-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Dollar Dips On US Consumer Concerns

MNI Credit Weekly: Broad-based Strength

MNI US MARKETS ANALYSIS: Tsy Curve Steepens As Odds Of Second Trump Term Surge

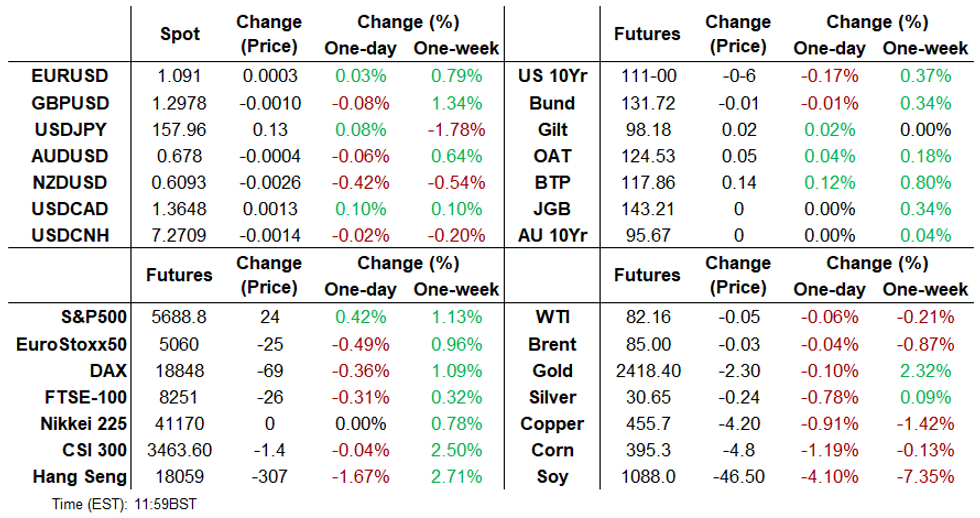

- USD off early Monday highs, bonds recover from lows.

- Failed assassination attempt on Trump boosts odds of second term.

- Comments from Chair Powell eyed later today.

US TSYS: Firmly Steeper With Higher Trump Odds On Sizeable Volumes

Treasuries have seen a mixed overnight session, initially paring early losses seen with the late open (Japanese holiday), aided by EGBs, before coming under pressure as US desks filter in.

- The front-end is back at similar levels to Friday’s highs after the initial reaction to the PPI beats was more than offset by more dovish PCE implications.

- The long end meanwhile holds a firmly net cheaper impetus after former President Trump’s odds of election victory have stepped higher after the assassination attempt at the weekend.

- Cash yields sit between 0.5bp lower (2s) and 6bps higher (30s).

- 2s10s (-22bps) and 5s30s (33.5bps) have hit multi-month highs although remain within ytd highs, whilst 2s30s has received particular attention at +0.9bps as it disinverts for the first time since February. Thursday’s large 2.1bp tail for the 30Y helps further set the tone here.

- TYU4 at 111-00+ (-05+) has pared an earlier climb to 111-04+ on strong volumes of 450k, remaining within Friday’s range. The bull cycle remains in play with initial resistance at Friday's 111-08+ after which lies 111-13 (Mar 25 high).

- Ahead, Fed Chair Powell's Rubenstein interview is firmly in focus for his last appearance before the FOMC blackout.

- Data: Empire Fed mfg Jul (0830ET)

- Fedspeak: Powell (1230ET) – see STIR bullet, SF Fed’s Daly (1635ET)

- Bill issuance: US Tsy $76B 13W Bill, $70B 26W Bill auctions (1130ET)

US 2s30s disinvert for the first time since early 2024Source: Bloomberg

US 2s30s disinvert for the first time since early 2024Source: Bloomberg

US TSY FUTURES: OI Points To Mix Of Long Setting & Short Cover Following PPI

Friday’s shallow rally in Tsy futures and OI data points to a mix of net long setting and short cover, with those impulses generally offsetting in net curve DV01 terms.

| 12-Jul-24 | 11-Jul-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 4,328,323 | 4,303,542 | +24,781 | +942,521 |

| FV | 6,423,942 | 6,406,039 | +17,903 | +759,109 |

| TY | 4,552,965 | 4,586,211 | -33,246 | -2,161,078 |

| UXY | 2,092,078 | 2,078,339 | +13,739 | +1,236,902 |

| US | 1,671,719 | 1,673,488 | -1,769 | -233,921 |

| WN | 1,677,127 | 1,679,318 | -2,191 | -446,009 |

| Total | +19,217 | +97,524 |

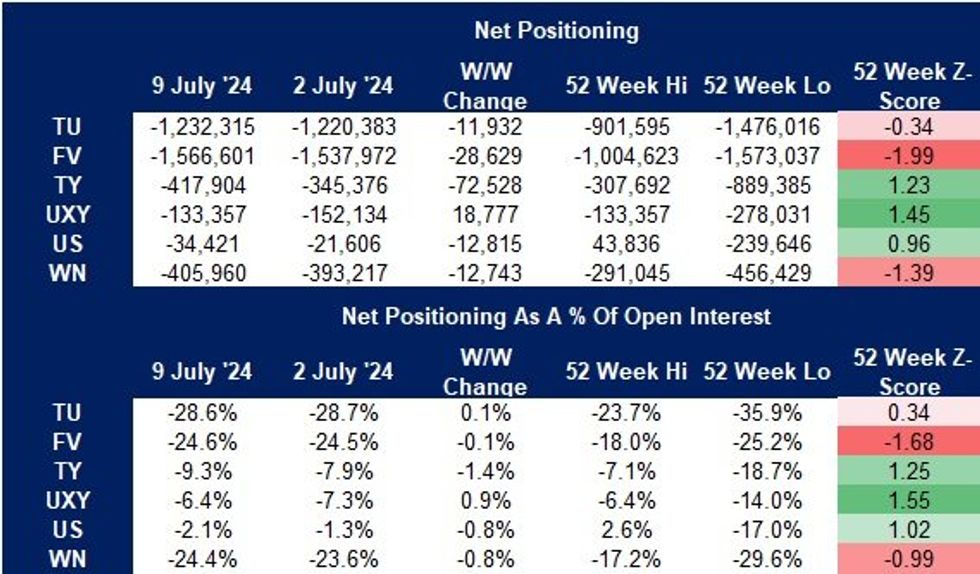

US TSY FUTURES: CFTC CoT Shows Most Net Shorts Extending Ahead Of CPI, Hedge Fund Short Cover Dominates In UXY

The latest CFTC CoT report shows non-commercial net shorts being added to in most Tsy futures contracts through July 9, with the only exception coming via a reduction in net short positioning in UXY futures.

- Looking a little deeper, asset mangers trimmed net longs in UXY futures, while hedge funds trimmed net shorts. The latter was slightly more sizeable.

- The latest CFTC report doesn’t capture the bullish reaction to the much softer-than-expected U.S. CPI data (released on July 11).

- A reminder that positioning metrics within the CFTC CoT report will be skewed by basis trades.

Source: MNI - Market News/CFTC/Bloomberg

Source: MNI - Market News/CFTC/Bloomberg

STIR: Two And A Half Fed Cuts In 2024, Pre-Blackout Powell In Focus

Fed Funds implied rates hold Friday’s late decline as subdued core PCE implications from the CPI and PPI reports were digested (analysts have narrowed in on ~0.165% M/M for June after a particularly soft 0.08% in May).

- Cumulative cuts from 5.33% effective: 1bp Jul, 25bp Sep, 41bp Nov, 64bp Dec and 82bp Jan.

- Powell headlines today’s docket in a Q&A-only interview by David Rubenstein at 1230ET. His last appearance before the FOMC media blackout provides an opportunity to comment on the potential policy impact from another soft CPI report.

- Without giving much away, Powell is likely to offer cautious optimism, with the key to cutting rates now being further evidence that inflation is not just headed to 2% but as per the existing guidance, “sustainably”. For now, it looks very likely that July’s meeting will be used to open the door to a September cut should the July and August inflation data paint a similar picture.

- SF Fed’s Daly (’24 voter) follows late on at 1635ET in a Q&A on technology’s impact on mon pol.

STIR: OI Suggests Mix Of Long & Short Setting Dominated In SOFR Post-PPI

The combination of preliminary OI data and Friday’s movement in SOFR futures suggests that net long setting dominated through the greens, while net short setting was more prominent in the blues.

- Mixed PCE readthrough from the components of the firmer-than-expected headline PPI numbers tempered the initial hawkish reaction to the data.

- Fed pricing was little changed to a touch more dovish on the day, with ~25bp of cuts priced through the Sep FOMC & ~63bp of ’24 cuts priced ahead of the close.

| 12-Jul-24 | 11-Jul-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRM4 | 1,183,685 | 1,192,435 | -8,750 | Whites | +45,435 |

| SFRU4 | 1,155,647 | 1,107,181 | +48,466 | Reds | +55,637 |

| SFRZ4 | 1,147,686 | 1,144,500 | +3,186 | Greens | +19,135 |

| SFRH5 | 851,597 | 849,064 | +2,533 | Blues | +11,060 |

| SFRM5 | 804,653 | 790,015 | +14,638 | ||

| SFRU5 | 708,529 | 710,832 | -2,303 | ||

| SFRZ5 | 890,911 | 852,949 | +37,962 | ||

| SFRH6 | 562,235 | 556,895 | +5,340 | ||

| SFRM6 | 492,188 | 492,725 | -537 | ||

| SFRU6 | 445,861 | 438,295 | +7,566 | ||

| SFRZ6 | 390,134 | 374,586 | +15,548 | ||

| SFRH7 | 238,944 | 242,386 | -3,442 | ||

| SFRM7 | 244,642 | 243,272 | +1,370 | ||

| SFRU7 | 192,532 | 199,834 | -7,302 | ||

| SFRZ7 | 199,683 | 186,057 | +13,626 | ||

| SFRH8 | 123,264 | 119,898 | +3,366 |

MACRO ANALYSIS: Businesses An Important Growth Driver Amidst Twin Deficits

The full release of the U.S. national accounts for Q1 continue to lay bare the scale of private sector net lending that is occurring under large fiscal deficits and sizeable current account deficits.

- Coming out of the post-pandemic period, which saw historically large transfers from the government to the private sector (and specifically households), the private sector is currently a net lender to the tune of more than 4% GDP.

- With the exception to the build-up to the dotcom crisis and then the Great Financial Crisis, this is close to the long-term historical norm and on its own isn’t particularly problematic.

- However, the breakdown within the private sector is more revealing.

- We explore these themes further, including the particular reliance on the business sector as an upcoming growth driver, in parts two, three and four.

EUROPEAN ECONOMIC SURVEY: Q2 SAFE Survey Broadly Consistent With Lower Deflator

The ECB’s Q2 SAFE survey (Survey on the Access to Finance of Enterprises) indicated a moderation in the “forces compressing profitability” amongst Euro-area firms relative to the Q1 survey round, while selling price and wage growth expectations also fell.

- 12-month ahead selling price expectations eased to 3.0% Y/Y (vs 3.3% prior), wage growth to 3.3% (vs 3.8% prior) and overall inflation expectations to 3.0% (vs 3.4% prior).

- However, both selling price and wage growth expectations were more elevated amongst respondents in the services sector, consistent with services HICP inflation remaining sticky over the coming months.

- A key pillar of the ECB’s macroeconomic projections is that slowing profit growth should contribute to a (modest) fall in GDP deflator growth through 2024, despite still-elevated unit labour costs.

- The SAFE survey’s results (less profit margin compression and falling wage expectations) may still be consistent with a moderation in 2024 GDP deflator growth, only with a slightly different composition of disinflation forces relative to the ECB’s projections.

- The sample consisted of almost 6,000 Euro-area firms, and the full write-up is here: https://www.ecb.europa.eu/stats/ecb_surveys/safe/html/ecb.safe202407~58a9f48351.en.html#toc8

FOREX: Greenback Reverses Opening Gains, AUDNZD Prints Fresh Cycle Highs

News of the Trump assassination attempt and increased odds of a Trump win in November prompted a 0.15% gap higher for the USD index to start the week. However, a recovery for both equities and core fixed income has prompted the DXY to edge lower through the European session, and tracks close to unchanged levels heading into the NY crossover.

- USDJPY has unsurprisingly posted the largest range across the majors, as volatility remains high in the aftermath of last week’s US data and supposed BOJ intervention. USDJPY reached as high as 158.42 but has since reverted back below the 158 handle to trade around 157.80 at typing. Last week’s lows around 157.40 mark the first area of interest on the downside before more notable support at 156.83, a Fibonacci retracement. 159.75 is the first resistance, the 20-day EMA.

- In similar vein, EURUSD has risen back above 1.0900 and GBPUSD is hovering just below 1.30, a level that would place cable at the highest level since July last year.

- NZD underperforms across G10, falling 0.35% against both the dollar and the AUD. The AU-NZ 2yr swap continues to tick higher, now back at November 2020 levels which continues to bolster the AUD/NZD rally, rising to a fresh cycle high of 1.1135.

- Scandinavian FX also underperforms, with USDNOK trading 0.5% higher on Monday, however, a more notable laggard has been MXN, dropping over 1% given its beta to Trump election odds.

- Looking ahead, the US Empire Survey is due and Fed Chair Powell’s Rubenstein interview is firmly in focus for his last appearance before the FOMC blackout.

EUROPEAN ISSUANCE UPDATE

EU Bond Auction Results:

That's a relatively poor 3-year EU-bond auction result - with the bids (E2.702bln) for the 3-year below the upper limit of E3bln. There was also a notable fall since the last time this EU-bond was reopened (7 weeks ago on 27 May), with bids at that auction E4.511bln.

- At that prior auction, the upper limit was a smaller E2.5bln with E2.362bln actually sold. So today did see a larger volume sold at E2.533bln - but with a wide tail bringing the lowest accepted price at 99.970 below the pre-auction mid-price of 99.975 (and notably below the 99.992 average price).

- The short 15-year 3.375% Oct-38 EU-bond auction was much more positive in comparison.

- E2.533bln of the 2.875% Dec-27 EU-bond. Avg yield 2.878% (bid-to-cover 1.07x).

- E1.9bln of the 3.375% Oct-38 EU-bond. Avg yield 3.268% (bid-to-cover 1.44x).

COMMODITIES: WTI Support Remains Intact

On the commodity front, Gold remains constructive for bulls and last Thursday's rally reinforces short-term bullish conditions. Recent gains resulted in a breach of $2387.8, the Jun 7 high. This undermines a recent bearish theme and a clear break represents a bullish development that opens the key resistance at $2450.1, the May 20 high. Initial support to watch lies at the 50-day EMA, at 2335.9.

- In the oil space, WTI futures remain above last week’s low. The recent bear leg appears to have been a correction. Recent cycle highs reinforced bullish conditions, signalling scope for a continuation of the bull cycle near-term. Moving average studies are in a bull-mode set-up too, highlighting a rising trend. Sights are on $85.27, the Apr 12 high and a bull trigger. Initial firm support to watch is $80.00, the 50-day EMA.

EQUITIES: Bull Cycle In S&P E-Minis Remains In Play

In the equity space, the trend condition in S&P E-Minis The trend condition in S&P E-Minis is bullish and the contract traded to a fresh trend high once again last week. The continuation higher confirms a resumption of the uptrend and maintains the bullish sequence of higher highs and higher lows. Sights are on the 5713.31, a 3.236 projection of the Apr 19 - 29 - May 2 price swing. Firm support is at 5569.65, the 20-day EMA.

- A bull cycle in EUROSTOXX 50 futures remains intact and Friday’s gains reinforce the current condition. 5039.84, 61.8% of the May 16 - Jun 14 sell-off, has been cleared. This has resulted in a print above 5082.32, the 76.4% retracement. A clear break of it would be a positive development and open 5132.00, Jun 6 high. Initial support is 4997.26, the 50-day EMA.

| Date | GMT/Local | Impact | Country | Event |

| 15/07/2024 | 1230/0830 | ** |  CA CA | Monthly Survey of Manufacturing |

| 15/07/2024 | 1230/0830 | ** |  CA CA | Wholesale Trade |

| 15/07/2024 | 1230/0830 | ** |  US US | Empire State Manufacturing Survey |

| 15/07/2024 | 1430/1030 | ** |  CA CA | BOC Business Outlook Survey |

| 15/07/2024 | 1435/1035 |  US US | San Francisco Fed's Mary Daly | |

| 15/07/2024 | 1530/1130 | * |  US US | US Treasury Auction Result for 13 Week Bill |

| 15/07/2024 | 1530/1130 | * |  US US | US Treasury Auction Result for 26 Week Bill |

| 15/07/2024 | 1630/1230 |  US US | Fed Chair Jerome Powell | |

| 16/07/2024 | 0700/0900 |  EU EU | ECB's De Guindos in ECONFIN meeting | |

| 16/07/2024 | 0800/1000 | ** |  EU EU | ECB Bank Lending Survey |

| 16/07/2024 | 0800/1000 | ** |  IT IT | Italy Final HICP |

| 16/07/2024 | 0900/1100 | *** |  DE DE | ZEW Current Conditions Index |

| 16/07/2024 | 0900/1100 | *** |  DE DE | ZEW Current Expectations Index |

| 16/07/2024 | 0900/1100 | * |  EU EU | Trade Balance |

| 16/07/2024 | 0900/1000 | ** |  GB GB | Gilt Outright Auction Result |

| 16/07/2024 | 1215/0815 | ** |  CA CA | CMHC Housing Starts |

| 16/07/2024 | 1230/0830 | ** |  US US | Import/Export Price Index |

| 16/07/2024 | 1230/0830 | *** |  CA CA | CPI |

| 16/07/2024 | 1230/0830 | *** |  US US | Retail Sales |

| 16/07/2024 | 1255/0855 | ** |  US US | Redbook Retail Sales Index |

| 16/07/2024 | 1400/1000 | * |  US US | Business Inventories |

| 16/07/2024 | 1400/1000 | ** |  US US | NAHB Home Builder Index |

| 16/07/2024 | 1530/1130 | * |  US US | US Treasury Auction Result for Cash Management Bill |

| 16/07/2024 | 1845/1445 |  US US | Fed Governor Adriana Kugler | |

| 17/07/2024 | 2245/1045 | *** |  NZ NZ | CPI inflation quarterly |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.