-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Treasuries Unwind Weds Bounce

Highlights:

- Treasuries unwind post-BoC rally

- 75bps expected from the ECB, with TLTRO terms also on the table

- EUR/USD overnight vols spike, highest since July meeting

US TSYS: Treasuries Unwind BoC Rally With ECB, GDP Eyed

- Ahead of the ECB, cash Tsys have unwound the rally after yesterday’s surprise downshift to a 50bp hike from the BoC. Front- and long-end yields alike are still some 20bps lower than Friday levels before some weaker US data helped drive a rally. ECB aside, that should see particular focus on today’s GDP Q3 advance, with the final Atlanta Fed nowcast implying upside risk with 3.1% vs consensus 2.4%. 7Y supply also draws attention after yesterday’s 5Y traded through after recent tails for both 2Y and 20Y.

- 2YY +5bps at 4.453%, 5YY +7.2bps at 4.256%, 10YY +7.3bps at 4.076%, and 30YY +5.9bps at 4.197%.

- TYZ2 trades 13+ ticks lower at 110-21+ on below average volumes (ECB eyed) pulling further back off yesterday’s high of 111-08+ which forms resistance doubled up with the 20-day EMA of 111-08. Support is seen at 109-20 (Oct 25 low) below which sits the bear trigger of 108-26+ (Oct 21 low).

- Data: A solid docket with the Q3 GDP advance, preliminary durable goods for Sep and weekly jobless claims all at 0830ET before the Kansas City Fed mfg index at 1100ET.

- Bond issuance: $35B 7Y Note auction (91282CFT3) – 1300ET

- Bill issuance: $65B 4W, $55B 8W bill auctions – 1130ET

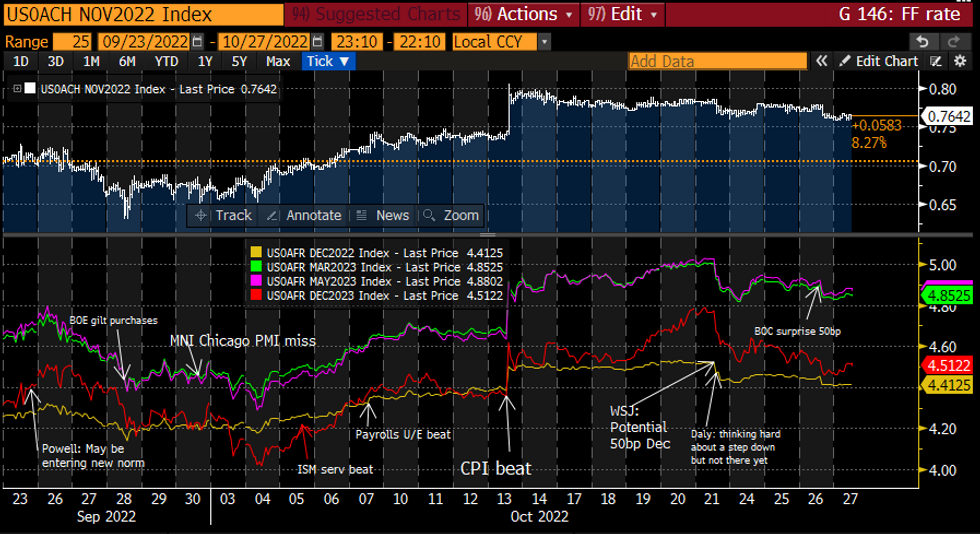

STIR FUTURES: Rates Broadly Holding Lower Post BoC Surprise 50bp Downshift

- Fed funds implied hikes hold levels after yesterday’s post-BoC dip to end-2022, with Nov 2 at 76.5bp and 133bp to 4.41% in Dec (-4bp from Tue close).

- Meetings further out retrace some of yesterday’s decline, with a terminal 4.88% in May’23 before 4.51% for Dec’23, but still 4-5bps below Tue close.

- US GDP Q3 advance and September durable goods in focus, with the final Atlanta Fed GDPNow of 3.1% implying some upside risk to consensus of 2.4%.

FOMC-dated Fed Funds implied hikesSource: Bloomberg

FOMC-dated Fed Funds implied hikesSource: Bloomberg

EUR/USD: Overnight Vols Climbing, At Highest Since July ECB

- EUR/USD breaking down slightly in recent trade, with the pair printing new lows of 1.0035 to near the 38.2% retracement of yesterday's rally. Nonetheless the pair is still comfortably higher on the week (Monday's open: $0.9850).

- A few contending forces worth noting with the ECB rate decision, a possible pick-up of month-end flow in NY hours (today marks M/E value date) and a slew of option expiries for today's cut: $1.0000(E1.5bln), $1.0025-40(E1.1bln), $1.0050-60(E711mln)

- Overnight option volatility for EUR/USD has suitably climbed, and is now clearing 20 points for the first time since the July ECB meeting (see below chart), which was the highest overnight vol reading since March 2020:

FOREX: USD Index Off the Mat, But Still Much Lower on the Week

- Markets trade with a broad risk-off backdrop - the USD is making furtive gains to stage a minor bounce off the week's lows. Nonetheless, the USD Index remains well below the 50-dma support that had contained price action earlier in the week.

- Month-end models continue to point to moderate USD sales for October, with flows likely to pick up in NY hours as Thursday marks month-end value date for FX rebalancing purposes.

- JPY trades well, boosted by general weakness across global equity markets and a break below the Monday low for USD/JPY. Support at 145.57 has given way, but there are few signs of official intervention at this stage, with the price action more leisurely relative to recent bouts of JPY strength.

- Elsewhere, the CNH is among the poorest performing currencies globally, putting USD/CNH back toward 7.25 to partially erase Wednesday's move lower. The moves come despite a brief move higher in the Chinese currency, with markets clearly remaining wary of state-run Chinese banks selling USD to shore up the exchange rate. 7.25 had previously been a closely watched level for USD/CNY.

- Focus turns to the ECB rate decision, with the bank expected to raise rates by 75bps and lay the groundwork for matched move higher of another 75bps in December. TLTRO terms are also a hot topic, with reports circulating this week that the ECB could change borrowing terms on TLTROs in order to reduce the payments due to the banking system for parking liquidity at the central bank.

FX OPTIONS: Expiries for Oct27 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9750-60(E953mln), $0.9800(E1.6bln), $0.9850(E2.1bln), $1.0000(E1.5bln), $1.0025-40(E1.1bln), $1.0050-60(E711mln)

- USD/JPY: Y145.00($714mln), Y147.50($580mln)

- GBP/USD: $1.1490-00(Gbp752mln)

- AUD/USD: $0.6430-35(A$674mln)

- USD/CAD: C$1.3470($710mln), C$1.3685-00($572mln)

- USD/CNY: Cny7.1800($600mln), Cny7.2000($907mln), Cny7.2500($1.7bln)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/10/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 27/10/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 27/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 27/10/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/10/2022 | 1230/0830 | *** |  | US | GDP (adv) |

| 27/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 27/10/2022 | 1245/1445 |  | EU | ECB post-policy decision press conference | |

| 27/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 27/10/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 27/10/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 27/10/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/10/2022 | 0430/0630 | *** |  | DE | North Rhine Westphalia CPI |

| 28/10/2022 | 0530/0730 | ** |  | FR | Consumer Spending |

| 28/10/2022 | 0530/0730 | *** |  | FR | GDP (p) |

| 28/10/2022 | 0600/0800 | *** |  | SE | GDP |

| 28/10/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/10/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 28/10/2022 | 0645/0845 | ** |  | FR | PPI |

| 28/10/2022 | 0700/0900 | *** |  | ES | GDP (p) |

| 28/10/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 28/10/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 28/10/2022 | 0800/1000 | *** |  | DE | GDP (p) |

| 28/10/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/10/2022 | 0800/1000 | ** |  | IT | PPI |

| 28/10/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 28/10/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 28/10/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 28/10/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 28/10/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/10/2022 | 1030/1330 |  | RU | Russia Central Bank Key Rate Decision | |

| 28/10/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/10/2022 | - | *** |  | JP | BOJ policy announcement |

| 28/10/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 28/10/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 28/10/2022 | 1230/0830 | ** |  | US | Employment Cost Index |

| 28/10/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 28/10/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 28/10/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.