-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

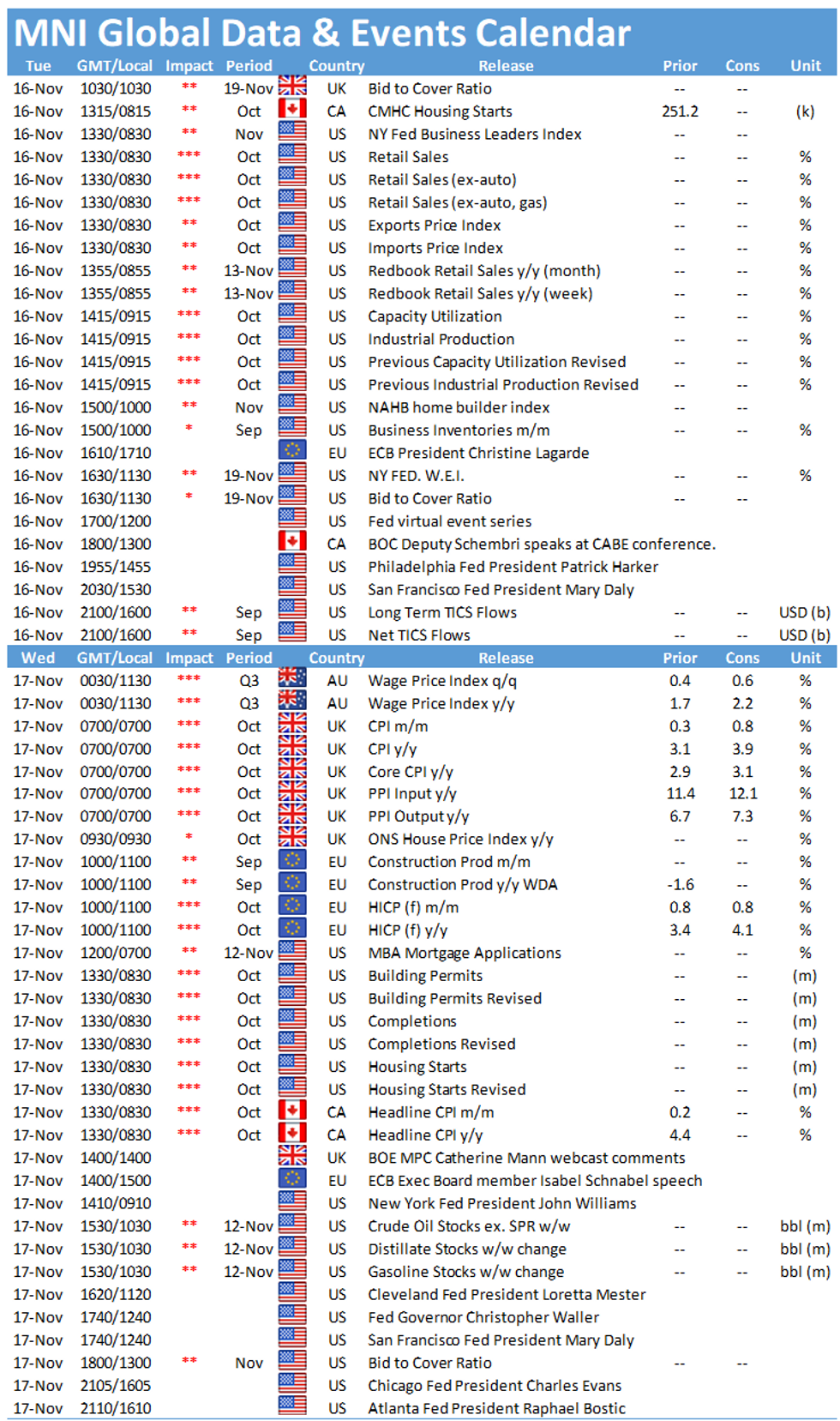

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Treasuries Inside A Range After Monday's Steepening

HIGHLIGHTS:

- Treasuries hold within narrow range after Monday's steepening

- UK jobs data opens door to December hike

- Retail sales, import/export prices indices on the docket

US TSYS SUMMARY: Data Surge W/ Retail Sales In Focus

Tsys little firmer after Monday's curve steepening sell-off (Ylds +2-5bp Mon), levels holding narrow range on moderate volumes (TYZ1>330k). Little react or at least no escalation in Sino-US tension following Biden-Xi summit late Monday. Equities off recent lows/near steady (ESZ1 4681.5), Gold gains +10.70, WTI crude +.33.- Data surge with Oct Retail Sales in focus (1.5% est vs. 0.7% prior); Import/Export prices (1.0%/1.0% ests), Industrial Production (0.9% vs. -1.3% prior) and Capacity Utilization (75.2% vs. 75.9% prior).

- Fed-speak includes StL Fed Bullard Bbg TV interview (0845ET); Fed Pres' Barkin, Bostic and George, racism and economy conf at MN Fed (1200ET) and SF Fed Daly speech at Commonwealth Club, media Q&A (1530ET).

- Tsy supply: $60B 14D bill CMB sale (9127965G0); two NY Fed buy-ops: Tsy 4.5Y-7Y (appr $5.275B) at 1030ET, Tsy 10Y-22.5Y (appr $1.425B) at 1120ET.

- Corporate debt issuance expected to remain strong, generate more two-way hedging after Mon's >$18.5B priced.

- Currently: 2-Yr yield is down 0.2bps at 0.5139%, 5-Yr is down 0.8bps at 1.2441%, 10-Yr is down 1.7bps at 1.5974%, and 30-Yr is down 2.2bps at 1.9741%.

EGB/GILT SUMMARY - FI Gaining Ground

European sovereign bonds have traded firmer this morning alongside gains for equities and a mixed performance for FX.

- Gilt yields are 1-3bp lower on the day with the curve bull flattening.

- The bund curve has conversely bull steepened with the 2s30s spread widening by 3bp.

- OATs have outperformed bunds with cash yields 1-5bp lower and the short-end of the curve leading the way.

- BTPs have lagged the move in OATs with yields 1-3bp lower on the day.

- UK employment data came in stronger than expected with job gains of 247k on a 3m/3m basis for September (190k consensus). The unemployment rate came in at 4.3% vs 4.4% expected while average weekly earnings came in at 5.8% Y/Y vs 5.6% expected.

- Supply this morning came from the UK (Gilt, GBP1.75bn), Spain (Letras, EUR1.898bn), Finland (RFGBs, EUR960mn) and the ESM (Bills, EUR1.5bn).

- The CB speaker slate is relatively light today with just ECB President Christine Lagarde due to speak this afternoon.

EUROPE ISSUANCE UPDATE: UK, Finland Sell Bonds

UK DMO sells GBP1.75bln 0.875% Jan-46 Gilt, Avg yield 1.178% (Prev. 0.940%), Bid-to-cover 2.03x (Prev. 2.38x), Tail 1.0bp (Prev. 0.2bp)

Finland sells:- E460mln 0.125% Sep-31 RFGB, Avg yield -0.0140% (Prev. 0.0700%), Bid-to-cover 1.99x (Prev. 1.49x)

- E500mln 1.375% Apr-47 RFGB, Avg yield 0.3160%, Bid-to-cover 1.87x

EUROPE OPTION FLOW SUMMARY

Eurozone:

2RH2 99.87/99.75ps vs 100.25/100.37cs, bought the ps for 0.75 in 5k

UK:

SFIH2 99.50/99.60cs, bought for 3.75 in 4kSFIH2 99.50/60/70/80c condor, bought for 2.5 in 4k

US:

TYZ1 129.75p, was bought for 15 in over 10kTYZ1 130.5/130/129.5p fly, bought for 2 in 1.59k

FVF2 121.25/120.00ps, sold at 33 in 10k

FOREX: GBP Extends Recovery on Favourable Jobs Data

- GBP trades stronger for a second session, extending the move seen off the back of the somewhat hawkish comments from BoE members including the governor Bailey in front of lawmakers yesterday. UK jobs data this morning showed that payrolled employment actually increased by around 160,000 across October, indicating that employment rose despite the conclusion of the UK government's COVID-era furlough scheme.

- GBP/USD has traded back above the 1.3450 mark, although gains have faded somewhat ahead of the NY crossover. The USD Index has firmed, but trades just shy of the year-to-date highs printed Monday. The weakest currencies across G10 include NZD, SEK and CHF.

- US retail sales and import/export price indices data crosses later today, with industrial production numbers following shortly afterwards.

- Central bank speakers today include Fed's Bullard, Barkin, Bostic, George as well as Daly, while ECB's Lagarde and BoC's Schembri are also on the docket.

FX OPTIONS: Expiries for Nov16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1450(E695mln), $1.1539-50(E892mln), $1.1600-25(E1.4bln)

- USD/JPY: Y113.40-50($1.3bln), Y114.30($1.6bln)

- GBP/USD: $1.3495-00(Gbp500mln)

- EUR/GBP: Gbp0.8525(E791mln)

- AUD/USD: $0.7300-15(A$757mln)

- USD/CAD: C$1.2370-90($830mln)

- USD/CNY: Cny6.4000($2.3bln); Cny6.4390-00($1.3bln)

EQUITIES: US Futures Indicate Flat-to-Lower Open

- European markets are mixed, with France's CAC-40 and Germany's DAX making decent headway, while the UK's FTSE-100 sits falt. Upside in core markets has been countered somewhat by weakness in both Italy's FTSE-MIB and Spain's IBEX-35.

- US futures sit slightly lower, with the e-mini S&P off around 5 points or so. The index has ebbed off overnight highs but has so far traded wholly inside the Monday range. Yesterday's 4697.50 marks the first upside target ahead of 4700.50 and the alltime highs just beyond at 4711.75.

- In corporate news, Home Depot's Q3 earnings showed comparable store sales coming in ahead of expectations, rising by 6.1% against exp. 1.5%.

COMMODITIES: Oil Regains Some Poise, Inventories Eyed

- WTI futures remain below recent highs but still above support. The key resistance and the bull trigger is at $85.41, Oct 25 high. A break of this hurdle is required to confirm a resumption of the uptrend and resume the bullish price sequence of higher highs and higher lows. This would open $87.45, a Fibonacci projection.

- API due after market will be watched for clues ahead of tomorrow's DoE inventories release, at which markets expected a build of around 700k barrels for the headline.

- Gold rallied sharply higher last week and the move higher resulted in a clear break of resistance at $1834.0, Sep 3 high. The breach of this hurdle reinforces current bullish conditions and paves the way for further strength. Note too that gold has also breached $1863.3, 76.4% of the Jun - Aug sell-off.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.