-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Tsys Reverse Rally After Busy Trade

MNI (LONDON) - Highlights:

- Crowdstrike tech hiccup prompts vast global services outage and risk-off trade

- Lingering impacts remain, but Microsoft say underlying issue "fixed"

- Treasuries reverse early rally, leaving curve unchanged, but volatile

US TSYS: Modestly Cheaper Amidst Global IT Outage Induced Volatility

- Treasuries have seen significant volatility overnight following global IT outages attributed to a “bad patch” at cybersecurity company CrowdStrike.

- Headlines that CrowdStrike has deployed a fix (and Microsoft most recently saying the underlying cause has been fixed) have helped the latest reversal of the initial rally but scope for continued knock-on effects keeps uncertainty high whilst full reversal of disruption is likely to take some time.

- With gains mostly pared, the current consolidation of yesterday’s sell-off has been helped by additional senior Democrats calling for President Biden to consider stepping aside late yesterday (VP Harris now tops betting markets as Democrat nominee). Former President Trump then talked on getting economic relief to citizens at the RNC in Milwaukee but also that he’ll take action against EVs on day one with mixed macro implications.

- Cash yields sit between 0-0.5bp higher on the day, with 2s10s within yesterday’s range at -26.9bps.

- 2Y yields earlier approaching 4.50% (4.4967 high) for highs since last week’s PPI report and its softer PCE implications also appears to have encouraged some buying, currently at 4.475%.

- TYU4 is back at 111-02 off a high of 111-07+ which didn’t test resistance at 111-13+ (Jul 16 high), with strong cumulative volumes of 430k.

- The overnight low of 110-30+ marked a push below yesterday’s range for levels last seen Monday but with the trend structure remaining bullish.

- NY Fed’s Williams highlights today’s docket amidst a lack of data. It could see additional focus on today’s earnings slate but they’re lower tier names including American Express, Haliburton, Travelers and Schlumberger. Fifth Third Bancorp results shouldn't have a wider impact at first glance (provision for credit losses $97m vs $102.5m expected).

- Fedspeak: Williams on monetary policy panel (1040ET), Bostic closing remarks (1300ET)

STIR: Second Williams Appearance Headlines A Thin Docket Ahead Of FOMC Blackout

- Fed Funds implied rates haven’t been immune to the broader FI gyrations on CrowdStrike-linked global outages, but are currently back to only modest changes on the day (between 1bp lower for Sep and 0.5bp higher for Jan).

- Cumulative cuts from 5.33% effective: 1bp Jul, 26bp Sep, 41bp Nov, 63bp Dec and 81bp Jan.

- NY Fed’s Williams (voter) headlines today’s particularly thin docket in a monetary policy panel at 1040ET (Q&A only) but Wednesday’s publication of a WSJ interview conducted Tuesday should limit surprises having already spoken since last week’s soft CPI report.

- He noted broad-based declines in inflation with the past three months closer to the disinflation trend that the Fed wants to see, but he wants to see more data to gain confidence that inflation is on a path to 2%. Current policy is appropriate until he sees more data, with the Fed set to learn “a lot” between July and September meetings.

- Atlanta Fed’s Bostic (’24 voter) is then set to give closing remarks at 1300ET which should see limited monetary policy relevant discussion.

- There is potential for further unscheduled appearances with the FOMC media blackout starting midnight ET although we’d be surprised if it moved the needle after Powell has recently talked on some progress made in the dual mandate.

GLOBAL: Crowdstrike Update: Airports, Payments and Broadcasting Still Impacted

The spillover impact of Crowdstrike's "bad patch" for their Falcon Sensor system continues to reverberate around the global economy, with key services globally still hindered. Microsoft have stated that the underlying causes of the issue have been "fixed". So far impacts include, but are not limited to:

- US airlines including Delta, American and United have grounded all flights, while European, Australian, American and Indian airports all see significant delays in processing times, from security clearance to ticket administration.

- Payments have been impacted, with some electronic payment methods being declined in store - particularly contactless.

- Exchanges and financial news providers have reported sporadic issues - the LSE have stated their exchange is operating as normal, however the news filing RNS system has been impacted. Anecdotally, Bloomberg terminals saw some performance issues, but these have been rectified.

- Central bank operations, including the Norges Bank's F-Auction system has been interrupted, while the UK DMO have had to extend the bidding deadline for their weekly T-bill tender.

US: Biden Nears Exit Door As Pressure Mounts For Withdrawal

President Joe Biden is seen to be nearing the point where he officially announces his withdrawal from the presidential race as the slow but steady series of Democrat lawmakers calling for him to drop out continues. On 18 July, Sen. Jon Tester (D-MT) became the second US senator to call for Biden to end his candidacy.

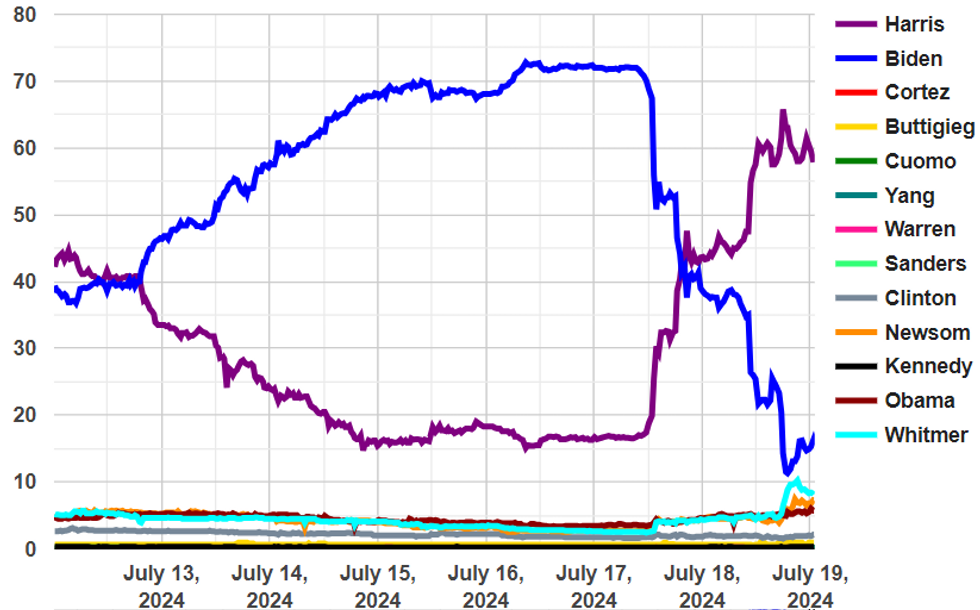

- Political betting markets have swung around wildly over the past week, but now Biden is assigned just a 16.1% implied probability of being the Democrat nominee according to electionbettingodds.com [compliling Betfair, Smarkets and Polymarket data]. VP Kamala Harris is the strong favourite with a 59.0% implied probability. Michigan Governor Gretchen Whitmer (8.1%), California Governor Gavin Newsom (7.3%) and former First Lady Michelle Obama (5.7%) are the other leading candidates.

- July 18 saw a flurry of reports suggesting that former House Speaker Nancy Pelosi (D-CA)'s efforts to convince Biden to drop out were beginning to work, with language changing to suggest Biden is more 'receptive' to calls for his withdrawal, which could come as soon as 'this weekend'.

- Notably, the increased probability of Biden not being the Democratic candidate has boosted the party's chances of winning the election according to bettors. The implied probability of Republican candidate former President Donald Trump winning has fallen to 64.9% from 71.9% on 18 July, while the implied probability of a Democrat win has risen from 27.0% to 30.3% according to data from Smarkets.

Chart 1. Betting Market Implied Probability of Democratic Presidential Nominee, %

Source: electionbettingodds.com

Source: electionbettingodds.com

INTERNATIONAL TRADE: SCMP-New EU Parl't Trade Committee 'Stuffed w/China Hawks'

(MNI) London - The European Parliament has confirmed the members of its Committee on International Trade (INTA) for the upcoming parliamentary session. Finbar Bermingham at SCMP posts on X: "EP trade committee fairly stuffed with China hawks. Glucksmann, Gregorova, Groothuis, Hahn, Karlsboro, Lexmann, van Brempt... I wouldn't call Vedrenne a hawk, but she is a champion for a more French-looking EU trade policy, which is usually not good for Beijing".

- INTA holds some notable powers with regards to the EU's trade policy, including the power to ratify or reject trade agreements, and providing oversight of Commission activities with regards to trade. Chair of the Comittee Bernd Lange, a German Social Democrat who is expected to win re-election to his position, saidin 2024 that the committee acts as "the democratic conscience of Europe's common trade policy".

- There is increased focus on EU-China trade relations at present amid apparent division within the Union as to the imposition of EU tariffs on Chinese-made electric vehicles.

- Provisional duties of 37.6% are currently in place against Chinese EVs, but the Commission is in the process of assessing whether these should be put in place definitively. If it does recommend their imposition it will require a qualified majority vote in the European Council, needing the backing of 15 member states representing 65% of the EU population.

Havens Outperform as Tech Outages Hinder Global Operations

- The strong USD backdrop so far Friday is persisting into the NY crossover, with the USD Index extending the bounce off yesterday's lows to near 0.7% and narrowing in on the 200-dma of 104.388.

- Flight to safe havens and a broad risk-off theme remains the key driver here, with the spillover effects of the bad patch from Crowdstrike grounding flights globally, impacting exchanges, stopping some electronic payments and interrupting global newsflow.

- Resultingly, the JPY is real outperformer, prompting EUR/JPY to ease off yesterday's highs and re-orient focus on the gravitational influence of the 50-dma at 170.82.

- Risk and growth proxy currencies are among the poorest performers, keeping Scandi currencies weaker against all others in G10. USD/NOK has cleared to new multi-month highs, taking out 10.8699 resistance in the process - the 61.8% retracement for the downleg off the early May high.

- Focus for the duration of Friday trade turns to Canadian retail sales data for May and appearances from Fed's Williams and Bostic.

Expiries for Jul19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0900-05(E850mln), $1.0940-50(E580mln)

- USD/JPY: Y155.50-60($653mln)

- GBP/USD: $1.2970-75(Gbp534mln)

- NZD/USD: $0.6050(N$527mln)

Recent Move Lower in E-Mini S&P Appears to Be a Correction

A bull cycle in Eurostoxx 50 futures remains intact, despite the pullback in prices early Friday. The move lower this week does undermine the bullish theme somewhat, with price having traded through the 50-day EMA, exposing the next support at 4860.00, the Jun 14 low. Clearance of this level would expose 4846.00, the Apr 19 low and a key reversal point. For bulls, a move higher and a break of 5087.00, the Jul 12 high, would again highlight a bullish theme. The trend condition in S&P E-Minis is bullish and yesterday’s move lower appears to be a correction. The continuation higher last week and this week’s cycle high, confirms a resumption of the uptrend and maintains the bullish sequence of higher highs and higher lows. MA studies are in a clear bull-mode set-up too, highlighting positive market sentiment. Sights are on 5741.34, a Fibonacci projection. Firm support is at 5597.81 the 20-day EMA.

- Japan's NIKKEI closed lower by 62.56 pts or -0.16% at 40063.79 and the TOPIX ended 7.8 pts lower or -0.27% at 2860.83.

- Elsewhere, in China the SHANGHAI closed higher by 5.176 pts or +0.17% at 2982.309 and the HANG SENG ended 360.73 pts lower or -2.03% at 17417.68.

- Across Europe, Germany's DAX trades lower by 159.03 pts or -0.87% at 18196, FTSE 100 lower by 48.59 pts or -0.59% at 8156.35, CAC 40 down 46.43 pts or -0.61% at 7541.09 and Euro Stoxx 50 down 29.58 pts or -0.61% at 4841.26.

- Dow Jones mini down 103 pts or -0.25% at 40856, S&P 500 mini down 8.25 pts or -0.15% at 5586.5, NASDAQ mini down 42.75 pts or -0.21% at 19856.5.

Gold Extends Moderate Pullback from Cycle Highs

WTI futures initially traded lower this week marking an extension of the corrective cycle. However, the contract has recovered from Tuesday’s low and this signals the end of a corrective phase. Note that support at the 50-day EMA, at $79.43, remains intact. This average represents an important pivot level and a clear break would highlight a stronger reversal. Initial key resistance to watch is $83.58, the Jul 5 high. The trend condition in Gold remains bullish and this week’s gains reinforce current conditions. The yellow metal has breached key resistance and the bull trigger at $2450.1, the May 20 high. This confirms a resumption of the medium-term uptrend and opens the $2500.00 handle next. Moving average studies are in a clear bull-mode set-up, highlighting a rising trend. Initial support is at $2382.6, the 20-day EMA.

- WTI Crude down $0.18 or -0.22% at $82.65

- Natural Gas down $0.04 or -1.69% at $2.088

- Gold spot down $24.55 or -1% at $2420.14

- Copper down $0.75 or -0.18% at $427.4

- Silver down $0.47 or -1.58% at $29.358

- Platinum down $4.84 or -0.5% at $967.43

| Date | GMT/Local | Impact | Country | Event |

| 19/07/2024 | 1230/0830 | * | Industrial Product and Raw Material Price Index | |

| 19/07/2024 | 1230/0830 | ** | Retail Trade | |

| 19/07/2024 | 1440/1040 | New York Fed's John Williams | ||

| 19/07/2024 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 19/07/2024 | 1700/1300 | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.