-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Biden Admin Eyes Productive Lame Duck

MNI US MARKETS ANALYSIS - Tsys Firmer Ahead of Early Close

MNI US MARKETS ANALYSIS - Stocks Lead Recovery After Monday Weakness

HIGHLIGHTS:

- Equities lead recovery after Monday weakness

- More buoyant stock markets flatter growth proxy FX and commodities

- Sell side remain of the opinion that Evergrande risks to be contained

US TSYS SUMMARY: Monday's Flattening Reverses On Equity Bounce

Retracement in Treasuries on a continued bounce in equities has been the story of the overnight session Tuesday, with housing data and 20Y supply eyed ahead of Wednesday's FOMC decision.

- TY1 futures are down -0-4+ at 133.04, 10y yields up 1.8bp at 1.330% while 30y yields trade higher by 2.6bp at 1.875%. 2s10s yield curve trades steeper by 1.8bp at 111.3bp while 10s30s is steeper by 0.8bp at 54.5bp.

- The curve has bear steepened, with 5s30s retracing all of Monday's bull flattening, and 2s10s not far off.

- The two-day Fed meeting kicks off today; our preview went out Monday.

- The House is set to vote today on a bill to avert government shutdown and suspend the debt ceiling - while likely to pass in the House, Senate passage looking more difficult.

- Supply in focus today, with $24B 20Y bond re-open at 1300ET.

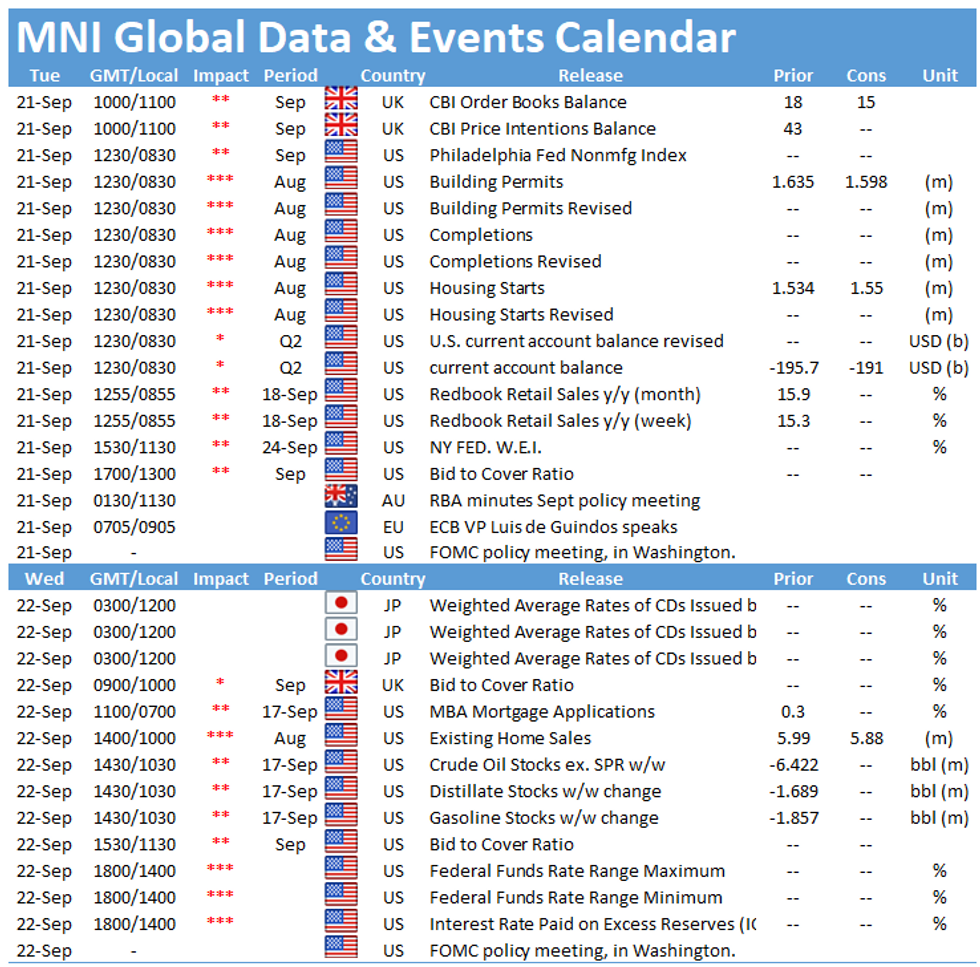

- Data includes housing starts / building permits alongside current account balance at 0830ET.

- NY Fed buys ~$1.225B of 7.5-30Y Tsys.

EGB/GILT SUMMARY: EGBs Initially Trade Heavy as Stocks Bounce

- A more subdued session so far for EGBs and Bunds, with most futures contracts taking their cue from the price action in equity markets.

- Supply has been one of the main talking points this morning with the UK holding a syndication for its inaugural 12-year green gilt (GBP10bln transaction size from books of over GBP100bln), Germany selling E3bln of its 7-year Bund and Finland selling E1bln of its 20-year RFGB.

- Bunds were better offered ahead of the NY crossover before recovering to trade flat. Peripheral spreads have all tightened against the German 10yr.

- Greece by a decent 5bps, following ECB's Stournaras saying that he expects the ECB to buy Greek debt in APP after the end of PEPP.

- Gilts have traded in line with Bund, initially wider by 0.6bp, but now 0.3bps tighter at the time of typing.

- Similar price action for Treasuries, with better selling on the margin on the back of higher Equities.

- US housing starts and building permits are due to cross later today. President Biden will be speaking later today with the Australian PM Scott Morrison as well as the UK PM Johnson.

EUROPE ISSUANCE UPDATE: German, Finnish Auctions, Gilt Syndication

Germany allots:

- E2.469bln 0% Nov-28 Bund, Avg yield -0.50% (Prev. -0.65%), Bid-to-cover 1.28x (Prev. 1.28x), Buba cover 1.56x (Prev. 1.55x)

GILT SYNDICATION: Inaugural green gilt 0.875% Jul-33: Deal sized at GBP10bln

- Spread previously set at 4.25% Jun-32 gilt +7.5 (guidance was 4.25% Jun-32 gilt +7.5/ +8.5 bps)

- Books closed in excess of GBP100bln (including JLM interest of GBP10bln)

Finland sells:

E936mln Jul-42 RFGB, Avg yield 0.274%, Price 147.43, Pre-auction mid 147.18

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXX1 170.50/169/168.50/167 put condor, bought for 25.5 in 20k

FOREX: Sentiment Stabilizes, But No Sea Change in Appetite

- Markets are reversing course Tuesday, with equities recovering off the Monday low and adding pressure to haven currencies. As a result, the JPY, USD and EUR are the poorest performers ahead of the NY open.

- At present, the turnaround in sentiment looks more like a stabilisation of investor appetite rather than any sea change, with the e-mini S&P still below 4400 and south of yesterday's highs. Similarly, European indices are a touch firmer but are yet to erase the losses suffered Monday.

- A bottoming out of commodity markets (WTI, Brent higher by over 1.5% apiece) is assisting the AUD, CAD and NOK strength. This solidifies the 50-dma in USD/NOK as solid resistance at 8.7965 - a level challenged, but not topped, earlier in the week.

- US housing starts and building permits data is the calendar highlight Tuesday, with the OECD also releasing their interim economic outlook. There are no central bank speakers of note.

FX OPTIONS: Expiries for Sep21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1685-00(E843mln), $1.1800(E655mln), $1.1900-20(E1.6bln)

- USD/JPY: Y108.55-65($651mln), Y109.00($1.3bln), Y109.50($679mln), Y109.65-70($807mln)

- EUR/JPY: Y127.00(E630mln)

- AUD/USD: $0.7315-20(A$585mln)

- USD/CAD: C$1.2675($550mln), C$1.2800($1.5bln)

Price Signal Summary - S&P E Minis Remain Below The Key 50-Day EMA

- In the equity space, S&P E-minis have recovered somewhat following yesterday's sell-off. The outlook is bearish however following the clear breach of the 50-day EMA and a key short-term support and bear trigger has been established at yesterday's low of 4293.75. Price needs to trade above yesterday's high of 4418.00 to suggest the tide may have turned, signalling scope for a stronger recovery. Note a break higher would also mean price is once again above the 50-day EMA and this would also represent a positive development. EUROSTOXX 50 futures also started the week on a bearish note and cleared former support at 4060.50, Aug 19 low. This signals scope for weakness towards 3962.50, 76.4% retracement of the Jul 19 - Sep 6 rally. Initial resistance is at 4102.50, yesterday's high.

- FX, EURUSD outlook remains bearish. Yesterday's weakness resulted in a breach of 1.1722, 76.4% of the Aug 20 - Sep 3 rally. This opens the key support at 1.1664, Aug 20 low and an important bear trigger. GBPUSD traded sharply lower yesterday and cleared support at 1.3727, Sep 8 low. The next key support is at 1.3602, Aug 20 low. Note too that there is a triangle base at 1.3631 that also represents an important support. The triangle is drawn from the July 20 low. Recent USD Index (DXY) gains have exposed the key resistance at 93.73, Aug 20 high and the bull trigger. A break would confirm a resumption of the uptrend that started May 25.

- On the commodity front, the Gold near-term outlook remains bearish. The focus is on $1724.5, 76.4% retracement of the Aug 9 - Sep 3 rally. WTI futures maintain a bullish outlook despite yesterday's move lower. Initial support is seen at $69.78, the 20-day EMA. Key support has been defined at $67.56, Sep 9 low.

- In FI, Bund futures remain in a downtrend. Recent weakness signals scope for a move towards 170.52, 3.00 projection of the Aug 5 - 11 - 17 price swing. Gilt futures remain in a bearish cycle too. The focus is on 126.83, 2.00 projection of the Aug 20 - 26 - 31 price swing.

EQUITIES: Europe Leads Bounce Off Lows

- Equity markets across the continent trade higher, partially reversing Monday's sharp losses, but are yet to take out the week's high. In cash markets, gains are led by France's CAC-40 and Germany's DAX, higher by 1.4% apiece.

- Energy and tech stocks are leading the rebound, with cyclicals outperforming defensive names. Nonetheless, the rally at present looks like a stabilisation of sentiment rather than any sea change in investor appetite. Chinese equity markets remain closed for holidays, with markets awaiting domestic investor response to the uncertainty surrounding Evergrande.

- US futures are taking the lead from their continental counterparts, with the e-mini S&P higher by around 100 points off the Monday low. VIX futures have ebbed off Monday's highs, but remain well elevated above last week's levels.

COMMODITIES: Oil Bounce Already Fading

- Commodity markets took the lead from global equities early Tuesday, recovering off the Monday low and trading solidly in positive territory. WTI crude futures managed to retake $71.50/bbl, but the bounce has already begun to fade with WTI just $1/bbl above the week's lows.

- Gold and silver both trade more positively, with gold now north of Monday's highs and keeping the uptick off $1742.25 intact. Gold now faces resistance at $1777.31 ahead of the Thursday high at $1796.24.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.