-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump To Address Business Leaders Today

MNI US MARKETS ANALYSIS - New EUR Highs on German Concessions

MNI US MARKETS ANALYSIS - Traders Await PPI, UMich for Inflationary Clues

Highlights:

- Markets look for inflationary clues from today's PPI / UMich releases

- Swaps spreads tighten as TLTRO repayments toward top-end of forecast

- Currencies largely steady ahead of next week's tight schedule

US TSYS: Twist Steepening As Wait For US PPI/UMich

- Cash Tsys see a twist steepening having stabilised an overnight rally at the front end but reversed it further out the curve. China CPI falling to an eight month low was in line with expectations with relatively few other drivers and little clear spillover from the ECB TLTRO announcement.

- Volumes, despite picking up more recently, remain below average ahead of US PPI and the preliminary U.Mich survey with markets otherwise focused on a heavy week of central banks and data ahead.

- 2YY -2.6bps at 4.282%, 5YY -1.4bps at 3.692%, 10YY +0.5bps at 3.487% and 30YY +2.2bps at 3.453%. 2s10s nudge back the other side of -80bps off recent fresh multi-decade lows.

- TYH3 trades 2+ ticks lower at 114-17. The technical uptrend is seen remaining intact -- resistance seen at 115-06+ (Dec 7 high) and a key resistance a little higher at 115-14 (50% of the Aug – Oct downleg) whilst support is seen at 113-21+.

- Data: PPI Nov (0830ET), U.Mich consumer survey Dec prelim (1000ET), Wholesale trades/inventories Oct/final (1000ET)

- No issuance.

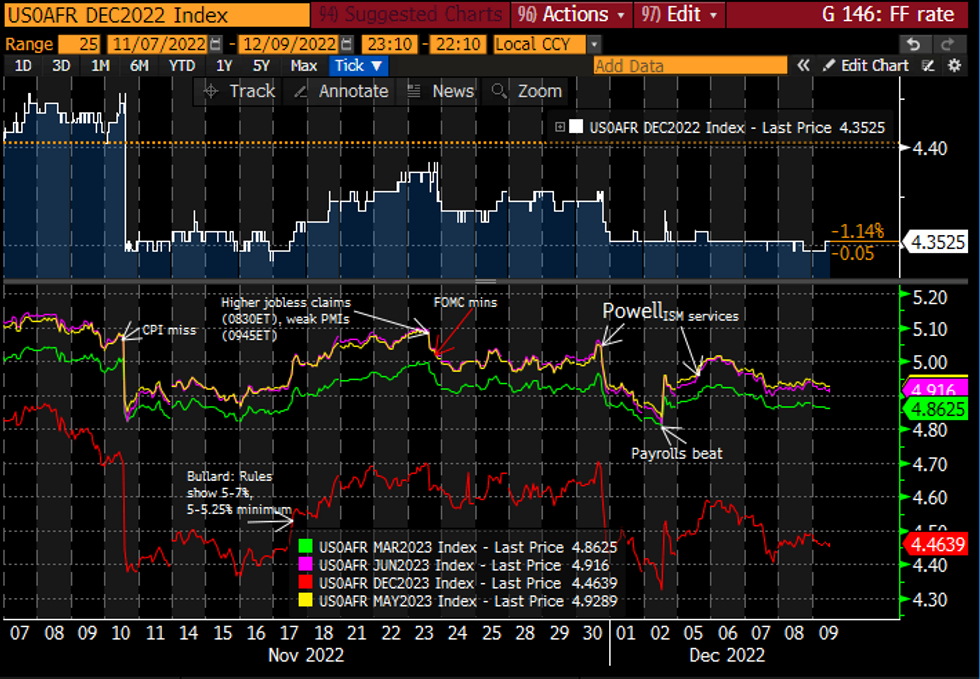

STIR FUTURES: Fed Pricing Within Recent Range Ahead Of Data

- Fed Funds implies hikes remain within yesterday’s range awaiting US PPI for Nov and the preliminary U.Mich consumer survey for Dec.

- 52bp for Wed (+0.5bp), cumulative 88bp to 4.71% Feb’23 (-0.5bp), terminal 4.93% May’23 (-2bp) and 4.46% Dec’23 (-3.5bp). 47bps of cuts from peak to end-2023 is at the higher end of the week’s range.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

US POLITICS: Senator Kyrsten Sinema To Switch Party Affiliation To Independent

Politico has reported that Senator Kyrsten Sinema (D-AZ) intends to switch her party affiliation from Democrat to Independent.

- According to Politico, Sinema will not caucus with the Republican Party but her decision may impede Democrat control over Senate Committees. This may be particularly damaging diplomatically, as the Biden administration is looking to fast-track confirmation of 40 ambassadorial vacancies which are stalled in the Senate.

- Sinema:“I don’t anticipate that anything will change about the Senate structure," saying that any issues relating to the function of the Senate is, “a question for Chuck Schumer …I just intend to show up to work as an independent.”

- Sinema is considered one of the most vulnerable Senate Democrats ahead of the 2024 elections and a switch of allegiance will help her avoid a primary challenge, should she choose to run again.

- Sinema's decision will be considered a significant setback for Senate Majority Leader Chuck Schumer (D-NY) who is now facing the prospect of a return to the 50-50 Senate and the outsized influence of Senator Joe Manchin (D-WV), just days after taking a 51st Senate seat in Georgia.

FOREX: Markets Awaiting Inflationary Cues From UMich, PPI

- Currency markets are generally extending the intraday trends that bedded in ahead of the Thursday close, with EUR and GBP extending their bounce against the greenback. EUR/USD printed an overnight high at 1.0588, just shy of the multi-month best printed on Monday. This reinforces the importance of 1.0595 as resistance going forward, with today's US data of particular importance.

- Equities futures are mixed, with US indices a touch firmer, while Europe looks weak in comparison. The e-mini S&P is continuing to edge back through the Monday/Tuesday losses, but a more significant rally will be needed to take out Tuesday's 4014.75 and Monday's 4075.75.

- On an intraday basis, JPY and GBP are the firmest in G10, while CAD and AUD are among the poorest performers. Nonetheless, ranges remain tight, with conviction limited ahead of the raft of CB meetings next week.

- The prelim read for December Uni of Michigan confidence is due, with inflation expectations seen holding at 4.9% and 3.0% on the one- and 5-10yr horizon respectively and markets will be looking to see whether slowdown in the Y/Y rate of CPI has filtered into inflationary expectations. US PPI is also due, adding to the inflationary picture ahead of next week's CPI release and the FOMC meeting.

FX OPTIONS: Expiries for Dec09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0300(E1.4bln), $1.0400(E522mln), $1.0450(E559mln), $1.0550(E1.1bln), $1.0600(E1.7bln), $1.0690-00(E2.4bln)

- USD/JPY: Y134.00-10($656mln), Y136.00($1.2bln), Y138.00($579mln), Y142.50($550mln)

- AUD/USD: $0.6585-00(A540mln), $0.6700(A$821mln), $0.7000(A$929mln)

- USD/CAD: C$1.3500($1.2bln), C$1.3550-60($579mln), C$1.3600-15($1.2bln), C$1.3650($765mln)

- USD/CNY: Cny6.9000($1.1bln), Cny7.0000($1.6bln)

Swap Spreads Tighten As TLTRO Repayments Toward High End Of Expectations

The E447.5bln in TLTRO repayments this week make a total of E743.8bln of loans repaid in the combined Nov and Dec repayment windows - cumulatively probably more toward the high end of expectations than the low end.

- Swap spreads tightened, with perhaps some optimism that high-quality collateral will be returning to market a little more quickly than expected.

- Notably, Schatz ASW dropped around 2bp, touching the lowest level since early July (73.2bp).

- Front Euribor futures are basically unchanged; not much reaction in BTP spreads either.

COMMODITIES: Gold Trend Conditions Remain Bullish

Trend conditions in WTI futures remain bearish and this week’s move lower has reinforced this theme. $74.96, the Sep 28 low, has been cleared. This break confirms a resumption of the downtrend and sights are on the $70.00 psychological handle. Moving average studies are in a bear mode condition, highlighting the current trend direction. Key resistance is at $82.17, the 50-day EMA. Trend conditions in Gold remain bullish and Monday’s retracement appears to be a correction. A fresh trend high last week reinforced a bullish theme and price breached $1786.5, the Nov 15 high and a bull trigger, confirming a resumption of the uptrend. $1800.0 has also been cleared and sights are on resistance at $1807.9, the Aug 10 high that has been pierced. A clear break would be bullish. Key trend support is at $1729.0, the Nov 23 low.

- WTI Crude up $0.16 or +0.22% at $71.67

- Natural Gas down $0.03 or -0.54% at $5.941

- Gold spot up $1.78 or +0.1% at $1791.24

- Copper down $0.15 or -0.04% at $388.85

- Silver down $0.05 or -0.21% at $23.0491

- Platinum down $5.63 or -0.56% at $1004.23

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/12/2022 | 1330/0830 | *** |  | US | PPI |

| 09/12/2022 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 09/12/2022 | 1500/1000 | ** |  | US | Wholesale Trade |

| 09/12/2022 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/12/2022 | 0001/0001 |  | UK | Rightmove House Prices | |

| 12/12/2022 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 12/12/2022 | 0700/0700 | ** |  | UK | Trade Balance |

| 12/12/2022 | 0700/0700 | *** |  | UK | Index of Production |

| 12/12/2022 | 0700/0700 | ** |  | UK | Index of Services |

| 12/12/2022 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 12/12/2022 | 1330/0830 | * |  | CA | Household debt-to-disposable income |

| 12/12/2022 | 1600/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 12/12/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 12/12/2022 | 1630/1130 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 12/12/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/12/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 12/12/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 12/12/2022 | 2025/1525 |  | CA | Governor Macklem speech in Vancouver | |

| 12/12/2022 | 2200/1700 |  | CA | BOC Governor Macklem press conference |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.