-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Treasuries a Touch Cheaper Ahead of 7y Supply, Q4 GDP

Highlights:

- Treasuries cheapen across European hours, but recent ranges respected

- JPY on the backfoot, but USD/JPY well shy of Wednesday high

- US GDP seen slowing on the quarter, with consensus around a 2.6% clip for Q4

US TSYS: Treasuries Pare Two Day Rally Ahead Of Data, 7Y Supply

- Cash Tsys see new lows across the curves with cheapening pressure through European hours. There was no obvious trigger to initial moves, also seen cross asset with equities moving higher, but potential downward pressure at the margin after a report from the IMF suggested a number of options for the BoJ including raising the 10-year target or shortening the yield curve target as options.

- 2YY +2.3bps at 4.148%, 5YY +4.3bps at 3.569%, 10YY +4.2bps at 3.484% and 30YY +4.3bps at 3.636%.

- TYH3 trades 5+ ticks lower at 114-31 just off session lows of 114-29, holding above close support at the 20-day EMA of 114-16 and then 114-13+ (Jan 24 low). The latest pullback is considered corrective with the medium-term trend condition seen bullish – resistance at 115-21 (Jan 20 high).

- Data: GDP/Core PCE in the Q4 advance is in focus, but it hits along with durable goods, international trade, inventories and weekly jobless claims all at 0830ET. Followed by new home sales (1000ET) and KC Fed mfg (1100ET).

- Bond issuance: US Tsy $35B 7Y note (91282CGJ4) auction – 1300ET

- Bill issuance: US Tsy $75B 4W, $60B 8W bill auctions – 1130ET

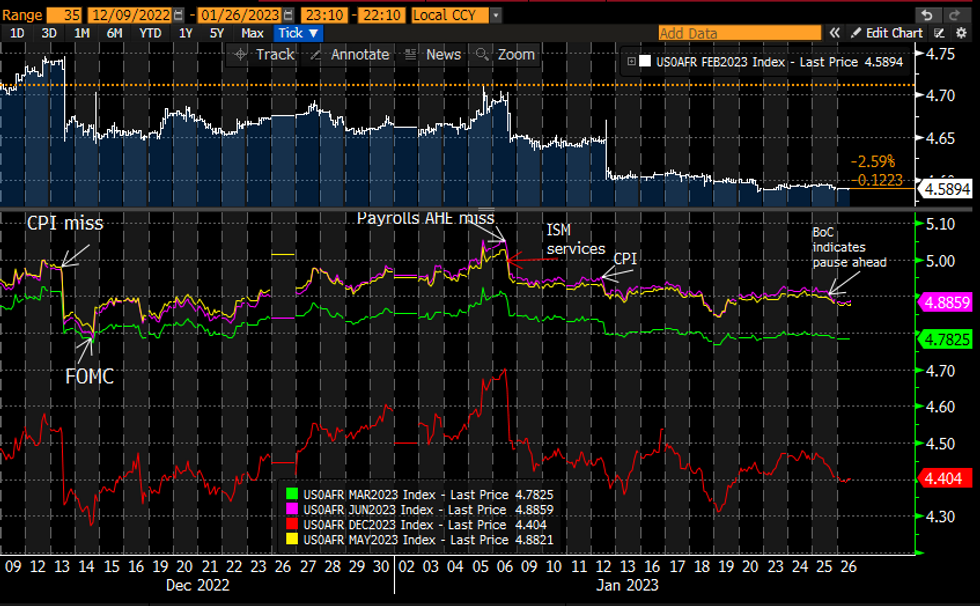

STIR FUTURES: Fed Rate Path Consolidates Post-BoC Dip

- Fed Funds implied hikes consolidate yesterday’s dip after the BoC led the way with its indicated pause.

- Sitting at 26bp for Feb 1 (unch), cumulative 45bp for Mar (-0.5bp), 55bp to 4.89% terminal (-0.5bp) before 48bp of cuts to 4.40% Dec (-0.5bp). The terminal remains in its 4.86-4.94% range seen since the miss for Dec ISM services.

- Today’s Q4 advance GDP/PCE report likely in focus, including core PCE implications for Friday’s December print.

Source: Bloomberg

Source: Bloomberg

EUROPE ISSUANCE UPDATE:

ITALY AUCTION RESULTS:

- E1.25bln 1.50% Jun-25 BTP, Avg yield 3.03% (Prev 0.00%), Bid-to-cover 2.39x

- E2bln 2.50% Nov-25 BTP, Avg yield 3.10%, Bid-to-cover 1.92x

- E1.75bln 0.10% May-33 BTPei, Avg yield 2.03% (Prev. 2.22%), Bid-to-cover 1.42x (Prev. 1.57x)

- EUR 3bln WNG 15Y Fixed (April 15, 2038) at Midswaps +10bps

- Initial Guidance MS+11 area, books above EUR 10bln (including JLM interest)

FOREX: Price Action Shallow, With USD a Touch Firmer Pre-GDP

- The greenback is on the front foot early Thursday, rising against most others in G10. Market moves are shallow so far, keeping prices well within recent ranges. A more constructive equity market backdrop has shored up USD/JPY, which is posting a near 100 pip recovery off the overnight lows. The Y130.00 handle marks the next hurdle for the pair, and a break above opens progress toward the 130.78 20-day EMA.

- NOK sits on top of the G10 pile, benefiting from firmer energy prices (WTI and Brent trade higher by 0.5% apiece). USD/NOK holds below 9.90 and the bearish developments across moving averages are continuing to add weight. Earlier this week, the 50-dma slipped below the 200-dma to form a death cross for the first time since the onset of the COVID pandemic in 2020.

- Advanced Q4 GDP from the US takes focus going forward, with the annualized quarterly figure seen clocking in at 2.6% - below the prior quarter's 3.2% clip. Weekly US jobless claims data and December new home sales make up the rest of the calendar. With the Fed remaining inside the pre-meeting media blackout period, the speaker slate is light Thursday.

FX OPTIONS: Expiries for Jan26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0890-00(E526mln), $1.0950(E825mln), $1.0980-00(E718mln)

- USD/JPY: Y127.00($1.6bln), Y127.50($755mln), Y130.00($2.0bln)

EQUITIES: Eurostoxx Futures Target 4206.0 Bull Trigger

- EUROSTOXX 50 futures remain above support at 4097.00, the Jan 19 low. The trend outlook is bullish, however, the cycle remains overbought and this continues to warn of the potential for a short-term corrective pullback. A move lower would allow the overbought reading to unwind and open 4075.60, the 20-day EMA and a key near-term support. Key resistance and the bull trigger is at 4206.00, the Jan 18 high. A breach would resume the uptrend.

- S&P E-Minis have recovered from yesterday’s low. Attention is on key S/T resistance at 4056.75, Jan 23 high. A break of this level would confirm a resumption of recent bullish activity and signal scope for a climb towards 4100.00 and key resistance at 4180.00 further out, the Dec 13 high. The key short-term support to watch lies at 3901.75, the Jan 19 low. A break would be bearish. 4056.75 and 3901.75 represent important directional triggers.

COMMODITIES: Gold Continues Price Sequence of Higher Highs and Higher Lows Continues

- WTI futures traded higher Monday but the contract has pulled back from its recent highs. Key short-term resistance is located at $82.66, the Jan 18 high. Clearance of this hurdle would reinstate the recent bullish theme and expose $83.14, the Dec 1 high and $85.33, a Fibonacci retracement. On the downside, the support to watch lies at $78.45, the Jan 19 low. A break of this level would signal a potential reversal.

- Trend conditions in Gold remain bullish and the yellow metal is higher again today. This confirms an extension of the uptrend and maintains the price sequence of higher highs and higher lows. Moving average studies remain in a bull mode position - reflecting the uptrend. The focus is on $1963.0 next, a Fibonacci retracement. Support to watch lies at $1890.0, the 20-day EMA. Short-term pullbacks are considered corrective.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/01/2023 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 26/01/2023 | 1330/0830 | * |  | CA | Payroll employment |

| 26/01/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 26/01/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 26/01/2023 | 1330/0830 | ** |  | US | durable goods new orders |

| 26/01/2023 | 1330/0830 | *** |  | US | GDP (adv) |

| 26/01/2023 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/01/2023 | 1500/1000 | *** |  | US | New Home Sales |

| 26/01/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 26/01/2023 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 26/01/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 26/01/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 26/01/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 27/01/2023 | 2350/0850 | ** |  | JP | Tokyo CPI |

| 27/01/2023 | 0030/1130 | ** |  | AU | Trade price indexes |

| 27/01/2023 | 0700/0800 | ** |  | SE | Unemployment |

| 27/01/2023 | 0700/0800 | ** |  | SE | Retail Sales |

| 27/01/2023 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 27/01/2023 | 0800/0900 | *** |  | ES | GDP (p) |

| 27/01/2023 | 0900/1000 | ** |  | EU | M3 |

| 27/01/2023 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 27/01/2023 | 1500/1000 | ** |  | US | NAR pending home sales |

| 27/01/2023 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 27/01/2023 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.