-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Treasuries Weaker Ahead of CPI

HIGHLIGHTS:

- Treasuries weaker ahead of CPI

- AUD poorest performer in G10 as Lowe talks against rates market pricing

- Oil strikes another high as inclement rolls into Gulf of Mexico

US TSYS SUMMARY: All About Inflation

Treasuries weakened slightly overnight Tuesday but without any real conviction and within the previous couple sessions' ranges. Focus is on today's much-anticipated CPI release.

- Slight steepening in the curve: 2-Yr yield is up 0.2bps at 0.215%, 5-Yr is up 1.3bps at 0.8176%, 10-Yr is up 1.2bps at 1.3377%, and 30-Yr is up 1bps at 1.9139%.

- Dec 10-Yr futures (TY) down 4.5/32 at 133-05 (L: 133-03.5 / H: 133-09.5), average volumes (~270k traded).

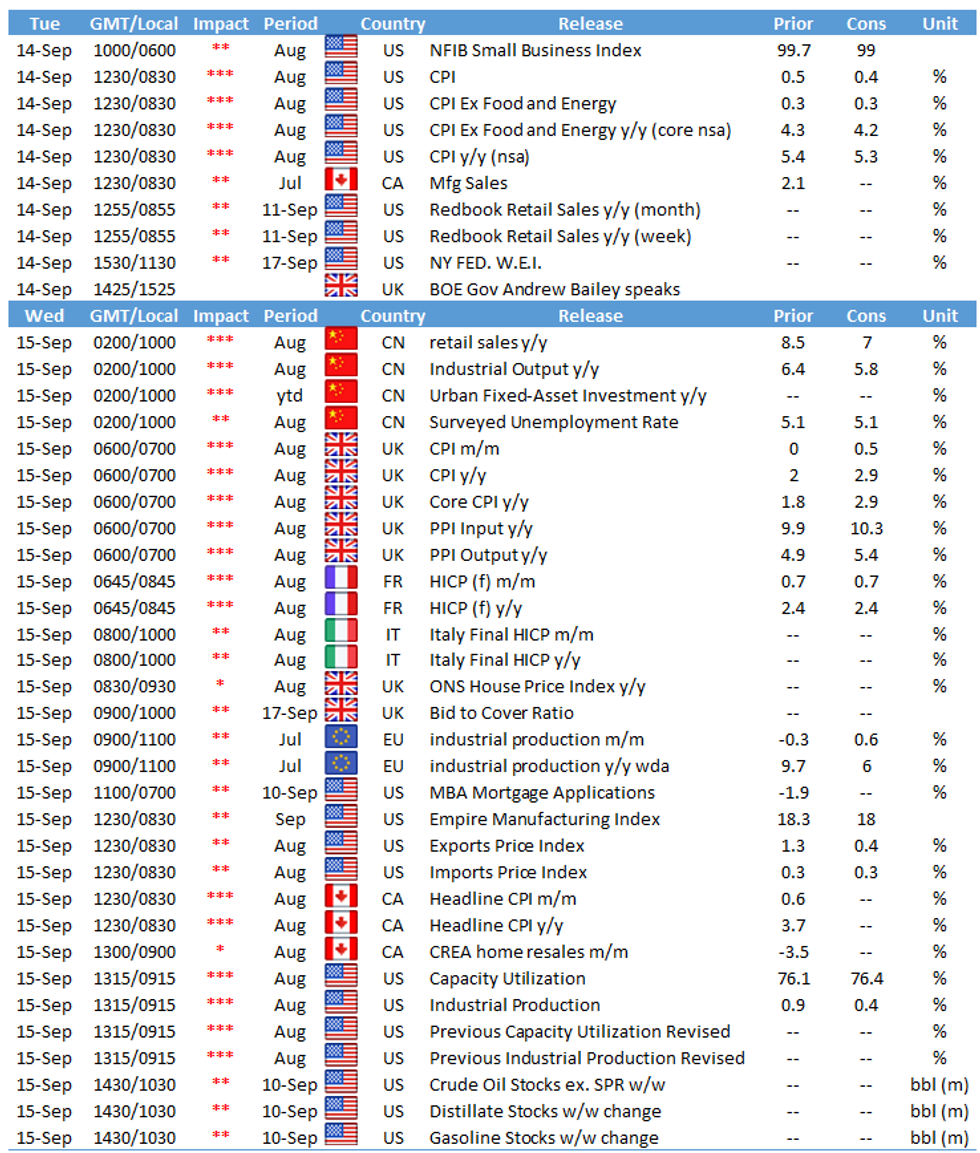

- Tuesday is all about the August CPI report, which is expected to show further deceleration in price pressures on both core and headline vs June's peak. We'll put out our short preview shortly.

- That being said, a modest deviation from the survey median on core (+0.3% M/M) will probably be discounted as an aberration either way, with the underlying components more closely eyed for signs of more lasting pipeline price pressure / disinflation.

- Inflation aside, it's a quiet calendar, with no other data (earlier, NFIB small business optimism X), no supply, and no Fed speakers.

- No NY Fed operational purchases either, though we get a new schedule of upcoming buying ops at 1500ET.

EGB/GILT SUMMARY: UK Labour Market Heats Up

European sovereign bonds have traded this weaker with gilts significantly underperforming alongside a mixed performance for equities and FX.

- UK labour market data for August showed the number of employees on payroll climbing above the pre-pandemic level with earnings growth running at a 8.3% Y/Y clip (above the 8.2% expected). Further signs that the labour market is heating up come from vacancies, which have pushed above 1mn for the first time on record. This contrasts with last week's data showing growth disappointing in July.

- Gilts have sold off with cash yields 3-4bp higher and the curve a touch steeper.

- The bund curve has bear steepened with the 2s30s spread 2bp wider on the day.

- The OAT curve has similarly steepened by 1bp.

- BTPs sold off earlier in the session, before recovering losses and now trading marginally above yeserday's close.

- Supply this morning came from the UK (Gilts, GBP3.00bnP, Germany (Schatz, EUR3.908bn allotted), Italy (BTPs, EUR9.0bn), Spain (Letras, EUR1.843bn), Finland (RFTBs, EUR1.506bn) and the ESM (Bills, eur1.1bn).

EUROPE ISSUANCE UPDATE: German, Italian, UK and Dutch Auctions, EU Syndication

Germany allots E3.908bln 0% Sep-23 Schatz, Avg yield -0.70% (Prev. -0.75%), Bid-to-cover 0.96x (Prev. 1.09x), Buba cover 1.23x (Prev. 1.35x)

Italy sells:

E2bln 0% Aug-24 BTP, Avg yield -0.27% (Prev. -0.19%), Bid-to-cover 1.65x (Prev. 1.34x)

E2bln 0.50% Jul-28 BTP, Avg yield 0.32% (Prev. 0.38%), Bid-to-cover 1.58x (Prev. 1.50x)

E1.75bln 1.70% Sep-51 BTP Avg yield 1.69% (Prev. 2.06%), Bid-to-cover 1.47x (Prev. 1.30x)

UK DMO sells GBP3.00bln 0.375% Oct-26 Gilt, Avg yield 0.429% (Prev. 0.324%), Bid-to-cover 2.67x (Prev. 2.11x), Tail 0.2bp (Prev. 0.9bp)

Netherlands sells E1.98bln 0% Jan-52 DSL, Avg yield 0.275% (Prev. -0.027%)

EUROZONE ISSUANCE: 7-year NGEU syndication: Final terms

The size of the transaction was set earlier at E9bln WNG

Maturity: 4 October 2028

Spread set at MS-14bps (guidance was MS -12bp area)

Books in excess of E85bln excluding JLM interest

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

RXV1 171.50p, sold 16k at 54.5/54 (ref 171.34), and 9k at 44 (ref 171.50)

ERM3 100.62/100.50ps 1x2, bought for -5.5 (receives) in 4.5k

UK:

0LZ1 99.37/99.25ps 1x2, bought for 0.75 in 10k

FOREX: AUD Softer as Lowe Talks Down Rates Market Pricing

- AUD sold off following a speech from the RBA Governor, in which he downplayed the near-term risks of market pricing pointing to rate hikes throughout 2022 and 2023, reaffirming the Bank's well-trodden guidance. The speech pressed AUD/USD through yesterday's lows of 0.7336, and now trades in a holding pattern below the 0.7356 50-dma.

- The USD index trades lower, with the market edging through yesterday's lows to narrow the gap with Friday's 92.33. Inflation data later today will likely prove key for the greenback, with today's release the last look ahead of the September FOMC.

- GBP trades solidly, with markets buoyant following jobs data showing UK payrolls figures erasing the entirety of the pandemic dip. GBP/USD traded at the week's highs in response, targeting the first upside target at 1.3889.

- The US CPI release is the calendar highlight Tuesday, with markets expecting a moderation in price pressures - although the Y/Y figure is still seen north of 5.0%. Elsewhere, BoE's Bailey is due to speak at 1400BST/0900ET.

FX OPTIONS: Expiries for Sep14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1745-55(E1.1bln), $1.1835(E1.1bln), $1.1900-25(E1.2bln)

- AUD/USD: $0.7340-45(A$1.0bln)

- USD/CAD: C$1.2600-10($747mln), C$1.2650($661mln)

- USD/CNY: Cny6.4390($600mln), Cny6.5000($532mln)

Price Signal Summary - Oil Bulls Still In Control

- In the equity space, S&P E-minis traded lower again yesterday but has found some support. The contract has cleared the 20-day EMA and this signals potential for a deeper pullback towards the key 50-day EMA at 4406.70. Key resistance has been established at 4539.50, the Sep 3 high. EUROSTOXX 50 futures are consolidating. The contract remains above 4132.50, Sep 9 low. A clear break of this level would expose 4078.00, Aug 19 low. The bull trigger is unchanged at 4252.00, Sep 6 high.

- In FX, EURUSD yesterday traded through last week's low of 1.1802, Sep 8 low before finding support. The break lower reinforces a short-term bearish theme and signals scope for a deeper pullback towards 1.1758 next, 61.8% of the Aug 20 - Sep 3 rally . Initial resistance is at 1.1851, Sep10 high. Recent activity in GBPUSD has defined short-term directional parameters at; 1.3892 as resistance, Sep 3 high and support at 1.3727, Sep 8 low. A break of either level would provide a clearer directional signal.

- On the commodity front, Gold is consolidating just ahead of recent lows. The near-term outlook remains bullish but a break of $1834.1, Jul 15 high is required to confirm a resumption of gains. Support to watch is $1774.5, Aug 19 low. A break would threaten a bull theme and signal scope for a deeper reversal. WTI futures maintain a bullish outlook and have traded higher today. Further gains are likely with $70.74 cleared, 76.4.% of the Jul 30 - Aug 23 sell-off. The focus is on $71.37, the bear channel top drawn from the Jul 6 high. This marks a key resistance and an important hurdle for bulls.

- In FI, Bund futures remain vulnerable and have traded lower this morning through last week's low of 171.45 from Sep 8. The focus is on 171.30, 2.382 projection of the Aug 5 - 11 - 17 price swing. Resistance to watch is 172.48, Sep 9 high. Gilt futures remain in a bear mode following last week's breach of support at 128.03, the Jul 6 low (cont). The contract has traded lower today as it extends the bear that started Aug 4. 127.65 has been probed, 61.8% of the Jun 3 - Aug rally (cont). An extension would open 127.50, Jun 28 low (cont).

EQUITIES: E-mini S&P Price Action Affirms Fragility

- Equity markets across Europe are mixed Tuesday, with core indices across the UK, France and EuroStoxx50 all in negative territory. This weakness has been somewhat countered by positive showings in German and Spain, but gains are modest at the midpoint of trade.

- Europe's energy and tech sectors are buoying headline indices, but gains are tempered by weakness across consumer discretionary and utilities stocks.

- In US futures space, the e-mini S&P holds just above unchanged, with gains of 5 points or so. Some support has surfaced in the near-term, but weakness Friday into Monday keeps today's price action fragile. The contract has breached its 20-day EMA and this signals potential for a pullback towards the key 50-day EMA at 4406.70.

COMMODITIES: Oil Sees Further Support on Inclement Weather Rolls In

- WTI and Brent crude futures hold in positive territory Tuesday, showing above the Monday high in the process as markets gear for further disruption to production after the linger impact of Hurricane Ida is dovetailed by another adverse weather system.

- Storm Nicholas has already struck Texas, with the high concentration of refining facilities in the area at risk of weather-forced shutdowns. Yesterday, the closing of the Port of Corpus Christi as well as the Houston Ship Channel were the first signs of disruption.

- Next resistance for WTI kicks in at the $73.52 Jul 30 high as well as the bear channel top drawn from the Jul 6 high at $71.37.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.