+ that moved closer to resistance at the 20-day EMA of 110-23+. The primary trend direction remains down with attention ultimately on the bear trigger of 108-26+ (Oct 21 low).

- Fedspeak: Barkin (’24 voter) at 1100ET, Kashkari (’23) at 2000ET.

- Data: Limited to weekly MBA mortgage rate/applications and wholesale sales/inventories before tomorrow’s CPI.

- Bond issuance: US Tsy $35B 10Y note auction (91282CFV8) – 1300ET

- Bill issuance: US Tsy $33B 17W bill auction – 1130ET

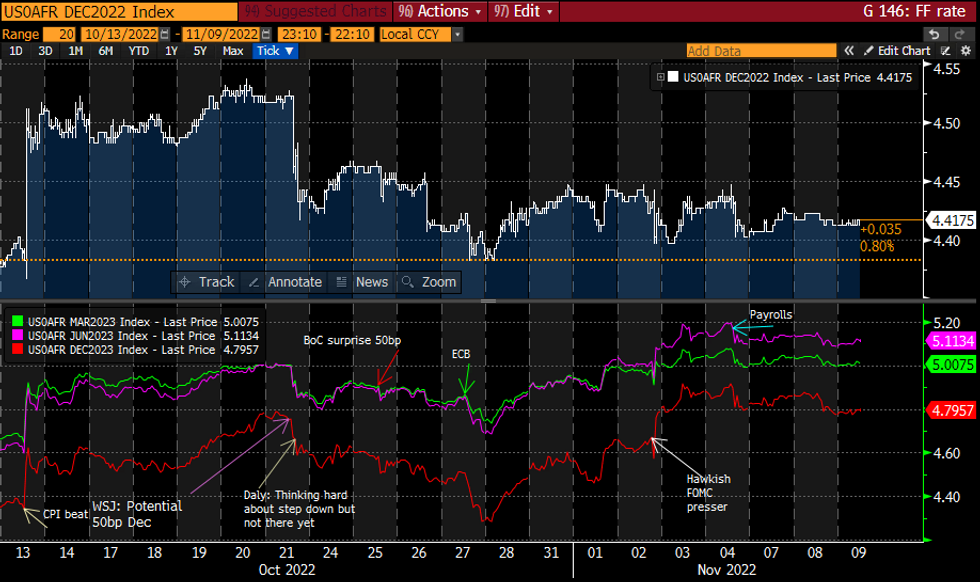

STIR FUTURES: Fed Rate Path Holds Near Lower End Of Post-FOMC Range

- Fed Funds implied hikes slowly reverse yesterday’s dip: 57bp for Dec (+1bp), 96bp to 4.81% for Feb (+0.5bp), terminal 5.11% Jun’23 (2.5bp) and 4.80% for Dec’23 (+2.5bp).

- Ahead, Barkin (’24) follows Mon remarks at 1100ET with Kashkari (’23) discussing inflation late at 2000ET.

- Earlier, NY Fed’s Williams noted that long-term inflation expectations remain well anchored with a surprising wrinkle where a similar share of consumers expect deflation 5yrs out as those expecting >4%. More here: https://marketnews.com/long-term-deflation-expectations-rising

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

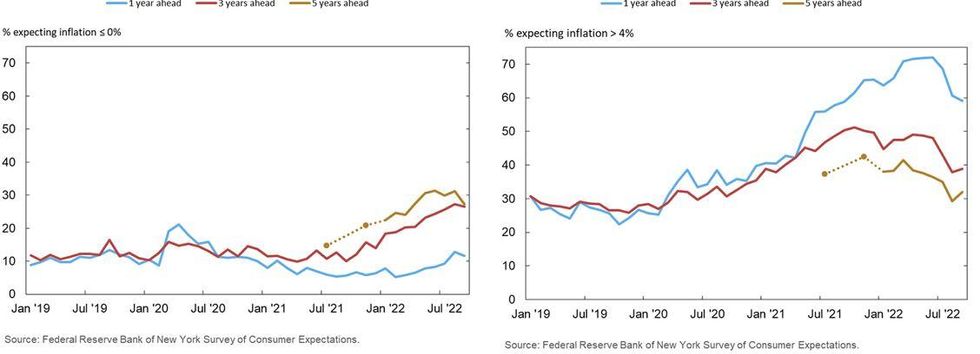

US: Long-Term Deflation Expectations Rising?

NY Fed President WIlliams'speech on long-term inflation expectations this morning concludes they remain well anchored: US households see the recent rise of inflation as "as likely being less persistent than in prior episodes", with professional forecasters still expecting inflation to remain close to 2% over the longer run.

- However, Williams notes a "surprising wrinkle" that is "worth further study" - there is an increasing divergence in consumer inflation "uncertainty" over the 3-5 year horizon, with rising disagreement in mean expectations as well as in the width of expected inflation distributions.

- While overall long-term inflation expectations have remained anchored since early 2021, there has been a significant increase in the share of respondents to the NY Fed's Survey of Consumer Expectations that expect deflation over the long term.

- The September SCE survey shows about 1/4 of respondents expect deflation 5 years in the future, similar to the proportion seeing inflation above 4% 5 years out. And if anything, the trend is toward rising deflation expectations, while expectations of 4+% inflation are falling.

- This counter-intuitive finding could be due to the way respondents think of inflation - are some respondents merely saying that inflation can't go higher from here, so disinflation is expected further out? (Williams notes the UMich 5-10Y inflation survey showed similar trends toward deflation.)

- Either way, this challenges the "uncertainty" part of Williams' 3 criteria for well-anchored expectations (the others are "sensitivity” and “level", which appear to be met).

FOREX: USD Favoured as Results Point to Split Congress

- Markets continue to digest the outcomes and results of the US Midterm elections, with the reaction favouring the USD, which is among the best performers in G10 ahead of the NY crossover. The results continue to lean toward an outcome in which Congress will be split between the GOP and the Democrats after a disappointing showing from Republican support.

- Trendline support in the USD Index is holding, and may have helped the rebound in the greenback so far Wednesday, with tomorrow's inflation print likely critical for the short-term direction. Support crosses at 109.310.

- GBP underperforms after a bout of selling pressure put EUR/GBP through the early November highs to print the best levels since mid-October. 0.8829 marks the next resistance for the cross, the 38.2% retracement for the September - November downleg.

- GBP and NZD are the session's poorest performers, while USD and CHF strength completes the risk-off backdrop.

- US and Canadian data releases are few and far between Wednesday, with focus resting on tomorrow's US CPI release, at which most see inflation slowing to below 8.0% on the year. The speaker slate could be more interesting, with BoE's Haskel & Cunliffe due as well as Fed's Barkin on the docket.

Source: MNI/BBG

FX OPTIONS: Expiries for Nov09 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9900-09(E690mln)

- USD/JPY: Y147.00($543mln)

- USD/CAD: C$1.3520($780mln)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 09/11/2022 | 1300/1300 |  | UK | BOE Haskel Speech at Digital Futures at Work | |

| 09/11/2022 | 1500/1000 | ** |  | US | Wholesale Trade |

| 09/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 09/11/2022 | 1600/1100 |  | US | Richmond Fed's Tom Barkin | |

| 09/11/2022 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/11/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 10/11/2022 | 0001/0001 | * |  | UK | RICS House Prices |

| 09/11/2022 | 0100/2000 |  | US | Minneapolis Fed's Neel Kashkari | |

| 10/11/2022 | 0130/0130 |  | UK | BOE Ramsden Panels PIIE & LKY Conference | |

| 10/11/2022 | 0700/0200 |  | US | Fed Governor Christopher Waller | |

| 10/11/2022 | 0700/0800 | * |  | NO | CPI Norway |

| 10/11/2022 | 0900/1000 | * |  | IT | Industrial Production |

| 10/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 10/11/2022 | - |  | UK | House of Commons Recess Starts | |

| 10/11/2022 | 1300/1400 |  | EU | ECB Schnabel Discussion at at Bank of Slovenia | |

| 10/11/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 10/11/2022 | 1330/0830 | *** |  | US | CPI |

| 10/11/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 10/11/2022 | 1400/0900 |  | US | Philadelphia Fed's Patrick Harker | |

| 10/11/2022 | 1435/0935 |  | US | Dallas Fed's Lorie Logan | |

| 10/11/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 10/11/2022 | 1600/1100 |  | US | San Francisco Fed's Mary Daly | |

| 10/11/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 10/11/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 10/11/2022 | 1650/1150 |  | CA | BOC Gov Macklem speech, "The evolution of Canadian labour markets" | |

| 10/11/2022 | 1730/1230 |  | US | Fed Governor Loretta Mester | |

| 10/11/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 10/11/2022 | 1830/1330 |  | US | Kansas City Fed's Esther George | |

| 10/11/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 10/11/2022 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

| 10/11/2022 | 2335/1835 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.